Bio-based Propylene Glycol Market Outlook:

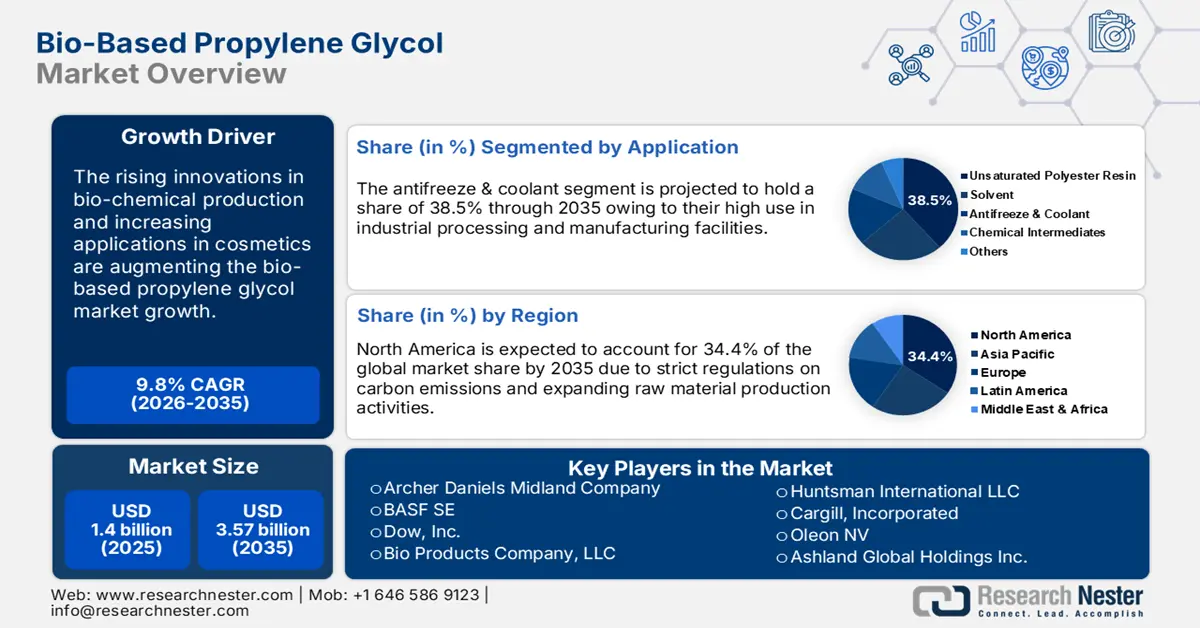

Bio-based Propylene Glycol Market size was valued at USD 1.4 billion in 2025 and is likely to cross USD 3.57 billion by 2035, registering more than 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bio-based propylene glycol is assessed at USD 1.52 billion.

The strict environmental regulations and sustainability trends are generating lucrative opportunities for bio-based propylene glycol producers. The growing adoption of biochemicals is driving innovations in the production of bio-based propylene glycols (PG). Personal care, cosmetics, pharmaceuticals, automotive, and food industries are majorly fueling the consumption of bio-based propylene glycols. Clean-label marketing and the growing popularity of eco-friendly products are promoting bio-based propylene glycol trade activities. The race towards lowering the carbon footprint is directly pushing the consumption of bio-based propylene glycols in these industries.

The trade of traditional propylene glycol is exhibiting a steady to sluggish growth curve owing to the increasing dominance of bio-based propylene glycol producers. The Observatory of Economic Complexity (OEC) study estimates that in 2022, the propylene glycol trade was evaluated at USD 2.64 billion, and accounted for 0.93 product complexity relatedness. The propylene glycol export registered a negative CAGR of -1.25% between 2021 to 2022. Furthermore, Germany witnessed a negative export value growth of USD 126.0 million, whereas France calculated a negative import value growth of USD 33.4 million in 2022. This directly highlights how sustainability and environmental awareness moves are fueling the bio-based propylene glycol sales.

Key Bio-Based Propylene Glycol Market Insights Summary:

Regional Highlights:

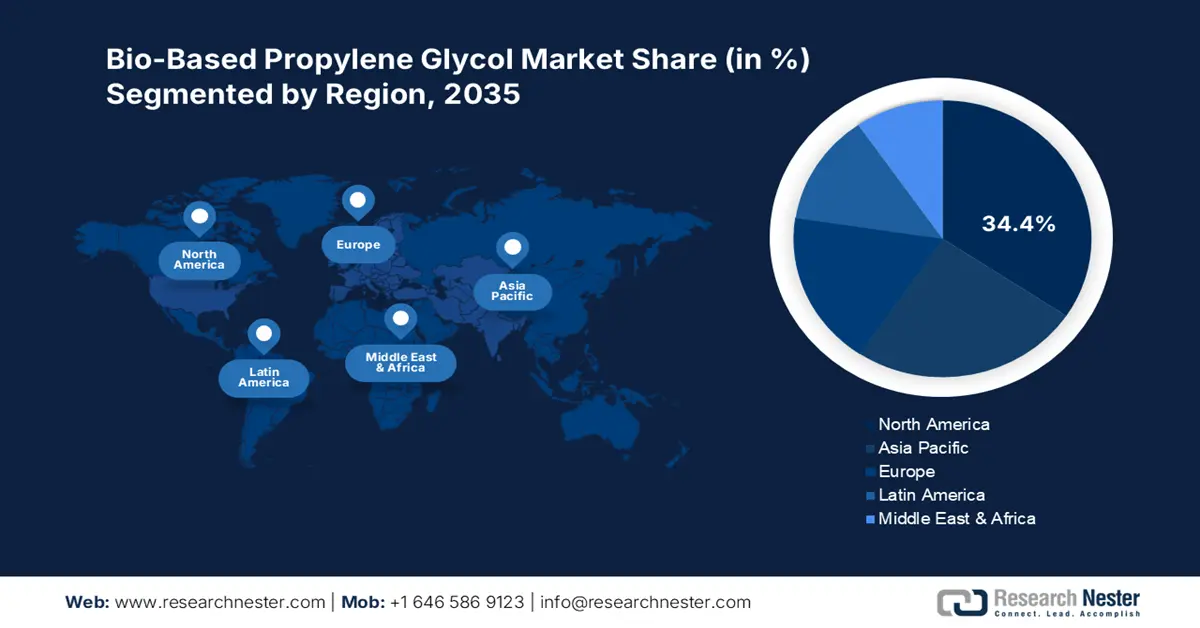

- North America holds a 34.40% share in the Bio-based Propylene Glycol Market, propelled by increasing demand for sustainable products, strict carbon regulations, and expanding bio-chemical industry, fostering growth through 2035.

- Asia Pacific’s bio-based propylene glycol market is set for rapid growth by 2035, driven by innovations in chemical & petrochemical sectors and rapidly expanding automotive industry.

Segment Insights:

- The Antifreeze & Coolant segment is anticipated to achieve over 38.5% share in the Bio-based Propylene Glycol Market by 2035, driven by its growing adoption in automotive and industrial systems for environmental and safety advantages.

- The Pharmaceuticals segment of the Bio-based Propylene Glycol Market is projected to dominate by 2035, driven by its widespread use in pharma formulations and strong biotech investments promoting bio-based chemicals.

Key Growth Trends:

- Increasing applications in cosmetics

- Green chemistry emergence revenue booster for manufacturers

Major Challenges:

- Fluctuations in raw material production and supply

- Competition from other industries

Key Players: Archer Daniels Midland Company, BASF SE, Dow, Inc., and DuPont.

Global Bio-Based Propylene Glycol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 1.52 billion

- Projected Market Size: USD 3.57 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.4% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Bio-based Propylene Glycol Market Growth Drivers and Challenges:

Growth Drivers

- Increasing applications in cosmetics: The increasing popularity of organic material-based cosmetic products is creating an opportunistic environment for bio-based propylene glycol manufacturers. Consumers are being active in choosing products based on what goes in them. Such evolving demand aspects are necessitating cosmetic product manufacturers to invest in bi0-based or plant-based chemical derivatives. Furthermore, the regulations surrounding chemicals used in cosmetics are promoting the consumption of bio-based propylene glycols. Thus, the clean beauty movement and label transparency needs are driving the purchasing decisions of consumers, leading to a healthy demand for bio-based propylene glycols. The top 5 revenue-generating countries from natural cosmetic trade are China, the U.S., India, Japan, and Russia.

- Green chemistry emergence revenue booster for manufacturers: The green chemistry’s increasing importance in mitigating the implications of hazardous chemical substances is set to positively influence the adoption of bio-based propylene glycols. The conventional production of propylene glycols is based on petroleum-based feedstocks, which directly contributes to environmental degradation and reliance on fossil fuels. Comparatively, bio-based propylene glycols rely on plant-based feedstocks such as sugarcane, soybean, and corn, which makes them a better sustainable alternative than direct chemicals. Furthermore, the rising advancements in the biotechnology and green chemistry process are enhancing the efficiency of bio-based propylene glycols.

Challenges

- Fluctuations in raw material production and supply: One of the major challenges faced by bio-based propylene glycol manufacturers is the dependency on renewable feedstocks, including corn, sugarcane, and soybean. The uncertainty or drastic environmental changes have the ability to hamper the production of these raw materials. The negative impact on the production and supply of raw materials directly hinders the manufacturing of bio-based propylene glycols and also uplifts its costs. Thus, fluctuations in raw material production and supply impede the overall bio-based propylene glycol market growth to some extent.

- Competition from other industries: The increasing competition from the food industry is also a drawback for the bio-based propylene glycol manufacturer’s revenue growth. The raw materials used in the bio-based propylene glycol production finds high applications in biofuel production and human consumption. The production and logistic complications owing to widespread applications are constraining the bio-based propylene glycol market growth.

Bio-based Propylene Glycol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2035) |

USD 3.57 billion |

|

Regional Scope |

|

Bio-based Propylene Glycol Market Segmentation:

Application (Unsaturated Polyester Resin, Solvent, Antifreeze & Coolant, Chemical Intermediates, Others)

Antifreeze & coolant segment is projected to dominate bio-based propylene glycol market share of over 38.5% by 2035. The bio-based propylene glycols antifreeze and coolant properties are fueling their use in various industries such as industrial processing and automotive. To improve the environmental credentials of vehicles automakers are investing heavily in bio-based propylene glycols as better antifreeze & coolant alternatives. The electric and hybrid vehicles, which heavily rely on eco-friendly components are fueling the demand for bio-based propylene glycols. Furthermore, industrial segments such as cooling systems in manufacturing units, power plants, and HVAC systems majorly employ bio-based propylene glycols due to their superior environmental and safety benefits. The OEC report states that the antifreeze trade expanded at a CAGR of 8.56% and amounted to USD 1.54 billion in 2022. The antifreeze trade activities are more saturated across European countries, wherein Germany (USD 310.0 million) and France (USD 106.0 million) captured the top position as leading exporters and importers of antifreeze.

End use Industry (Cosmetics, Building & Construction, Automotive, Pharmaceuticals, Detergent & Household, Others)

The pharmaceuticals segment is anticipated to hold a dominant bio-based propylene glycol market share during the assessed period. Bio-based propylene glycols are widely used in injectable, oral, and topical formulations as a solvent. Continuous advancements in the biotechnology field are contributing to the bio-based propylene glycol applications in pharma product production. The supportive government policies and investments in organic chemical production and usage in the pharmaceutical sector are also promoting the consumption of bio-based propylene glycols. For instance, the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) report states that the yearly R&D spending on the biopharmaceutical sector is 8.1 times higher than other high-technology industries such as aerospace and defense. Furthermore, it is estimated that the growth of the pharmaceutical sector has a positive influence on the sales of bio-based propylene glycols.

Our in-depth analysis of the global bio-based propylene glycol market includes the following segments:

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bio-based Propylene Glycol Market Regional Analysis:

North America Market Forecast

North America bio-based propylene glycol market is projected to dominate revenue share of over 34.4% by 2035. The increasing demand for sustainable and eco-friendly products, strict regulations on mitigating carbon footprint, and expanding bio-chemical industry are propelling the trade of bio-based propylene glycols. The continuous advancements in the agriculture sector focused on feedstock production are aiding the bio-based propylene glycol manufacturers in a healthy supply of raw materials, both in the U.S. and Canada.

In the U.S., the rising importance of green chemistry and supportive government policies surrounding it are limiting the sales of hazardous chemicals and generating opportunities for bio-based chemical producers. The 12 principles of green chemistry developed by the U.S. Environmental Protection Agency (EPA) are augmenting the consumption of bio-based propylene glycols in the country. The EPA study states that around 30 million pounds of hazardous solvents and chemicals are discarded annually. The stringent regulations are also offering snowfall effects on the consumption of bio-based propylene glycols.

Canada’s robust agriculture sector is maintaining the supply chain of feedstocks required for the production of bio-based propylene glycols. These factors are not only multiplying the production of bio-based propylene glycols but also propelling their sales on the global landscape. The SoyCanada report underscores that soy is the 3rd largest among principal field crops and the farm cash receipts totaled around USD 2.94 billion (CDN$ 4.25 billion) in 2022. The soy production amounted to 6.98 million metric tons (MMT) in 2023. The U.S. Department of Agriculture (USFDA) analysis also highlights a positive growth in soy production in Canada.

|

Market Year |

Area (1000 Ha) |

Production (1000 Tons) |

Yield (T/Ha) |

|

2014/2015 |

2,257 |

6,045 |

2.68 |

|

2015/2016 |

2,233 |

6,456 |

2.89 |

|

2016/2017 |

2,232 |

6,597 |

2.96 |

|

2017/2018 |

2,935 |

7,717 |

2.63 |

|

2018/2019 |

2,540 |

7,417 |

2.92 |

|

2019/2020 |

2,271 |

6,145 |

2.71 |

|

2020/2021 |

2,041 |

6,359 |

3.12 |

|

2021/2022 |

2,080 |

6,224 |

2.99 |

|

2022/2023 |

2,118 |

6,543 |

3.09 |

|

2023/2024 |

2,261 |

6,981 |

3.09 |

|

2024/2025 |

2,290 |

7,568 |

3.30 |

|

5-year Average 2019/20 - 2023/24 |

2,154 |

6,450 |

3.00 |

|

Percent Change From 5-Year Average (%) |

6 |

17 |

10 |

|

Record |

2,935 |

7,717 |

3.12 |

|

Record Year |

2017/2018 |

2017/2018 |

2020/2021 |

Source: USDA

Asia Pacific Market Statistics

The Asia Pacific bio-based propylene glycol market is poised to rise at the fastest CAGR through 2035. The ongoing innovations in the chemical and petrochemical sector and the swiftly expanding automotive industry are increasing the consumption of bio-based propylene glycols. The hike in industrial activities and booming manufacturing trade are fueling the use of bio-based propylene glycols as antifreeze and coolants. China and India are high-earning bio-based propylene glycol markets, whereas Japan and South Korea are more focused on innovations and export.

India is the most lucrative marketplace for bio-based propylene glycol manufacturers owing to supportive government policies for green chemicals and foreign direct investments (FDI). The expanding number of high-performance and specialized chemical producers is subsequently uplifting India’s position in the global landscape. The India Brand Equity Foundation (IBEF) states that the specialty chemical companies’ expanding manufacturing units in the country are highlighting the boasting domestic and international chemical demand. The FDI in the chemical industry surpassed USD 22.7 billion between April 2000 and June 2024. Furthermore, the rise in automotive production capacities is also contributing to the increasing sales of bio-based propylene glycols as cooling and antifreeze agents. For instance, in January 2024, the Society of Indian Automobile Manufacturers (SIAM) disclosed that the total production of passenger vehicles, 3-wheelers, 2-wheelers, and quadricycles totaled 19,21,268 units in December 2024.

In China, the increasing number of manufacturing and industrial facilities are fueling the use of bio-based propylene glycols. The data from Trading Economics highlights that the industrial product increased by 6.2% YoY in December 2024. The same source also revealed that the manufacturing segment exhibited high growth in FY 2024 amid several stimulus measures. Another factor is that the high automobile production cycle is also contributing to the overall bio-based propylene glycol market growth.

Key Bio-based Propylene Glycol Market Players:

- Archer Daniels Midland Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Dow, Inc.

- DuPont

- Tate & Lyle

- Bio Products Company, LLC

- Huntsman International LLC

- Cargill, Incorporated

- Oleon NV

- Ashland Global Holdings Inc.

- Repsol S.A.

- SK Global Chemical

- P&G Chemicals

- GLOBAL BioChem Technology Group

The bio-based propylene glycol market is characterized by the presence of dominant players and the increasing emergence of new companies. The green chemistry trends, supportive policies on bio-based chemicals, and high demand from end use sectors are generating profitable opportunities for bio-based propylene glycol manufacturers. To maintain the dominant position in the global landscape the leading companies are employing several organic and inorganic marketing strategies such as new product launches, technological innovations, strategic collaborations and partnerships, mergers & acquisitions, and global expansions. The expanding production activities are underscoring the high global demand for bio-based propylene glycols.

Some of the key players include:

Recent Developments

- In March 2024, Dow, Inc. revealed the launch of two new sustainable varieties of propylene glycol (PG) solutions in North America. Renuva and Ecolibrium technologies are suitable for a broad range of applications including pharmaceuticals, agricultural, food ingredients, personal care, cosmetics, flavorings, fragrances, and industrial.

- In May 2023, BASF SE announced that the ORLEN Południe plant by using BASF technology is making propylene glycol production more sustainable. The plant aims to achieve carbon neutrality by 2050.

- Report ID: 7075

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bio-Based Propylene Glycol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.