Biohybrid Solar Cell Market Outlook:

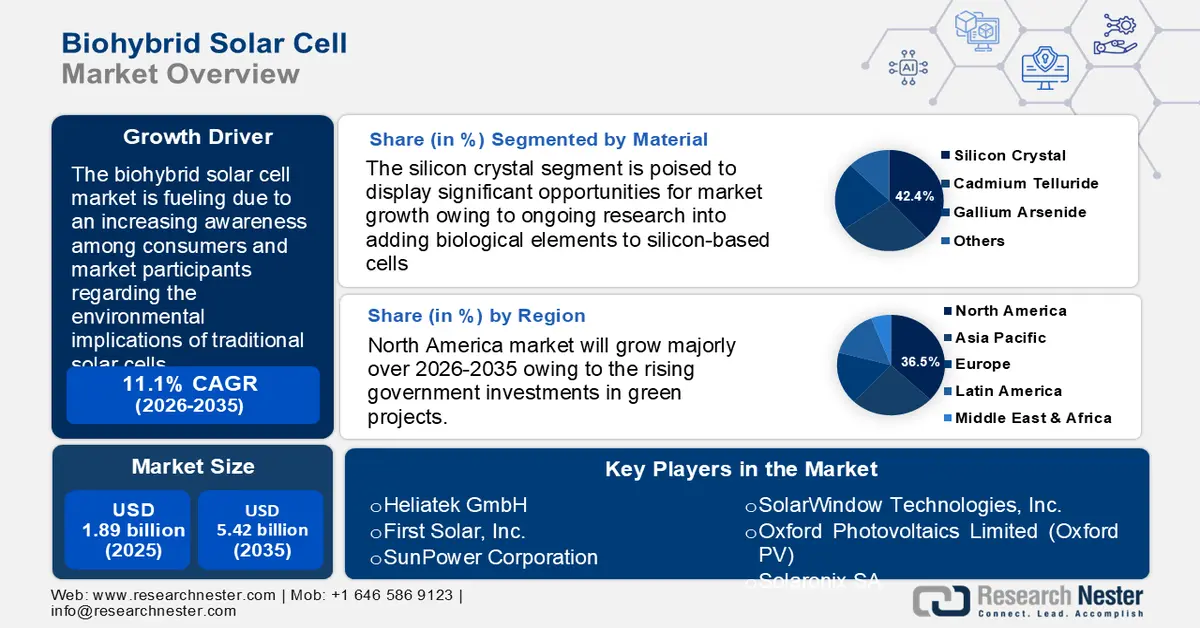

Biohybrid Solar Cell Market size was valued at USD 1.89 billion in 2025 and is set to exceed USD 5.42 billion by 2035, registering over 11.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biohybrid solar cell is estimated at USD 2.08 billion.

The global biohybrid solar cell market is experiencing notable growth, driven by an increasing awareness among consumers and market participants regarding the environmental implications of traditional solar cells. Biohybrid solar cells contribute to mitigating climate change by reducing carbon emissions. Several factors are anticipated to further drive the biohybrid solar cell market, including a rise in the utilization of solar panels to satisfy the escalating demand for electricity, a heightened preference for clean energy solutions, reduced carbon emissions, and an increase in residential rooftop installations. The International Energy Agency (IEA) projects that by 2030, there will be 100 million households using solar photovoltaics, surpassing the 25 million in 2022, to achieve Net Zero Emissions.

Biohybrid solar cells, which integrate biological components such as photosynthetic proteins with conventional photovoltaic materials, offer advantages such as improved energy conversion efficiency, reduced environmental impact, and lower production costs. As urban spaces become more constrained and the adoption of solar energy accelerates, biohybrid solar cells present a viable alternative for rooftop installations, especially in regions with high solar potential but limited space for large-scale solar farms.

The IEA has reported that the installation cost for household rooftop photovoltaic (PV) systems has now reached approximately USD 1 per watt, representing a highly competitive pricing structure. Over the past decade, the costs associated with both equipment and installation have experienced a decline of more than 80%. In addition to the outright purchase of PV systems, emerging business models are offering leasing or rental options that encompass supplementary maintenance services and, in certain instances, electricity expenses. Moreover, new regulatory frameworks have been established to facilitate the sale of PV-generated electricity to neighbors or other third parties, while also providing compensation for production and consumption across different locations.

Source: IEA

Key Biohybrid Solar Cell Market Insights Summary:

Regional Highlights:

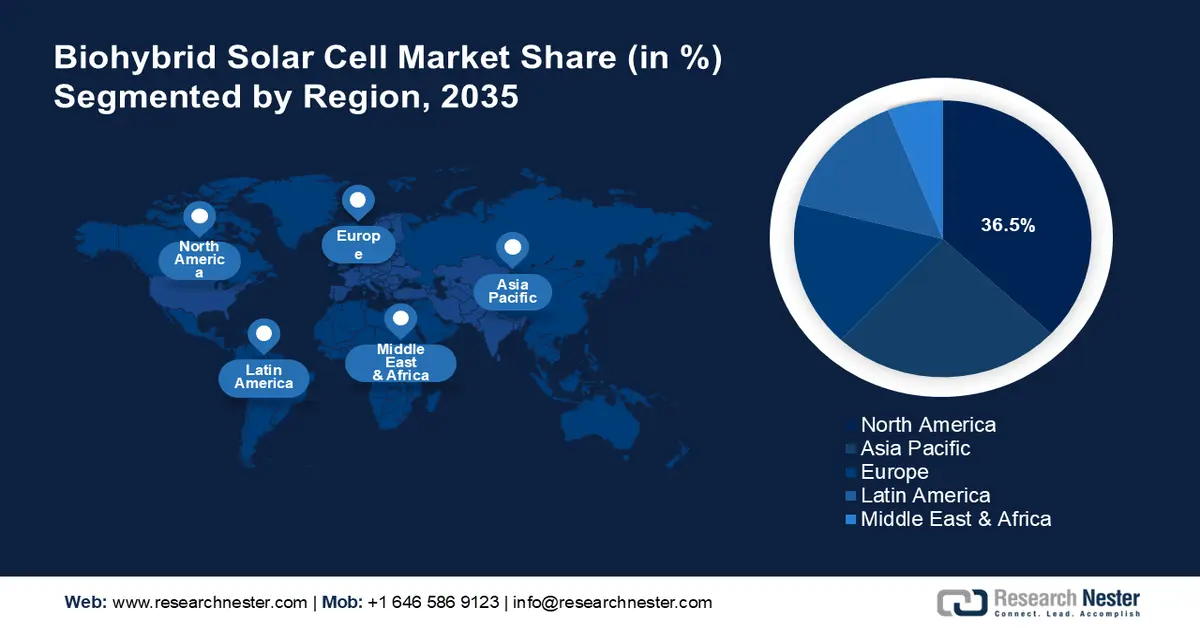

- By 2035, North America is set to command over 36.5% share in the biohybrid solar cell market, underpinned by expanding green investments and collaborative R&D initiatives.

- Asia Pacific is projected to grow at the fastest pace through 2026–2035, supported by escalating sustainability commitments and intensifying research efforts across key economies.

Segment Insights:

- By 2035, the silicon crystal segment is projected to secure over 42.4% share in the biohybrid solar cell market, propelled by ongoing research integrating biological components with durable silicon structures.

- The battery storage segment is anticipated to capture a notable share during 2026–2035, supported by rising adoption of storage systems that enhance reliability in off-grid and remote applications.

Key Growth Trends:

- Advancements in biohybrid solar cell technology

- Increased international trade of PV products

Major Challenges:

- Intense competition from conventional solar

- Expand production while optimizing cost efficiency

Key Players: Heliatek GmbH, First Solar, Inc., SunPower Corporation, SolarWindow Technologies, Inc., Oxford Photovoltaics Limited (Oxford PV), The Commonwealth Scientific and Industrial Research Organization, Solaronix SA, Dyesol Limited, Exeger Operations AB, G24 Power Ltd.

Global Biohybrid Solar Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.89 billion

- 2026 Market Size: USD 2.08 billion

- Projected Market Size: USD 5.42 billion by 2035

- Growth Forecasts: 11.1%

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Australia, Canada, United Kingdom

Last updated on : 3 December, 2025

Biohybrid Solar Cell Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in biohybrid solar cell technology: The potential of biohybrid solar cells is revolutionized by the astounding advancements in genetic engineering, synthetic biology, and biotechnology. By using cutting-edge biological materials and components, researchers are constantly improving these cells' scalability, stability, and efficiency. As companies and consumers become more aware of the potential of biohybrid solar cells as a flexible, efficient, and sustainable energy source, these innovations are fueling market demand. The biohybrid solar cell market is rising to prominence in the field of renewable energy as a result of these considerations taken together.

- Recently, researchers discovered that the photoactive, retinal-containing membrane protein bacteriorhodopsin (bR) is one of the biosensitizers that exhibit promise in terms of simplicity, stability, and quantum efficiency. In the current study, they employed a bR mutant, D96N, in a photoanode-sensitized TiO2 solar cell, incorporating inexpensive, carbon-based components such as a hydroquinone/benzoquinone (HQ/BQ) redox electrolyte and a cathode made of PEDOT (poly(3,4-ethylenedioxythiophene) functionalized with multi-walled carbon nanotubes (CNT). SEM, TEM, and Raman were used to analyze the cathode and photoanode chemically and morphologically. Impedance spectroscopic analysis (EIS), open circuit potential decay (VOC), and linear sweep voltammetry (LSV) were used to examine the electrochemical performance of the bR-BSCs. The champion device produced a power conversion efficiency (PCE) of 0.16 percent, a fill factor of approximately 24%, a current density (JSC) of 1.0 mA/cm2, and a VOC of -669 mV. One of the earliest bio-based solar cells to use carbon-based substitutes for the photoanode, cathode, and electrolyte is this bR device. This might lower the price and greatly increase the sustainability of the gadget.

- Increased international trade of PV products: The growing trade of solar PV products is accelerating advancements in the biohybrid solar cell market by driving innovation, reducing costs, and expanding market opportunities. As the demand for renewable energy rises, large-scale production and distribution of solar components, such as photovoltaic cells, electrodes, and nanomaterials, have improved accessibility to advanced materials, including carbon-based elements used in biohybrid solar cells. Increased investments in solar PV technology foster research into alternative and eco-friendly solutions such as bacteriorhodopsin-based biohybrid cells, which offer biodegradable and sustainable energy solutions.

|

Solar PV Products |

Trade Value in 2020 (USD billion) |

Trade Value in 2021 (USD billion) |

Trade Value in 2022 (USD billion) |

|

Modules |

19.0 |

32.5 |

39.3 |

|

Polysilicon |

0.9 |

2.6 |

3.2 |

|

Cells |

2.2 |

2.2 |

3.1 |

|

Wafers |

1.7 |

3.4 |

2.9

|

Source: IEA

The IEA revealed that China exports a large number of solar PV products. Over USD 30 billion worth of solar PV exports were made by China in 2021, accounting for nearly 7% of the country's five-year trade surplus. Furthermore, global commerce in PV-related products, such as polysilicon, wafers, cells, and modules, was valued at over USD 40 billion in 2021, up more than 70% from 2020.

Challenges

- Intense competition from conventional solar: The major limitation is the long-standing dominance of conventional solar panels, such as silicon-based photovoltaics. These traditional technologies are more efficient, have a longer history, and cost less to produce. They therefore present fierce competition and frequently exceed biohybrid solar cells in terms of dependability and efficiency. The adoption of biohybrid cells may be constrained by competition from established solar technologies, especially in biohybrid solar cell markets where performance and cost-effectiveness are the main priorities.

- Expand production while optimizing cost efficiency: The incorporation of biological materials and living things in the creation of biohybrid solar cells might add complexity and unpredictability to the process. Achieving reliable and large-scale production is essential to the commercial viability of biohybrid cells. The cost of biohybrid solar cells could increase as a result of this scaling-up process, which necessitates large investments in R&D and production infrastructure. These difficulties show how crucial it is to address cost-effectiveness, scalability, and efficiency to defeat competition from traditional solar technologies and increase biohybrid solar cell market demand.

Biohybrid Solar Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 1.89 billion |

|

Forecast Year Market Size (2035) |

USD 5.42 billion |

|

Regional Scope |

|

Biohybrid Solar Cell Market Segmentation:

Material Segment Analysis

Silicon crystal segment is set to account for biohybrid solar cell market share of more than 42.4% by the end of 2035. A key component of the solar business for a long time has been silicon crystals. As a result of its durability and well-established production techniques, silicon crystals continue to be important in the biohybrid solar cell market. Research into adding biological elements to silicon-based cells to improve sustainability and efficiency is still ongoing, according to trends. By fusing the inventiveness of biological components with the dependability of silicon, this hybrid technique aims to produce a new generation of biohybrid solar cells that may perform better.

Application Segment Analysis

The battery storage segment is biohybrid solar cell market is poised to garner a significant share during the assessed period. Two important applications that are shaping industry trends in the biohybrid solar cell market are solar illumination and battery storage. The use of battery storage systems has grown as they work in tandem with biohybrid solar cells to store extra energy produced during the day for use at night or during overcast conditions. By improving the dependability of off-grid and remote applications and addressing the sporadic nature of solar energy, this trend makes biohybrid solar cells a viable option for a range of settings.

Our in-depth analysis of the global biohybrid solar cell market includes the following segments:

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biohybrid Solar Cell Market - Regional Analysis

North America Market Insights

North America biohybrid solar cell market is set to capture revenue share of over 36.5% by 2035. A strong scientific ecosystem and a dedication to sustainability define the region. Companies and research organizations are working together to create biohybrid solar cell technologies that are more scalable and efficient. The use of solar cells is also fueled by government investments in green projects and their emphasis on renewable energy sources.

The biohybrid solar cell market is growing in the U.S. owing to increasing investments in renewable energy, cutting-edge research in biotechnology and nanomaterials, and a strong push for sustainable energy solutions. Federal and state-level policies supporting clean energy innovation, along with funding from institutions are driving advancements in biohybrid solar cells. The presence of top-notch universities and research centers enables the development of efficient biohybrid solar technologies, particularly those incorporating carbon-based components. Additionally, the rising demand for eco-friendly and biodegradable alternatives to conventional solar cells aligns with the U.S.’s commitment to reducing carbon footprints and achieving energy independence, further fueling biohybrid solar cell market growth.

Also, a preliminary decision to apply countervailing duties to c-Si panels and cells made in Vietnam, Malaysia, Thailand, and Cambodia was released by the U.S. Department of Commerce on October 1, 2024. A preliminary ruling about antidumping duties is anticipated later; tariffs range from 0% to 300%. These tariffs aim to protect domestic manufacturers but also drive innovation in emerging solar solutions that bypass trade restrictions.

Furthermore, with vast solar energy potential and government support for green innovation, Canada is investing in next-generation solar technologies, including biohybrid solar cells. Additionally, Canada’s push towards carbon neutrality and its commitment to reducing reliance on fossil fuels creates a favorable environment for emerging solar technologies. Natural Resources Canada disclosed that the installed capacity of solar photovoltaic power has grown significantly over the last 20 years, reaching 6'452 megawatts in 2022. In 2022, Canada produced approximately 4,323 gigawatt-hours of solar energy, which was sufficient to power more than 470,000 average Canadian homes. Therefore, the increased use of solar photovoltaic power is significantly escalating the market.

APAC Market Insights

Asia Pacific's biohybrid solar cell market is expected to grow at a significant rate during the projected period. Asia Pacific is anticipated to expand at the highest rate, with a special emphasis on nations like Japan and India demonstrating a strong commitment to sustainable energy solutions. Research and development efforts to increase the efficiency and scalability of these cutting-edge solar cells are booming in the biohybrid solar cell market. Additionally, the need for novel energy sources and the significance of environmental sustainability are becoming more widely acknowledged in the region. Together, these factors are driving the market for biohybrid solar cells and establishing the Asia Pacific region as a potential hub for developments in this region.

As the world’s largest producer and consumer of solar energy, China is investing heavily in next-generation solar technologies, including biohybrid solar cells, to enhance efficiency and sustainability. Government policies promoting clean energy along with substantial funding for research and development, have accelerated innovation in biohybrid solar technology, driving the biohybrid solar cell market growth. Additionally, China’s dominance in photovoltaic supply chains and expertise in large-scale production enable faster commercialization of biohybrid solar cells, making them a promising addition to the country’s renewable mix.

Also, the IEA highlighted that since 2011, China has established more than 300,000 manufacturing jobs along the solar PV value chain and invested more than USD 50 billion in new PV supply capacity, which is ten times more than Europe. China now accounts for more than 80% of the production of solar panels at every level, including polysilicon, ingots, wafers, cells, and modules. China's proportion of the world's PV demand is more than doubled. Furthermore, since 2017, China's investments in Malaysia and Vietnam have made these nations significant exporters of PV products, contributing roughly 10% and 5% of their respective trade surpluses. Altogether these factors are boosting the biohybrid solar cell market in the nation.

With ambitious solar energy targets under the National Solar Mission, India is actively investing in innovative solar cells, to enhance efficiency and sustainability. The availability of cost-effective research facilities, a skilled workforce, and strong academic-industry collaborations support the development of biohybrid solar solutions. Additionally, the country’s focus on affordable and eco-friendly alternatives aligns with biohybrid solar cells, which utilize biodegradable materials. As India strengthens its position as a global solar hub, increasing trade and investment in solar PV technologies further accelerate the adoption and commercialization of biohybrid solar cells.

Furthermore, The Press Information Bureau stated that with the remarkable accomplishment of more than 200 GW of installed capacity, India's renewable energy path has reached a major milestone. This achievement demonstrates the country's dedication to a sustainable energy future powered by a wide range of renewable resources, such as bioenergy, wind, sun, and hydropower. The government's strategic commitment to increasing energy generation capacity while lowering dependency on fossil fuels is demonstrated by proactive efforts like the National Green Hydrogen Mission, PM-KUSUM, PM Surya Ghar, and the PLI schemes for solar PV modules.

Biohybrid Solar Cell Market Players:

- Heliatek GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- First Solar, Inc.

- SunPower Corporation

- SolarWindow Technologies, Inc.

- Oxford Photovoltaics Limited (Oxford PV)

- The Commonwealth Scientific and Industrial Research Organization

- Solaronix SA

- Dyesol Limited

- Exeger Operations AB

- G24 Power Ltd.

Companies in the biohybrid solar cell market compete with one another based on the quality of their products. The key companies in this market concentrate on growing their R&D expenditures, manufacturing facilities, infrastructure, and chances for value chain integration. By using these tactics, biohybrid solar cell manufacturers may meet rising demand, maintain competitiveness, create cutting-edge goods and technology, lower production costs, and grow their clientele.

This paper profiles several biohybrid solar cell firms, including

Recent Developments

- In March 2024, Australia's national research agency, CSIRO, created cutting-edge printed flexible solar cell technology, which was successfully launched into orbit today atop Australia's largest private satellite, Optimus-1, as part of SpaceX's Transporter-10 mission.

- In January 2024, Oxford PV, a leader in next-generation solar technology, established a new record for the world's most efficient solar panel, marking a watershed moment in the clean energy revolution. The panel, developed in partnership with the Fraunhofer Institute for Solar Energy Systems, reached a record 25% conversion efficiency, significantly higher than the more common 21-23% efficiency of commercial modules.

- Report ID: 7267

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biohybrid Solar Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.