Big Data and Business Analytics Market Outlook:

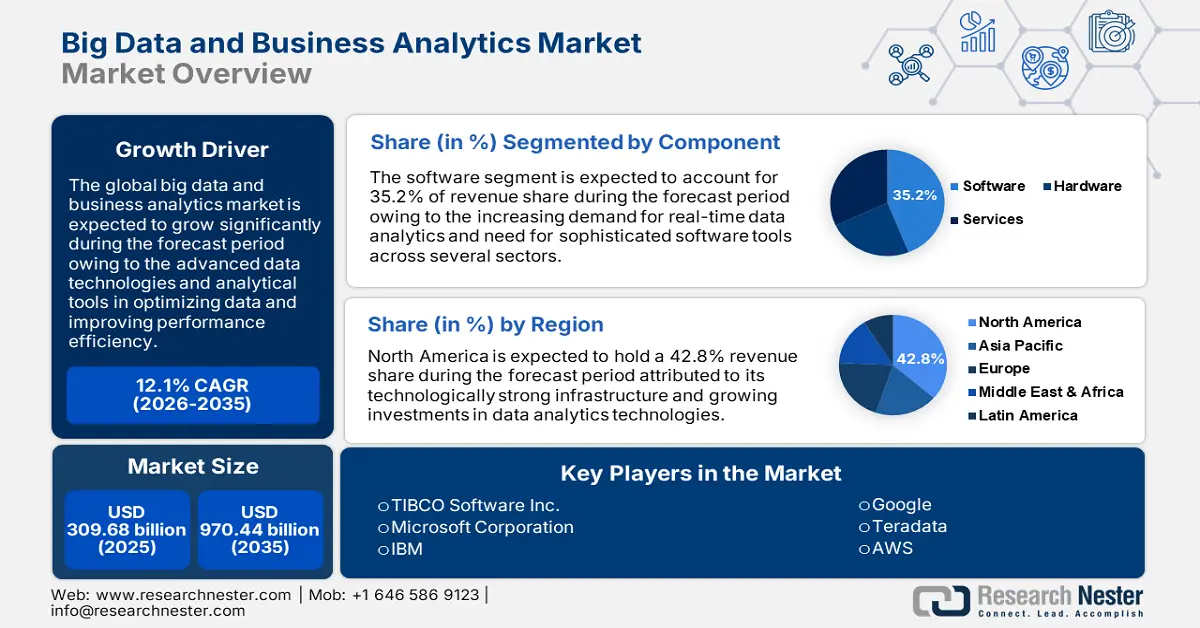

Big Data and Business Analytics Market size was over USD 309.68 billion in 2025 and is projected to reach USD 970.44 billion by 2035, witnessing around 12.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of big data and business analytics is evaluated at USD 343.4 billion.

Big data and business analytics have become the backbone of modern business strategy, enabling decisiveness and operationally efficient activities across various sectors. With technology, the multiplication of data generation has been exponential with the increase in IoT devices and further digitalization of services, fueling market growth. Furthermore, the rise in investment and effort to become more competitive brings investments in optimizing big data solutions and analytics, which maintains the market well for sustained growth. Also, big data technologies and analytics tools are paramount for improvements in the efficiency of operations through optimal performance and innovation.

The advent of cloud computing allows for the cost-effective storage and scaling of processing data, which makes analytics accessible to all business sizes. Also, advancements in artificial intelligence and machine learning are making analytics tools more powerful such as predictive and prescriptive analytics that contribute to strategic initiatives. Better governance of data and regulatory compliance push organizations to invest in sophisticated analytics solutions that ensure data integrity and security. For instance, In November 2022, IBM unveiled new software IBM Cognos Analytics with Watson that aims to assist businesses in dismantling data and analytics silos so they can swiftly make decisions based on data and manage unforeseen interruptions.

Key Big Data and Business Analytics Market Insights Summary:

Regional Highlights:

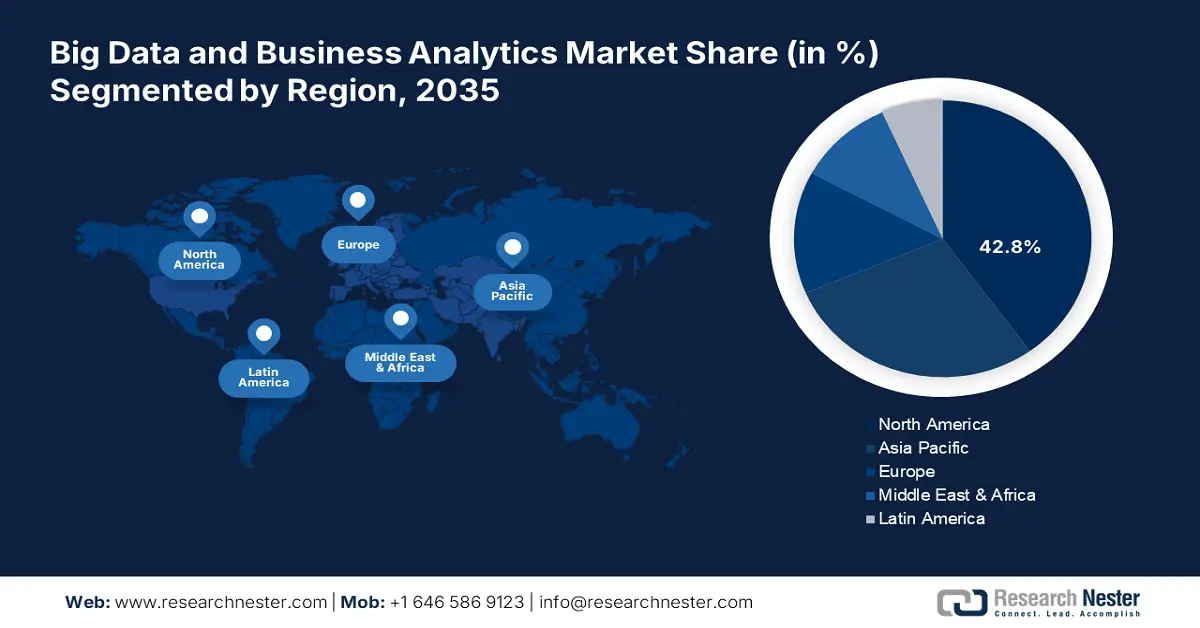

- North America big data and business analytics market will account for 42.80% share by 2035, driven by sound technological infrastructure and high concentration of leading technology companies.

Segment Insights:

- The software segment in the big data and business analytics market is forecasted to exhibit significant growth till 2035, fueled by the increasing demand for real-time data analytics and AI integration.

- The cloud segment in the big data and business analytics market is projected to capture dominant share by 2035, driven by its cost-effectiveness, scalability, and ability to handle large data volumes.

Key Growth Trends:

- Improvements in data processing tools

- Growing adoption of big data analytics

Major Challenges:

- Lack of expertise

Key Players: IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Google LLC, SAS Institute Inc., Teradata Corporation, Tableau Software (Salesforce), Palantir Technologies Inc.

Global Big Data and Business Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 309.68 billion

- 2026 Market Size: USD 343.4 billion

- Projected Market Size: USD 970.44 billion by 2035

- Growth Forecasts: 12.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, India

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Big Data and Business Analytics Market Growth Drivers and Challenges:

Growth Drivers

-

Improvements in data processing tools: Advances in data processing tools within the big data and business analytics markets have increased functionalities and effectiveness considerably. Artificial intelligence and machine learning algorithms have improved predictive analytics, allowing an organization to attain more insight into its massive datasets.

Scalable and flexible data storage and processing is enabled through cloud-based computing platforms, thus allowing firms to manage large volumes of information with efficiency, while offering access and collaboration opportunities within teams, offering timely decisions based on real-time processing technologies such as Apache Kafka and Apache Flink. Furthermore, increased demand for data-driven decision-making and strict regulatory requirements for data governance and privacy serve as a key source of competitive advantage in a more data-centric landscape. - Growing adoption of big data analytics: Organizations use huge volumes of structured and unstructured data to gather actionable insights for providing clear strategic planning and improving customer retention rates. Big data analytics further enables companies to understand the market trends and preferences of their consumers for marketing campaigns and personalize services for their targeted clients. Additionally, integration with advanced technologies like machine learning and artificial intelligence presents capabilities for data analysis to yield predictive models and real-time analytics. Thus, strategic adoption of big data analytics is perceived as crucial to an organization's competitive advantage and sustainable growth.

- Regulatory framework requirements: The increasing complexity of the legal and regulatory environment are extremely contrasting factors that challenge the base where this market operates. Most imperative regulations create a significant demand for a more sophisticated data management solution, such as a completely transparent and accountable system. Other factors that are contributing to market growth include the ever-increasing volume of data being produced, increasing sophistication in AI and ML technologies, and an increasing requirement for businesses to use data for strategic decision-making. As a result, compliance and innovation interplay will determine the future of big data analytics in navigating that regulatory environment.

Challenges

-

Security concerns over data: Data privacy and security are the biggest challenges for the big data and analytics market. The more organizations become dependent on vast stacks of data to gain insights for informed decision-making, the greater the associated risks of unauthorized access and breaches of data, while being compliant with changing regulations like GDPR and CCPA. These risks are worsened by the complexity of ensuring the sensitive information is handled rightly with different varieties of platforms, thereby requiring security protocols that are quite tight and better encryption methods.

Also, ethical issues with data usage, where businesses balance the benefit of analytics with protecting privacy. Hence, data privacy and security are a technical necessity and a critical component of building trust with consumers and ensuring organizational integrity in the age of big data. - Lack of expertise: The biggest challenge to the big data and business analytics market is the scarce number of skilled professionals. The increasing demand for making valuable and data-driven decisions has necessitated the requirement for expertise in data analysis, machine learning, and statistical modeling methods. This skill gap impacts the market growth and capacity to use data appropriately and limits the scale of innovation. Hence, the market experiences restricted growth and competitiveness in such a very data-centric landscape.

Big Data and Business Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 309.68 billion |

|

Forecast Year Market Size (2035) |

USD 970.44 billion |

|

Regional Scope |

|

Big Data and Business Analytics Market Segmentation:

Component (Hardware, Software, Services)

Software segment is estimated to account for around 35.2% big data and business analytics market share by 2035. The exponential surge in the utilization of data across various domains demands advanced and high-tech software solutions that can process voluminous data and offer meaningful insights from large sets of data. Furthermore, the increasing demand for real-time data analytics poses the need for sophisticated software tools to support organizations in making timely, data-driven decisions. In addition, artificial intelligence and machine learning are now a part of big data software to analyze and perform predictive modeling on a level that had never been feasible before. The adoption of cloud-based solutions worldwide has created further openness and scalability to access, thereby raising the stronghold of the software segment as the dominant position of the market.

Organization Size (Large Enterprise, SME)

The large enterprises segment in big data and business analytics market is anticipated to witness robust revenue growth during the forecast period. Large enterprises have high capital resources, enabling them to invest in advanced technologies and skilled personnel that contribute to effective data analysis. In addition, huge volumes of data from diverse sources and the urgency to extract actionable insights continue to create pressing needs for robust analytics solutions for large enterprises. Their business operations are also complex, necessitating advanced analytics to make better decisions, improve operational effectiveness, and gain competitive advantages.

Above all, large enterprises rely on data-driven strategies to better innovate and deliver great experiences to customers, which further solidifies their dependency on big data technologies. The infusion of artificial intelligence and machine learning into analytics platforms drives this market forward as one can now process sophisticated data to enable more advanced forms of predictive analytics capabilities. Hence, the existence of resources, the volume of data, and the increasing need for strategic insights contribute to large enterprises leading the big data and business analytics landscape.

Deployment Model (On-premises, Cloud)

Based on deployment type, the cloud segment in big data and business analytics market dominates the market owing to its cost-effectiveness, flexibility, and scaling up. Also, organizations are shifting toward solutions in the cloud as it offers rapid capabilities of deployment and handling as much data without having expansive on-premises infrastructure. Furthermore, cloud collaboration capabilities offer teams real-time access to the data, a highly integral piece in today’s remote work environment. Further, the pay-as-you-go pricing of cloud services reduces the upfront cost and risk associated with adopting advanced analytics solutions by businesses of all sizes.

The adoption also accelerates the penetration of further enhancements in cloud technology, including enhanced controls for security and artificial intelligence integration. In addition, real-time data analytics is in demand, which can be possible with agile cloud-based solutions as they will efficiently process large volumes of data. Such factors and the trend showing the cloud segment as a pivotal force in the growth of the big data and business analytics market as a whole are factors to consider.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Deployment Model |

|

|

Organization Size |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Big Data and Business Analytics Market Regional Analysis:

North America Market Statistics

North America industry is estimated to hold largest revenue share of 42.8% by 2035, owing to a sound technological infrastructure, with a high concentration of leading technology companies that can prompt innovation through the rapid development of sophisticated analytics tools. The market is also driven by the growing volume of data coming from finance, healthcare, and retail.

The need for sophisticated analytics solutions can draw actionable insights into decision-making processes and profoundly highly skilled professionals in data science and analytics have emerged as a catalyst of growth for this trend, as organizations are moving towards tapping into their expertise to be in a better competitive position in the future. The continuing favorable government policies and investments in data-related technologies have been driving a favorable environment for the growth of the market. Additionally, data-driven strategies and growing awareness about the importance of data privacy and security are driving the growth of businesses, underlining the strategic imperative of embracing big data solutions.

The U.S. leads the big data and business analytics market due to its high-tech hubs like Google, Amazon, and Microsoft which accelerate the pace of innovation and investment in data analytics tools and cloud computing. Also, higher levels of investment from the private sector and government advance data science and analytics along with the well-developed education system, which has produced high-caliber professionals in data science, statistics, and computer science, feeding into the talent required by the industry. The sectors such as finance, healthcare, retail, and logistics use big data analytics very elaborately for decisions risk management, and customer insight. Additionally, the regulatory environment is flexible to encourage innovation while maintaining the privacy and security of data, making big data allow businesses to withstand market competition.

Asia Pacific Market Analysis

The Asia Pacific has been acknowledged as the fastest-growing market for big data and business analytics owing to significant growth drivers such as rapid digitalization in industries and the proliferation of connected devices has led to an exponential increase in data generation. Organizations are inclining toward the utilization of advanced analytics to analyze actionable insights, optimize operations, and improve customer experiences. Additionally, the scope for government initiatives in digital transformation and data-based decision-making also supports growth in this market.

Evolving technologies in cloud computing and artificial intelligence are facilitating effortless handling of data. Furthermore, the growing concern of businesses regarding the importance of data analytics enables gaining competitive advantages and further fuels market growth. This is a promising region to emerge as a prime hub that attracts considerable investments and innovation in the big data and business analytics market.

Companies in China are reaping the benefits of big data and business analytics in facilitating innovation and business growth. For example, Alibaba Cloud offers advanced data analytics solutions, such as MaxCompute and Quick BI, allowing businesses to process large datasets and draw actionable insights efficiently. Similarly, Tata Consultancy Services (TCS) in India, offers several analytics services, combining AI and machine learning within its Ignio platform to optimize enterprise operations and inform better decision-making.

Big Data and Business Analytics Market Players:

- AWS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hewlett Packard Enterprise company

- IBM

- Microsoft Corporation

- Oracle

- SAP

- SAS

- Teradata

- TIBCO Software Inc.

Companies play a vital role in the growth of the big data and business analytics market by making investments in advanced and innovative technologies. These companies introduce market scalable tools and processes that encourage businesses to make well-informed decisions, optimize their operations, and increase competitiveness. Some of the competitive market players are:

Recent Developments

- In April 2022, Wipro partnered with DataRobotto to increase the business impact of customers by providing augmented intelligence at scale and helping them transform into an AI-powered enterprise. Furthermore, by working together, it will be ensured that businesses acquire their data more efficiently and that the AI strategy is promptly adopted.

- In March 2022, Microsoft introduced a Platform as a Service (PaaS) called Azure Health Data Services intending to facilitate analytical and transactional workloads. It facilitates the integration of health data in the cloud, enabling Artificial Intelligence (AI) and protecting Protected Health Information (PHI).

- Report ID: 6469

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.