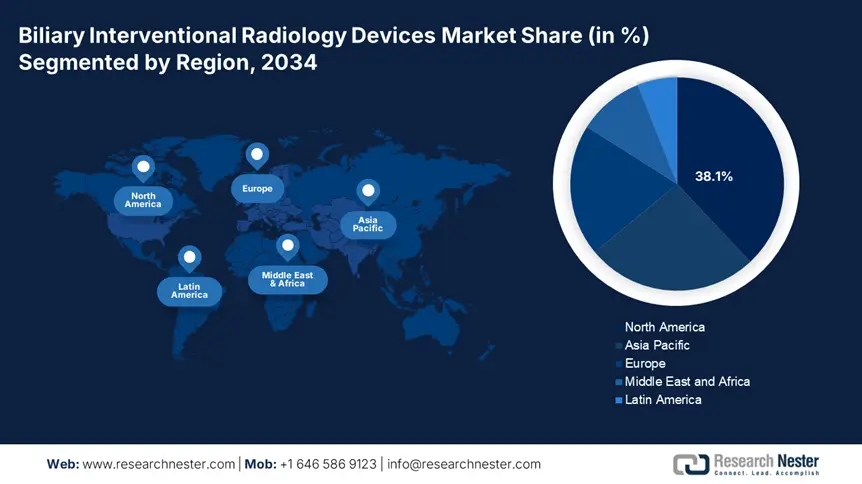

Biliary Interventional Radiology Devices Market - Regional Analysis

North America Market Insights

The North America market is projected to garner 38.1% of the revenue share by 2034, owing to the widespread expansion of Medicare and Medicaid coverage and increasing cases of hepatobiliary diseases. Hospitals are including AI-enabled imaging, CBCT-assisted IR suites, and biodegradable stents. In the U.S., the market is experiencing sturdy growth fostered by a surge in the prevalence of hepatobiliary disorders and an exponential demand for minimally invasive procedures. According to the National Institute of Health in 2023, the federal government has allocated USD 5.1 billion for the biliary interventions.

The market in Canada is thriving, primarily driven by the rising usage of interventional therapies and increasing government investment. The Health Canada in 2023 has allocated USD 3.1 billion to biliary interventions. The increment in the funding aligns with the national health priorities, focusing on a reduction in the wait time and widespread expansion in the image-guided procedures. As reported by the Ontario Ministry of Health, the government has supported more than 200,100 patients per year. The market in the country is also driven by the implementation of a combined health strategy and robust public funding.

Asia Pacific Market Insights

The market in Asia Pacific is poised to garner a CAGR of 8.2% during 2025-2034, driven by rising efforts from the government for healthcare advancements and rapid technological adoption. In China, the government is supporting the inclusion of advanced medical technologies, further propelling the market growth. According to the National Cancer Center in 2024, liver and gallbladder cancers are the top ten most common cancers. Also, gallstones affect over 10.1% of adults in the country, with a surge in cases owing to changes in dietary habits.

The market in India is also growing rapidly with rising advancements in healthcare initiatives. There has been a rise in incidences of biliary diseases. According to the Indian Council of Medical Research in 2023, gallbladder cancer is the most common type of biliary tract cancer in the country. Under the National Health Authority 2024, the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana covers biliary stenting. The National Health Authority in 2024 stated that Ayushman Bharat has given 60.1 million hospital admissions.

Latest Developments & Government Initiatives: Biliary Interventional Radiology Devices (2023–2025)

|

Country |

Latest Developments |

Government Initiatives |

|

Japan |

Nationwide upgrade of interventional radiology suites across public hospitals |

MHLW allocated 12% of the healthcare budget in 2024

|

|

Indonesia |

Introduction of fluoroscopy-guided biliary drainage in tertiary hospitals |

The Ministry of Health launched “Smart Hospital 2025,” including IR tech investments |

|

Malaysia |

Major public-private partnerships for biliary device trials |

Government funding for Biliary IR Devices rose by 20% (2013–2023) |

|

Australia |

Increasing use of biodegradable stents and hybrid IR-surgical systems |

Medicare extended coverage for biliary procedures (2023) |

|

South Korea |

Deployment of robotic catheter navigation systems |

MOHW supports digital IR infrastructure and hospital equipment upgrades |

Europe Market Insights

The biliary interventional radiology devices market in Europe is witnessing sturdy growth, bolstered by increasing incidences of hepatobiliary diseases. Various EU-backed funding programs are supporting interventional healthcare infrastructure. The data published by the European Health Data Space stated that USD 2.6 billion has been spent in recent years. In the UK, the demand is witnessing steady growth due to a surge in the burden of liver-associated diseases. According to NHS England, between 2021 and 2023, more than 2.1 million biliary procedures were conducted.

Additionally, Germany is also maintaining its place as the largest market in the region, as there is a surge in the integration of AI and various robotic navigation systems. Local players are including state-of-the-art robot-assisted IR procedures to render upscaled treatment. According to the Federal Ministry of Health in Germany in 2023, the Digital Healthcare Act strengthens advanced IR techniques in hospitals. The strong reimbursement policies from the government, coupled with a rising aging population, are promoting the market growth in the country.

Key Data & Initiatives by Countries in Europe

|

Country/Region |

Government Spending & Budget Allocation |

Latest Initiatives / Trends |

|

France |

7% of healthcare budget in 2023 (↑ from 5.5% in 2021) |

AI-supported biliary imaging endorsed by HAS |

|

Italy |

~6.5% of national health budget toward diagnostic/interventional radiology (est. 2023) |

AIFA fast-tracks approval for IR technologies |

|

Spain |

~6% of the healthcare budget allocated to IR and imaging in 2023 |

AEMPS supports centralized device registration & training |

|

Russia |

MoH budget includes ~5% for advanced diagnostics and radiology equipment |

Local production of biliary catheters encouraged |

|

NORDIC (e.g., Sweden, Norway, Denmark) |

~7–8% of healthcare budgets are dedicated to minimally invasive imaging & radiology |

E-health integration for radiology decision-making |

|

Rest of Europe |

Varies by country (average 5–6.5% of healthcare budget for radiology) |

Centralized radiology registries and tele-radiology investments |