Bioreactors Market Outlook:

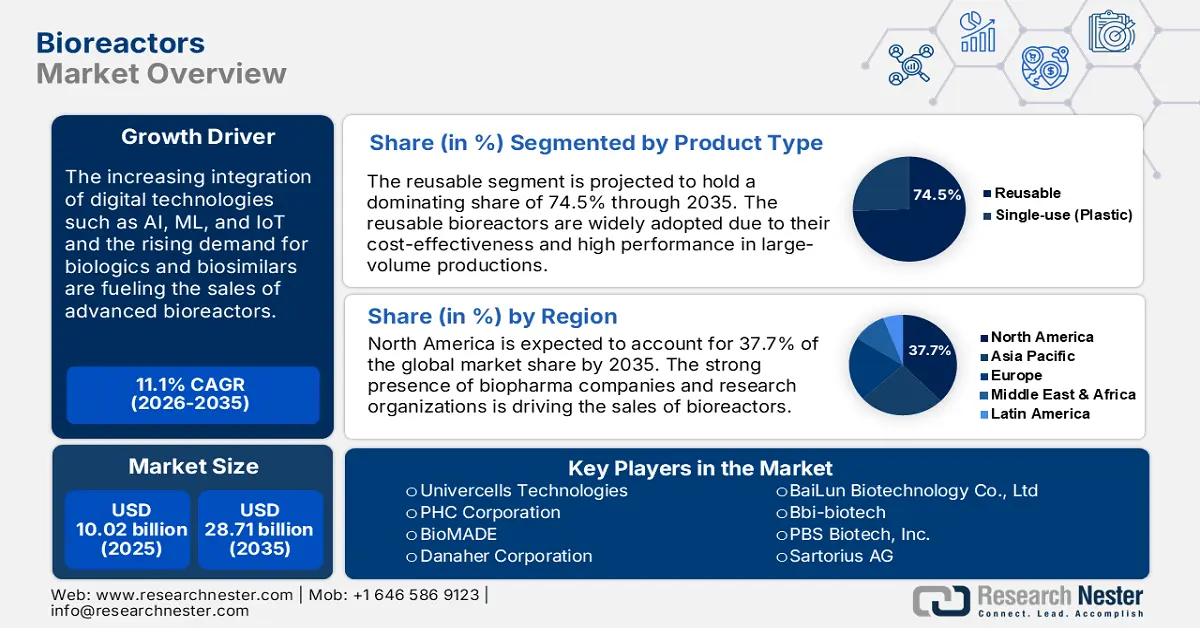

Bioreactors Market size was over USD 10.02 billion in 2025 and is anticipated to cross USD 28.71 billion by 2035, growing at more than 11.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bioreactors is estimated at USD 11.02 billion.

Governments and several pharma companies are investing heavily in research and development activities to introduce next-gen therapeutic solutions such as vaccines, gene therapies, antibiotics, and more to combat infectious diseases including, COVID-19. For instance, the Medical Countermeasures Gov revealed that the Biomedical Advanced Research and Development Authority (BARDA) in collaboration with the National Institute of Allergy and Infectious Disease is concentrating on the development of next-gen medical solutions such as vaccines and therapeutics to protect Americans from public health security threats such as coronaviruses.

Furthermore, in June 2024, the U.S. Department of Health and Human Services announced that BARDA awarded USD 500 million in Project NextGen funding for vaccine clinical trials. The funding is set to execute several Phase 2b clinical trials to evaluate novel vaccines administered as a nasal spray or pill to protect against symptomatic COVID-19. Such moves create profitable opportunities for bioreactor manufacturers, as bioreactor systems are necessary for the chemical reaction process in the developmental and clinical phases.

Key Bioreactors Market Insights Summary:

Regional Highlights:

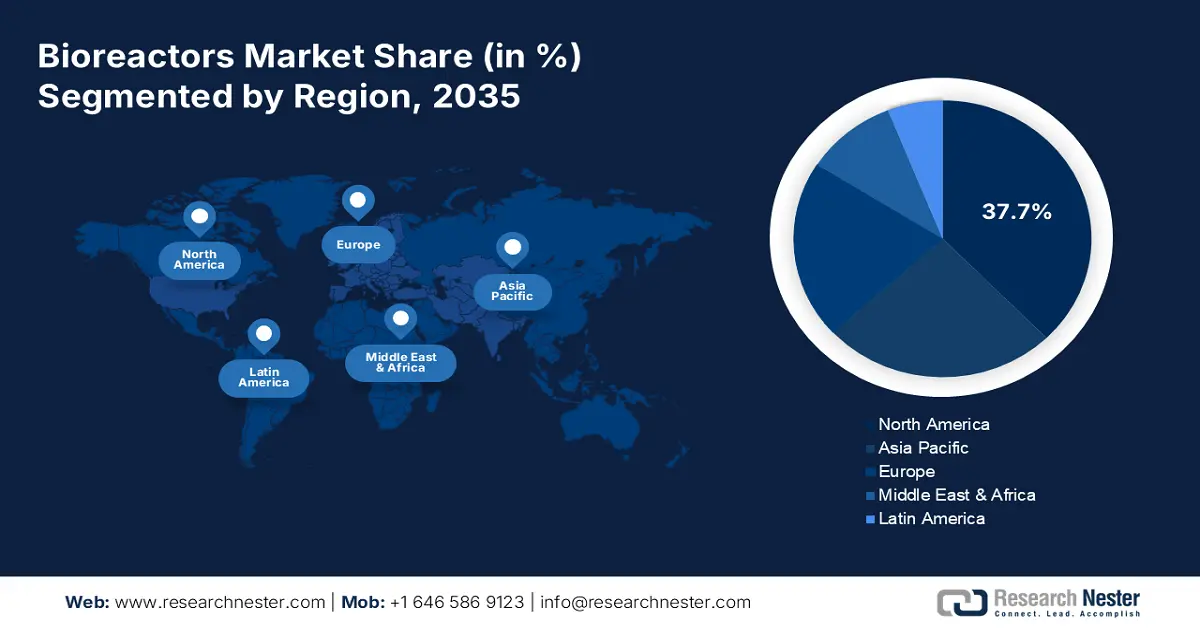

- North America leads the Bioreactors Market with a 37.7% share, supported by the strong presence of biopharma companies and increasing government investments in therapeutic solutions, driving growth through 2026–2035.

- Asia Pacific’s bioreactors market is projected to experience rapid growth by 2035, driven by the rising biopharma product manufacturing and the need for improved healthcare infrastructure.

Segment Insights:

- The Reusable Bioreactors segment is forecasted to achieve around 74.5% market share by 2035, driven by cost-effectiveness in the long term due to fewer needs for frequent single-use component purchases.

- Vaccines segment are expected to capture more than a 50.2% share by 2035, driven by increasing demand for advanced bioreactors for high-volume vaccine production.

Key Growth Trends:

- Automation and digitalization of bioreactors

- Increasing demand for biopharma solutions

Major Challenges:

- Expensive advanced bioreactor systems

- Strict and long approval processes

- Key Players: Univercells Technologies, PHC Corporation, BioMADE, and Danaher Corporation.

Global Bioreactors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.02 billion

- 2026 Market Size: USD 11.02 billion

- Projected Market Size: USD 28.71 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Bioreactors Market Growth Drivers and Challenges:

Growth Drivers

- Automation and digitalization of bioreactors: The digital shift is enhancing the capabilities of bioreactors such as improving process control and mitigating human error. The integration of advanced sensors, artificial intelligence (AI), machine learning (ML), and the Internet of Things (ML) are boosting the performance of bioreactors, leading to faster development of biopharma solutions. For instance, the Georgia Institute of Technology reveals that automated bioreactor sampling systems can eliminate the cross-contamination of samples. Thus, the automation and digitalization of bioreactor systems are set to enable better scalability, simplify sampling, boost swift production, and cost-effectiveness of therapeutic solutions, and augment bioreactor adoption among biopharma companies.

- Increasing demand for biopharma solutions: The rising demand for biosimilars and biologics is positively influencing the sales of bioreactors, as they are essential components of biopharma solution production. The increasing prevalence of infectious and chronic disorders is augmenting a high demand for vaccines, monoclonal antibodies, therapeutic proteins, and gene therapies. The high demand directly creates pressure on production units, and to combat this issue many biopharma companies employ advanced bioreactors.

Modern bioreactor systems can handle huge cell densities and complex production processes required for biologic and biosimilar manufacturing. For instance, in August 2023, Sartorius AG and Repligen Corporation collaboratively launched an integrated bioreactor system. The Repligen XCell ATF upstream intensification technology is integrated into Sartorius’s Biostat STR bioreactor. This innovative model is gaining traction among biopharma manufacturers as it simplifies intensified seed train and N perfusion implementation, enabling swift production.

Challenges

- Expensive advanced bioreactor systems: The high-tech bioreactor systems particularly automated and single-use models are costly due to their complex technologies. The capital required to manufacture such a complex system adds up to the overall product costs. This increased cost acts as a barrier to small-scale and medium-scale biopharma companies that are running on tight budgets. Overall high costs of advanced bioreactors can limit their adoption rates.

- Strict and long approval processes: The stringent and lengthy product approval procedures hinder the introduction of new bioreactor technologies. As the bioreactors are vital devices used for chemical reactions to develop vaccinations, gene therapy, and antibodies, their validation is important. The strict regulatory policies for the approval and validation of bioreactor systems are time-consuming, which leads to their slow adoption and hampers the profits of bioreactors market players as they are not able to grab trending opportunities.

Bioreactors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 10.02 billion |

|

Forecast Year Market Size (2035) |

USD 28.71 billion |

|

Regional Scope |

|

Bioreactors Market Segmentation:

Product Type (Single-use (Plastic), Reusable))

Reusable segment is set to capture around 74.5% bioreactors market share by the end of 2035. The main factor that is driving the sales of reusable bioreactors is their cost-effectiveness in the long term. The reusable bioreactors cut down the need for frequent purchases of single-use bags, liners, and other components, which leads to lower operational expenses for large-scale production. Large-scale biomanufacturing companies widely prefer employing reusable bioreactors due to their cost-effectiveness. Furthermore, many market players are advancing cleaning and sterilization technologies to make reusable bioreactors safer and more reliable. The integration of advanced materials that can withstand harsh cleaning cycles and high-performance environments is also boosting the efficiency of reusable bioreactors, contributing to their sales growth.

Molecule (Monoclonal Antibodies, Vaccines, Recombinant Proteins, Stem Cells, Gene Therapy, Others)

By the end of 2035, vaccines segment is expected to account for more than 50.2% bioreactors market share. The National Institutes of Health estimates that the use of bioreactors is high in cell culture-based viral vaccine production. The advanced bioreactors offer cost-effectiveness and convenience in the production of a high volume of vaccines to meet global demand. Furthermore, as the prevalence of infectious and non-infectious diseases such as influenza, malaria, and tuberculosis is increasing the demand for advanced bioreactors for efficient and scalable production of vaccines is gaining a boom. The ongoing advancements in biotechnology are anticipated to augment the demand for automated bioreactors for more efficient control of the production process.

Our in-depth analysis of the bioreactors market includes the following segments:

|

Product Type |

|

|

Cell |

|

|

Molecule |

|

|

Usage |

|

|

Material |

|

|

Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioreactors Market Regional Analysis:

North America Market Forecast

North America industry is poised to account for largest revenue share of 37.7% by 2035. The strong presence of biopharma companies and research organizations, and increasing investments by governments for the production of advanced therapeutic solutions are fuelling the sales of bioreactors.

In the U.S., the government’s supportive initiatives such as the National Biotechnology and Biomanufacturing Initiative to accelerate the biotechnology market growth are directly augmenting the sales of bioreactors. The supportive regulatory frameworks and funding to encourage research and production of biopharmaceuticals are boosting the demand for bioreactors. For instance, in December 2022, the U.S. Department of Energy invested USD 120 million in biotechnology and biomanufacturing innovations. Such investments further drive the adoption of bioreactors to carry out complex chemical reactions.

In Canada, the strong presence of research organizations such as the National Research Council Canada, CellCAN, and the Canadian Research Association that focuses on the production of regenerative medicines and cell therapies is contributing to the sales of bioreactors. High-performance bioreactors are essential in managing the high capacities of vaccine and drug manufacturing. Thus, the presence of advanced research organizations is creating lucrative opportunities for bioreactor manufacturers to earn high profits.

Asia Pacific Market Statistics

The Asia Pacific bioreactors market is calculated to expand at the fastest pace from 2026 to 2035. The rising biopharma product manufacturing, the growing need to improve healthcare infrastructure, and the increasing prevalence of chronic disorders are boosting the sales of advanced bioreactors. India, China, Japan, and South Korea are some of the high-growth marketplaces for bioreactors market.

In India, the increasing investments in expanding biopharma manufacturing and innovations in medical research and development sectors are pushing the sales of bioreactors. India has played a vital role during the COVID-19 pandemic by developing and exporting high volumes of vaccines across the world. According to the India Brand Equity Foundation, the National Biopharma Mission is supporting 101 projects including more than 150 organizations and 30 MSMEs. Such initiatives are driving the high adoption of automated bioreactors to carry out complex chemical reactions.

China’s rapidly expanding aging population is driving high demand for gene therapies, biologics, and biosimilars. The biopharma companies are investing heavily to accelerate the production cycles, which is increasing the adoption of high-performance bioreactors. As per the analysis by the Center for Strategic and International Studies, China is pitching to become a biotechnology powerhouse and in the past few years, it has invested over USD 100 billion in life sciences research and development. Such huge investment moves by the country are pushing a high demand for bioreactors.

Key Bioreactors Market Players:

- Univercells Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PHC Corporation

- BioMADE

- Danaher Corporation

- Donaldson Company, Inc.

- Eppendorf Group

- Esco Micro Pte. Ltd.

- Cellexus

- CerCell A/S

- GEA Group Aktiengesellschaft

- Getinge AB

- Merck KGaA

- Altrad Group

- BaiLun Biotechnology Co., Ltd

- Bbi-biotech

- PBS Biotech, Inc.

- Sartorius AG

The bioreactors market is quite competitive and to uplift their positions in the crowded space, leading companies are employing various organic and inorganic strategies. Technological innovations and new product launches are aiding them to mark a presence and stand out. Industry giants are collaborating with tech firms to integrate digital technologies and introduce automated bioreactors. This aids them in attracting a wider consumer base and earning high profits.

Some of the key players bioreactors market include:

Recent Developments

- In October 2024, Univercells Technologies revealed the launch of a scale-X nexo bioreactor to accelerate the production timelines. The bioreactor offers a 0.5 m² growth surface, designed for efficient cell culture process development across multiple modalities.

- In April 2023, BioMADE announced 5 new projects aimed at the production of flexible, cost-effective, efficient, and re-deployable bioreactors to accelerate the U.S. bioeconomy and biomanufacturing goals. The five projects are the Development of a Continuous Taylor Vortex Fermentor-Extractor-Separator, Modeling and Mimicking of Bioreactor Gradients to Predict Scale-Up Performance, Modular Biofilm Reactors to Convert Waste-Based Feedstocks to Vitamin A, Product Quality Sensors for Machine Learning (ML)-Guided Process Optimization and Control of Modularized Production Plants, and Project MONDE.

- Report ID: 6722

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioreactors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.