Biotechnology Instruments Market Outlook:

Biotechnology Instruments Market size was over USD 93.98 billion in 2025 and is poised to exceed USD 140.46 billion by 2035, witnessing over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biotechnology instruments is estimated at USD 97.45 billion.

The rise in the need for personalized medicines to combat the occurrence of chronic disorders is highly driving the growth of the biotechnology instruments market, bringing out improvements in health. For instance, in a review analysis conducted by NLM in August 2022, there have been 60% of cancer treatment cases and 72% of pharmaceutical interventions owing to personalized medications. Besides, the optimal personalized medicine rule assigning therapy is a standard technique to ensure clinical-based development pertaining to creating evolution in drug facilities for patients suffering from rare diseases.

Moreover, extensive research on vaccines by administrative bodies for pediatric and adult populations is positively amplifying the biotechnology instruments market growth. Based on this, the vaccination market in India is poised to expand to USD 3.0 billion, as stated in the 2025 IBEF report. However, different vaccines comprise a range of price depending upon the disease type and also on the population type. In this regard, the February 2025 CDC report enlisted a payer’s pricing for each type of vaccine suitable for the adult population which is another parameter encouraging the biotechnology instruments market growth.

Vaccine payer’s pricing for adult

|

Vaccine |

Tradename |

Packaging |

CDC Cost/Dose |

Private Sector Cost/Dose |

|

e-IPV |

IPOL |

1 pack – 10 dose |

USD 23.7 |

USD 44.7 |

|

Hepatitis A Adult |

Vaqta |

10 pack – 1 dose |

USD 40.5 |

USD 81.3 |

|

Hepatitis B Adult |

Heplisav-B |

5 pack – 1 dose |

USD 77.9 |

USD 147.6 |

|

HPV-Human Papillomavirus 9 Valent |

Gardasil9 |

10 pack – 1 dose |

USD 182.7 |

USD 307.6 |

|

Measles, Mumps, & Rubella A |

M-M-RII |

10 pack – 1 dose |

USD 62.6 |

USD 95.2 |

|

Meningococcal Conjugate |

Menquadfi |

10 pack – 1 dose |

USD 81.7 |

USD 171.9 |

|

MPOX |

Jynneos |

10 pack – 1 dose |

USD 198.0 |

USD 270.0 |

Source: CDC 2025

Key Biotechnology Instruments Market Insights Summary:

Regional Highlights:

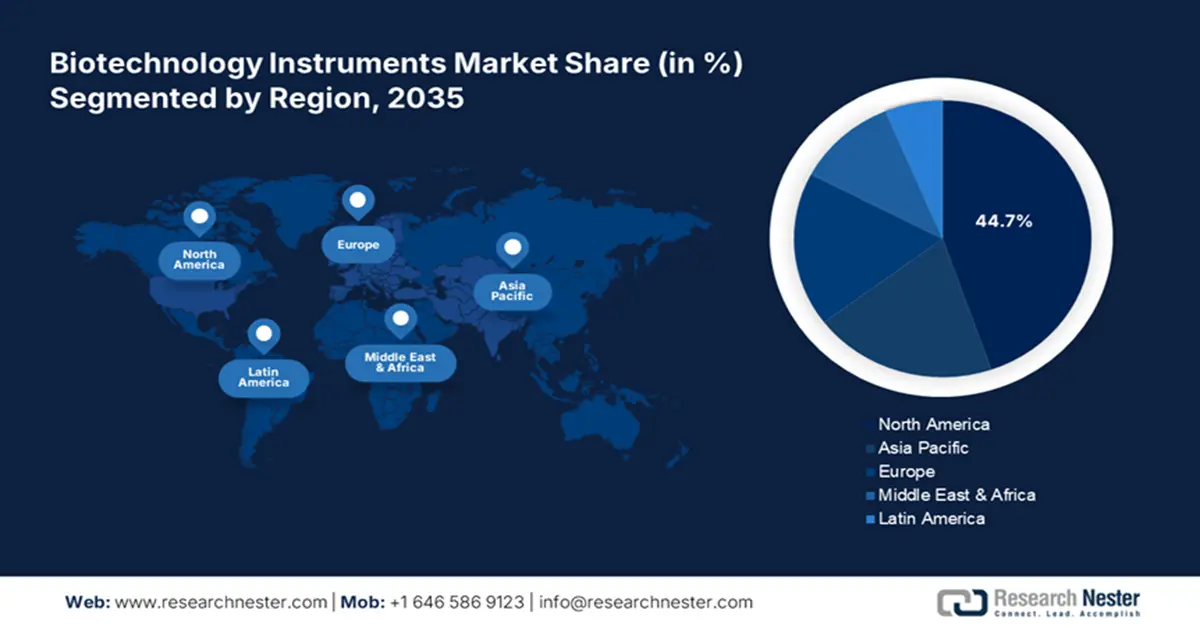

- North America dominates the Biotechnology Instruments Market with a 44.7% share, propelled by the implementation of advanced technologies by biopharmaceutical research centers, driving growth through 2026–2035.

- The biotechnology instruments market in APAC is experiencing the fastest growth by 2035, attributed to government investments facilitating cooperation and attracting FDIs.

Segment Insights:

- The Life Science Consumables segment is forecasted to hold a 59.2% share by 2035, driven by widespread use of PCR tests, particularly during the COVID-19 outbreak.

Key Growth Trends:

- Adoption of diagnostic devices

- Environment safety from harmful chemicals

Major Challenges:

- Premium cost of instruments

- Absence of skilled professionals

- Key Players: Abbott, Alcon, Inc., Becton, Dickinson, and Company, Bio-Rad Laboratories, Candela Medical.

Global Biotechnology Instruments Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 93.98 billion

- 2026 Market Size: USD 97.45 billion

- Projected Market Size: USD 140.46 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Biotechnology Instruments Market Growth Drivers and Challenges:

Growth Drivers

-

Adoption of diagnostic devices: Tools such as thermometers, glucometers, bio-signal recording instruments, pulse oximeters, and patient monitoring systems usually locate and monitor crucial parameters that derive from the body, which is effectively contributing to the biotechnology instruments market evolution. Based on this, a blood test diagnostic study was conducted by NLM in March 2023, wherein 1000 patients were considered, 427 displayed positive results of diseases, and 523 displayed negative outcomes. Moreover, the accuracy of the test depended upon six factors accounting for different ratios to evaluate the success rate.

Blood test accuracy

|

Factors |

Ratio |

|

Sensitivity |

0.961 |

|

Specificity |

0.906 |

|

Positive Predictive Value |

0.864 |

|

Negative Predictive Value |

0.974 |

|

Positive Likelihood Ratio |

10.22 |

|

Negative Likelihood Ratio |

0.043 |

Source: NLM 2023

- Environment safety from harmful chemicals: Protection from toxic substances is pivotal to safeguard the surrounding ecosystem which is a major growth driver for the biotechnology instruments market. As per the 2025 OECD report, the chemical legislation indicator ensures legal framework exploration to support human and environmental safety, and it has liberated global nations for over USD 309 million each year. Besides, automated instruments such as spectroscopy, ground-based monitoring sensors, aerial imaging, and satellite remote sensing evaluate air quality with an accuracy rate of 99% as stated in the February 2024 Frontiers Organization report, thus an optimistic outlook for the biotechnology instruments market.

Challenges

-

Premium cost of instruments: The effort to integrate research and development to launch the latest drugs is quite expensive within a range of USD 1 billion to USD 2 billion, thus resulting in a high cost of biotechnology instruments, as stated in the April 2021 CBO report. As per the 2021 DNI report, the global bioeconomy has experienced a growth of 10%-15% due to which overall value is expected to increase by USD 20 trillion by 2030, hence an increase in biotechnology instruments. According to the Indian Council of Agricultural Research June 2021 report, the expense of electric-based medical equipment was over USD 460,272, hence a restraint for the biotechnology instrument market.

|

Instrument Type |

Cost |

|

Hi-tech analytical instruments |

Over USD 460,272 |

|

Standalone scientific equipment |

Over USD 115,068 |

|

Analytical equipment |

Over USD 28,767 |

Source: Indian Council of Agricultural Research June 2021

- Absence of skilled professionals: The limitation in proficient personnel in biotechnology is a major hurdle for the development of the biotechnology instruments market. According to the May 2022 American Society of Mechanical Engineers, 50% of operational activities in the medical manufacturing and pharmaceutical sectors can be automated, resulting in the disappearance of over 90,000 workers in upcoming years. Besides, the presence of few experts in this field and scattered course offerings for healthcare information technology is a huge challenge for the market to expand globally.

Biotechnology Instruments Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 93.98 billion |

|

Forecast Year Market Size (2035) |

USD 140.46 billion |

|

Regional Scope |

|

Biotechnology Instruments Market Segmentation:

Product (Life Science Consumables, Medical Lasers, Lab Automation Instruments, IVD Instruments)

The life science consumables segment is expected to hold biotechnology instrument market share of over 59.2% by the end of 2035. The widespread use of PCR tests, especially during the COVID-19 outbreak is an effective factor responsible for the growth of the segment. As per the April 2024 CDC report, a study of positive antigen and RT-PCR test was conducted on 236 SARS-CoV-2–infected participants, wherein the success rate of the antigen was 51% to 67% and the RT-PCR test was 76% to 88%. Likewise, the sensitivity rate of paired antigen was low by 47%, thus accounting for the PCR test suitability, highly driving the biotechnology instruments market growth.

End User (Pharmaceutical Companies, Government & Academic Institutions, Hospitals & Healthcare Facilities)

Based on end user, the hospitals & healthcare facilities segment is expected to influence the biotechnology instruments market at a considerable rate by the end of 2035. A rapid boost in the need for IVD instruments in health centers is fostering market upliftment since there are 40,000 products available globally that assist in the detection of infections, diseases, and other medical conditions as stated in the 2025 WHO report. Additionally, the October 2024 FDA report pointed out the Class I (low to moderate risk), Class II (moderate to high risk), and Class III (high risk) regulatory classification of these instruments to ensure the effectiveness and safety of IVD product availability in hospitals.

Our in-depth analysis of the global biotechnology instruments market includes the following segments:

|

Product |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biotechnology Instruments Market Regional Analysis:

North America Market Analysis

By 2035, North America biotechnology instrument market is set to dominate over 44.7% revenue share. The implementation of advanced technologies by biopharmaceutical research centers has resulted in the evolution of state-of-the-art drug therapies. For instance, the North Carolina Biotechnology Center in its 2025 report stated that the manufacturing of monoclonal antibodies, small-molecule therapeutics, vaccines, and industrial enzymes unravel disease occurrences. Also, the adoption of gene and cell-based therapy plays a pivotal role in commercializing the production process of the products, thus contributing towards market growth.

The U.S. biotechnology instruments market is gaining traction due to biopharmaceutical research centers and key players making medical inventions. The 2024 CSIS declared that under the Department of Defense and the Department of Health and Human Services (DHHS), the National Institutes of Health (NIH) conducted regional-based biomedical research by providing 83% of its funds out of its total budget of USD 49.0 billion, thus assisting for the identification of potential treatment methods for modulating diseases. Besides, in January 2025, Takara Bio USA Holdings, Inc. acquired Curio Bioscience to develop spatial biology platforms for single-cell genomics instrument enhancement, thus ensuring life science research and innovation.

The biotechnology instruments market in Canada is witnessing significant growth since the country comprises the second-largest biotechnology sector internationally. According to the August 2024 Northeastern University report, Toronto is a suitable location with approximately 30,000 professionals contributing USD 2.0 million to the local economy in terms of medical instrument manufacturing. Moreover, in May 2023, Recursion declared its acquisition of Cyclica at USD 40 million to uplift generative AI and chemistry capabilities and ensure biotechnology enhancement in the country. Thereby, there has been job growth which is predicted to increase by 233,000 by 2029, which is expected to positively impact the market.

APAC Market Statistics

The APAC biotechnology instruments market is projected to be the fastest-growing landscape since there are government investments that are facilitating cooperation and captivating FDIs of the local companies with the foreign companies. According to the December 2023 US Department of Agriculture report, the Philippine Fiber Industry Development Authority (PhilFIDA) produced Bt cotton as a plant biotechnology with approval by the Bureau of Plant Industry (BPI). It can yield 3 tons per hectare compared with 1-2 tons using present local varieties to combat pest issues and ensure high profits for farmers. Additionally, it can promote heirloom and organic cotton production technology, thus a positive impact on the market development in the region.

The biotechnology instruments market in India is expecting substantial growth due to the presence of key organizations making service expansions and providing support to scientists. For instance, in November 2023, Parse Biosciences signed an agreement with India-based Spinco Biotech to broaden its reach in Asia. This provided researchers in India with access to single cell portfolio, including Evercode TCR, Evercode Whole Transcriptome, Evercode Nuclei Fixation, Evercode Cell Fixation, CRISPR Detect, and the Parse Biosciences data analysis solution. Besides, as per the 2025 Department of Biotechnology India, there are 48,502 research personnel, 1,042 technology generation, and three international projects driving the market growth.

The biotechnology instruments market in China is gaining traction due to the availability of rich bioresources and large biological product consumption. According to the NLM report published in November 2022, the China government announced the 14th Five‐Year Plan for Bioeconomy Development policy which focuses on biomedicine to amplify the latest medical equipment and drugs. This is expected to enhance the biomedical requirement in the country by USD 109.0 billion at a 20% growth rate along with 62.9% of contributions by biomedical enterprises. Thereby, the implementation of developmental policies is striving to improve biotechnology innovation while facilitating advancements in technical capability within the nation.

Key Biotechnology Instruments Market Players:

- Abbott

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alcon, Inc.

- Becton, Dickinson, and Company

- Bio-Rad Laboratories, Inc.

- Candela Medical

- Cynosure, LLC

- Danaher Corporation

- Endress+Hauser

- F. Hoffmann-La Roche Ltd.

- IIlumina Inc.

- Spear Bio Inc.

Companies dominating the biotechnology instruments market are gaining rapid exposure to bridge the gap between healthcare providers and scientists and cater to meet their evolving requirements. For instance, in May 2022, three subsidiaries of Nikon Corporation and Nikon Solutions Co., Ltd. provided organ-on-a-chip imaging and analysis contract services in the US, Europe, and Japan. Nikon Instruments Inc., Nikon Europe B.V., and Nikon Solutions Co., Ltd. ensured research and development for drug discovery based on cutting edge instruments.

Recent Developments

- In July 2024, Spear Bio Inc. declared the successful securing of USD 45 million in oversubscribed Series A funding to expedite the product launch for protein research and disease diagnostics and leverage suitable qPCR instruments to measure protein biomarkers precisely.

- In April 2024, Bio-Rad Laboratories, Inc. reported the launch of its first ultrasensitive multiplexed digital PCR assay, the ddPLEX ESR1 mutation detection kit. The purpose was to expand the company's offerings with multiplexed and sensitive detection assays to assist research, translational, disease, and therapy selection monitoring.

- In December 2023, Nestle Corporation in collaboration with Eppendorf made advancements in the development of lab products made with renewable raw materials. This led to the creation of renewable plastic lab consumables: Eppendorf Consumables BioBased.

- Report ID: 7188

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biotechnology Instruments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.