Bevel Gearbox Market Outlook:

Bevel Gearbox Market size was valued at USD 3.97 billion in 2025 and is likely to cross USD 6.78 billion by 2035, registering more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bevel gearbox is assessed at USD 4.17 billion.

Industrial growth across the world is a major growth factor in the bevel gearbox market due to its heavy usage in various industries such as manufacturing, energy generation, and automotive. Manufacturing processes are increasingly adopting smart features to achieve efficient production and cope with the increasing demand. In such industrial operations, equipment such as conveyors, robots, and other machinery are essential, which rely on bevel gearboxes to maintain consistent performance. This further inflates investments in this sector with the growing interest of both private and governing manufacturer authorities.

Integration of advanced technologies such as robotics, AI, and machine learning has marked a significant growth in the bevel gearbox market. A 2022 OEC report states, that the global industrial robot business registered a trade worth USD 751 million. The expansion of next-generation industrial reach requires efficient and reliable power transmission systems. These systems use bevel gearboxes to automate the whole production and management with additional AI assistance. Thus, the increased implementation of such technologies in the industries to generate profitable revenue implies the enlargement of this sector.

Key Bevel Gearbox Market Insights Summary:

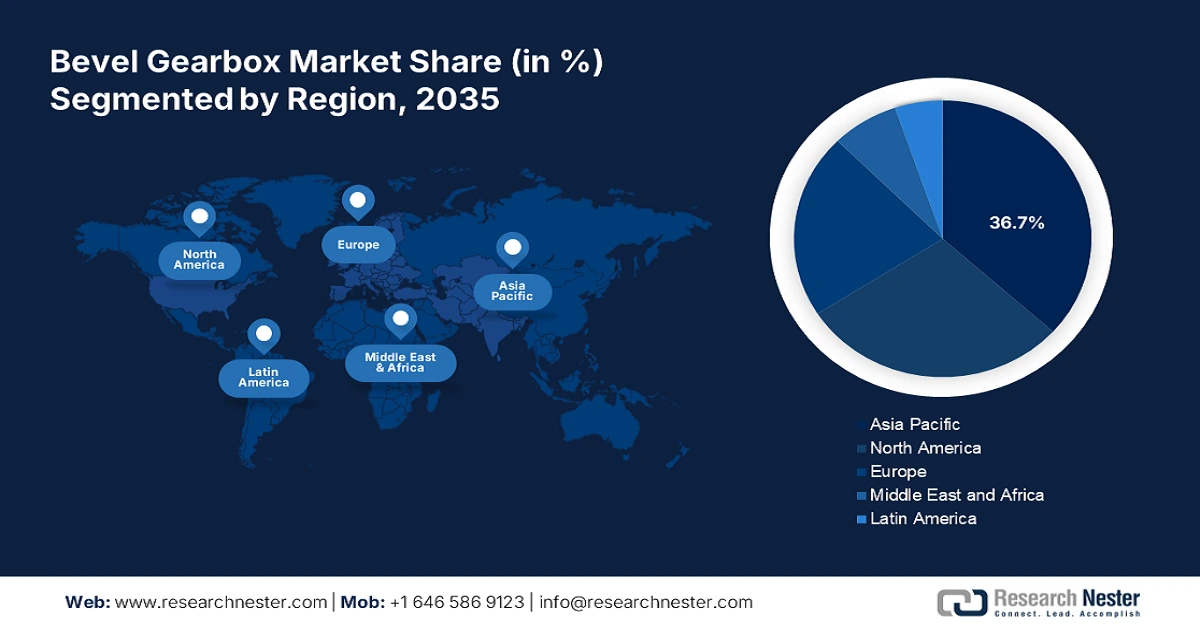

Regional Highlights:

- Asia Pacific leads the Bevel Gearbox Market with a 36.7% share, propelled by massive industrial growth in countries like Japan, China, India, and South Korea, ensuring strong growth prospects through 2035.

- North America's Bevel Gearbox Market is set for lucrative growth by 2035, propelled by automation in manufacturing and increasing car demand.

Segment Insights:

- The Medium segment is projected to hold a significant market share by 2035, fueled by balanced performance and cost-effectiveness suitable for applications with space constraints.

- The Straight Bevel Gears segment of the Bevel Gearbox Market is expected to capture a 33.30% share by 2035, fueled by their widespread use in automotive, industrial, agricultural, marine, and aerospace applications.

Key Growth Trends:

- Technological advancement for innovation

- Increasing demand for renewable energy

Major Challenges:

- Expensive production and product pricing

- Lack of designers and engineer

Key Players: Nord Gear, Bonfiglioli, Radex, SEWEurodrive, Flender, Acme Industrial Group, Transgear, Rossi Gear, Regal Beloit Corporation.

Global Bevel Gearbox Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.97 billion

- 2026 Market Size: USD 4.17 billion

- Projected Market Size: USD 6.78 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, Germany, United States, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 13 August, 2025

Bevel Gearbox Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancement for innovation: Improvement in product performance by utilising innovative designs is a positive influence on the bevel gearbox market. Many tech companies are now showing interest in developing new solutions to serve the purpose. For instance, in January 2022, Siemens announced the launch of updated Simcenter 3D software to help engineers handle the complexity of product development and innovation with advanced simulation. The new set of tools in this solution can seamlessly simulate spiral bevel gears, enabling NVH analysis on these mechanisms to reduce gear whine.

-

Increasing demand for renewable energy: With the growing energy demand, the need for alternative and environment-friendly power sources increases. The pivotal role of these gearboxes in wind turbines is to convert the low-speed rotation of blades into high-speed rotation for electricity generation. Thus, expansion in the renewable energy industry, particularly wind power generation is a remarkable contributor to the bevel gearbox market. According to the 2023 IEA report, the global wind electricity generation increased by 14% in 2022, reaching 2100 TWh. The report further states the requirement of increment in capacity from 75 GW in 2022 to 350 GW by 2030, in order to achieve carbon neutrality goals by 2050.

Challenges

- Expensive production and product pricing: The need for high-quality materials and precise engineering to manufacture these tools may become an economic burden for the producers in the bevel gearbox market. In addition, fluctuations in the availability and cost of raw materials due to geographical tensions or natural disasters may add up to the budget of production. The increased manufacturing cost further affects the competitive pricing of the products, making it difficult to generate profit from the price-sensitive markets.

- Lack of designers and engineers: The complexity of turbomachinery operations, particularly thermal multiphysics, rotor dynamics, and thermal fatigue capabilities can make it difficult to find skilled engineers to make new designs. The intricate design of bevel gearboxes often gives a hard time for designers with the difficulty in meeting accurate angles and tooth profiles. Handling such a high risk of defects while manufacturing requires knowledgeable and skilled technicians. Thus, a shortage of skilled labor may affect production quality, restricting growth in the bevel gearbox market.

Bevel Gearbox Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 3.97 billion |

|

Forecast Year Market Size (2035) |

USD 6.78 billion |

|

Regional Scope |

|

Bevel Gearbox Market Segmentation:

Gear Type (Straight Bevel Gears, Spiral Bevel Gears, Hypoid Bevel Gears, Zerol Bevel Gears)

Based on the gear type, the straight bevel gears segment is projected to hold bevel gearbox market share of more than 33.3% by 2035. These gears are widely used for transmitting motion between shafts in automotive, industrial machinery, agricultural equipment, marine, and aerospace. Further, studies are being conducted to improve the efficiency and reduce the wear of these gears in operation. For instance, in May 2022, a report was published by the International Research Journal of Modernization in Engineering Technology and Science on the straight bevel and spur gear of different materials. The study analyzed all the aspects of structural steel and aluminium alloy-made gears to identify the most effective material for improved performance.

Size (Small, Medium, Large)

In terms of size, the medium segment is expected to hold a significant share of the bevel gearbox market by the end of 2035. The widespread application area of these gears in multiple sectors is a major driving factor of this segment. It can produce reliable, efficient, and cost-effective transmission solutions for industrial machinery, automotive manufacturing, material handling, renewable energy, and agricultural equipment. The balanced performance by efficiently tacking its size and power makes it preferable for applications with space constraints. Compared to large gearboxes, these tools have become more attractive for industries due to their affordability and robust performance.

Our in-depth analysis of the global market includes the following segments:

|

Gear Type |

|

|

Size |

|

|

Shaft Angle |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bevel Gearbox Market Regional Analysis:

APAC Market Statistics

Asia Pacific in bevel gearbox market is anticipated to hold over 36.7% revenue share by the end of 2035. The region is experiencing massive industrial growth in developing countries such as Japan, China, India, and South Korea. The strong focus of these emerging markets is set on technological advancements and infrastructure development, which implies the surge for high-performance gearboxes.

India is one of the emerging landscapes of the regional bevel gearbox market due to its growing industrial activities and government support. The initiatives taken by the governing body of this country are commendably influencing domestic leaders to participate in the Make in India campaign, impelling growth in this sector. For instance, in October 2021, government of India launched an initiative, PM GatiShakti to achieve Aatmanirbhar Bharat with USD 5 trillion economy by 2025, creating multimodal and last-mile connectivity infrastructure.

China is maintaining steady growth in the bevel gearbox market with its high manufacturing capabilities. Further, the country sets its goals to increase domestic manufacturing capacity for more local supply of heavy machinery, impelling demand in this sector. According to a report published by the government of China, in November 2024, the value-added industrial output of the country is enlarging with a 5.3% expansion every year. The data further indicated a 6.6% increment in equipment manufacturing, compared to the previous year.

North America Market Analysis

North America is one of the fastest-growing regions in the bevel gearbox market due to its well-established automotive industry. Domestic automakers are eagerly adopting advanced technologies to secure a sufficient supply for the growing demand for cars. According to a report published by the International Federation of Robotics, in May 2023, total robotics installations to bring automation in manufacturing in North America rose by 12% in 2022. With the installed 20,391 industrial robots, the automotive industry became the top contributor, increasing adoption by 30% than it was in 2021. This subsequently increases the need for reliable gearboxes to support robust production.

The U.S. is paving the way for generating profitable revenue from the bevel gearbox market with its increasing advancements in automotive manufacturing and wind energy generation. Besides the industrial expansion, the country leads in producing renewable power, particularly through wind, increasing demand for turbine-suitable gearboxes. According to an EIA report, published in December 2023, the annual electricity generation from wind turbines in the U.S. increased by 428 billion kWh within the timeline, 2000-2022.

Canada contributes to a steady demand in the bevel gearbox market due to the ongoing and proactive mining operations across the country. Heavy mining equipment such as conveyors and crushers present a wide application for the gearbox suppliers. The country’s government is now investing in equipment for robust gear systems for optimal outputs. For instance, in March 2022, the government of Canada announced a funding of USD 3.8 billion for more efficient equipment, supporting mining efforts in the country.

Key Bevel Gearbox Market Players:

- Nord Gear

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bonfiglioli

- Radex

- SEWEurodrive

- Flender

- Acme Industrial Group

- Transgear

- Rossi Gear

- Regal Beloit Corporation

- Sona Comstar

- Dana Incorporated

The global market is evolving with the efforts made by the leading suppliers to improve gear designs for enhanced and energy-efficient performance. Thus, manufacturers and engineers are willing to invest in advanced technologies to ensure the effectiveness and reliability of these gearboxes. These upgraded systems are capable of delivering better quality material, precise techniques, and development in models, inspiring other leaders to engage in the trail of innovation. For instance, in September 2022, Luder Transmission launched multiple series of new bevel gearboxes including the HD series, T series, and ARA series. Such key players include:

Recent Developments

- In November 2022, Sona Comstar announced the commercial launch of net-formed spiral bevel gear with lesser steel usage, offering a favorable grain structure. The company aims to earn a maximum of USD 117.4 million over three years to support its next booked orders, worth USD 2.4 billion.

- In August 2022, Dana Incorporated launched a series of helical and bevel-helical gearboxes, Brevini EvoMax for marine and offshore applications. The new range incorporated 5 new sizes and 14 redesigned gearboxes, providing higher torque, greater efficiency, and longer service.

- Report ID: 6900

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bevel Gearbox Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.