Bicycle Lights Market - Growth Drivers and Challenges

Growth Drivers

- Growing focus on vulnerable road user safety: Greater emphasis on VRU protection is inspiring record investment in cyclist safety and visibility infrastructure, driving long-term demand for high-performance bicycle light systems. Government funding programs targeted specifically at reducing cyclist fatalities through increased visibility and improved infrastructure are being introduced by the government agencies. In 2023, the U.S. Federal Highway Administration implemented the Vulnerable Road User Safety Special Rule, requiring states with 15% or more VRU fatalities to spend at least 15% of Highway Safety Improvement Program funds on pedestrian and bicyclist safety projects. Pennsylvania demonstrated its commitment by implementing the rule to install 779 pedestrian countdown signals, with completion expected by September 2025.

- Revolutionary advances in smart lighting technology: The bicycle lights market is experiencing a technology resurgence with the integration of intelligent features such as radar detection, adaptive brightness, and automatic response systems that enhance safety and customer experience. These innovations represent a huge shift from traditional static lighting to dynamic responsive systems that adapt based on riding conditions and traffic scenarios. In November 2024, CYCLAMI introduced its revolutionary CY300T smart light system with radar-integrated brake detection and a dual-circle front light of 300 lumens and a rear module with an adaptive flash feature. The configuration includes automatic deceleration signals that enhance visibility upon speed reduction, particularly effective in case of heavy traffic situations, with IPX-rated waterproof protection for optimizing issues in practical performance.

- Rapid e-bike market and integrated systems growth: The swift growth in electric bikes is giving rise to new market opportunities for focused lighting systems that are able to harness the power infrastructure of the e-bike without compromising on higher performance demands for speed and visibility. E-bike cyclists ride faster and longer distances than standard cyclists, necessitating more powerful and heavier-duty lighting solutions integrated into the vehicle electrical system. In June 2025, Samsung launched its E-Cycle in the India market, featuring a full LED lighting system alongside disc brakes, an anti-theft lock, and an LCD screen for battery indication. The 145-kilometer range of the e-cycle, combined with the down payment facility, indicates that lighting systems are becoming a standard safety feature, rather than an aftermarket upgrade.

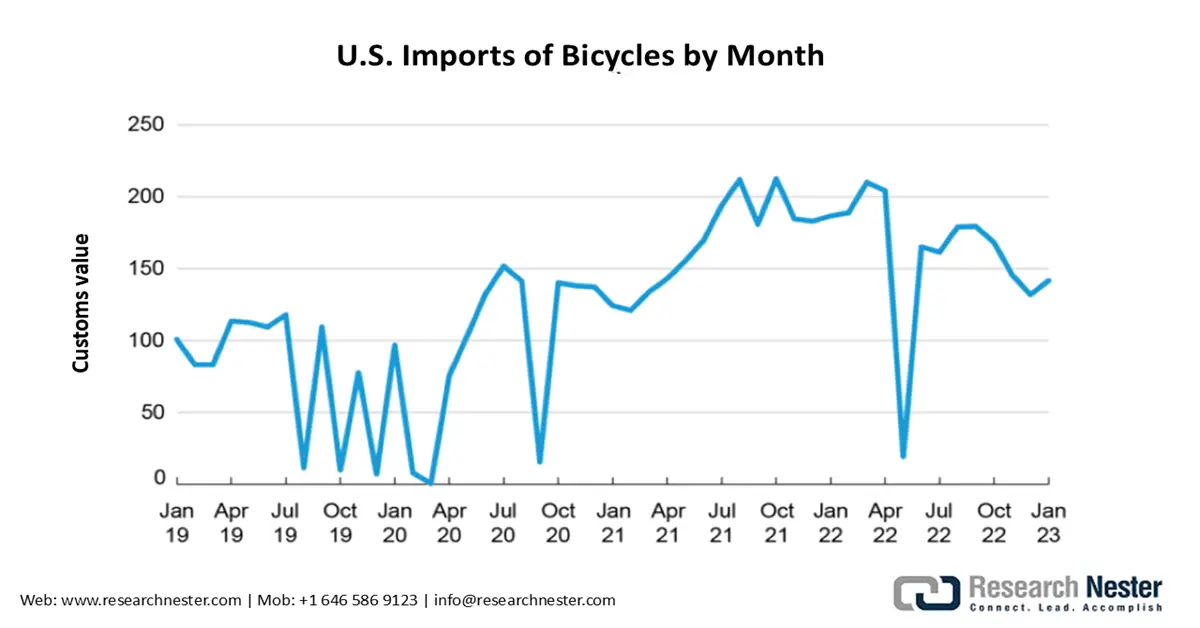

Rising Bicycle Imports Propel Growth in the Bicycle Light Industry

The significant increase in bicycle imports, with values soaring over 1,000% from 2020 to 2023, translates to a significant growth in the bicycle light industry. This influx of millions of new bicycles leads to a rise in demand for important safety accessories. Each new bike means a possible sale, as new cyclists, who make up a large part of this growth, need to equip their bikes with the required and critical lighting systems for safety. As a result, this trend offers a major and immediate growth opportunity for light manufacturers, retailers, and innovators. It boosts the industry's sales baseline and opens up both volume and opportunities for upgraded, premium products. For instance, the total number of non-motorized bicycle imports from the U.S. increased from 0.5 million in March 2020 to 1.0 billion in February 2023.

Source: U.S. BTS

Challenges

- Rising safety concerns over lithium-ion battery systems: The bicycle lights market faces growing pressure to address battery safety issues, particularly with lithium-ion technology, which, if not handled responsibly by consumers, can lead to fires and safety hazards. Regulatory bodies are responding with tighter rules and enforcement measures that impact product design deadlines and compliance costs. In January 2025, the UK Office for Product Safety and Standards published regulatory activity notices of just under 200 e-bike, e-scooter, and lithium-ion battery product fires that resulted in 10 fatalities in the UK throughout 2023. The research greatly improved policy-making data and targeted regulatory efforts, as well as encouraged consumer awareness of hazards.

- Market fragmentation through non-compliant and sub-standard products: The bicycle lights market faces a severe threat from the spread of poor-quality, non-compliant products that don't meet safety standards but undermine authentic manufacturers using undercutting or predatory pricing strategies. Online platforms act as gateways to such low-quality products, creating regulatory enforcement issues and consumer safety risks. In May 2025, a comprehensive E-bike Action Plan for Government was published by the UK Bicycle Association, calling for urgent action, taking obvious, clear action beyond technical action. The plan requires multiple government departments to collaborate in regulating online marketplaces and gig economy food delivery operators, who must take responsibility for unsafe products supplied through their platforms. This emphasizes the need to distinguish legitimate products from throttle-controlled high-speed vehicles that cause safety incidents.

Bicycle Lights Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 452.5 million |

|

Forecast Year Market Size (2035) |

USD 1.17 billion |

|

Regional Scope |

|