Biocompatible Coatings Market Outlook:

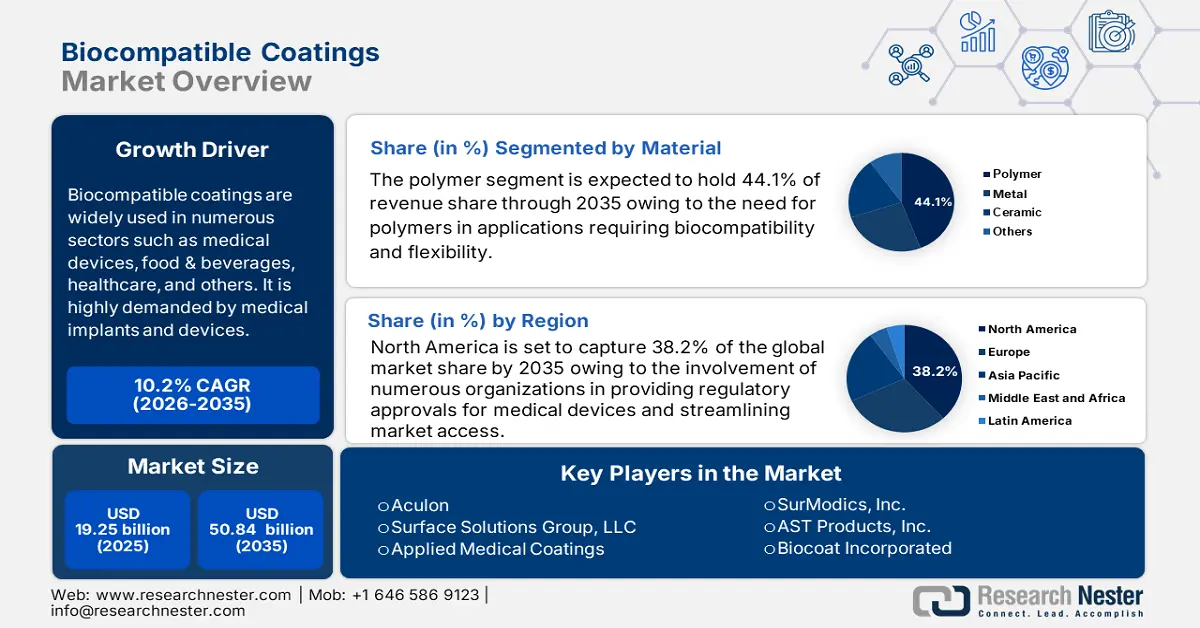

Biocompatible Coatings Market size was over USD 19.25 billion in 2025 and is poised to exceed USD 50.84 billion by 2035, growing at over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biocompatible coatings is estimated at USD 21.02 billion.

Biocompatible coatings are widely used in numerous sectors such as medical devices, food & beverages, healthcare, and others. It is highly demanded by medical implants and devices. The increasing incidence of chronic diseases and an aging population are the key drivers of the biocompatible coatings market. According to the World Health Organization (WHO) by 2035, the portion of people aged 60 and older is expected to nearly double, from 12% to 22%, with chronic conditions affecting 95% of adults over 60 and 80% managing multiple conditions. Further, chronic diseases like cancer, diabetes, and heart disease, account for 75% of global deaths, which raises the need for enhanced medical implants and devices made of biocompatible coating.

The biocompatible coating improves the longevity and performance of medical devices by offering a surface that interacts with biological tissues. In addition, enhancement in material science helps to overcome existing limitations, facilitating the growth of a coating that easily mimics natural tissue properties. This innovation not only enhances the effectiveness of implants but also reduces the risk of adverse reactions, thereby extending their usage in healthcare.

Biocompatible coating has increased abundantly as industries started to focus on increasing their product's performance, efficacy, and safety. The rising field of biosensor and drug delivery systems offers unique applications for these coatings and also boosts their potential. Rising technologies in biomimetic material and nanotechnology pave the way to improve functionality and applicability in several medical and industrial domains. Businesses that utilize these innovations can have market presence by addressing consumers' needs and improving product offerings.

Manufacturers show interest in customized biocompatible coating to make their products fit all applications and user requirements. Furthermore, the increasing regulatory scrutiny drives many companies to invest in research and development to improve efficacy and safety along with improved consumer trust and market growth. The increasing focus on sustainability encourages developers to explore biocompatible coating materials, aligning their products with environmental goals while adhering to industrial regulations.

Key Biocompatible Coatings Market Insights Summary:

Regional Highlights:

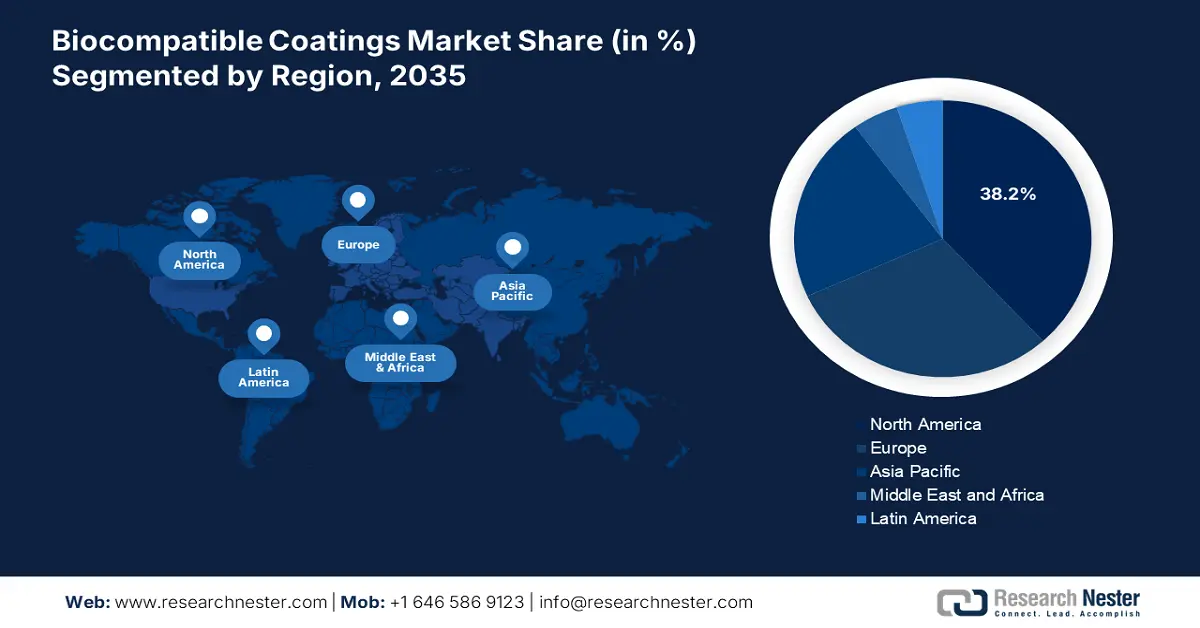

- North America leads the Biocompatible Coatings Market with a 38.2% share, propelled by the role of regulatory bodies in supporting medical device approvals and innovation, fostering significant growth through 2026–2035.

- Europe's Biocompatible Coatings Market holds a notable share with strong growth projected through 2026–2035, fueled by partnership strategies enhancing product development and smoother market entry.

Segment Insights:

- The Polymer segment is projected to achieve a 44.1% share by 2035, driven by lower production costs, biocompatibility, and versatility in medical devices and implants.

- Hydrophilic Coatings segment are projected to capture a significant share by 2035, fueled by rising demand for medical devices with enhanced performance.

Key Growth Trends:

- Technological advancements in coating materials

- Growing focus on personalized medicine

Major Challenges:

- High production and R&D costs

- Stringent regulatory & compliance

- Key Players: Applied Membrane Technology, Inc., SurModics, Inc., AST Products, Inc., Biocoat Incorporated, Covalon Technologies Ltd., Formacoat.

Global Biocompatible Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.25 billion

- 2026 Market Size: USD 21.02 billion

- Projected Market Size: USD 50.84 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Biocompatible Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in coating materials: Recent breakthroughs in biocompatible coating technologies have greatly accelerated the growth of the biocompatible coating sector. Enhancements in nanotechnology, chemistry, polymer, and surface engineering have led to the creation of enhanced coatings with advanced properties like greater durability, biocompatibility, and functionality. For instance, nanoparticles with sizes ranging from 1 to 100 nanometers (nm) can alter the physical characteristics of conventional coatings in the coatings industry, enabling coating systems to react to environmental stimuli smartly or operate independently as distinct coatings with special qualities. This advancement allows the manufacturers to create a coating in a way that safeguards the devices and also optimizes their operational efficiency.

The segregation of biodegradable and non-biodegradable coating gives flexibility for several applications in the medical industry. In addition, the rising funds for researching coating technologies have grabbed the attention of numerous new players to step into the biocompatible coatings market, further stimulating the competition and driving industry growth. - Growing focus on personalized medicine: The rising demand for personalized healthcare solutions has significant implications for the growth of the biocompatible coatings market globally. This advancement in medical practices drives the development of biocompatible coatings that address numerous clinical applications and patient needs. The development of 3D printing technology creates customized implants, thus highlighting the crucial role of biocompatible coatings in terms of compatibility and optimal performance of these tailored devices. Biocompatible materials like MED625FLX and TPU95A are utilized to print cardiac 3D surgical guides for Brugada syndrome substrate ablation. Epicardial ablation has shown excellent therapeutic efficacy in preventing ventricular arrhythmias. Healthcare manufacturers and providers work collaboratively to deliver safer & effective personalized medical solutions.

Challenges

- High production and R&D costs: The development of enhanced biocompatible coating needs recent technologies, specialized materials, and extensive clinical tests to verify safety and efficacy. The need for nanotechnology-based coatings and customized surface modification increases material costs. Additionally, integrating biocompatible coating with medical devices also increases production expenses. High capital investments are required for manufacturing biocompatible coating-based medical devices.

- Stringent regulatory & compliance: The regulatory landscape for biocompatible coating is highly complex and regulated to ensure patient efficacy and safety. In addition, compliance with these regulations is also necessary for manufacturers to sell their biocompatible coating. One of the key challenges is navigating all these regulatory pathways, approvals, and certifications. Based on the usage and classification of biocompatible coating, manufacturers have to satisfy several regulatory frameworks like the FDA in the US or MDR in Europe. These regulations need data such as risk management, preclinical & clinical data, and quality control processes to demonstrate the effectiveness and safety of the coating.

Additionally, regulatory requirements for biocompatible coating are subject to changing market dynamics. Manufacturers have to update their processes, documentation, and regulations. However, stringent regulatory requirements pose a high challenge for the biocompatible coatings market.

Biocompatible Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 19.25 billion |

|

Forecast Year Market Size (2035) |

USD 50.84 billion |

|

Regional Scope |

|

Biocompatible Coatings Market Segmentation:

Type (Hydrophilic and Antibacterial)

The hydrophilic coatings segment in biocompatible coatings market is estimated to account for a significant share due to rising demand for medical devices. Medical device companies rely on hydrophilic coatings to enhance the operation of vascular devices. DSM Corporation's ComfortCoat hydrophilic lubricious coatings enhance device performance in a variety of applications and procedures, including cardiovascular and urology. These coatings are specifically designed to minimize surface friction and enhance lubricity, which contributes to their widespread usage. Furthermore, their benefits, including optical clarity and resilience during maintenance processes like storage, sterility, and cleaning, are expected to drive increased demand for these products.

The need for antibacterial coatings will also increase in the upcoming years, driven by their application in several medical products, appliances, and surfaces to stop the spread of infections. The awareness of health and hygiene, especially in the time of the COVID-19 pandemic, boosted the necessity for these biocompatible coatings within the healthcare industry. Designed to prevent the growth of odor-causing microbes, these coatings are recognized as safe and effective solutions, with approval for use in HVAC systems by the EPA.

Material (Polymer, Metal, Ceramic)

The biocompatible coatings market exhibits incredible growth for material types across various applications. Polymer segment is likely to hold biocompatible coatings market share of over 44.1% by the end of 2035. This highlights the need for polymers in applications requiring biocompatibility and flexibility. This segment is highly preferred due to its lower production costs and its versatile nature, which makes it vital for medical devices and implants.

Further, ceramics are highly known for their outstanding mechanical properties and biocompatibility, making them unique solutions for applications like dental restorations, and bone implants, creating a notable presence in the market. In terms of structural applications, metal dominates others by its superior strength and load-bearing capabilities. So, it's highly recommended in surgical implants and orthopedic devices.

Our in-depth analysis of the global biocompatible coatings market includes the following segments:

|

Type |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biocompatible Coatings Market Regional Analysis:

North America Market Analysis

North America biocompatible coatings market is likely to hold revenue share of more than 38.2% by 2035. This is attributed to the involvement of numerous organizations in providing regulatory approvals for medical devices and streamlining market access. For instance, in August 2023, the Musculoskeletal Clinical Regulatory Adviser, LLC (MCRA), a U.S. company, secured FDA approval for the SurVeil drug-coated balloon. This illustrates the significance of biocompatible coating in treating peripheral artery disease (PAD).

In the U.S., key players such as DSM Biomedical, Hydromer Inc., and SurModics Inc. increase the need for biocompatible coatings in the region. For instance, in March 2022, DSM Biomedical collaborated with Svelte Medical Systems to enhance the development of DISCREET bioresorbable coating technology. These companies are actively engaged in research and development to introduce innovative coating solutions that meet the evolving needs of the healthcare sector. Moreover, in Canada, the biocompatible coatings market growth is largely attributed to the increasing demand for medical implants and devices that require biocompatible coatings to enhance performance and reduce rejection rates.

Europe Market Analysis

Europe's biocompatible coating holds a notable share, driven by a partnership strategy which covers various aspects of product development and market entry for biocompatible coating solutions. For example, in February 2023, BioInteraction launched an expanded product pathway partnership at Medical Design & Manufacturing West. This offer encloses optimized application, custom coating, regulatory guidance, commercial production, and testing, thus providing smoother product enhancement and market entry for biocompatible coating solutions in the market. The growing strategy in Europe drives the biocompatible coatings market by strengthening research and development capabilities, thus improving the distribution networks.

Key Biocompatible Coatings Market Players:

- DSM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aculon

- Surface Solutions Group, LLC

- Applied Medical Coatings

- Hydromer

- Applied Membrane Technology, Inc.

- SurModics, Inc.

- AST Products, Inc.

- Biocoat Incorporated

- Covalon Technologies Ltd.

- Formacoat

- BioInteractions

- Specialty Coating Systems Inc.

Key players in the biocompatible coatings market are driving growth through technological advancements, strategic partnerships, regulatory compliance, and expanding applications in various industries. Companies are forming partnerships with medical device manufacturers, research institutions, and biotechnology firms to develop new biocompatible solutions.

Recent Developments

- In August 2024, Biocoat Incorporated, a market leader in the research, manufacture, and application of hydrophilic coatings for medical devices, announced the issuance of a patent for Lumen Coating Method and Apparatus. This new invention includes a revolutionary thermal cure hydrophilic coating technology created specifically for use on the lumen, or inner diameter. This technique is commonly utilized in catheters and other medical devices across a wide range of disciplines, including cardiology and neurology.

- In June 2024, Hydromer, Inc., a leader in hydrophilic, thromboresistant, and antimicrobial coating technologies for medical devices for over 44 years, announced the release of HydroThrombX, a next-generation version of the Company's current legacy product F200t, a thromboresistant coating well-known in the industry for significantly reducing platelet adhesion and cell mitosis, thereby aiding in restenosis prevention.

- Report ID: 7252

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biocompatible Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.