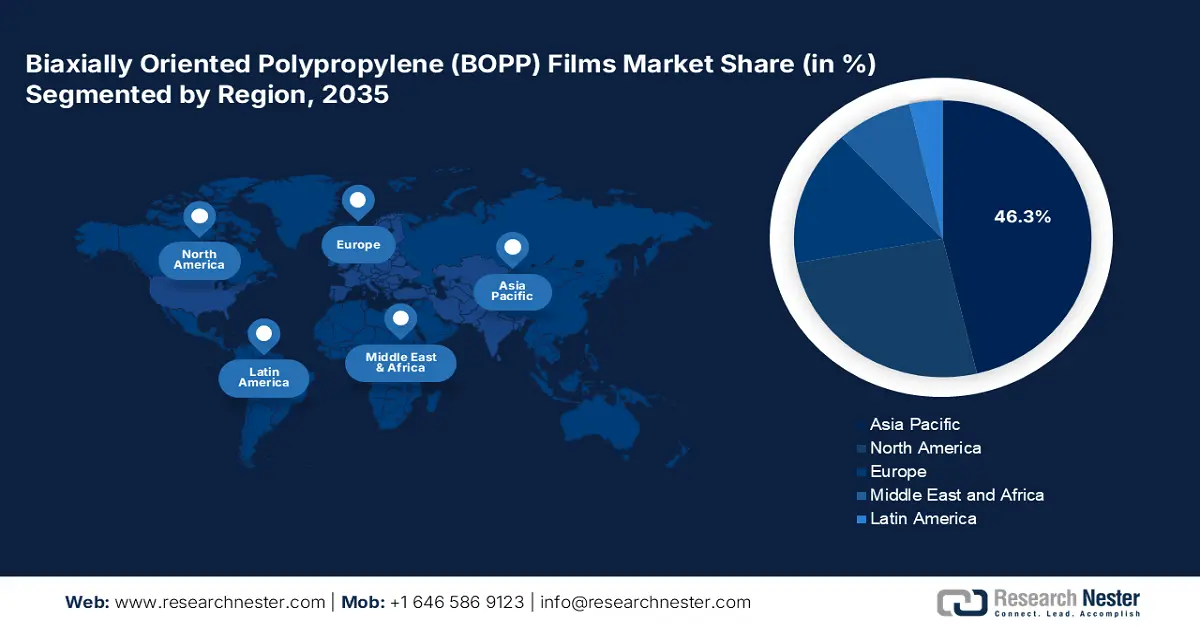

BOPP Films Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is expected to lead the BOPP films market with a share of 46.3% during the forecast period. Rising disposable incomes, the growing middle class, and rapid urbanization are all contributing to the need for packaged foods and consumer products, which in turn is driving up demand for BOPP films. The BOPP films market is expanding due in large part to the region's thriving e-commerce sector, which calls for effective and long-lasting packaging solutions. Furthermore, Asia Pacific is becoming a center for BOPP film production due to the construction of sophisticated manufacturing facilities and the availability of inexpensive labor, drawing investments from international companies.

In India, the increased need for flexible and affordable packaging options is driving the nation's biaxially oriented polypropylene films market expansion. Furthermore, the maker of BOPP films has made significant investments to increase manufacturing capacity, which has contributed to the market's growth. A new BOPP plant in Nashik, Maharashtra, would increase capacity, according to JPFL Films Private Limited, a division of the massive flexible packaging company Jindal Poly Films Ltd. The new line will require a capital expenditure of USD 3,498.55 billion and is anticipated to be put into service in H2 FY 25–26. The expansion follows a 142% increase in EBITDA in the first quarter of FY'25, which was supported by excellent top-line growth. It also aims to preserve its market leadership in the face of business difficulties.

On the other side, in China, the established packaging sector and a strong focus on high-performance and sustainable packaging materials are driving the BOPP market's consistent expansion. The food and beverage and pharmaceutical industries, where BOPP films are essential to preserving product safety and prolonging shelf life, are the key drivers of demand. The use of BOPP films is further encouraged by the regulatory environment, which is moving toward recyclable and environmentally friendly packaging options.

It is anticipated that the industry in this area would keep growing, albeit slowly, due to advancements and the growing popularity of smart and customized packaging. At least five more BOPP film/sheet converters are expected to enter the Chinese biaxially oriented polypropylene films market in the first quarter of 2024, bringing the total number of completed goods to 265,000 tons annually. Currently, China produces an estimated 7.305 million tons of BOPP film and sheet annually. These startups typically signify increased demand for raw materials, in this case, BOPP and homo-PP yarn.

North America Market Insights

The North America BOPP films market due to high-performance barrier films are required to safeguard delicate items due to strict regulatory requirements, which is driving the market's expansion in pharmaceutical packaging. Continuous technological developments, such as metallization and co-extrusion, are also enhancing the functionality of BOPP films and increasing their marketability. Furthermore, the industry's increasing emphasis on mono-material packaging and recyclability is driving manufacturers to create environmentally friendly BOPP films that satisfy industry standards. Furthermore, the growing trend of premiumization in consumer products packaging is increasing demand for BOPP films with high clarity and aesthetic appeal, hence strengthening their position in improving product aesthetics and competitiveness in the market.

In the U.S., the existence numerous BOPP producers who are making significant research and development investments to enhance the qualities of BOPP films. BOPP films are in a favorable position because of the region's strict environmental laws and dedication to lowering carbon footprints, which has increased demand for recyclable materials. The demand from the pharmaceutical, personal care, and food and beverage sectors are driving the market. Additionally, developments in film technology and the creation of specialty films for particular uses support market expansion.

In Canada, the government's significant emphasis on environmentally friendly packaging options and the quick development of technology are driving the country's market expansion. Because BOPP films can be used in a variety of life situations, their demand has also grown. This film is thought to be the greatest option for food packaging because it is made of non-toxic basic materials. The plastic sheet adheres precisely to the paper's surface when the heat melts the adhesive and applies pressure. Numerous packaging machines are compatible with BOPP thermal laminating film. It is the best option for prints and photographs. The printed region is shielded by the thin, translucent layer without becoming overly noticeable. Kingchuan Packaging offers matte, textured, metallic, gloss, metallic, PVC, acrylic, and silk laminates.