Biometrics for Banking and Financial Services Market Outlook:

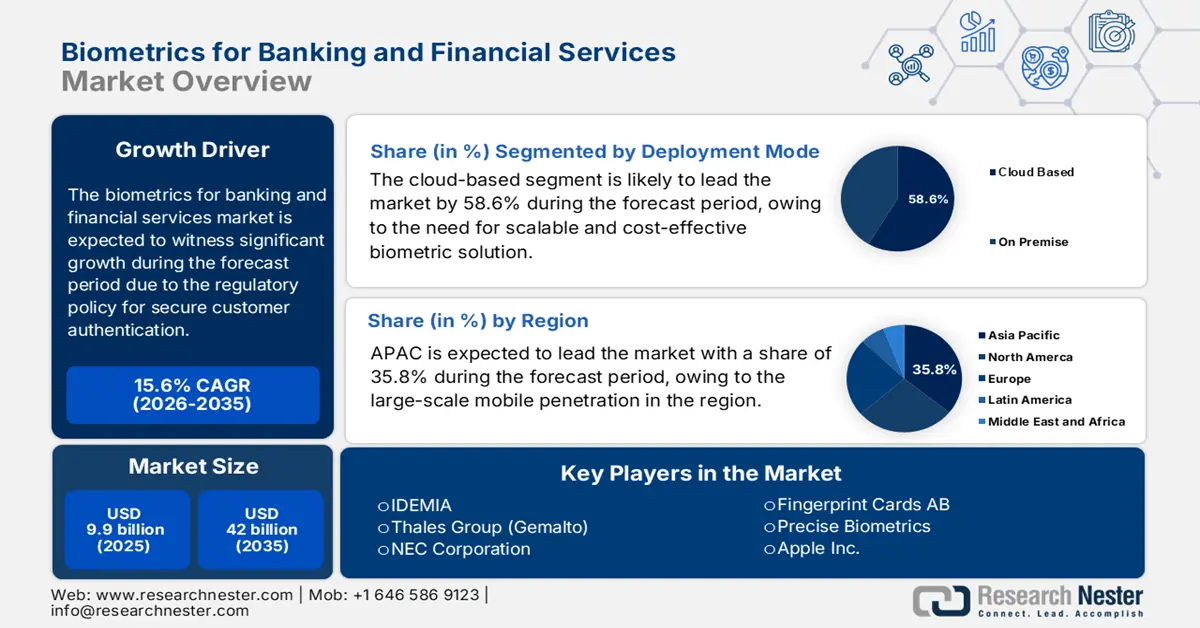

Biometrics for Banking and Financial Services Market size was valued at USD 9.9 billion in 2025 and is poised to reach USD 42 billion by 2035, registering a CAGR of 15.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of biometrics for banking and financial services at USD 11.4 billion.

The biometrics for banking and financial services market is expanding rapidly due to the regulatory policy for secure customer authentication and the necessity to fight against cyber fraud. The Federal Financial Institutions Examination Council (FFIEC) in the U.S. released a guideline strengthening the need for multi-factor authentication, establishing a methodical demand for layered security solutions with the use of biometrics. This is further surged by the scale of cybercrime, as the number of complaints registered increased by 10% and the losses increased by 22% from 2022, as stated in the FBI’s Internet Crime Report in 2023.

India's domestic cybersecurity market reached USD 3.76 billion in 2023, reflecting the increasing need for advanced software tools in India to protect digital ecosystems, including biometric and financial platforms. This growth depends on the global research, development, and deployment priorities aimed at improving system security and interoperability. Further, collaborative efforts among the public agencies and private firms are surging innovation in identity protection, encryption, and biometric data security across India’s financial and digital infrastructure.