Bioidentical Hormones Market Outlook:

Bioidentical Hormones Market size was over USD 2.8 billion in 2025 and is estimated to reach USD 4.7 billion by the end of 2035, expanding at a CAGR of 6.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of bioidentical hormones is evaluated at USD 2.9 billion.

The rising incidence of hormone-related disorders, such as menopause, andropause, PCOS, adrenal fatigue, thyroid, and hypogonadism, collectively presents a wide range of applications for specialized components. Besides, the tendency to develop these ailments amplifies notably with age. As evidence of this expanding high-risk population, a report from the World Health Organization (WHO) estimated the proportion of residents aged over 60 across the globe to double during the timeline from 2015 to 2050, accounting for 22%. Another WHO finding unveiled that, till 2025, 6–13% of reproductive-aged women in the world were suffering from PCOS, fueling demand in the market.

Despite the rising consumer demand and pressure for integrative care, the current dynamics of payers' pricing in the bioidentical hormones market remain complex and somewhat fragmented. A majority of the sector’s economic landscape runs upon an out-of-pocket and cash-pay basis, which may restrict its reach toward price-sensitive regions. However, under flexible spending and health savings measures, several insurers have enabled partial reimbursement for some of the government-certified products available in this sector. Currently, the ongoing reformation of payer models is offering broader financial support to both suppliers and eligible patients, as the introduction of standardized pricing is becoming more evident with time.

Key Bioidentical Hormones Market Insights Summary:

Regional Highlights:

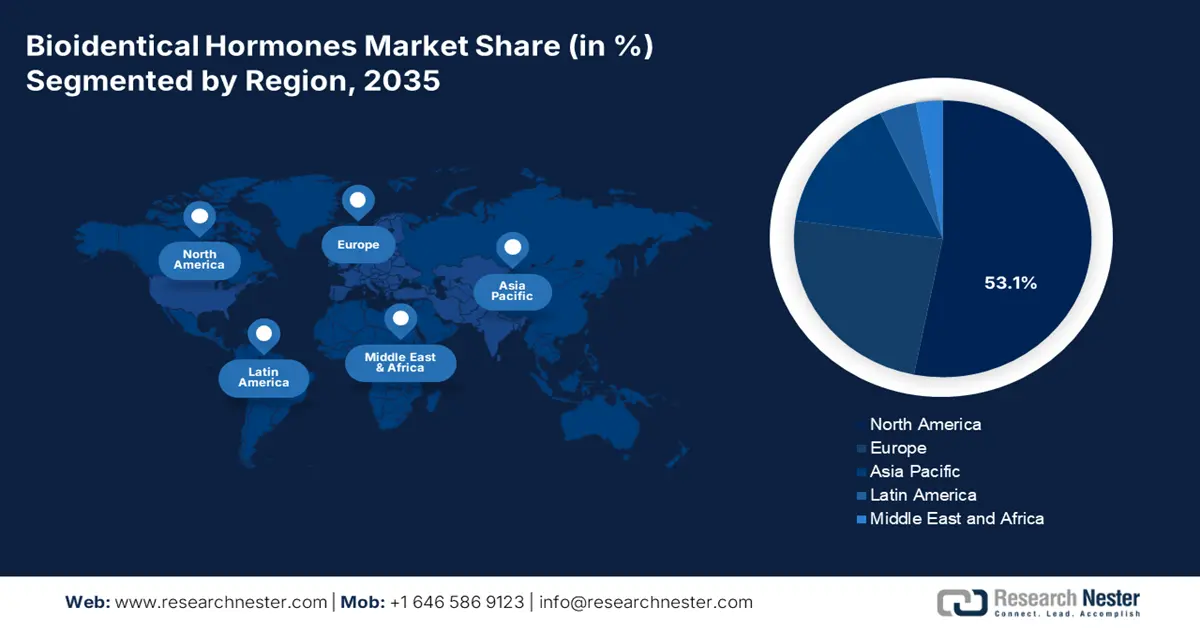

- North America is anticipated to dominate the bioidentical hormones market with a 53.1% share by 2035, stimulated by high personal healthcare spending, advanced medical infrastructure, and a growing aging population.

- Europe is forecasted to secure the second-largest position in the market during 2026-2035, underpinned by an expanding geriatric base and robust biomedical advancements.

Segment Insights:

- The menopause segment of the bioidentical hormones market is projected to account for a dominant 65.4% share by 2035, propelled by the expanding patient base experiencing menopausal symptoms requiring treatment.

- The transdermal segment is expected to hold a significant 38.9% share by 2035, owing to its superior safety profile and strong patient preference for non-invasive administration.

Key Growth Trends:

- Growing demand for natural and personalized treatments

- Expansion of the compounding pharmacies industry

Major Challenges:

- Increasing complexity in earning reimbursement

- Vulnerabilities in the supply chain

Key Players: Pfizer Inc., Novartis AG (Sandoz), Bayer AG, Viatris Inc., AbbVie Inc., Teva Pharmaceutical Industries Ltd., Merck KGaA (EMD Serono), Ferrer Pharmaceuticals, Theramex, Novo Nordisk A/S, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Gedeon Richter Plc., Besins Healthcare, Mayne Pharma Group Ltd., Hikma Pharmaceuticals PLC, Korea Pharma Co., Ltd., Spark Hormone Therapy, Jagsonpal Pharmaceuticals Limited.

Global Bioidentical Hormones Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 4.7 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (53.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Canada

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 16 September, 2025

Bioidentical Hormones Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for natural and personalized treatments: The shifting preference for tailored clinical solutions is one of the major growth factors in the bioidentical hormones sector. These compounds are often perceived as safer and more effective alternatives to synthetic therapeutics that allow flexibility in dosage and indication. This patient-centered approach aligns with broader trends in precision medicine; hence, the sector continues to expand. Moreover, the growing trend of consumer-driven services and product design in the healthcare industry is fueling substantial growth in the market.

- Expansion of the compounding pharmacies industry: According to the 2024 NLM report, the industry of compounded bioidentical hormone therapies (cBHT) generates approximately USD 2-9 billion in revenue annually, while exhibiting a year-on-year (YoY) rise. In addition, these specialized pharmaceuticals are becoming more regulated and quality-controlled, building greater consumer trust in their offerings. This progressive infrastructure is further enhancing the availability in this sector, especially for patients not served by standardized commercial products, translating to continuous cash inflow in this sector.

- Surge in preventive and anti-aging medicine: Medical settings across the globe are increasingly moving from reactive to preventive models. Thus, with such a strong focus on maintaining vitality and preventing age-related conditions, the bioidentical hormones market is viewed not only as a reliable source of treatment for hormonal deficiencies but also as a crucial asset for anti-aging protocols. Many wellness clinics now offer these therapies as part of the worldwide cohort of comprehensive longevity programs. This is attracting higher consumer interest in functional medicine and wellness optimization commodities available in this sector.

Trends in Utilization Rates Benefiting the Market

Estimated Prescription Rates of thyroid hormones in OECD Countries (2040)

|

Country |

Increase in Prescribing Trends (2040) |

|

Chile |

220.0% |

|

Greece |

238.7% |

|

Spain |

162.8% |

|

UK |

138.1% |

|

Croatia |

190.6% |

|

Slovakia |

182.1% |

|

Turkey |

168.7% |

|

Lithuania |

131.2% |

|

Portugal |

106.7% |

|

Estonia |

87.8% |

|

Latvia |

83.7% |

|

Slovenia |

57.4% |

|

Czechia |

52.8% |

Source: NLM

Cost Differentiations in Products Available in the Market

Comparative Treatment Costs for Vasomotor Symptoms (2022)

|

Generic name (Brand Name) |

Annual drug cost (in USD) |

|

Estradiol-progesterone (Bijuva; 0.5 mg & 1 mg/100 mg) |

327 |

|

17beta-estradiol (Estrace; 1 mg) + medroxyprogesterone (Provera) |

189 |

|

17beta-estradiol (Estrace; 0.5 mg) + progesterone (Prometrium) |

599 |

|

17beta-estradiol (Estrace; 0.5 mg) + progesterone (Teva-Progesterone) |

573 |

|

17beta-estradiol (Estrace; 2mg) + medroxyprogesterone (Teva-Medroxyprogesterone) |

185 |

|

17beta-estradiol (Lupin-Estradiol; 0.5 mg) + progesterone (Teva-Progesterone) |

560 |

Source: NLM

Challenges

- Increasing complexity in earning reimbursement: Both certification authorities and public payers are increasingly demanding real-world comparative analysis for the therapeutic pipelines. They often question the premium price of newer products in the bioidentical hormones market, especially when their offerings are limited to incremental benefits, such as improved delivery over a novel mechanism. Moreover, as coverage for specific options available in this sector varies wildly across insurance plans, formulary inclusion and patient access become more constrained.

- Vulnerabilities in the supply chain: The line of production in the bioidentical hormones market heavily relies on the global trade liberty for active pharmaceutical ingredients (APIs). As a majority of outsourcing of these essentials predominantly originates from China and India, disruptions from trade disputes, geopolitical instability, and quality control issues become more evident and harmful for the sector’s financial liability. These factors ultimately lead to shortages, compliance failures, and trend irrelevance in the field.

Bioidentical Hormones Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Bioidentical Hormones Market Segmentation:

Application Segment Analysis

The estimated dominance of the menopause sub-segment in the bioidentical hormones market showcases the potential to procure the largest share of 65.4% by the end of 2035. The large and continuously expanding target patient population experiencing symptoms that require treatment is a major growth factor in this sector. According to the 2024 U.S.-based Study of Women’s Health Across the Nation (SWAN), the occurrence of hot flashes and/or night sweats, related to menopause, ranged from 36-50% in North America to 22-63% in Asia. As a result, a majority of the therapeutic advances and products in this sector are designed to treat these conditions, solidifying the segment’s position in this field.

Formulation Segment Analysis

The transdermal segment is poised to lead the bioidentical hormones market with a 38.9% throughout the discussed period. Due to having a superior safety profile and patient preference, this formulation type is becoming the gold standard for administering BIHs in a non-invasive and effective pathway. Moreover, this drug delivery method avoids first-pass metabolism in the liver, securing a greater safety profile in comparison to other routes by reducing the risk of serious adverse events, such as venous thromboembolism (VTE) and stroke. This attracts both prescribing physicians and payers, making transdermal gels and patches the most preferred first-line option.

Distribution Channel Segment Analysis

Retail pharmacies are expected to secure the highest share of 40.5% in the bioidentical hormones market over the assessed timeframe. The wide accessibility and consumer trust involved with these entities make them the primary distributors in this sector. Retailers serve as a critical point of contact for a dominant proportion of patients seeking BIH replacement therapies, as they offer both convenience and personalized service. Specifically in developed markets, retail pharmacies are increasingly becoming an essential source of revenue generation from this field by partnering with compounding specialists and healthcare providers, ensuring accurate dispensing and patient education.

Our in-depth analysis of the bioidentical hormones market includes the following segments:

| Segment | Subsegment |

|

Product Type |

|

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Formulation |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioidentical Hormones Market - Regional Analysis

North America Market Insights

North America is predicted to remain the dominant region in the global bioidentical hormones market by capturing the largest share of 53.1% during the analyzed tenure. High spending on personal healthcare, advanced medical infrastructure, and the aging population are collectively fostering a lucrative landscape for the sector. The U.S., in particular, leads the region in this category due to having a large menopause-related vasomotor symptoms (VMS) afflicted population. Besides, the strong network of compounding pharmacies and widespread demand for natural treatment options are also consolidating the region’s forefront position in this field.

Favorable regulatory frameworks, ongoing research, and the presence of global pioneers fuel the leadership of the U.S. in the regional bioidentical hormones market. As residents in the country increasingly seek alternatives to synthetic hormones, the merchandise continues to be empowered through large-scale prescription fillings and over-the-counter (OTC) BIH products availability. In this regard, a 2024 article published by the NLM revealed that the number of women aged 40 years or older using compound BIH therapy in the U.S. ranged between 1.0 million and 2.5 million. It also mentioned that more than 26-33 million of these medications are prescribed every year nationwide.

Canada also plays an important role in the overall growth of the North America bioidentical hormones market. It is largely supported by heavy capital allocations to elderly and female-oriented medical programs, prioritizing early intervention and disease severity prevention. For instance, in August 2023, the Ministry of Health released USD 8.3 million in funding to strengthen pan-Canada women’s health coalition hubs, raising awareness of holistic and personalized healthcare options. Such events also foster opportunities for both domestic and foreign companies focused on extensive research in this category.

APAC Market Insights

Asia Pacific is predicted to emerge as the fastest-growing region in the global bioidentical hormones market by the end of 2035. The increasing disposable incomes and a growing elderly population are the major propellers of the region’s progress in this sector. Particularly, the unmet needs of VMS-affected patient populations in developing countries, such as Japan, China, India, and South Korea, are attracting greater public interest toward investments in the field. Evidencing the epidemiological factor, a 2024 NLM study unveiled that the occurrence rates of menopausal depression and urogenital issues among middle-aged women in Asia accounted for 45.6% and 44%, respectively.

China is witnessing a surge in demand in the bioidentical hormones market due to the shifting consumer preference toward natural and personalized therapies. Particularly among women experiencing menopause and individuals seeking age-management solutions, the tendency to adopt these solutions is increasingly observed. Besides, recent improvements in healthcare access and the incorporation of value-based clinical practices are accelerating the penetration of products available in this sector in the mainstream therapeutic supplier network. These incremental aspects are cumulatively positioning China as the epitome of massive adoption.

India is establishing itself as both a hub of API production and innovation in the bioidentical hormones market. The increasing personal health awareness, a growing middle-class population, and ongoing accomplishments in precision medicine are solidifying the country’s position in the APAC landscape. Moreover, the rising consumer tendency of seeking natural and safer alternatives, empowered by its ancient roots in biomedical commodities, is enabling a great momentum for India in this field. Moreover, the wide network of private healthcare providers, integrative medicine clinics, and compounding pharmacies is also contributing to this expansion.

Country-wise Import-Export Data for Hormones (2023)

|

Country |

Import Value (in USD, Million) |

Export Value (in USD, Million) |

|

India |

390 |

320 |

|

China |

2310 |

1420 |

|

South Korea |

79.2 |

40.6 |

|

Malaysia |

14.0 |

76.9 |

Source: OEC

Europe Market Insights

Europe is poised to remain the second-largest shareholder in the global bioidentical hormones market over the timeline between 2026 and 2035 with a consistent cash inflow. The expanding geriatric demography, world-class healthcare system, and revolutionary advances in the biomedical industry are helping the region maintain its significance in this sector. Among the most contributing countries, Germany, France, and the UK are leading the landscape in terms of adoption of BIH therapy. The region further fuels from a well-distributed network of pharmacies and integrative healthcare practitioners, coupled with an evolving regulatory framework and comprehensive public payer system.

The UK is one of the key contributors to the regional revenue generation from the bioidentical hormones market. According to a 2024 NLM report, the incidence rates of menopausal urogenital issues and depression among middle-aged women in the country reached 45.6% and 35.5%. This ultimately displays the substantial nature of the BIH demand base in the UK, particularly for natural and individualized solutions. Moreover, the country is gaining traction in this category, with an explosive industry value of specialized clinics and personalized medicine-associated R&D.

Germany is also positioned as one of the leading participants in the Europe bioidentical hormones market, which is progressing in support of an advanced healthcare infrastructure and strong emphasis on personalized medicine. Besides, the continuously aging population and growing awareness of BIH benefits for managing menopause and other hormonal imbalances are cultivating a sustainable consumer base for this sector. The country is also home to several well-established compounding pharmacies and integrative healthcare practicioners, securing consistency in growth.

Country-wise Consumption of a Selected Bioidentical Hormone (Levothyroxine)

|

Country |

Consumption of ATC H03AA01 (Levothyroxine) |

Year |

|

Denmark |

46´968´308 DDD |

2022 |

|

Finland |

121´210´700 DDD |

2021 |

|

Germany |

1´458.3 DDD in million |

2022 |

|

Netherlands |

35.8 DDD per 1000 inhabitants per day |

2023 |

|

Norway |

20.2 DDD per 1000 inhabitants per day |

2020 |

Source: NLM

Legends:

DDD = Defined Daily Dose

Key Bioidentical Hormones Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG (Sandoz)

- Bayer AG

- Viatris Inc.

- AbbVie Inc.

- Teva Pharmaceutical Industries Ltd.

- Merck KGaA (EMD Serono)

- Ferrer Pharmaceuticals

- Theramex

- Novo Nordisk A/S

- Cipla Ltd.

- Sun Pharmaceutical Industries Ltd.

- Gedeon Richter Plc.

- Besins Healthcare

- Mayne Pharma Group Ltd.

- Hikma Pharmaceuticals PLC

- Korea Pharma Co., Ltd.

- Spark Hormone Therapy

- Jagsonpal Pharmaceuticals Limited

The bioidentical hormones market is established as a lucrative space of competition for age-related therapeutic suppliers. Major players in this category are continuously expanding their territory through cutting-edge innovation and strategic commercial moves. Exemplifying the same, in January 2024, Biote Corp. acquired Asteria Health, a 503B manufacturer, to strengthen its supply chain and network of partnered clinics in this field. On the other hand, in February 2025, Noom debuted in this category by offering FDA-approved and compounded holistic BIH options as part of its future plans for pipeline expansion in the menopause care industry.

Such key players are:

Recent Developments

- In April 2025, Spark Hormone launched its innovative Auto Injector device, designed to deliver an at-home treatment experience by eliminating injection-related anxiety and discomfort. This tool intends to minimize challenges faced by patients self-administering bioidentical hormone therapies.

- In May 2024, Jagsonpal introduced the first bioidentical hormone replacement therapy, MemUp, in a single daily oral capsule. The therapeutic features USFDA-approved combination of bio-identical estradiol and bio-identical progesterone for the management of vasomotor symptoms of menopause.

- Report ID: 8109

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioidentical Hormones Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.