Biogas Plant Market Outlook:

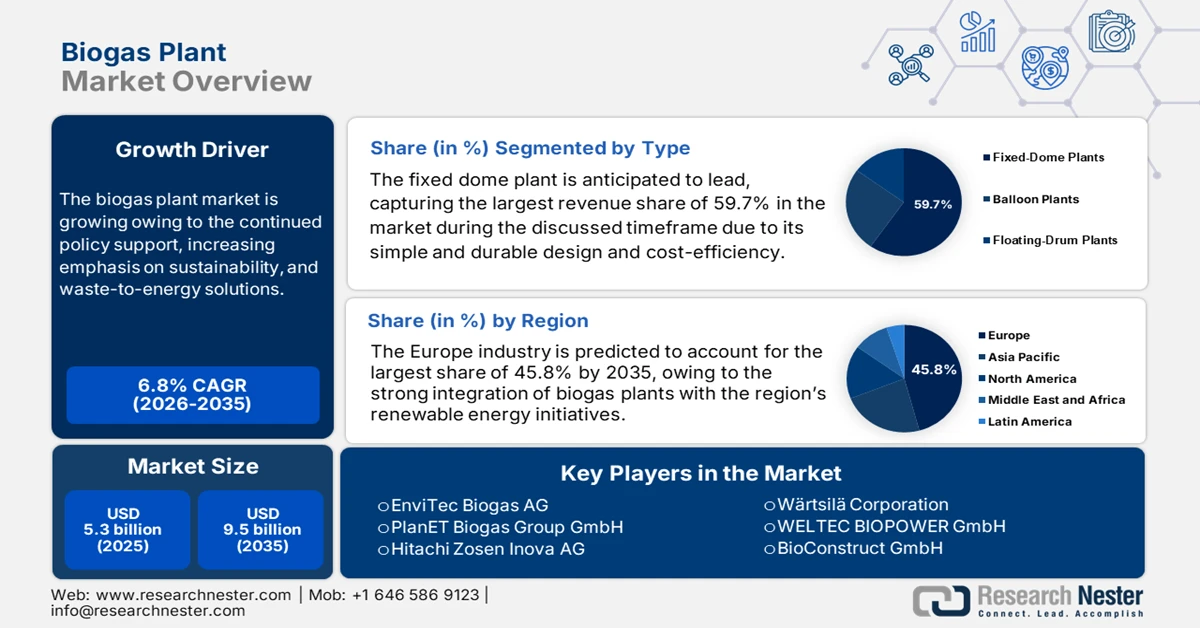

Biogas Plant Market size was valued at USD 5.3 billion in 2025 and is projected to reach USD 9.5 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of biogas plant is evaluated at USD 5.6 billion.

The market is entering a new phase of growth owing to the continued policy support, increasing emphasis on sustainability, and waste-to-energy solutions. Rising awareness of environmental conservation and the need to reduce greenhouse gas emissions are encouraging industries, municipalities, and agricultural sectors to adopt biogas technology. In this context, IEA in 2025 officially reported that policy support for biogas and biomethane has surged globally, driven by energy security, decarbonization, methane reduction, circular economy goals, and rural development. Global production is expected to increase significantly, with biomethane leading this trend due to its infrastructure compatibility. It also noted that Europe experienced a 14% rise in biomethane in 2024, while Germany remains the top biogas producer. Emerging markets such as France, Italy, and Denmark are also expanding rapidly. The U.S. is the largest biomethane producer, China is expanding industrial-scale projects, and India is increasing its CBG plants.

Biogas and Biomethane Production and Forecasts by Region/Country (PJ/year)

|

Region/Country |

2024 Production |

2030 Forecast |

Growth % (2025-2030) |

|

Global |

- |

- |

22% |

|

Europe |

Biogas: - |

- |

- |

|

|

Biomethane: +14% |

- |

- |

|

Germany |

53% of EU biogas |

- |

- |

|

France, Italy, Denmark, Netherlands |

93% of EU biomethane |

- |

- |

|

U.S. |

136 PJ |

218 PJ |

1.6× (main case) |

|

China |

- |

- |

23% |

|

India |

- |

- |

21% |

Source: IEA

Furthermore, government initiatives play a pivotal role in reshaping adoption in the market. As stated by MNRE India’s Biogas Programme (Phase-I) for FY 2021-22 to 2025-26, aims to promote small (1-25 m³/day) and medium (25-2500 m³/day) biogas plants, leveraging livestock and organic waste for clean cooking, power, and manure production. It also mentioned that biogas can be directly used for cooking, electricity, or transport after upgrading to compressed bio-gas (CBG). Moreover, the programme provides central financial assistance (CFA), turnkey job fees, and additional incentives for linking plants with toilets or slurry filters. Hence, the presence of such initiatives stimulates market growth by providing financial incentives, technical support, and infrastructure integration, making biogas adoption both economically viable and scalable.

Central Financial Assistance (CFA) and Incentives for Small Biogas Plants (1-25 m³/day) under Biogas Programme Phase-I

|

Plant Size (m³/day) |

Hilly/NER/SC/ST States |

Other States |

Additional Subsidy (Toilet/Slurry Filter) |

Turnkey Job Fee |

Fossil Fuel/Electricity Incentive |

|

1 |

17,000 |

9,800 |

1,600 |

3,000 |

- |

|

2-4 |

22,000 |

14,350 |

1,600 |

3,000 |

- |

|

6 |

29,250 |

22,750 |

1,600 |

3,000 |

- |

|

8-10 |

34,500 |

23,000 |

1,600 |

3,000 |

- |

|

15 |

63,250 |

37,950 |

NA |

5,000 |

- |

|

20-25 |

70,400 |

52,800 |

NA |

5,000 |

10,000 (Generator/BPS) |

Source: MNRE

Central Financial Assistance (CFA) and Administrative Charges for Medium Biogas Plants (Power/Thermal Applications) under Biogas Programme Phase-I

|

Capacity (kW) |

DPR Required |

CFA – Power (₹/kW) |

CFA – Thermal/Cooling (₹/kWeq) |

Admin Charges |

|

3–50 |

No |

45,000 |

22,500 |

10% / 5% |

|

>50–200 |

Yes |

40,000 |

20,000 |

2,00,000 / 1,00,000 |

|

>200–250 |

Yes |

35,000 |

17,500 |

2,50,000 / 1,00,000 |

Source: MNRE

Key Biogas Plant Market Insights Summary:

Regional Highlights:

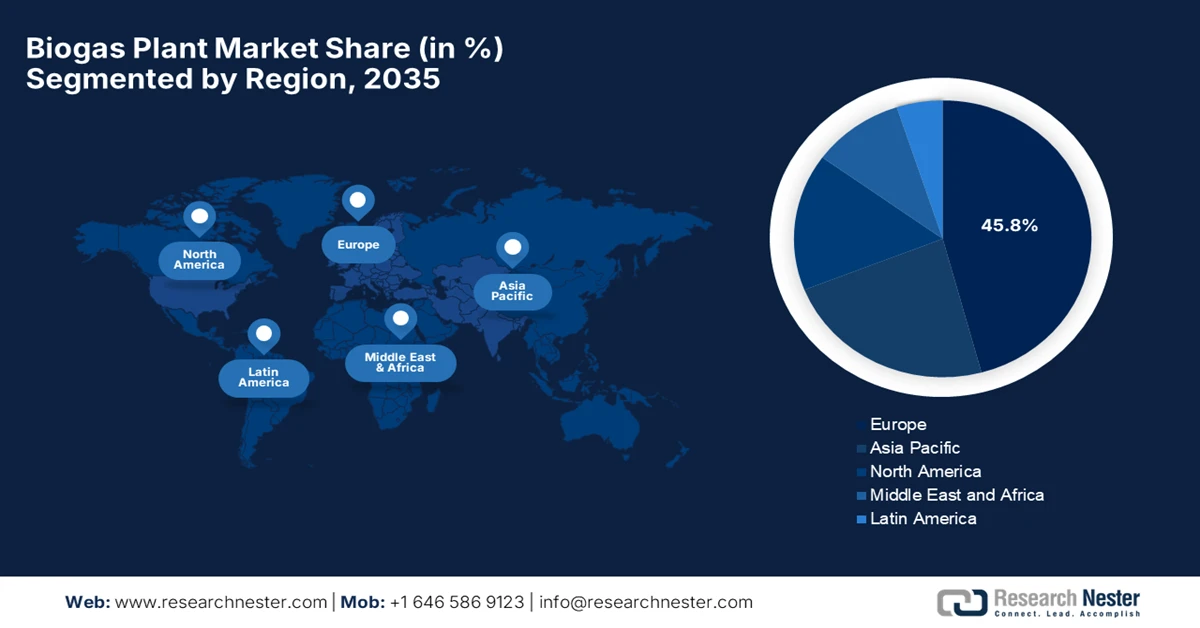

- Europe is projected to dominate the biogas plant market with a commanding 45.8% revenue share by 2035, reflecting its leadership in renewable gas deployment and policy-backed circular economy alignment, reinforced by deep integration of biogas plants with renewable energy initiatives and circular economy frameworks

- Asia Pacific is poised to emerge as the fastest-growing region through 2035, as rising energy demand and rural electrification priorities strengthen adoption momentum, stimulated by favorable government incentives and the urgent need for agricultural and organic waste management

Segment Insights:

- The fixed dome plant segment in the biogas plant market is projected to command a dominant 59.7% revenue share by 2035, supported by its robust concrete-based structure, low installation and maintenance costs, and suitability for decentralized rural deployments, anchored by simple and durable design and cost-efficiency

- The continuous flow filling segment is expected to expand at a notable pace through 2035, as its ability to deliver stable digestion, higher biogas yields, and scalable performance makes it increasingly preferred for commercial and industrial applications, underpinned by superior efficiency and scalability

Key Growth Trends:

- Rising demand for renewable energy

- Sustainable waste management needs

Major Challenges:

- Feedstock availability and supply chain issues

- Limited market awareness and public acceptance

Key Players: EnviTec Biogas AG (Germany), PlanET Biogas Group GmbH (Germany), Hitachi Zosen Inova AG (Switzerland/Japan), Wärtsilä Corporation (Finland), WELTEC BIOPOWER GmbH (Germany), BioConstruct GmbH (Germany), Naskeo Environnement (France), Renergon Biogas AG (Switzerland), AEV Energy GmbH (Germany), IES Biogas (Italy), ENGIE SA (France), Nijhuis Saur Industries (Netherlands), Agraferm GmbH (Germany), Lundsby Biogas A/S (Denmark), Toyo Engineering Corp. (Japan), Organic Recycling Systems Ltd (ORS) (India), Greenlane Renewables Inc. (Canada/U.S.), UTS Biogas Ltd (UK), Green Energy Resources (M) Sdn Bhd (Malaysia), True Eco Sdn Bhd (Malaysia)

Global Biogas Plant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.3 billion

- 2026 Market Size: USD 5.6 billion

- Projected Market Size: USD 9.5 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (45.8% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, China, United States, Japan, France

- Emerging Countries: India, Brazil, Spain, Italy, South Korea

Last updated on : 30 January, 2026

Biogas Plant Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for renewable energy: Governments and companies across the globe are shifting from fossil fuels toward renewable energy sources in order to meet the national & international climate targets and reduce carbon emissions. This transition, in turn, increases demand in the biogas plant market since they generate clean energy from organic waste. In February 2025, AstraZeneca and Future Biogas announced that they have commissioned the Moor Bioenergy plant in Lincolnshire, which is the UK’s first unsubsidised biomethane facility that is dedicated to life sciences, supplying 100 GWh of renewable energy annually, and is enough to heat over 8,000 homes and offset 18,000 tonnes of CO₂ per year. The project demonstrates the commercial viability of large-scale, unsubsidized biogas projects, encouraging increased investment, the adoption of renewable energy solutions, and the expansion of the biogas sector.

- Sustainable waste management needs: The aspects of urbanization and industrialization are increasing organic waste volumes, wherein these biogas plants provide an efficient method to convert agricultural, municipal, and industrial waste into useful energy and reduce landfill usage. In October 2025, Clarke Energy announced the commissioning of its first-ever membrane-based biogas facility in India, located at a municipal solid waste anaerobic digestion site in Chennai, which will be managed by Srinivas Waste Management Services. It also mentioned that the plant processes biodegradable organic food waste into biogas and soil enhancer, thereby supporting the country’s SATAT bio-CNG initiative to promote renewable fuel from waste. Such projects represent how urban organic waste is being converted into clean energy and the circular economy, creating optimistic opportunities for players in the market.

- Agricultural sector adoption: The large agricultural operations are major producers of organic residues, i.e., manure and crop waste, which makes biogas a natural fit for decentralized energy generation in rural and farming communities. Based on the government data from the Ministry of Housing & Urban Affairs, in November 2024, the Prime Minister inaugurated India’s first modern, self-sufficient gaushala at Laltipara, Gwalior in October 2024. It consists of a 100 TPD cattle-dung-based compressed biogas plant, which is developed with the Indian Oil Corporation. In addition, the facility converts cow dung and organic waste from local markets and households into 2 to 3 tons of bio-CNG and 10 to 15 tons of organic manure on a daily basis, thereby supporting sustainable energy use and organic farming and benefiting the biogas plant market.

Challenges

- Feedstock availability and supply chain issues: The aspect of reliable and consistent feedstock supply is a major operational challenge for the biogas plant market. The agricultural residues, animal manure, food waste, and organic municipal waste are often geographically dispersed, or poorly segregated, which poses an obstacle for transportation and storage of feedstock add logistical complexity and cost, especially for large-scale plants. Also, any type of variation in feedstock quality can negatively affect gas yield and plant efficiency, leading to unstable output. On the other hand, competition for organic waste from composting, animal feed, or other bioenergy uses can strain the supply. Therefore, without long-term feedstock contracts and efficient waste management systems, the plant operators face uncertainty, which affects both financial stability and scalability.

- Limited market awareness and public acceptance: The absence of proper awareness and misconceptions about biogas technology hampers biogas plant market growth. Also, communities may find biogas plants with foul odors and health risks, leading to public opposition. Similarly, the farmers and small businesses are not completely aware of the economic benefits, such as waste management savings and energy self-sufficiency, which in turn is limiting adoption in this field. In addition, limited understanding among financial institutions increases perceived investment risk. Therefore, the absence of adequate training and outreach programs hinders adoption, especially in rural areas. Improving public education, demonstrating successful projects, and highlighting environmental and economic benefits are highly essential to gaining social acceptance.

Biogas Plant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 5.3 billion |

|

Forecast Year Market Size (2035) |

USD 9.5 billion |

|

Regional Scope |

|

Biogas Plant Market Segmentation:

Type Segment Analysis

In the type segment, the fixed dome plant is anticipated to lead, capturing the largest revenue share of 59.7% in the market during the discussed timeframe. The dominance of the segment is effectively attributable to its simple and durable design and cost-efficiency. Such plants are made from concrete, which eliminates the need for moving parts or any type of external gas holders, thus reducing initial and maintenance costs. In addition, the fixed dome plants offer a longer operational lifespan due to their underground construction, which protects the structure from weather-related damage and external wear. These systems are suitable for decentralized and rural installations where there are limitations in access to maintenance and replacement parts. Furthermore, the ability to integrate easily with agricultural and household waste streams efficiently enhances their adoption across farming communities, hence denoting a wider segment scope.

Operation Mode Segment Analysis

Based on the operation mode, the continuous flow filling segment is expected to propel at a considerable rate in the biogas plant market by the conclusion of 2035. The superior efficiency and scalability are the key factors driving the subtype’s leadership in this field. Unlike batch systems, these continuous flow plants maintain a steady inflow of organic material and consistent digestion, ensuring uninterrupted microbial activity. Therefore, this results in higher biogas production and process stability. Moreover, this operation mode is well-suited for commercial and industrial applications where a reliable energy supply is highly essential. Additionally, automated feeding systems reduce labor requirements and minimize risks associated with irregular substrate loading. Since there has been an increased demand for sustainable energy industries worldwide, they are opting for continuous flow systems for their ability to handle large volumes of diverse feedstocks efficiently.

Feedstock Type Segment Analysis

The agricultural waste is predicted to capture a significant revenue market share over the forecasted years. The growth of the subsegment is mainly propelled by its widespread availability and the economic benefits associated with its use. As stated by the Ministry of Jal Shakti in January 2024, the Government of India’s GOBARdhan initiative aims to convert agricultural residues, cattle dung, and other organic waste into biogas, compressed biogas (CBG), and organic manure to promote a circular economy. According to the official statistics, since its launch in June 2023, 536 CBG plants and 1,193 biogas plants have been registered on the unified registration portal, with an additional 556 plants under construction. Also, the policy incentives such as carbon credit trading, excise duty exemptions, and amendments to fertiliser control orders deliberately support the commercial viability of these plants. Furthermore, GOBARdhan is integrating organic waste management with renewable energy production, thereby promoting organic farming and creating revenue opportunities for plant operators.

GOBARdhan Initiative: Biogas and Compressed Biogas (CBG) Plant Deployment Statistics (FY 2023-2024)

|

Year/Status |

CBG Plants |

Biogas Plants |

Total Plants |

|

Registered (June 2023–Jan 2024) |

12 |

186 |

198 |

|

Under Construction |

129 |

427 |

556 |

|

Total Registered So Far |

536 |

1,193 |

1,729 |

|

Planned (Budget 2023) |

- |

500 (new) |

500 |

Source: Ministry of Jal Shakti

Our in-depth analysis of the biogas plant market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Operation Mode |

|

|

Feedstock Type |

|

|

Digester Type |

|

|

Digester Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biogas Plant Market - Regional Analysis

Europe Market Insights

Europe market is expected to lead the overall international landscape with the largest revenue share of 45.8% by the end of 2035. The dominance is mainly driven by the strong integration of biogas plants with the region’s renewable energy initiatives and circular economy frameworks. For instance, in October 2025, Wärtsilä Gas Solutions reported that it achieved a contract for upgrading a biogas plant in Bigadan AS, Denmark, which is capable of processing 6,000 Nm³ of raw biogas per hour. The plant is expected to be fully operational by the third quarter of 2026, and it supports Denmark’s green transition by enhancing biogas utilization. Hence, such instances will accelerate the market growth by increasing the supply of grid-quality biogas and demonstrating scalable, efficient technology. It also encourages investment in terms of renewable gas infrastructure, accelerating adoption across Europe.

Germany biogas plant market is steadily progressing owing to its long-standing experience in anaerobic digestion and strong technological expertise. The country’s market also benefits from research-driven innovation and funding grants, which continue to support improvements in plant efficiency and operational reliability. In this context, Clean Energy Wire in September 2025 officially reported that the country is continuously advancing in the biogas sector, leveraging a 7.9-billion-euro (USD 8.6 billion) support package approved by the EU, which is aimed at promoting climate-friendly electricity and heating. It also mentioned that this funding offers proper investment security for around 2,500 plants and incentivizes flexible operation to align with electricity generation. Hence, such instances promote growth by reducing financial risk for plant operators, fostering newer investments, modernization of existing facilities, and adoption of flexible technologies, which attracts more players to operate in the country.

The UK biogas plant market is also significantly growing, driven by decarbonization goals and a shift towards upgradation to biomethane for grid injection. Integration of biogas plants with municipal waste systems and commercial food supply chains is also a major driving factor for the country’s market. In October 2025, Kanadevia Inova reported that it had acquired the Lower Drayton and Wardley biogas plants in the country, which expanded its portfolio to 17 operational facilities. Both facilities are credited under the Renewable Heat Incentive scheme of the UK government and supply biomethane to the national gas grid, supporting decarbonisation and circular economy practices. Such strategic steps by key players enhance the country’s market exposure by increasing biomethane supply, encouraging investment in low-carbon infrastructure, and demonstrating high-quality biogas operations.

APAC Market Insights

The Asia Pacific market is expected to register the fastest growth owing to the heightened energy demand, suitable government incentives, and the extensive need to manage both agricultural and organic waste. Nations across the region are focused on launching and promoting suitable biogas technologies with a prime focus on addressing energy deficits and rural electrification. For instance, in February 2022, WELTEC BIOPOWER reported that it successfully commissioned its fourth biogas plant in Saitama Prefecture, Japan, which is equipped with a 450-kW cogeneration system that processes about 12,000 tons of organic waste and cattle manure annually. The plant consists of stainless-steel digesters that are especially designed to withstand seismic risks and utilizes technology to separate and dry digestate for use as compost and fertilizer, hence such instances significantly attract investments and accelerate market expansion in the years ahead.

China biogas plant market is growing on account of the government’s priority for renewable energy and the continued expansion of rural biogas plants. Domestic firms are unveiling large biogas projects with growing use of automated monitoring and control systems. As stated by SCIO Peoples Republic of China, in June 2025, the country is turning agricultural and organic waste into clean energy, with biomass power plants such as those in Xuzhou converting straw, kitchen waste, and forestry residues into electricity, biogas, and fuel pellets, reducing coal use and cutting carbon emissions. It also mentions the pilot projects in Shanghai and Anhui, which are advancing biomass-derived green fuels and liquefied bio-natural gas, whereas the centralized monitoring systems enhance efficiency and grid integration. Therefore, such advancements strengthen the market by creating new revenue streams from waste-to-energy solutions, driving the adoption of renewable energy infrastructure.

India shows significant growth in the biogas plant market, mainly driven by government support through various schemes and initiatives. The country is home to millions of operational household-level plants, along with numerous large-scale and industrial CBG facilities. For example, in July 2024, Maruti Suzuki India Ltd. announced the launch of a pilot biogas plant at its Manesar facility in Haryana, where biogas is generated from Napier grass and canteen food waste. The purified gas is used for cooking and manufacturing, while the residue is used as organic fertilizer, producing about 0.2 tons of biogas daily and reducing roughly 190 tons of CO₂ annually. Therefore, such pilot projects and government backing promote wider adoption of biogas technologies in India, strengthening the renewable energy sector in the coming years.

Top 10 States by Number of Biogas Plants Installed (Last 10 Years)

|

State |

Biogas Plants (Nos) |

|

Maharashtra |

71,653 |

|

Karnataka |

34,657 |

|

Madhya Pradesh |

32,120 |

|

Andhra Pradesh |

28,505 |

|

Punjab |

19,288 |

|

Telangana |

11,159 |

|

Chhattisgarh |

11,030 |

|

Kerala |

9,639 |

|

Uttarakhand |

8,362 |

|

Gujarat |

5,427 |

Source: Ministry of New and Renewable Energy, December 2025

North America Market Insights

The increasing emphasis on sustainable waste management and renewable energy integration across agricultural, municipal, and industrial sectors is efficiently driving business in the North America biogas plant market. The region also benefits from advanced anaerobic digestion technologies and rising adoption of biogas upgrading for pipeline injection as well as transportation fuel use. In July 2024, PlanET Biogas USA Inc. reported that in the past 12 months, completed 12 new anaerobic digestion (AD) plants across the U.S., 10 of which include PlanET STATERON RNG upgrading technology. It also mentioned that these facilities capture greenhouse gases, manage manure efficiently, and will effectively generate additional revenue for rural communities, whereas PlanET provides full engineering, operational, and technical support. Thus, such advanced AD technologies and biogas upgrading from major pioneers create new revenue streams and promote wider adoption, driving market growth in the upcoming years.

In the U.S., the biogas plant market is mainly fueled by the large-scale deployment of projects across livestock farms, landfills, and wastewater treatment facilities. The country is witnessing participation from both the public and private entities, which has accelerated the commercialization of renewable natural gas. The Environmental Protection Agency provides a Biogas Toolkit that serves as a resource hub for stakeholders who are involved in biogas projects, by offering guidance across project phases, sectors, and technical, financial, and regulatory aspects. It compiles tools, handbooks, and best practices from programs like AgSTAR, LMOP, and the Global Methane Initiative to support anaerobic digestion, landfill gas, and renewable natural gas projects. The presence of increased government support is enabling efficient biogas project development, boosting renewable energy adoption, and reducing greenhouse gas emissions in the country.

The increasing focus on organic waste management and sustainable farming practices is the key factor driving the biogas plant market in Canada. The integration of biogas with district heating and combined heat and power systems is also facilitating a favorable business ecosystem in the country. NGIF Accelerator in November 2023 reported that it has awarded USD 365,900 to Hydron Energy for its innovative INTRUPTor system, which upgrades biogas to renewable natural gas, thereby offering lower costs and improved efficiency when compared to conventional technologies. This funding supports field testing in Alberta and Ontario and aims to advance clean energy commercialization in Canada. Moreover, through its Industry Grants program, NGIF collaborates with federal and provincial governments to de-risk pre-commercial technologies and increase the adoption of low-carbon solutions in the natural gas sector. Hence, these initiatives are strengthening the country’s market by promoting technological innovation and improving economic viability.

Key Biogas Plant Market Players:

- EnviTec Biogas AG (Germany)

- PlanET Biogas Group GmbH (Germany)

- Hitachi Zosen Inova AG (Switzerland/Japan)

- Wärtsilä Corporation (Finland)

- WELTEC BIOPOWER GmbH (Germany)

- BioConstruct GmbH (Germany)

- Naskeo Environnement (France)

- Renergon Biogas AG (Switzerland)

- AEV Energy GmbH (Germany)

- IES Biogas (Italy)

- ENGIE SA (France)

- Nijhuis Saur Industries (Netherlands)

- Agraferm GmbH (Germany)

- Lundsby Biogas A/S (Denmark)

- Toyo Engineering Corp. (Japan)

- Organic Recycling Systems Ltd (ORS) (India)

- Greenlane Renewables Inc. (Canada/U.S.)

- UTS Biogas Ltd (UK)

- Green Energy Resources (M) Sdn Bhd (Malaysia)

- True Eco Sdn Bhd (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EnviTec Biogas AG is a leading global provider of biogas and biomethane solutions, which is offering end‑to‑end services from planning and turnkey construction to operation and maintenance of plants across the globe. The company is focused on delivering bespoke anaerobic digestion and upgrading systems, which include its proprietary EnviThan technology for high-efficiency biomethane production. In addition, EnviTec also participates in its own plant operations and renewable fuel production, reinforcing its integrated business model.

- PlanET Biogas Group GmbH is a specialist in terms of design, construction, and servicing of anaerobic digestion and renewable natural gas (RNG) plants. The company provides lifecycle support by including engineering, biological optimization, and technical services, and it emphasizes sustainability and carbon footprint reduction across agricultural, industrial, and organic waste sectors. The company has a very strong international presence, and it continues expanding its footprint in Europe, North America, and beyond.

- Wärtsilä Corporation is identified as a major technology group which is offering advanced biogas upgrading and utilization solutions that convert raw biogas into high-quality biomethane and bioLNG. The company’s PuregasCA upgrading technology and integrated power systems support renewable energy deployment for industrial and utility applications. Furthermore, its strong focus on innovation and hybrid renewables integration strengthens biogas value chains in markets such as Scandinavia.

- WELTEC BIOPOWER GmbH is a frontrunner in this field and is a specialist in stainless‑steel biogas and biomethane plants, providing turnkey construction, operation, and service solutions across multiple continents. The company is serving the agriculture, food, waste management, and wastewater sectors. In addition, the company’s offerings include concept development, plant construction, and long-term operational support geared toward sustainability and resource optimization.

- Naskeo Environnement is based in France and is focused on biomethanisation systems for organic waste treatment. Besides, the firm is a specialist in terms of custom methanisation installations that convert agricultural and organic waste into renewable energy. Naseko’s solutions emphasize efficient substrate handling and methane production, contributing to regional renewable energy adoption and waste-to-energy strategies.

Below is the list of some prominent players operating in the global market:

The global biogas plant market is hosting long-established Europe-specific engineering leaders such as EnviTec Biogas and PlanET Biogas that offer turnkey anaerobic digestion and upgrading solutions. Meanwhile, the integrated energy firms such as ENGIE and Wärtsilä leverage global scale and long-term offtakes, whereas the specialist technology providers such as WELTEC BIOPOWER and Naskeo focus on modular and efficient designs. In this context, in May 2025, Nordic energy company Gasum acquired full ownership of NSR Biogas AB and the remaining shares of Liquidgas Biofuels Genesis AB in Helsingborg, Sweden, by consolidating the entire biogas production and upgrading chain at the site. It also mentioned that the plant processes 160,000 tons of household, industrial waste, and manure, producing up to 80 GWh of upgraded biogas annually, which is supplied to the market.

Corporate Landscape of the Biogas Plant Market:

Recent Developments

- In January 2026, EnviTec Biogas began feeding 237 Nm³/h of biomethane from its new biogas and gas upgrading plant in Soncino, Cremona, into the public gas grid. The plant, designed for pig slurry and catch crops, consists of EnviTec’s complete biogas and EnviThan upgrading system.

- In November 2025, EnviTec Biogas announced its first biogas plant in the Philippines through a contract with First Quezon Biogas Corporation in Candelaria, Quezon Province. The 1.4 MW plant will generate renewable electricity for the national grid starting in June 2026 and produce high-quality biofertilizer.

- Report ID: 3204

- Published Date: Jan 30, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biogas Plant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.