Biological Sample Collection Kits Market Outlook:

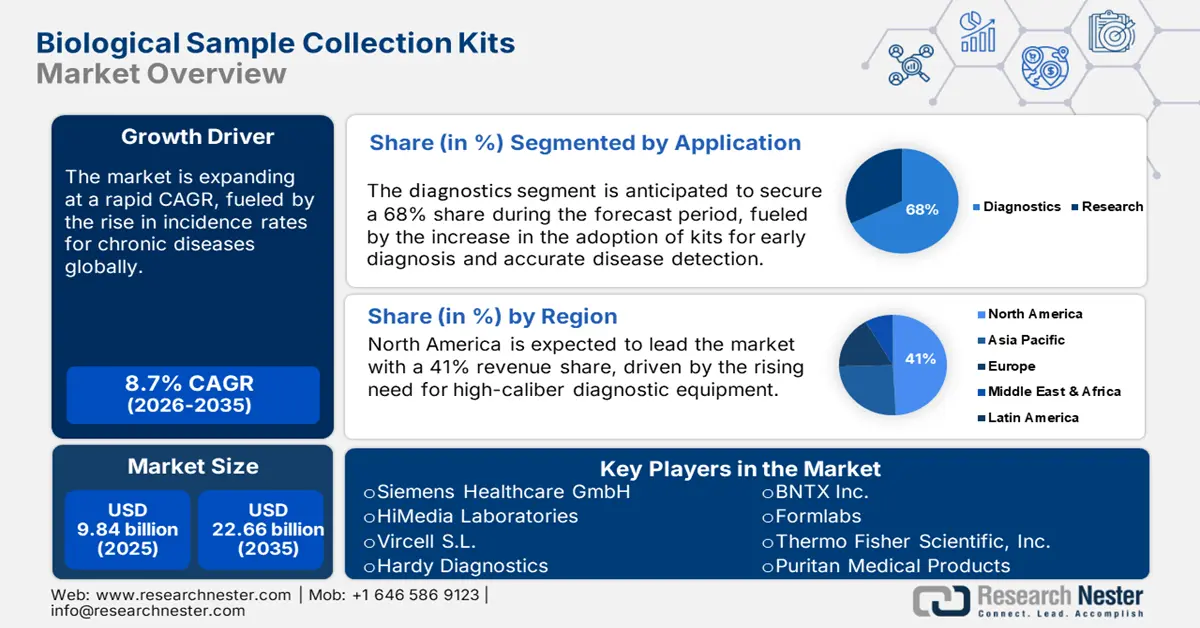

Biological Sample Collection Kits Market size was valued at USD 9.84 billion in 2025 and is expected to reach USD 22.66 billion by 2035, registering around 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biological sample collection kits is evaluated at USD 10.61 billion.

The recent trends in sample testing and personalized medicine are expected to boost the growth of the biological sample collection kits market. The increasing awareness of early disease detection and the rise in incidence rates for chronic diseases have been growing, leading to an increased demand for efficient sample collection methods. Furthermore, an increase in in-home medical care solutions represents a significant opportunity for market growth, as these kits enable the easy and accurate collection of samples outside traditional clinical settings.

To strengthen their market presence, key players in the biological sample collection kits market are focused on product innovation and strategic collaborations. In March 2023, Cue Health introduced a family of at-home diagnostic test kits that allow users to take control with reliable and private sample collection. In addition, growing investment from governments across the globe is expected to boost advanced biological sample collection methods. In December 2023, the FDA issued a 510(k) clearance to BD's MiniDraw Capillary Blood Collection System, which offers blood sample collection with less invasiveness as an example. The approval showcases the role of government in promoting the wide availability of patients with innovative care solutions and consequently improved patient outcomes.

Key Biological Sample Collection Kits Market Insights Summary:

Regional Highlights:

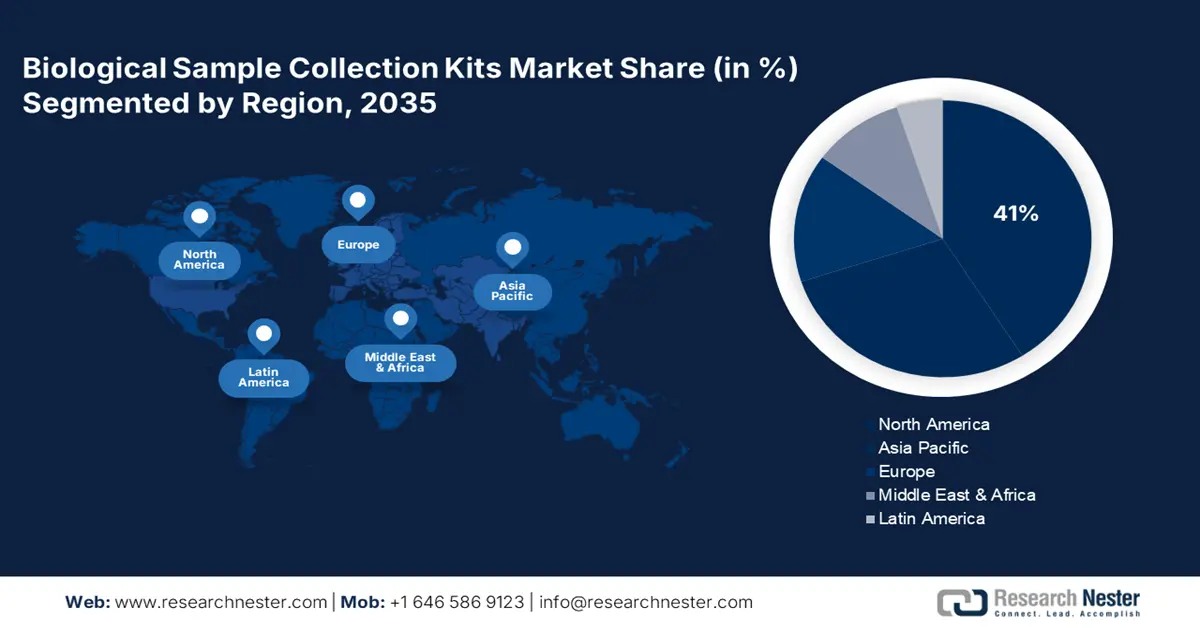

- North America’s biological sample collection kits market will account for 41% share by 2035, driven by strong investments in healthcare infrastructure and advancements in diagnostic technologies.

- Asia Pacific market will register lucrative growth during the forecast timeline, driven by rising healthcare expenditure, early detection focus, and government efforts to improve healthcare access in the region.

Segment Insights:

- The diagnostics segment in the biological sample collection kits market is projected to attain a 68% share by 2035, fueled by early diagnosis, accurate disease detection, and rising chronic disease incidence.

Key Growth Trends:

- Growing popularity of home diagnostics

- Growing burden of chronic ailments

Major Challenges:

- Privacy concerns regarding data

- Regulatory hurdles

Key Players: Siemens Healthcare GmbH, HiMedia Laboratories, Vircell S.L., Hardy Diagnostics, BNTX Inc., Formlabs, Thermo Fisher Scientific, Inc., Puritan Medical Products, Becton, Dickinson and Company, Medline Industries, Inc., F. Hoffmann-La Roche Ltd, Abbott, Altona Diagnostics GmbH, QIAGEN, Laboratory Corporation.

Global Biological Sample Collection Kits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.84 billion

- 2026 Market Size: USD 10.61 billion

- Projected Market Size: USD 22.66 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Biological Sample Collection Kits Market Growth Drivers and Challenges:

Growth Drivers

-

Growing popularity of home diagnostics: Increasing adoption of home-based diagnostic testing is an important driver of the biological sample collection kits market. These scenarios, coupled with the convenience and privacy provided by home testing, created a surge in demand for access to reliable, easy-to-use collection kits. A recent development saw CVS Health partner with ixlayer in October 2022 to offer home test kits for multiple conditions, including Lyme disease, and testing thyroid function. The partnership exemplifies how companies are adapting to growing interest in home diagnostics.

- Growing burden of chronic ailments: Rising prevalence of chronic disorders such as diabetes and cardiovascular diseases impels efficiency in sample collection kits. These kits are critical for monitoring and managing chronic conditions. Labcorp launched a home collection kit to measure HbA1c in May 2022, which is an important test for diabetes control. The announcement reflects the continued emphasis on connected health solutions to address the increasing trend of chronic disease monitoring.

- Technological advances in sample collection: Innovations in biological sample collection kits provide an impetus for technological developments that enhance the ease and accuracy of these products. Takara Bio USA officially announced the launch of a breakthrough automation-friendly library preparation kit for oncology research, the Shasta Total RNA-Seq Kit, in February 2024. The kit allows researchers to conduct in-depth assessments of genome-wide transcription, highlighting how advancements in the market are captivating new regional markets.

Challenges

-

Privacy concerns regarding data: Considering the nature of gathering biological sample collection kits, personal information is often involved, and hence data privacy has become one of the major challenges in the industry. Governments are putting in place more stringent regulations to protect patient data, implementing new technologies even more complicated. A good example is the GDPR that the European Union set, which indeed had wide implications for companies operating within this space, with data management changed since enforcement.

- Regulatory hurdles: Strict regulatory requirements is a key challenge to development and commercialization of biological sample collection kits. To sell their products, companies are bound to acquire FDA approval and follow international standards. This can delay product launches due to prolonged approval procedures and increased costs. According to GCC FDA reports, delays in approval processes have slowed the BD MiniDraw Capillary Blood Collection System’s clearance to December 2023. Such challenges adversely impact the market’s growth trajectory.

Biological Sample Collection Kits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 9.84 billion |

|

Forecast Year Market Size (2035) |

USD 22.66 billion |

|

Regional Scope |

|

Biological Sample Collection Kits Market Segmentation:

Product

The swabs segment in the biological sample collection kits market is expected to register rapid revenue growth during the forecast period. This is due to an increase in the use of swabs, which cover a broad array of diagnostic applications, especially infectious disease testing. This is reinforced by the growing need for test swabs. The Panbio COVID-19 Antigen Self-Test launched by Abbott in July 2021 in India was based largely on swabs demand during the pandemic. This indicates their continued importance and adoption during the forecast period.

Application

The diagnostics segment is projected to contribute around 68% of the biological sample collection kits market share during the forecast period owing to early diagnosis and accurate disease detection. The increasing incidence of chronic diseases, coupled with the global trend towards prevention-based healthcare, is positively influencing demand for diagnostic sample collection kits. For example, in March 2023, Cue Health launched a new range of home-based diagnostic kits compatible with iOS and Android smartphones, enhancing convenience and leading growth for this segment.

Our in-depth analysis of the biological sample collection kits market includes the following segments:

|

Product |

|

|

Application |

|

|

Site of Collection |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biological Sample Collection Kits Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 41% by 2035, due to strong investments in healthcare infrastructure and ongoing advancements in diagnostic technologies. The U.S. is leading the market as the country conducts a large number of clinical lab tests each year, with expenditure surpassing more than 7 billion. In August 2021, Sedia Biosciences launched Asante DNA Specimen Collection Kits to support innovative specimen collections with the goal of expansion from outside of the U.S. into its domestic market.

The biological sample collection kits market is also seeing increased traction in Canada, backed by government efforts to reduce gaps in the accessibility of healthcare services. Investments by the local government in healthcare technology and expansion of reach to rural locations and underserved areas have helped this market grow further. The rising incidence of chronic diseases and the increasing adoption rate for personalized medicine are other significant factors driving market growth in Canada.

Asia Pacific Market Insights

Asia Pacific is likely to witness lucrative growth in the biological sample collection kits market. The rising healthcare expenditure and heightened focus on early detection of diseases are fueling demand for high-performance diagnostic solutions. The region also offers huge growth opportunities due to the rising demand for personalized and home-based healthcare solutions.

The market is also bolstered by the government's efforts to enhance healthcare facilities and encourage preventive care in India. The launch of Azooka Labs' mWRAPR in February 2022 a product designed to serve biobanks and research labs working with biological samples, indicates how dynamic the market is evolving within India.

Government efforts to enhance healthcare access and quality have played a pivotal role in the market expansion of the biological sample collection kits sector, particularly in China. Growing investments in healthcare infrastructure and technology by the government and private sectors is boosting demand for high-quality diagnostic equipment. The RealStar Zoonotic Orthopoxvirus PCR Kit 1.0 by Altona Diagnostics was launched in China in June 2022, augmenting the company’s market position within this region and signaling potential future growth boosters for the area of interest.

The biological sample collection kits market in Japan is well-established and geared toward innovation and quality. The aging population in the country, as well as the increasing demand for personalized medicine, are key factors boosting growth.

Biological Sample Collection Kits Market Players:

- Siemens Healthcare GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HiMedia Laboratories

- Vircell S.L.

- Hardy Diagnostics

- BNTX Inc.

- Formlabs

- Thermo Fisher Scientific, Inc.

- Puritan Medical Products

- Becton, Dickinson and Company

- Medline Industries, Inc.

- F. Hoffmann-La Roche Ltd

- Abbott

- Altona Diagnostics GmbH

- QIAGEN

- Laboratory Corporation of America Holdings

- Sensing Self

- BioMaxima SA

- CTK Biotech, Inc

The biological sample collection kits market is fragmented, with several global and regional players seeking to gain a competitive advantage. Top companies include Roche, Becton, Dickinson and Company (BD), LabCorp, Abbott, and Cue Health. These companies are involved in product innovations along with advancements to gain a competitive edge over others, as well as other strategic and collaborative initiatives, including mergers and acquisitions. With a rapidly increasing market for diagnostic testing, competition is fierce, with many players seeking to deliver the best-in-class software solutions that have no downtime and yield reliable outputs. Here are some leading players in the biological sample collection kits market:

Recent Developments

- In April 2024, Bio-Rad launched its first ultrasensitive multiplexed digital PCR assay for breast cancer mutation detection, enhancing clinical research capabilities in biological sample analysis.

- In March 2024, ChristianaCare's Gene Editing Institute partnered with Carolina to introduce "CRISPR in a Box," providing high school educators with resources to facilitate gene editing experiments, which may include essential biological sample collection kits

- In March 2024, Watchmaker Genomics launched its mRNA Library Prep Kits featuring a rapid workflow and sensitive mRNA detection, to provide researchers with effective tools for biological and genetic sample analysis.

- Report ID: 6382

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.