Biosimilar Monoclonal Antibody Market Outlook:

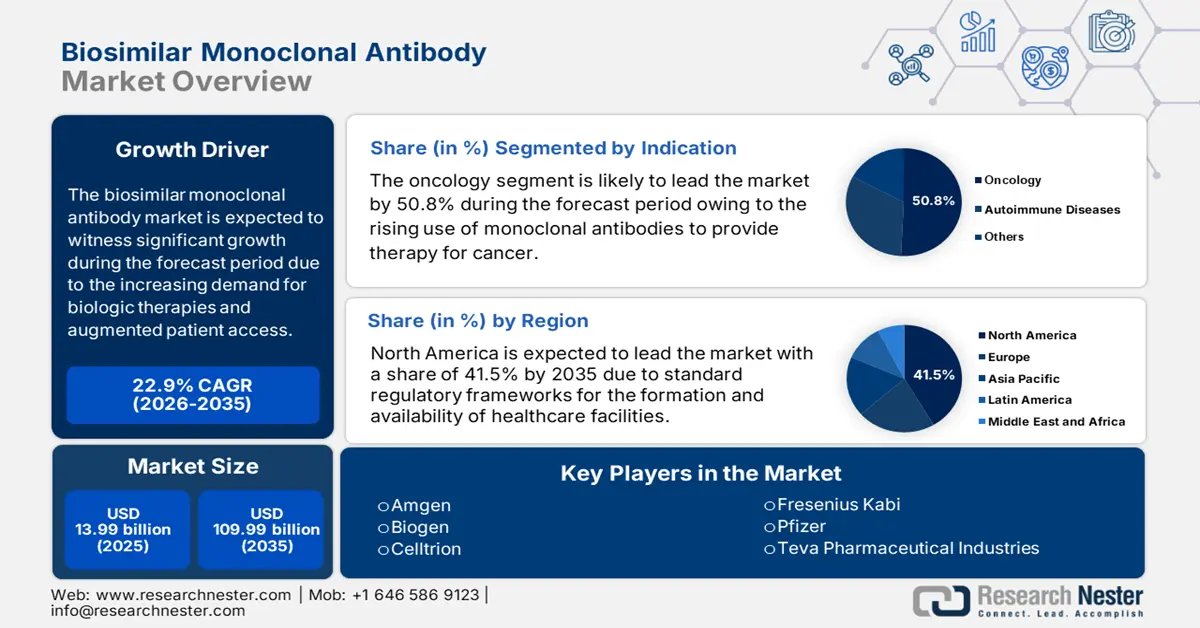

Biosimilar Monoclonal Antibody Market size was valued at USD 13.99 billion in 2025 and is set to exceed USD 109.99 billion by 2035, registering over 22.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biosimilar monoclonal antibody is estimated at USD 16.87 billion.

The market is readily evolving in the pharmaceutical industry for the manufacturing and production of antibody-based drugs as treatment solutions. Besides, the demand for economically viable biologic therapies and healthcare costs are making biosimilars an alternative to expensive conventional medications. As per the January 2024 article published by NLM, the cost-saving aspect of biosimilar, especially in the U.S., increased with the anticipated cost of USD 104 billion between 2020 and 2024 in comparison to USD 19 billion between 2015 and 2019. Thereby, the cost-effectiveness of biosimilars makes them available, which is bolstering the market growth globally.

The growth of medication drugs is highly driving the expansion of the biosimilar monoclonal antibody market worldwide. Additionally, the entry of biosimilars has effectively reduced the cost of biologics both in the U.S. as well as globally. Based on this, an analytical study was conducted across 57 regions and countries regarding the payer’s pricing of biologics following the inclusion of biosimilars, published in June 2024 by NLM. The study denoted a reduction of the average price for trastuzumab by USD 438, infliximab by USD 112, and bevacizumab by USD 110. Besides, the effect of biosimilars’ market entry led to further reductions in price per dose every year, accounting for USD 49 for adalimumab, USD 290 for filgrastim, USD 21 for infliximab, and USD 189 for trastuzumab.

Key Biosimilar Monoclonal Antibody Market Insights Summary:

Regional Highlights:

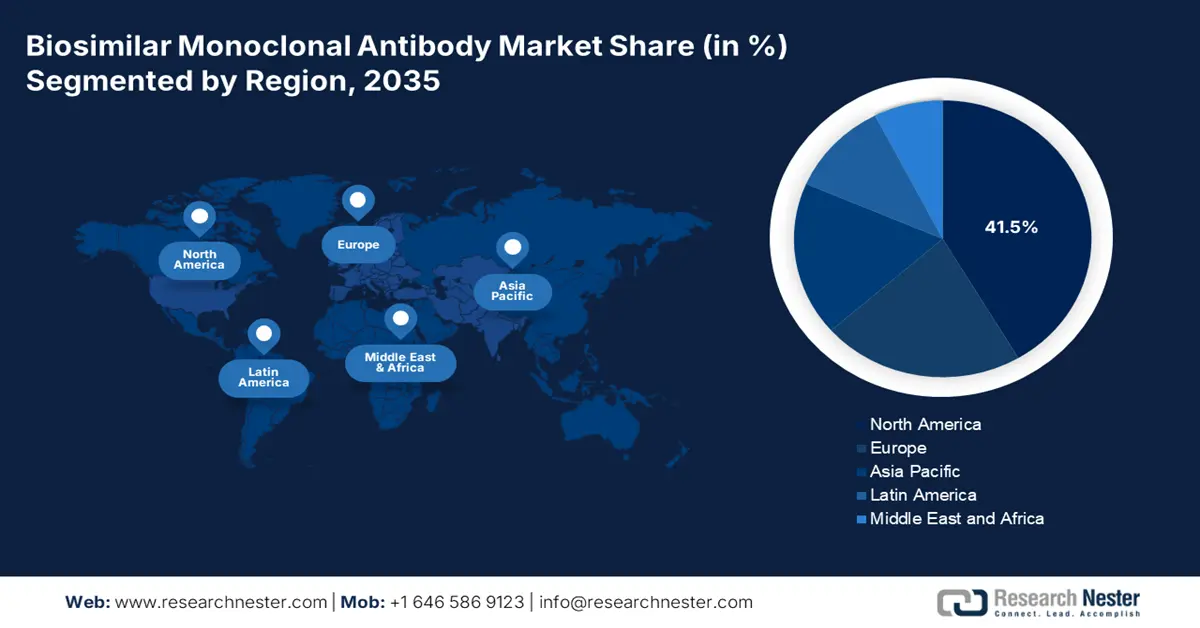

- North America biosimilar monoclonal antibody market will account for 41.50% share by 2035, driven by a vast presence of healthcare facilities, enabling market expansion to cater to patients.

Segment Insights:

- The oncology segment in the biosimilar monoclonal antibody market is projected to secure a 50.80% share by 2035, driven by the use of monoclonal antibodies for cancer therapy increasing patient access to treatments.

- The infliximab segment in the biosimilar monoclonal antibody market is projected to hold a 38.60% share by 2035, driven by its broad use in treating autoimmune diseases and high clinical remission rates.

Key Growth Trends:

- Patient termination

- Adoption of novel treatment

Major Challenges:

- Prerequisites for clinical trials

- Stringent regulatory policies

Key Players: Pfizer Inc., Amgen Inc., Sandoz International GmbH (Novartis), Celltrion, Inc., Samsung Bioepis Co., Ltd., Biocon Limited, Mylan N.V. (Viatris), Dr. Reddy’s Laboratories Ltd., Coherus BioSciences, Inc., Shanghai Henlius Biotech, Inc.

Global Biosimilar Monoclonal Antibody Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.99 billion

- 2026 Market Size: USD 16.87 billion

- Projected Market Size: USD 109.99 billion by 2035

- Growth Forecasts: 22.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Biosimilar Monoclonal Antibody Market Growth Drivers and Challenges:

Growth Drivers

- Patient termination: This helps pharmaceutical organizations to undertake the development of biosimilar alternatives, creating a lucrative business opportunity for the biosimilar monoclonal antibody market to boost. This results in biosimilar manufacturers entering the arena and bestowing competition that yields a range of essential advantages. Besides, an article published by NLM in 2021 stated that the provision of understandable information in a transparent way, tailoring to patients’ requirements in support by audiovisual material is a suitable strategy to make patients aware of the availability of biosimilars, thus a positive impact on the market upliftment.

- Adoption of novel treatment: This therapeutic solution has proved to be more effective than conventional treatment options which is amplifying the biosimilar monoclonal antibody market. For instance, the use of daratumumab, a monoclonal antibody, for the treatment of multiple myeloma constitutes a 43% lower risk of disease progression or death, as stated by the Memorial Sloan Kettering Cancer Center in February 2025. Thereby, this kind of novel treatment ensures an increase in the number of patients to concede a transplant– a multifaceted procedure that requires a long hospital stay, positively bolstering the market growth internationally.

Challenges

- Prerequisites for clinical trials: Clinical trial fundamentals stand as a prominent obstruction to the enlargement of the biosimilar monoclonal antibody market. Governing establishments mandate severe clinical trials for biosimilar development to confirm product efficacy and safety. These trials require considerable resource allocation, time consumption, and financial investments. Also, the increasing clinical trial requirements not only outspread the product development timeframe but also pose financial burdens that might discourage potential manufacturers from entering the market.

- Stringent regulatory policies: Critical regulations challenge patient enrollment resulting in delayed admission, a restraining factor for the biosimilar monoclonal antibody market. Furthermore, the need for extensive comparative studies upsurges the time and cost to approve the latest biosimilars. Although they are more inexpensive alternatives to the biological reference, the development process remains to be over-expensive. Additionally, the replacement of a biological reference with a biosimilar without medical intervention also hinders the growth of the market globally.

Biosimilar Monoclonal Antibody Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.9% |

|

Base Year Market Size (2025) |

USD 13.99 billion |

|

Forecast Year Market Size (2035) |

USD 109.99 billion |

|

Regional Scope |

|

Biosimilar Monoclonal Antibody Market Segmentation:

Indication

In biosimilar monoclonal antibody market, oncology segment is set to account for revenue share of more than 50.8% by the end of 2035. The use of monoclonal antibodies for cancer therapy is the main reason behind the segment’s growth. As per the February 2025 WHO report, cancer resulted in 10 million deaths in 2020, and cancer-based infections such as hepatitis and human papillomavirus (HPV) are accountable for approximately 30% of cancer cases in low- and lower-middle-income nations. However, the use of biosimilars to keep a check on cancer occurrence resulted in a 44% increase in the number of patients who have access to cancer treatments and medications, as stated in the December 2022 NLM article.

Type

By 2035, infliximab segment is anticipated to dominate biosimilar monoclonal antibody market share of over 38.6%. Infliximab is a broadly used monoclonal antibody for treating numerous autoimmune diseases, making it a significant part of the overall market. According to a clinical study that was published by Sage Journals in September 2021, the pooled clinical remission rate of infliximab retreatment in patients with inflammatory bowel disease (IBD) was 85%. Additionally, infliximab reintroduction was gained in 87% of patients with Crohn’s disease, thus a positive impact on the segment’s growth.

Our in-depth analysis of the global biosimilar monoclonal antibody market includes the following segments:

|

Indication |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biosimilar Monoclonal Antibody Market Regional Analysis:

North America Market Insights

North America biosimilar monoclonal antibody market is expected to account for revenue share of around 41.5% by 2035. According to the January 2025 American Hospital Association report, the region comprises 6,093 healthcare infrastructures, including 5,112 community hospitals, 207 federal government centers, and 654 non-federal psychiatric hospitals. Additionally, there is the provision of 1,796 rural community hospitals, 3,316 urban hospitals, and 3,525 community hospitals in a system. Therefore, with a vast presence of healthcare facilities in the region, there is ample opportunity for the market to expand and cater to patients to overcome diseases.

The U.S. biosimilar monoclonal antibody market has been gaining traction due to the presence of biosimilars for the treatment of rare diseases. As per the February 2020 NLM article, rituximab, trastuzumab, and bevacizumab have been approved in the country for their effective use. Rituximab aids non‐Hodgkin’s lymphoma and chronic lymphocytic leukemia; trastuzumab caters to stomach and breast cancer; bevacizumab is useful to get rid of ovary, cervical, kidney, colorectal, lung, and breast cancer. Besides, the U.S. FDA in May 2024 approved jubbonti injection as a compatible biosimilar to U.S.-licensed Prolia, and Wyost injection as an identical biosimilar to U.S.-licensed Xgeva, thus contributing toward market expansion.

The biosimilar monoclonal antibody market in Canada is witnessing significant growth owing to a huge amount of biosimilars being introduced in the country that requires the evolution of policies and strategies for effective management. According to the January 2025 Health Canada report, the naming of biological drugs, international agreements, product monographs, and the engagement of stakeholders are a few guidance-based documents that are required for the overall administration of biosimilars in the country. All of these assist manufacturers in following the legal way to produce biosimilars, thus amplifying the market growth efficiently.

APAC Market Insights

The biosimilar monoclonal antibody market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. Factors such as the huge population, enhancement in healthcare expenditures, and cost-effective therapeutics solutions are readily driving the market expansion in the region. For instance, as per the April 2024 World Bank Group Organization report, the latest health expenditure based on the gross domestic product accounts for 6.76% as of the financial year 2021. Therefore, this makes the availability and purchase of biosimilars more affordable for patients in the region, which positively impacts the market growth and expansion.

The biosimilar monoclonal antibody market in India is expecting substantial growth since regional organizations have taken the responsibility to unveil the latest biosimilars through thorough research and development. For instance, in November 2023, Enzene Biosciences launched Ranibizumab, a biosimilar to innovator product Lucentis that is sold under the brand name Accentrix in India. It is a recombinant that is utilized as a therapy for neovascular age-related macular degeneration (AMD). In addition, this biosimilar is the organization’s seventh biosimilar that can significantly reduce treatment costs for thousands of patients from the country, thus driving the market effectively.

The biosimilar monoclonal antibody market in China is gaining exposure owing to extreme experimentation and expansion along with policies-based support. As of the February 2023 Generics and Biosimilars Initiative report, these antibodies emerged as pivotal therapies to aid autoimmune diseases since the cost is limited and these are easily accessible in the country. In addition, China comprises a huge number of biosimilars, and out of the lot bevacizumab and adalimumab are common hotbeds that are readily available in the regional market which thrives a positive development.

R&D Projects of Popular Biosimilars in China

|

Biosimilar Drugs |

Preclinical |

IND |

Phase I |

Phase II |

Phase III |

NDA |

Launched |

Total |

|

Actemra |

1 |

|

2 |

|

4 |

|

|

7 |

|

Cosentyx |

|

1 |

|

|

|

|

|

1 |

|

Darzalex |

|

1 |

|

|

|

|

|

1 |

|

Erbitux |

|

2 |

2 |

2 |

4 |

|

|

10 |

|

Herceptin |

|

2 |

2 |

|

6 |

|

1 |

11 |

|

Lemtrada |

|

|

1 |

1 |

|

|

|

2 |

|

MabThera |

|

3 |

1 |

|

6 |

|

2 |

12 |

Source: Generics and Biosimilars Initiative February 2023

Biosimilar Monoclonal Antibody Market Players:

- Roche

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis

- Pfizer

- Samsung Bioepis

- Amgen

- Mylan

- Teva Pharmaceutical Industries

- Biogen

- Celltrion

- Fresenius Kabi

- Sandoz

- Boehringer Ingelheim

- Merck

- Amneal Pharmaceuticals

- Biocon Biologics Ltd

- Celltrion

- Enzene Biosciences

Companies dominating the biosimilar monoclonal antibody market are gaining rapid exposure due to clinical performances suitable for aiding different diseases that affect patients internationally. Additionally, administrative bodies are also playing an essential role in the approval of these biosimilars. For instance, in September 2024, Fresenius Kabi and Formycon received approval from the U.S. FDA regarding the biosimilar Otulfi (ustekinumab-aauz). This proved to be useful for the treatment of Chron’s disease, ulcerative colitis, moderate to severe plaque psoriasis, and active psoriatic arthritis, thus an optimistic outlook for the market to expand globally.

Here's the list of some key players:

Recent Developments

- In February 2025, Celltrion notified the European Commission (EC) approval of biosimilars- Eydenzelt, a biosimilar to Eylea to treat multiple retinal disorders, and Stoboclo and Osenvelt, biosimilars referencing Prolia and Xgeva used for all indications of the reference products.

- In December 2024, Biocon Biologics Ltd declared the U.S. Food and Drug Administration (FDA) approval of YESINTEK, a biosimilar to the reference product Stelara. This monoclonal antibody is approved for the treatment of Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis.

- Report ID: 7276

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.