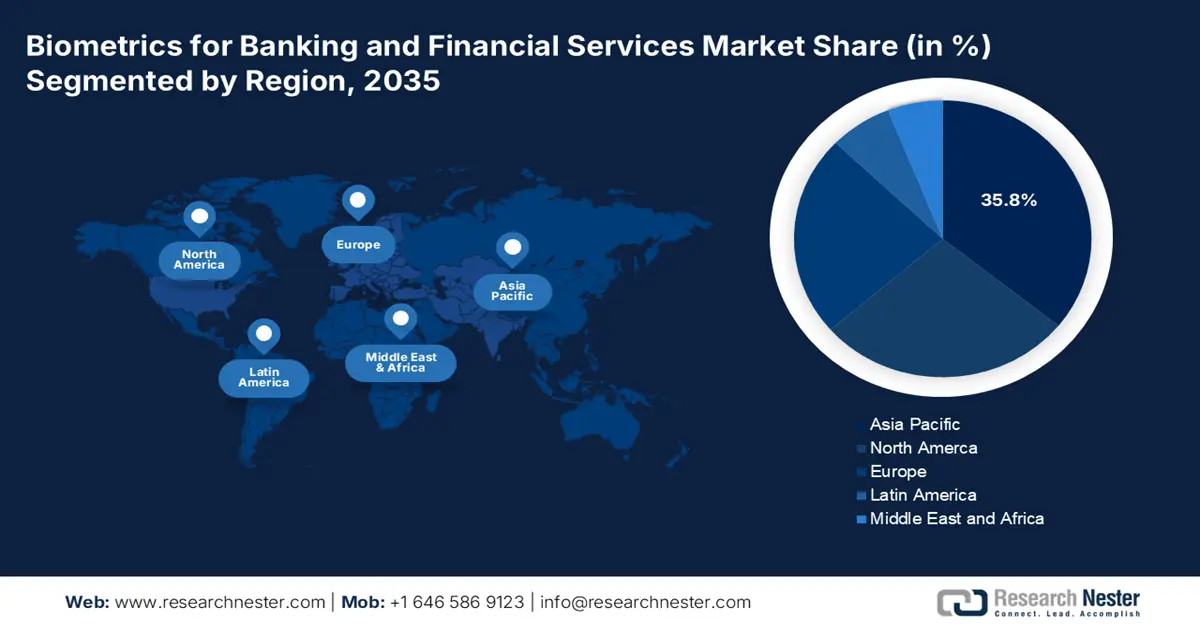

Biometrics for Banking and Financial Services Market - Regional Analysis

Asia Pacific Market Insights

The APAC biometrics for banking and financial services market is set to hold a dominant revenue share of 35.8% during the forecast timeline. A key factor contributing to APAC’s expansion is the considerably large smartphone penetration, and digital ID initiatives such as e-KTP of Indonesia and Aadhar of India, highlighting the successful use cases of biometrics. A primary trend is the seamless integration of national digital IDs with banking services, for instance, paperless onboarding. The trends have created surging opportunities for global biometrics vendors.

The China's biometrics for the banking and financial services market is poised to maintain a leading revenue share during the anticipated timeline. The market’s expansion is supported by the state-backed digital identity initiatives. The People's Bank of China is the key driver, mandating robust authentication for all online payments. As per the China Internet Network Information Center report in August 2022, nearly 227 million people are using mobile payments, which is nearly 77.5% of rural people use online payments.

India is at the forefront of the biometrics for banking and financial services market, and is defined by the Aadhaar digital identity initiative. According to the Protean data in 2025, almost 1.3 billion Aadhar cards have been issued so far, this is testifying the demand for the market. Additionally, the UPI transactions passed ₹25.14 lakh crore in May 2025. This digital identity and payment system adoption is surging the integration of biometric authentication in banks and fintech platforms.

Adoption of Biometrics in Banks

|

Country |

2023 |

2024 |

|

India |

95% of the population is enrolled in Aadhaar |

Over 1.3 billion Aadhaar biometric IDs issued |

|

China |

296.163 electronic transactions are processed |

Domestic mobile payment reached ¥373.3 trillion |

Source: UIDAI 2024, Protean 2025. PBC 2023, CIW 2025

North America Market Insights

North America is the fastest-growing region in the biometrics for banking and financial services market and is growing at a CAGR of 7.8% during the forecast period 2026 to 2035. The expansion of the regional market is attributed to the surging deployment of contactless and multi-factor biometric systems across payment terminals and banking apps. In terms of investments, major financial institutions such as Wells Fargo have been at the forefront of investing in biometric upgrades to meet the changing customer demands.

The U.S. biometrics for banking and financial services market is projected to expand during the forecast timeline. The regional market is driven by stringent regulatory insight and high-value fraud prevention mandates. As per the FDIC report in November 2024, 94% of households were using online banking in 2023. Further, the deployment of advanced multimodal systems by the major banks in the U.S. under the aegis of the Bank Secrecy Act has expanded the scope of deployments in the regional market. Additionally, with the fintech adoption accelerating, the U.S. market is slated to expand its biometric ecosystem across Tier 1 banks.

Canada’s market is shaped by the consumer-driven banking framework that mandates user-consented data sharing, to be secure by creating a biometric verification. This aligns with national digital identity programs that is driven by the Digital Identity and Authentication Council of Canada to provide a trusted pan Canadian environment. According to the CISION report in February 2025, the Canada government has announced a new National Cyber Security Strategy in 2025, which is aimed at protecting data from cyber threats. The initial funding for this initiative announced was USD 37.8 million over 6 years for programs under this strategy.

Europe Market Insights

The biometrics for banking and financial services market in Europe is characterized by a complex regulatory policy. The region is primarily driven by a strong authentication requirement of the Revised Payment Service Directive. This adopts multi-factor authentication by creating a vital role for biometrics in safeguarding electronic payments and online banking. Key drivers also include digital-only banks and fast growth in fintech that uses biometrics for seamless customer onboarding, and escalating efforts to combat advanced phishing and identity fraud.

The UK biometric for banking and financial services market is fueled by the mature fintech sector and regulatory guidance supporting secure customer authentication. As per the UK Finance report in 2025, the fraud losses in authorized push payment reached £459.7 million, underpinning the requirement for strong security using biometrics. The UK government, via its National Cyber Strategy, has committed to investing in cybersecurity programs that bolster financial services security infrastructure, indirectly supporting biometric adoption.

France market is driven by the national support for fintech startups and a rate of adoption of biometric payment cards. The National Cybersecurity Agency in France certifies solutions for secure remote enrollment and transaction signing. The French government’s broader investment plan France 2030 allocates €500M in Deeptech startups, provides investments to the development of nnext gen biometric technologies for the financial sector.