Biometric Technology Market Outlook:

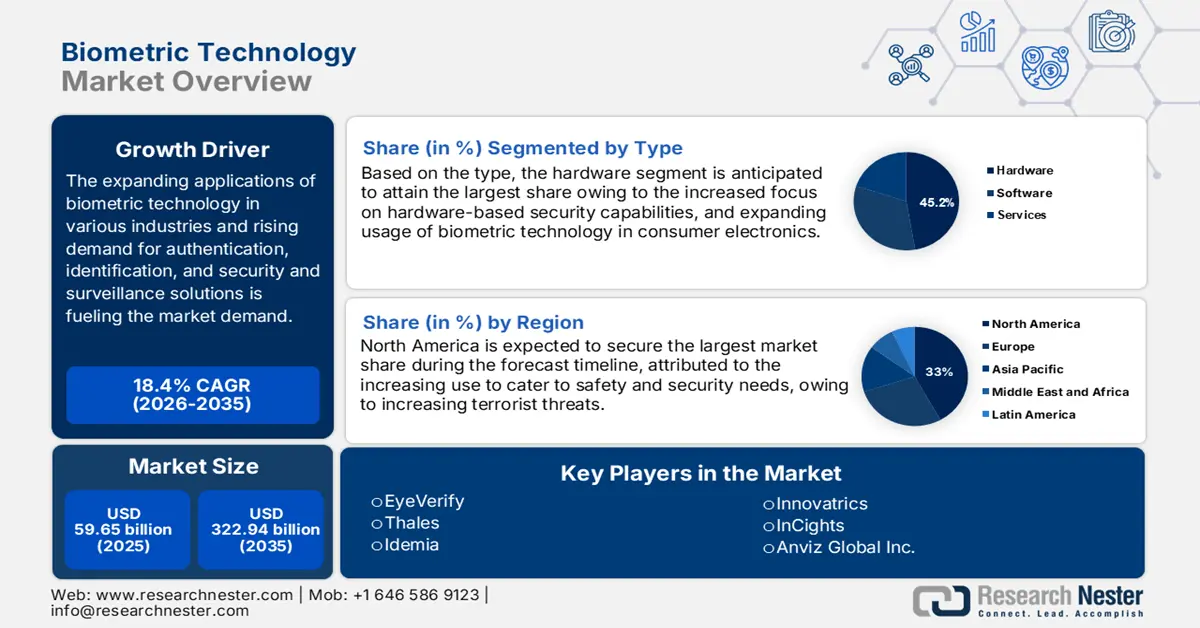

Biometric Technology Market size was valued at USD 59.65 billion in 2025 and is set to exceed USD 322.94 billion by 2035, registering over 18.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biometric technology is estimated at USD 69.53 billion.

With the rapid increase in digitization globally, the need for robust security features have increased. The rising awareness of data privacy and security concerns are the primary drivers of the biometric technology market. In recent years, more governments and companies have actively invested in biometric technology for security and population identification concerns, leading to market growth. In August 2024, FINGERPRINTS released their new biometric technology system, FPC AllKey, which is designed to bring smooth and secure authentication to multiple end uses such as peripherals, padlocks, cryptocurrency wallets, FIDO tokens, residential and workplace locks.

Manufacturers across the globe are focused on improving biometric technology to cater to rising demands for greater data privacy and combat security threats. Manufacturers are trying to integrate behavioral biometric technology and liveness detection techniques for enhanced security. For instance, in April 2023, Innovatrics released MagnifEye, capable of multimodal liveness detection within seconds without hampering user experience.

Key Biometric Technology Market Insights Summary:

Regional Highlights:

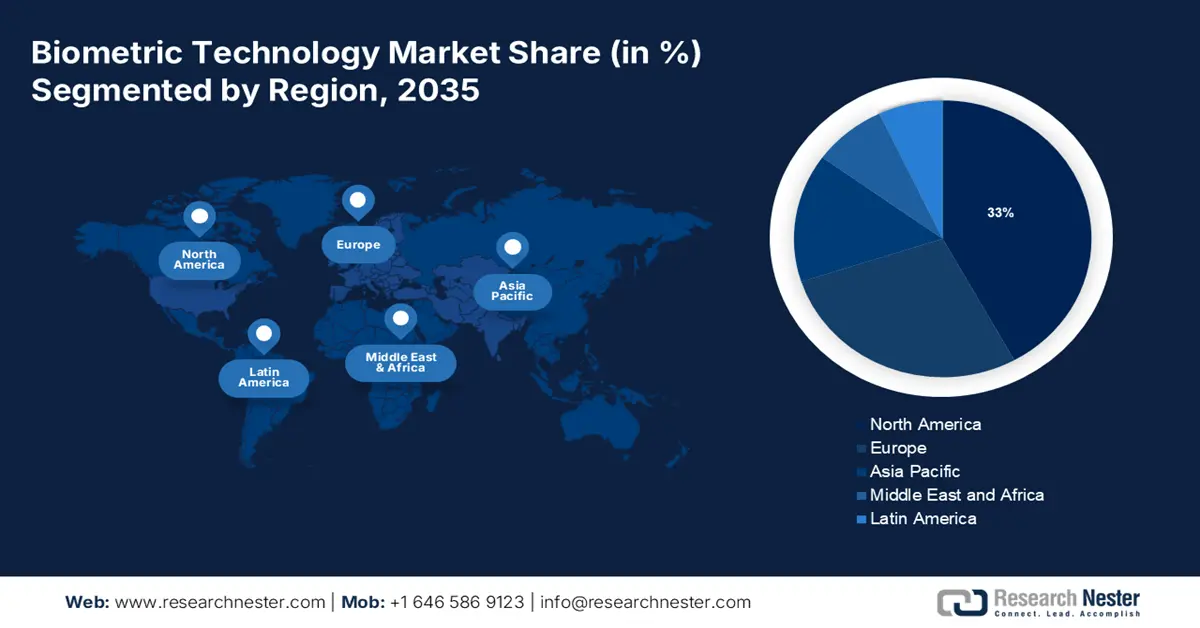

- North America’s biometric technology market will account for 33% share by 2035, driven by innovations, government investments, and advanced technological infrastructure.

Segment Insights:

- The hardware segment in the biometric technology market is forecasted to achieve notable growth till 2035, fueled by rising demand for physical biometric devices like fingerprint scanners and facial recognition cameras.

- The iris recognition segment in the biometric technology market is expected to exhibit a staggering CAGR through 2035, influenced by the scalability, flexibility, and non-intrusive nature of iris recognition, boosted during the COVID-19 pandemic.

Key Growth Trends:

- Rapid rise in consumer biometric technology applications

- Government programs to integrate biometric technology

Major Challenges:

- Rising privacy concerns

- Lack of standardization and high costs

Key Players: Accu-Time systems, Fujitsu Corporation, Thales, Idemia, DERMALOG identification systems, NEC Corporation, InCights.

Global Biometric Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 59.65 billion

- 2026 Market Size: USD 69.53 billion

- Projected Market Size: USD 322.94 billion by 2035

- Growth Forecasts: 18.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Singapore, South Korea, Japan

Last updated on : 18 September, 2025

Biometric Technology Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid rise in consumer biometric technology applications: There has been a significant demand for consumer biometric applications due to the high usage of smartphones and mobile devices. With increased digitization, the security threats to user data have been growing. To cater to this, in October 2019, WhatsApp launched a finger and face ID for the app which will serve as an additional layer of security. Other popular messaging apps such as Kakao Talk and Signal too have integrated biometric security.

Trust-based apps like dating apps have seen a surge in biometric verification demands. For instance, in 2023, Tinder integrated video selfies to verify identity via its 3D biometric liveness detection software. With artificial intelligence (AI) and machine learning improving, the user demands for greater security layers will also rise leading to a continuous growth of the biometric technology market during the forecast period. - Government programs to integrate biometric technology: A key driver to the growth of the market is the increased willingness of governments to integrate biometric technology. This has helped speed the regulatory approvals for biometric systems boosting the market growth. More investments are made by the government in biometric technology to facilitate security and services. In 2018, China applied biometric technology for visa applications. In 2024, the Ministry of Interior in Kuwait implemented biometric fingerprints. Many European countries such as France, the United Kingdom, and Italy employ ePassport gates that use biometric technology to verify a person’s identity. Emerging economies such as India are integrating biometric technology in large-scale welfare schemes for identity verification. For instance, In June 2024, the Goods and Services Tax (GST) Council of India rolled out a pan-India Aadhar-based biometric system to improve user security. The increasing use of biometric system by governments for various programs is expected to significantly boost the market by inculcating greater investments.

Challenges

-

Rising privacy concerns: Privacy concerns regarding the use of biometric systems and the storage of biometric data is a key factor expected to hamper overall market growth during the forecast period. Many users have flagged privacy issues related to biometric technology systems such as function creep, where their data was used for secondary use without user permission. Covert data collection without user consent is also a rising concern, hampering market growth.

- Lack of standardization and high costs: Installation of biometric technology and hardware for iris and facial scans can be costly. Depending on the complexity, the software costs can fluctuate, increasing the overall costs. A major challenge to the market growth is the lack of standardization. As there are no set guidelines, it can create compatibility issues. The lack of standardization also affects cooperation between organizations in integrating different biometric systems.

Biometric Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.4% |

|

Base Year Market Size (2025) |

USD 59.65 billion |

|

Forecast Year Market Size (2035) |

USD 322.94 billion |

|

Regional Scope |

|

Biometric Technology Market Segmentation:

Type Segment Analysis

The hardware segment is expected to account for a market share of 45.2% during the forecast period. The physical devices used to process biometric data such as facial recognition cameras, fingerprint scanners, and iris scanners are growing in demand. The continuous rise in security risks has led to a boost in the growth of this segment. The manufacturing trend in the hardware segment is to reduce complexity and boost ease of use, and improve accuracy of the such as emotion detection, vein recognition, and heartbeat detection the hardware segment is expected to witness significant growth going ahead.

The software segment is also growing rapidly in the biometric technology market owing to rising security threats, including spoofing. To combat security risks, commercial and government entities seek advanced software for behavioral and physiological recognition. The current trend in this segment is to fix any gap in identifications by the software by updating their machine learning. For instance, in 2023, Aware released a biometric liveness detection software that can conduct identity proofing along with biometric authentication by using liveness detection.

Biometric Type Segment Analysis

In biometric technology type, the fingerprint segment will account for the largest market share by 2035. Fingerprint authentication analyzes the unique fingerprint patterns of an individual to authenticate them. The primary driver in the segment is the large-scale integration of fingerprint recognition in smartphones. Each smartphone released today has fingerprint sensors embedded in it. With the development of faster and more accurate fingerprint identifications and increased use in personal and commercial spaces, this segment is poised to witness rapid growth during the forecast period.

The iris recognition segment is poised to grow at a staggering rate during the forecast period. Iris recognition authenticates individuals based identifying the unique patterns in the iris of individuals. The iris segment saw a boost during the COVID-19 pandemic due to its non-intrusive nature. The scalability and flexibility of the iris recognition method will continue to boost its growth.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

biometric technology Type |

|

|

Contact Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biometric Technology Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 33% by 2035. The rapid growth can be attributed to innovations, high-quality technological infrastructure, a high rate of government investments, increased focus on security risks, and leading manufacturers. The large scale of investment in the research and development of advanced biometric systems positions North America as a lucrative market.

The market in the U.S. is expected to hold a significant market share during the forecast period due to the considerably high rate of biometric technology usage in government, commercial, and private entities along with the growing demand for advanced biometric technology to address security concerns. For instance, the Department of Homeland Security (DHS) has been actively using biometric systems to secure the US borders. Since the U.S. is the largest investor in defense, the investment in advanced biometric technologies is immense boosting the market growth as demands for advanced biometric technology rise.

In Canada, the market is expected to grow at a rapid pace owing to large investments in defense and border security, increased use in the healthcare sector, and integration in government services. The government uses biometric technology for immigration by setting up various biometric collection sites. For instance, Canada invested USD 4 million in a new biometric app, ReportIn, that will ensure that two photos of an individual match. The rising focus on immigration surveillance and border security boosts the market.

Asia Pacific Market Insights

Asia Pacific is expected to have significant growth in the biometric technology market owing to greater security concerns, increased integration with government programs, and growing digitization of services. In addition, countries such as India, China, and Japan are integrating biometric technology into national identification programs and border security.

In India, the Unique Identification Authority of India (UIDAI) issues an Aadhar card that stores the biometric data of the citizens to eliminate duplicates under various welfare schemes to improve the efficiency of delivery mechanisms. India has invested in biometric use in identification documents such as driving licenses and permanent account numbers (PAN). Due to the large population, there is a continuous demand for fingerprint sensors in India, leading to considerable market growth. The government has launched the next generation of biometric standards i.e. L1 which opens up the market to replace all previous biometric components that were certified LO. The high demand for advanced biometric technology will continue to drive the market growth.

China is a major player in the global biometric technology market owing to the widespread use of facial recognition across several sectors. As per Research Nester, in 2023 facial recognition was used in public services such as to activate tissue dispensers. The increasing use of biometric technology integrated with big data and artificial intelligence in China is poised to grow the market rapidly during the forecast period.

Biometric Technology Market Players:

- Accu-Time Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DERMALOG Identification Systems

- Innovatrics

- BIO-key international

- EyeVerify

- Thales

- Idemia

- Iris ID Systems

- Suprema INC.

- Safran S.A.

- Cognitec Systems

- InCights

- Anviz Global Inc.

- Synaptics Incorporated

- Precise Biometrics AB

The biometric technology market has witnessed drastic changes owing to constant innovation in technology. The rapid integration of biometric technology in national identification programs, healthcare, security uses, and for commercial devices such as smartphones has led to a significant demand various segments of the market. The market is highly competitive with several global and regional players seeking to innovate and meet the changing demands for biometric technology

The key players in the market are focused on improving their production capabilities, investing in research, and enhancing product qualities to ensure ease of integration of biometric technology. Various strategies such as mergers, acquisitions, partnerships, and product launches are done to retain their market position and enter new emerging markets. Here are some key players dominating the global biometric technology market:

Recent Developments

- In February 2024, Innovatrics announced the release of the ninth generation of Automated Biometric Identification System (ABIS). ABIS is equipped with updated algorithms for iris, face, and fingerprint recognition. The new release is aimed at law enforcement agencies and facilitates a seamless user experience.

- In April 2023, Antolin collaborated with Biometric Voc to develop voice recognition biometrics into a vehicle access system with the support of AED-Vantage. The vehicles integrated with this system will be able to accurately identify the voice of the registered owner.

- Report ID: 6394

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biometric Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.