Big Data in Flight Operations Market Outlook:

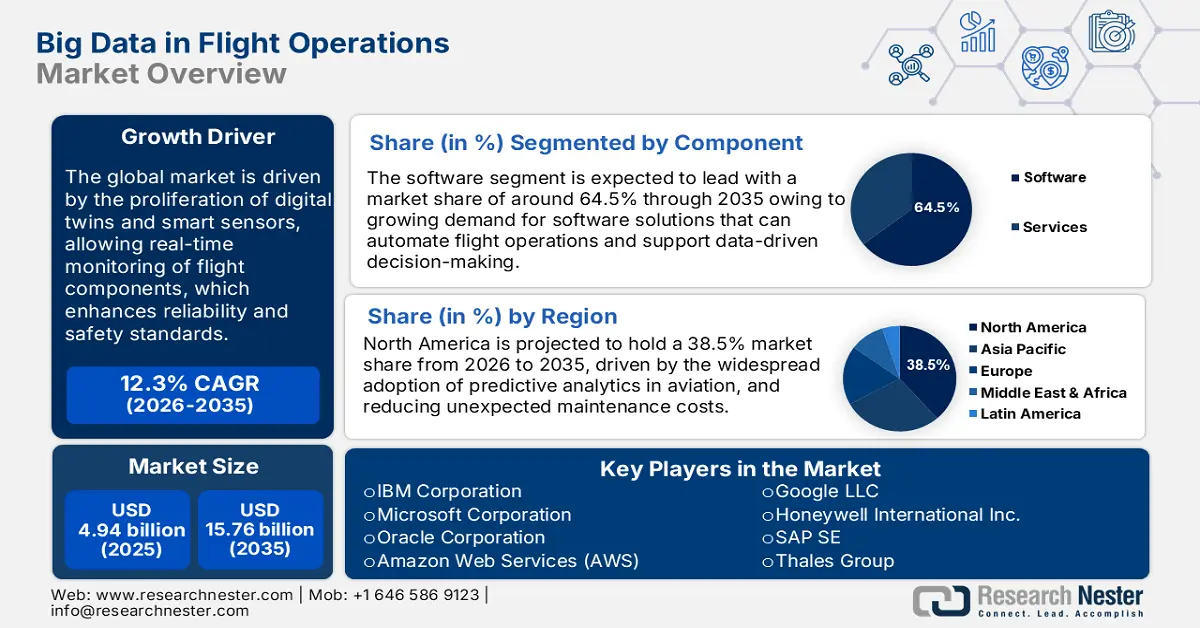

Big Data in Flight Operations Market size was over USD 4.94 billion in 2025 and is anticipated to cross USD 15.76 billion by 2035, witnessing more than 12.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of big data in flight operations is estimated at USD 5.49 billion.

Advancements in real-time analytics, integration of data, and AI adoption are expected to create significant opportunities for growth in the big data in flight operations market. These technologies enable airlines to optimize fuel consumption, lessen delays, and promote aircraft safety. Following the serious incident on Singapore Airlines SQ 321 in May 2024, interest of organizations surged in IATA's Turbulence Aware program. Initially from 21 airlines, this system, which launched in 2018, collects data with a forecast of 150 million reports collected by 2024-end to improve turbulence safety. Governments around the world are also investing in aviation data infrastructure, further facilitating data-centric operations.

The market is further driven by burgeoning government initiatives aimed at digitizing the aviation sector, forcing changes in operational efficiency and innovation that come into play during flight management. Such efforts represent the increasing recognition of data in revolutionizing flight operations to ensure better planning, compliance, and passenger safety. These include policies and financing programs that governments in all regions have proposed to accelerate the integration of aviation data, enabling airlines to adopt technologies such as real-time analytics and predictive maintenance. This not only improves safety and reliability within flights but also gives airlines a chance to improve fuel efficiency and reduce operational costs, thus further strengthening their dependence on data-driven solutions.

Key Big Data in Flight Operations Market Market Insights Summary:

Regional Highlights:

- North America's 38.5% share in the Big Data in Flight Operations Market is driven by demand for real-time analytics and presence of major tech companies, solidifying its dominance through 2026–2035.

- The Big Data in Flight Operations Market in Asia Pacific is projected to achieve substantial growth through 2026–2035, fueled by rapid digitalization and aviation investments.

Segment Insights:

- The Cloud-Based segment is anticipated to achieve a 68% share from 2026 to 2035, propelled by the need for scalable, cost-efficient data solutions in aviation.

- The Software segment is projected to hold 64.5% market share by 2035, fueled by demand for real-time analytics and predictive maintenance in flight operations.

Key Growth Trends:

- Growing use of real-time analytics

- Increasing use of AI and machine learning

Major Challenges:

- Privacy concerns

- Data integration complexity

- Key Players: Oracle Corporation, Amazon Web Services (AWS), Google LLC, IBM Corporation, Microsoft Corporation, Honeywell International Inc., SAP SE, Thales Group, Airbus SE, and Teradata Corporation

Global Big Data in Flight Operations Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.94 billion

- 2026 Market Size: USD 5.49 billion

- Projected Market Size: USD 15.76 billion by 2035

- Growth Forecasts: 12.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, Brazil, UAE

Last updated on : 14 August, 2025

Big Data in Flight Operations Market Growth Drivers and Challenges:

Growth Drivers

-

Growing use of real-time analytics: Big data analytics continues to be integrated into flight operations for the real-time monitoring of flights and predictive maintenance. With AWS's release in February 2023 of Amazon Kinesis Data Streams, airlines are better positioned to stream data in real time, thereby supporting route optimization and early detection of mechanical issues that can become critical. In addition to that, the increase in cloud computing platforms supports enhanced scaling for processing real-time analytics, which, in turn, strengthens the role of big data in flight operations.

-

Increasing use of AI and machine learning: AI-based integration into flight operations is also a major growth driver, enhancing capabilities for route optimization, fuel efficiency, and maintenance prediction. In September 2023, airlines in Indonesia, such as Lion Air, Batik Air, and Super Air Jet started deploying digital technologies offered by Airbus to expand AI-assisted flight and maintenance efficiency, showing the aviation data management sector's growth of AI. Moreover, AI-powered predictive maintenance at airlines reduces downtime, where the savings are significant enough to contribute to better operational planning.

- Government investment in aviation modernization: Government organizations are now focusing on upgrading their aviation infrastructure by using modern technologies. This huge investment is likely to spur the growth of big data analytics applications in flight operations, especially as digital monitoring and predictive maintenance are indispensable parts of such developments. In other countries, strategic investments are rolled out to upgrade air traffic management, thus calling for increased demand for data analytics solutions.

Challenges

-

Privacy concerns: Despite the increasing use of big data in aviation, privacy is one of the major concerns. Governments ensure that no misuse is made of the passenger data collected and used, hence putting brakes on the adoption of big data technologies. In February 2023, for instance, the European Union updated its data protection laws to increase controls on the use of aviation information to seek improved transparency and security for better protection of data. These are some of the regulations that carriers should keep a watchful eye on to balance data usage with privacy to avoid being penalized and also not losing the trust of customers.

-

Data integration complexity: Although there are various data sources from several systems and stakeholders, integration still poses huge challenges at the industry level. Airlines require a huge amount of information streams, starting from flight data, weather reports, and maintenance logs to passenger information. Moreover, due to the multiple systems of airlines and different service providers, unifying a data strategy remains challenging and significantly holds up the efficiency of big data initiatives. The non-standard nature of these systems leads to data silos, which in turn make it incredibly difficult for aviation firms to extract comprehensive and actionable insights.

Big Data in Flight Operations Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 4.94 billion |

|

Forecast Year Market Size (2035) |

USD 15.76 billion |

|

Regional Scope |

|

Big Data in Flight Operations Market Segmentation:

Components (Software, Services)

The software segment leads the big data in flight operations market and is poised to retain a revenue share of about 64.5% by 2035. This growth is driven by increasing demand for advanced software solutions providing real-time analytics, predictive maintenance, and other forms of efficient data management. Microsoft introduced Azure Stream Analytics, a software solution that can enable airlines to leverage real-time data through streaming of data in March 2023, further strengthening the role played by software in flight operations. The software solutions will have an important role in enabling aggregation, real-time monitoring, and analytics of data for optimization of flight operations and ensuring passenger safety.

Deployment Mode (Cloud-Based, On-Premises)

The cloud-based segment is likely to account for a 68% share of the big data in flight operations market during the forecast period. Accessible, affordable, and scalable data solutions are driving cloud-based deployments, further propelling market growth. Cloud-based solutions, in particular, enable airlines to save part of the IT infrastructure cost without compromising on high data availability and security standards. Also, big data analytics in real time is a capability supported by cloud platforms to further enhance operational insights and decision-making for flight efficiency. This is one of the latest trends in the aviation sector, with an uptrend in digital transformation where airlines can get advanced analytics capability without the hassle of managing on-premise systems.

Our in-depth analysis of the big data in flight operations market includes the following segments:

|

Components |

|

|

Deployment Mode |

|

|

Applications |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Big Data in Flight Operations Market Regional Analysis:

North America Market Analysis

North America is anticipated to dominate the global big data in flight operations market, recording a share of over 38.5% during the forecast period. This is due to the increasing demand for real-time data analytics solutions driven by the regional existence of major technology corporations such as Amazon and Google. For example, OAG teamed up with The Pacific Asia Travel Association in June 2022 to deepen aviation data access, underscoring the trend where data partnerships are becoming integral in North America.

The top airlines in the U.S. already employ advanced analytics in most aspects of their operations. Furthermore, the Federal Aviation Administration also invests in digital infrastructure to enhance air traffic control to a level that is expected to drive big data technology adoption in aviation over time. Also, various collaborations between airlines and technology companies such as Amazon AWS in the development of innovations in data handling and analytics positions the U.S. as a significant influencer in this market.

In Canada, many efforts have been made to improve the productivity and safety of flight operations through effective data utilization. More airlines in Canada are using big data to improve scheduling and reduce delays. The growth has also been propelled by government-led initiatives to ensure future programs support the digital transformation of transport modes. Technology companies that provide cloud-based aviation analytics platforms further boost the contribution of Canada to North America big data in flight operations market. Additionally, initiatives toward modernizing air transport infrastructure contribute to improving data-driven decision-making processes and place Canada as a significant player in the market.

Asia Pacific Market Analysis

The big data in flight operations market in Asia Pacific is expected to witness steady growth from 2026 to 2035, attributed to rapid digitalization across major economies like China, India, and Japan. This is further supported by increased government and airline investments in advanced data analytics solutions for flight efficiency and passenger safety. This, along with the growing aviation sector in the region and rapid growth in air travel demand in emerging economies, is driving demand for scalable and efficient data management systems.

In China, big data adoption in aviation is driven by the rapid expansion of the domestic airline industry along with the increasing focus on operational efficiency. Accordingly, the aviation infrastructure in China is particularly large, as it develops smart airports with big data applications for enhancing passenger experiences and smoothing operational procedures. Similarly, the use of AI is becoming increasingly common for predictive maintenance; therefore, airlines are in a position to minimize downtime while optimizing resource deployment. Government support in the development of smart airports and integration of AI underlines China's strategic approach toward modernizing its aviation sector through the competitive usage of big data.

Big data analytics adoption is witnessing a rapid surge in flight operations in India, facilitated by the rollout of 5G. As per a report, approximately 300 million Indians are likely to access 5G by March 2025, considerably improving the ability to implement real-time data analytics at airlines. This rise in connectivity is likely to be a major driver in the adoption of big data in the aviation sector. Furthermore, government policies on digitalizing air traffic management, coupled with upgrading safety standards, are driving big data solutions in flight operations in India. Increased investments in digital infrastructure also contribute to making India one of the leading adopters of big data in aviation across Asia Pacific.

Key Big Data in Flight Operations Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Oracle Corporation

- Amazon Web Services (AWS)

- Google LLC

- Honeywell International Inc.

- SAP SE

- Thales Group

- Airbus SE

- Teradata Corporation

The big data in flight operations market is competitive, with few players holding the majority of shares. Oracle Corporation, Amazon Web Services, Incorporated (AWS), Google LLC, IBM Corporation, Microsoft Corporation, Honeywell International, Inc., SAP SE, Thales Group, Airbus SE, and Teradata Corporation are some of the leading companies in the industry. These companies focus more on innovation, cloud migration, and AI integration in efforts to retain their market position by ensuring that their solutions meet the emerging needs of the aviation industry. The competitive landscape is defined by strategic alliances, partnerships, and frequent product launches that enhance their offerings in big data analytics, thereby enabling them to deliver cutting-edge and scalable solutions.

Moreover, industry-leading companies are committed to investing significantly in research and development to drive improvements in predictive analytics, flight operations, and safety standards for the industry. In March 2023, Boeing's DAS division added another twist to this dynamic by trying to address airlines' data-sharing and operational challenges. By deploying AI-driven solutions such as Fleet Insight, Boeing focuses on real-time aircraft tracking and predictive maintenance. Therefore, Boeing makes it easier for airlines to reduce delays and operational disruptions. Such moves by key players aid them to compete in the market delivering effective digital solutions to meet an evolving aviation industry.

Here are some leading players in the big data in flight operations market:

Recent Developments

- In May 2023, IBM and Airbus unveiled Airbus Smarter Fleet, a cloud-based analytics platform for the aerospace sector. Using machine learning, it processes vast sensor data to improve fleet maintenance and operational efficiency. The tool enables real-time performance optimization and supports predictive maintenance across diverse aircraft fleets.

- In April 2023, Spire Worldwide entered a long-term deal with ch-aviation, granting access to Spire’s daily Flight-Report for comprehensive flight insights. This report aggregates satellite and ADS-B data, detecting scheduled and unscheduled flights even in radar-limited regions. The integration offers ch-aviation’s platform users enhanced tracking of aircraft utilization, passenger capacity, and wet-lease contracts, aiding operational planning.

- Report ID: 6613

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Big Data in Flight Operations Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.