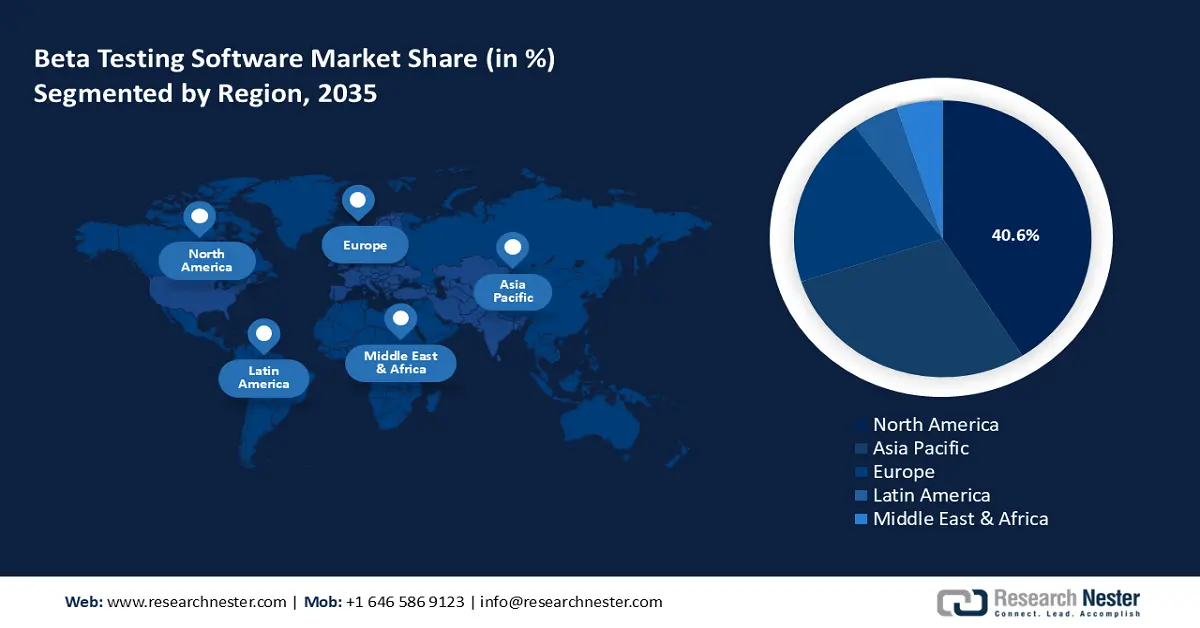

Beta Testing Software Market - Regional Analysis

North America Market Insights

The North America market is projected to maintain a leading revenue share of 40.6% throughout the forecast period. A major factor of the sector’s dominance is the surging adoption rates of 5G tech, which has improved the scope of deployment for beta testing software. Additionally, there have been extensive investments in advanced technology solutions. The regional market is favorably impacted by the rise of digital-native industries and enterprises adopting DevOps and agile methodologies.

The U.S. beta testing software market is estimated to maintain a major revenue share during the anticipated timeline. The market’s expansion is favorably reinforced by a deep integration of software testing tools across industries such as healthcare, telecom, and technology. Opportunities remain rife in the U.S. market with the prominence of SaaS companies, along with the greater consumer demand for high-quality applications. The launch of Trump Media’s public beta testing of Truth Search AI in August 2025 is a major indicator of how the U.S. market is being driven by the rising adoption of AI-powered features in consumer-facing platforms. As platforms such as Truth Social increase their ecosystems with AI search and personalization tools, beta testing becomes essential to validate accuracy, usability, and security before full-scale release. Such initiatives expand the demand for effective beta testing software that can manage AI-driven, data-intensive applications, thereby speeding up overall market growth in the U.S.

In Canada, the market is expanding as startups and enterprises use beta programs to compete in global technology markets. Supportive government programs in digital innovation and cybersecurity strengthen the adoption of in-house and external beta testing platforms. The country’s increasing SaaS sector depends heavily on beta testing to enhance offerings for international customers. In 2024, Shopify developed beta trials for its AI-powered commerce tools with a few Canadian merchants to achieve real-world validation before expanding globally. This demonstrates how Canadian firms leverage beta testing to improve product quality, gain user insights, and maintain competitiveness in the worldwide market.

Asia Pacific Market Insights

The APAC market is expected to register a CAGR of 13.6% during the forecast period, owing surging adoption of cloud-native applications and an improving tech ecosystem. Additionally, the rapid adoption of 5G infrastructure, coupled with an expanding IoT ecosystem has ensured a sustained requirement for advanced beta testing solutions that can ensure high-quality mobile applications. As the requirement for mobile-first applications significantly expands, the demand for reliable beta testing solutions is projected to remain steady.

The China market is slated to maintain a major revenue share in APAC owing to the proliferation of mobile applications. Additionally, major investments, funneled under the Made in China 2025, have set the stage for unparalleled growth in notable sectors such as AI and cloud computing. With the investments in smart city solutions expanding the region, the demand for rigorous beta testing software for applications is poised to increase.

The South Korea market is fueled by the country’s advanced digital infrastructure and huge smartphone penetration. Tech firms and gaming companies, in particular, depend on beta testing to ensure seamless performance across devices and networks in a highly competitive consumer market. Moreover, government initiatives supporting AI, 5G, and digital transformation further encourage the demand for robust pre-release testing platforms. Such efforts highlight how beta testing is becoming a strategic tool for South Korean enterprises to maintain global competitiveness.

Europe Market Insights

The Europe beta testing software market is poised to expand its revenue share during the anticipated timeline, supported by the regional emphasis on digital innovation and the proliferation of mobile-first applications. Additionally, Europe has a well-established tech ecosystem, which has pushed the adoption of advanced software testing tools across critical industries such as fintech, e-commerce, and telecommunications. The market is also buoyed by the EU’s Digital Single Market strategy, which seeks to harmonize regulations and bolster cross-border cooperation in software development.

The Germany market is poised to register a major revenue share during the forecast period, owing to rising investments in beta testing software solutions with major end users in the thriving automotive, industrial automation, and fintech sectors. The Industry 4.0 Initiative has heightened the demand for automated testing platforms that are capable of handling long product development cycles.

Additionally, the market is expected to be continuously driven by the automated testing frameworks that can meet the demands of a digital economy. For instance, in December 2024, Siemens ran a number of beta programs for its industrial automation software updates, collaborating with selected enterprise clients to validate performance under real-world factory conditions. This trend shows how Germany’s focus on industrial digitalization and precision engineering promotes growth in beta testing adoption.

In the UK, the market is expected to expand due to an evolving fintech, gaming, and SaaS ecosystem that depends heavily on pre-release testing to maintain competitiveness. Companies increasingly invest in beta programs to fulfill data security requirements and provide effortless customer experiences in a post-Brexit digital economy. The UK government’s target on AI and digital innovation funding also pushes the adoption of advanced testing methods. Such initiatives reflect the country's solid role in shaping beta testing adoption.