Biaxially Oriented Polyamide Films Market Outlook:

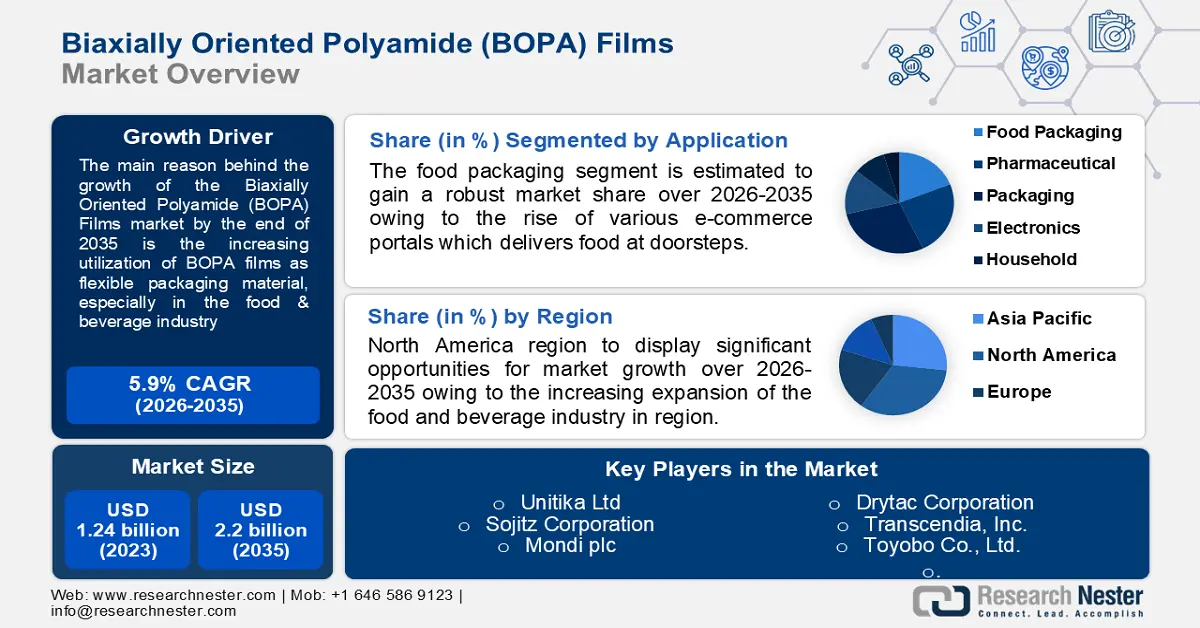

Biaxially Oriented Polyamide Films Market size was over USD 1.24 Billion in 2025 and is anticipated to cross USD 2.2 Billion by 2035, growing at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biaxially oriented polyamide films is assessed at USD 1.31 Billion.

The growth of the market can be attributed to the increasing utilization of biaxially oriented polyamide (BOPA) films as flexible packaging material, especially in the food & beverage industry, along with the rapidly increasing personal care product industry. As per the United States Environmental Protection Agency (EPA), in 2018, 14.5 million tons of packaging and plastic containers were manufactured in the USA.

Global biaxially oriented polyamide (BOPA) films market trends such as, higher utilization of these films in several industries on account of excellent mechanical strength, high abrasion resistance, and resistance to flex-cracks, making them highly appropriate in packaging of products. It is observed in research, BOPA film has an outstanding shield to gas, fat, and aroma transmission, as well as remarkable mechanical durability and resistance to impact, puncture, and pin holing. Biaxially oriented polyamide (BOPA) films have an excellent property to prevent the oxidation of food items or products. All these characteristics of BOPA and its higher demand is anticipated to influence the market growth positively over the forecast period.

Key BOPA Films Market Insights Summary:

Regional Highlights:

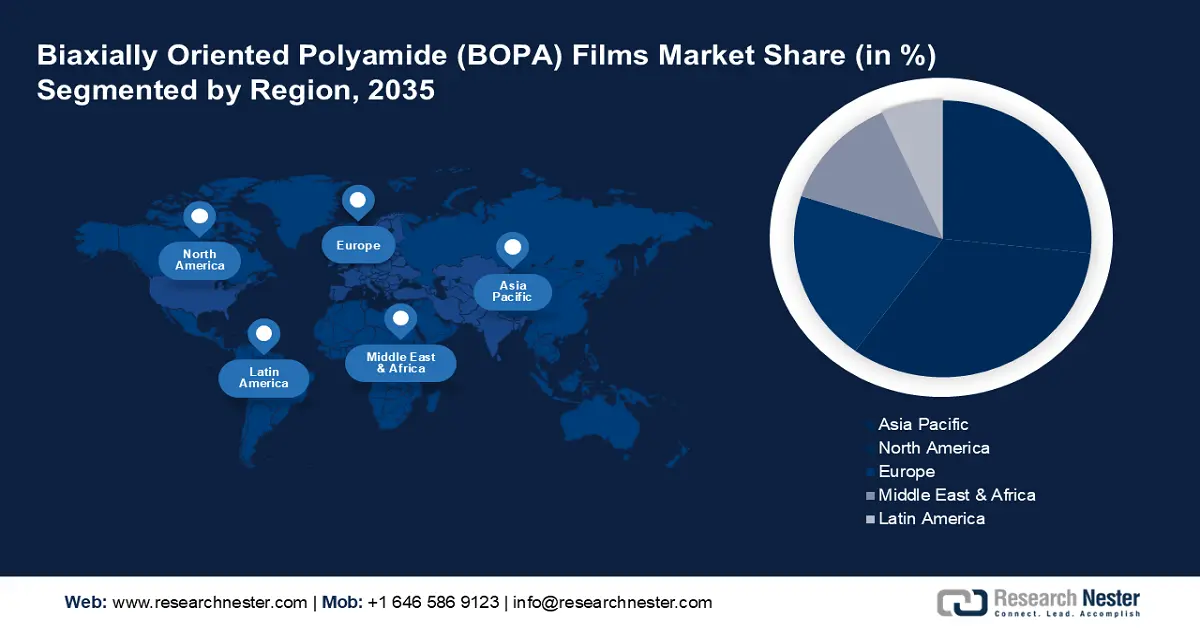

- North America’s biaxially oriented polyamide (BOPA) films market holds the largest share by 2035, driven by the expanding food & beverage and pharmaceutical industries.

Segment Insights:

- The sequential stretching segment in the biaxially oriented polyamide films market is projected to capture a significant share by 2035, driven by its cost-effectiveness and wide application in plastic production.

- The food packaging segment in the biaxially oriented polyamide films market will hold the largest share, driven by rising food & beverage packaging needs and growth in e-commerce, forecast year 2035.

Key Growth Trends:

- Surge in Packaged Food Consumption

- Growing Intake of Sea Food

Major Challenges:

- Surge in Packaged Food Consumption

- Growing Intake of Sea Food

Key Players: AdvanSix Inc., Unitika Ltd, Sojitz Corporation, Mondi plc, Mitsubishi Chemical Corporation, Now Plastics Inc, Toray Industries, Inc., Drytac Corporation, Transcendia, Inc., Toyobo Co., Ltd.

Global BOPA Films Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.24 Billion

- 2026 Market Size: USD 1.31 Billion

- Projected Market Size: USD 2.2 Billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Biaxially Oriented Polyamide Films Market Growth Drivers and Challenges:

Growth Drivers

- Surge in Packaged Food Consumption - For instance, global consumption of ultra-processed foods has skyrocketed. In several parts of the world, these foods now contribute for 26-62% of a person's daily energy needs.

Packaged foods, such as ready to eat meals, processed meats, and baked goods, are considerably high in demand as a result of their easy to store and easy to cook factors. Such food items require a specific type of packaging, so that they stay fresh without getting any type of contamination. Therefore, the surge in packaged food consumption is fueling up the market growth of BOPA films.

- Growing Intake of Sea Food - Seafood includes all bony fishes as well as shrimp, tuna, clams, and oysters. The increasing intake of these sea food items is increasing the demand for their export, which leads to their proper packaging. For instance, global fish consumption is expected to increase to 21.6 kg per capita in 2030, which is up from 20.4 kg in 2018.

- Escalation in Pharmaceutical Industry - The escalating growth of the pharmaceutical industry is anticipated to boost the demand for biaxially oriented polyamide (BOPA) films as a durable packaging material for packing various kind of drugs. The global pharmaceutical industry is expected to be worth approximately USD 2 trillion by the end of 2030.

- Increasing Expenditure in Research and Development – According to the World Bank, the total expenditure globally on research and development surged from 2.2% of the total GDP in 2018 to 2.63% of the total GDP in 2020. Such spending on research and development expenditure is estimated to be helpful for the manufactures to obtain raw materials and cover basic production costs.

- Significant Progression in Chemical Industry - The total global revenue of the chemical industry reached its highest level in the previous 15 years in 2021, totaling about USD 4 trillion.

Challenges

- Availability of BOPA Films Substitutes – There are presence of plenty of other substitutes for BOPA films, such as- paper packaging, glass containers, and steel, which are more sustainable, and environmentally friendly as compared to BOPA films. Hence, the presence of other substitutes is anticipated to restrain the market growth.

- Presence of High Concentration Active Chemicals in BOPA Films

- Stringent Governmental Standards

Biaxially Oriented Polyamide Films Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 1.24 Billion |

|

Forecast Year Market Size (2035) |

USD 2.2 Billion |

|

Regional Scope |

|

Biaxially Oriented Polyamide Films Market Segmentation:

Application (Food Packaging, Pharmaceutical Packaging, Electronics, Household, Chemical & Industrial)

The global biaxially oriented polyamide (BOPA) films market is segmented and analyzed for demand and supply by application into food packaging, pharmaceutical packaging, electronics, household, chemical & industrial,

others. Out of these types of segments, the food packaging segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing demand for packaging in several industry at rapid pace, especially in food & beverage industry and rise of various e-commerce portals which delivers food at doorsteps backed by the up-surged urbanization. For instance, in 2020, the global packaging industry grown to be worth of around USD 769 billion.

Type (Sequential Stretching, Mechanical Simultaneous Stretching, LISIM Simultaneous)

The global biaxially oriented polyamide (BOPA) films market is also segmented and analyzed for demand and supply by type into sequential stretching, mechanical simultaneous stretching, and LISIM simultaneous. Amongst these segments, the sequential stretching segment is expected to garner a significant share. The growth of the segment can be assigned to fact that it is a quite cost-effective processing method. Moreover, sequential stretching is a most common process that is used in the production of BOPTFE, BOPS, BOPLA, BOPET, BOPA, and others. Additionally, higher production of plastic has also spurred the demand for sequential stretching processing method. For instance, in 2021, approximately 400 million metric tons of plastic were produced across the globe.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Function |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biaxially Oriented Polyamide Films Market Regional Analysis:

North America industry is set to account for largest revenue share by 2035, attributed to increasing expansion of the food and beverage industry. The growth of the market can be attributed majorly to the increasing expansion of the food and beverage industry which is fueling up the high demand for BOPA films since they are significantly required in food packaging for distribution and export. Food is a sensitive substance that can be contaminated within a short time period, therefore, it requires specialized packaging methods and this requirement is fulfilled by BOPA films in every parameter. As per the data provided by the U.S. Department of Agriculture, foodservice and food retail industries supplied approximately USD 1.81 trillion worth of food in 2020, out of this total, USD 922.2 billion value of food was supplied by foodservice facilities only. Moreover, rising demand for BOPA films from domestic products, as well as a significant surge in the pharmaceutical industry is also estimated to augment the growth of the global BOPA films market over the forecast period in the region. Pharmaceutical products come with the strict precautions and can be packed in materials that have been tested and recommended to preserve their capacity to treat diseases. As of 2021, the pharmaceutical industry in the United States was estimated to hit USD 500 billion, while nearly USD 550 billion were spent on medicine by Americans in a similar year.

Biaxially Oriented Polyamide Films Market Players:

- AdvanSix Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Unitika Ltd

- Sojitz Corporation

- Mondi plc

- Mitsubishi Chemical Corporation

- Now Plastics Inc

- Toray Industries, Inc.

- Drytac Corporation

- Transcendia, Inc.

- Toyobo Co., Ltd.

Recent Developments

-

Mondi plc, a leading company in paper and packaging, launched Retort Pouch Recyclable, a mono-material solution. With this innovative high-barrier film, aluminum is replaced with a fully recyclable retort pouch solution. The mono-material solution is best suitable for wet pet food manufacturers and fully recyclable owing to the extensive research.

-

Mitsubishi Chemical Corporation, acquired the Gelest, Inc. from New Mountain Capital, LLC. Now Gelest has become the exclusively owned subsidiary of Mitsubishi Chemical America. Gelest is a renowned company in metal-organics, organosilanes, silicones, including medical devices, personal care and life sciences. The acquisition of the company is based on the advance management and growing customer pool.

- Report ID: 4296

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

BOPA Films Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.