Biogas Plant Market Outlook:

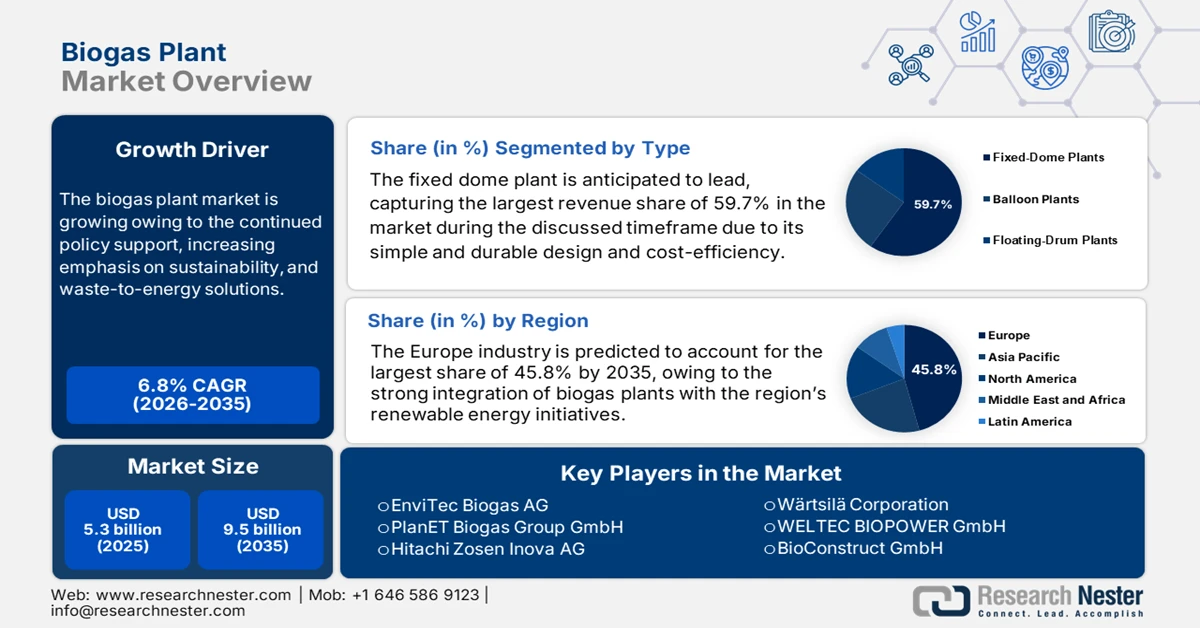

Biogas Plant Market size was valued at USD 5.3 billion in 2025 and is projected to reach USD 9.5 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of biogas plant is evaluated at USD 5.6 billion.

The market is entering a new phase of growth owing to the continued policy support, increasing emphasis on sustainability, and waste-to-energy solutions. Rising awareness of environmental conservation and the need to reduce greenhouse gas emissions are encouraging industries, municipalities, and agricultural sectors to adopt biogas technology. In this context, IEA in 2025 officially reported that policy support for biogas and biomethane has surged globally, driven by energy security, decarbonization, methane reduction, circular economy goals, and rural development. Global production is expected to increase significantly, with biomethane leading this trend due to its infrastructure compatibility. It also noted that Europe experienced a 14% rise in biomethane in 2024, while Germany remains the top biogas producer. Emerging markets such as France, Italy, and Denmark are also expanding rapidly. The U.S. is the largest biomethane producer, China is expanding industrial-scale projects, and India is increasing its CBG plants.

Biogas and Biomethane Production and Forecasts by Region/Country (PJ/year)

|

Region/Country |

2024 Production |

2030 Forecast |

Growth % (2025-2030) |

|

Global |

- |

- |

22% |

|

Europe |

Biogas: - |

- |

- |

|

|

Biomethane: +14% |

- |

- |

|

Germany |

53% of EU biogas |

- |

- |

|

France, Italy, Denmark, Netherlands |

93% of EU biomethane |

- |

- |

|

U.S. |

136 PJ |

218 PJ |

1.6× (main case) |

|

China |

- |

- |

23% |

|

India |

- |

- |

21% |

Source: IEA

Furthermore, government initiatives play a pivotal role in reshaping adoption in the market. As stated by MNRE India’s Biogas Programme (Phase-I) for FY 2021-22 to 2025-26, aims to promote small (1-25 m³/day) and medium (25-2500 m³/day) biogas plants, leveraging livestock and organic waste for clean cooking, power, and manure production. It also mentioned that biogas can be directly used for cooking, electricity, or transport after upgrading to compressed bio-gas (CBG). Moreover, the programme provides central financial assistance (CFA), turnkey job fees, and additional incentives for linking plants with toilets or slurry filters. Hence, the presence of such initiatives stimulates market growth by providing financial incentives, technical support, and infrastructure integration, making biogas adoption both economically viable and scalable.

Central Financial Assistance (CFA) and Incentives for Small Biogas Plants (1-25 m³/day) under Biogas Programme Phase-I

|

Plant Size (m³/day) |

Hilly/NER/SC/ST States |

Other States |

Additional Subsidy (Toilet/Slurry Filter) |

Turnkey Job Fee |

Fossil Fuel/Electricity Incentive |

|

1 |

17,000 |

9,800 |

1,600 |

3,000 |

- |

|

2-4 |

22,000 |

14,350 |

1,600 |

3,000 |

- |

|

6 |

29,250 |

22,750 |

1,600 |

3,000 |

- |

|

8-10 |

34,500 |

23,000 |

1,600 |

3,000 |

- |

|

15 |

63,250 |

37,950 |

NA |

5,000 |

- |

|

20-25 |

70,400 |

52,800 |

NA |

5,000 |

10,000 (Generator/BPS) |

Source: MNRE

Central Financial Assistance (CFA) and Administrative Charges for Medium Biogas Plants (Power/Thermal Applications) under Biogas Programme Phase-I

|

Capacity (kW) |

DPR Required |

CFA – Power (₹/kW) |

CFA – Thermal/Cooling (₹/kWeq) |

Admin Charges |

|

3–50 |

No |

45,000 |

22,500 |

10% / 5% |

|

>50–200 |

Yes |

40,000 |

20,000 |

2,00,000 / 1,00,000 |

|

>200–250 |

Yes |

35,000 |

17,500 |

2,50,000 / 1,00,000 |

Source: MNRE