Benzaldehyde Market Outlook:

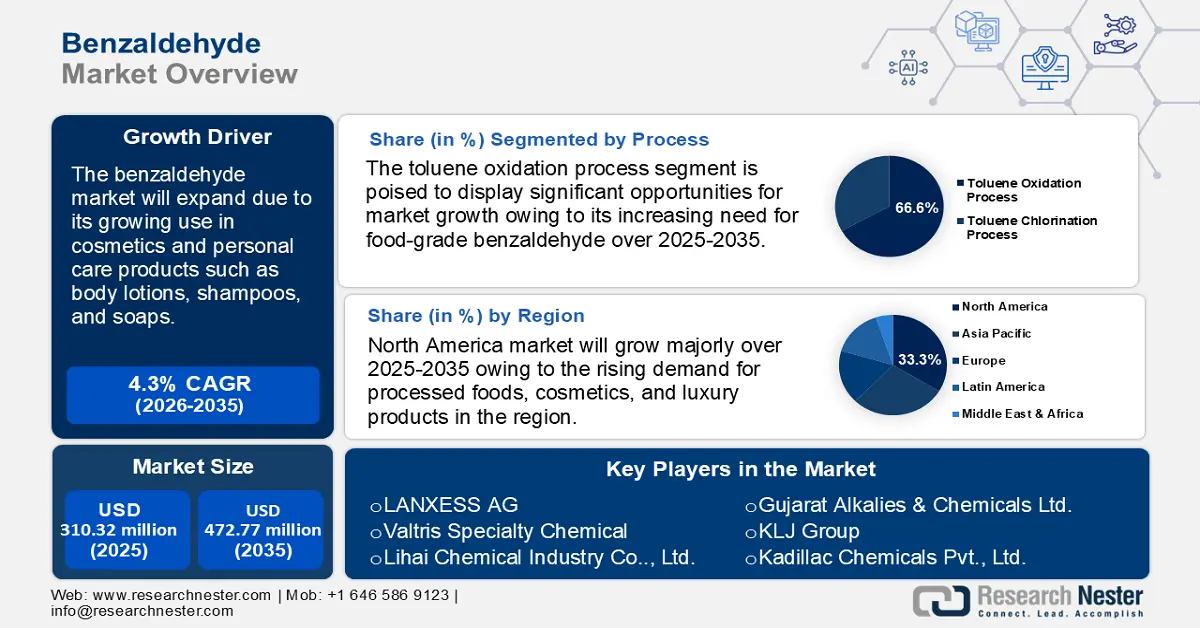

Benzaldehyde Market size was valued at USD 310.32 million in 2025 and is set to exceed USD 472.77 million by 2035, registering over 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of benzaldehyde is estimated at USD 322.33 million.

The benzaldehyde market is experiencing rapid growth due to its extensive use in perfumes, soaps, lotions, and various cosmetic products. It is also a crucial ingredient in food and drink flavorings, giving them a distinctive cherry or almond taste. The chemical molecule benzaldehyde (C6H5CHO) is made up of a benzene ring with a formyl substituent. It is one of the most industrially useful and basic aromatic aldehydes. Benzaldehyde, a bitter almond oil component, can be derived from various natural sources. Cakes and other baked items are flavored with imitation almond extract, which contains synthetic benzaldehyde as a flavoring agent.

|

Country |

Export Value for Benzaldehyde (in USD Million) |

Country |

Import Value for Benzaldehyde (in USD Million) |

|

China |

41.5 |

U.S. |

30.6 |

|

Netherlands |

19.7 |

UK |

11.2 |

|

India |

8.19 |

India |

5.47 |

|

Belgium |

7.28 |

South Korea |

5.09 |

|

Malaysia |

5.45 |

Germany |

5.07 |

OEC

According to the Observatory of Economic Complexity (OEC), benzaldehyde was the 4125th most traded product in the world in 2022, with USD 94.7 million in global commerce. Benzaldehyde exports fell by 17% between 2021 and 2022, from USD 114 million to USD 94.7 million. Benzaldehyde trade accounts for 0.0004% of global trade. According to the Product Complexity Index (PCI), benzaldehyde is ranked 2862nd.

Furthermore, the growth in the production capacity of benzaldehyde has been a key driver of its benzaldehyde market growth. As demand continues to rise, manufacturers are expected to invest in expanding their production facilities, ensuring a steady supply of this versatile product.

Proposed benzaldehyde usage and end use applications are as follows:

|

Compound |

Proposed Quantity MT/MONTH |

End use |

|

Ortho Chloro Benzaldehyde |

750 |

Used in electroplating, optical brighteners, zinc electroplating intermediates, pharmaceuticals, dyes, and API intermediates. |

|

Para Chloro Benzaldehyde |

750 |

Used in dyestuffs, optical brighteners, pharmaceuticals, and metal finishing products. |

|

2-Methyl Benzaldehyde |

750 |

Used in perfumes and as a flavoring agent. |

|

4-Methyl Benzaldehyde |

750 |

Used in perfumes, pharmaceuticals, dyestuff intermediate, and as a flavoring agent. |

|

2,4-Dichloro Benzaldehyde |

150 |

Used in the preparation of dyes. |

|

2,6-Dichloro Benzaldehyde |

150 |

Used in the preparation of dyes, as an intermediate in manufacturing pharmaceuticals, dyes, and other organic chemicals. |

Key Benzaldehyde Market Insights Summary:

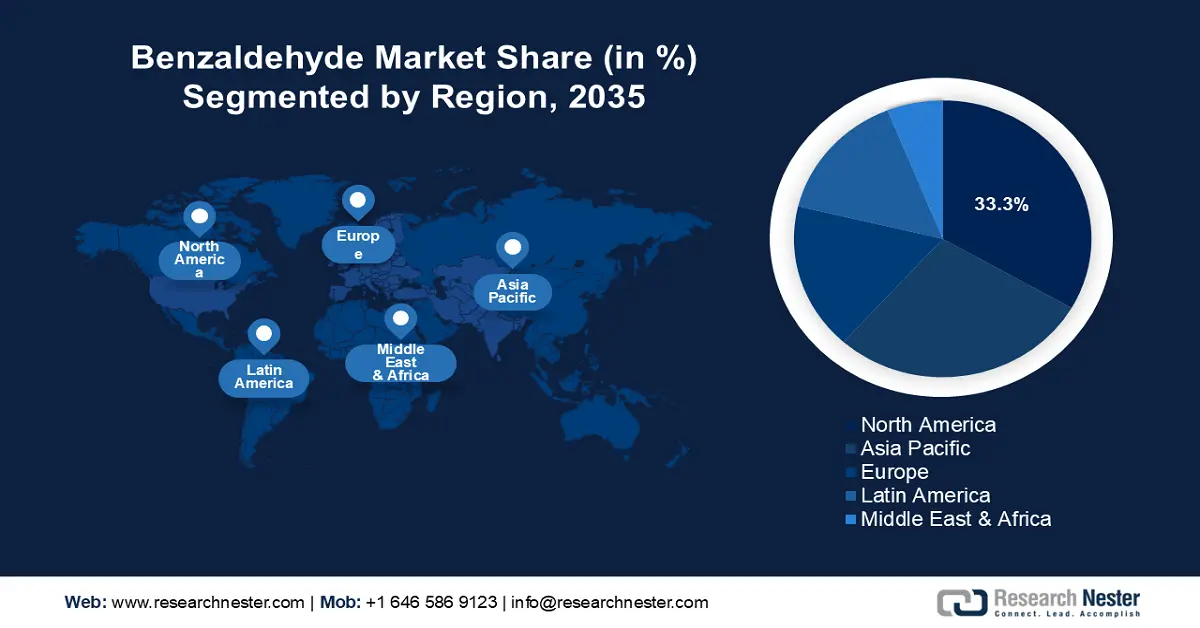

Regional Highlights:

- North America leads the Benzaldehyde Market with a 33.00% share, supported by a strong agricultural and pharmaceutical base, plus sustainable production efforts, positioning it for growth through 2035.

- Asia Pacific’s benzaldehyde market is set for significant growth through 2026–2035, fueled by rising cosmetic demand, urbanization, and income growth.

Segment Insights:

- The Toluene Oxidation Process segment is forecasted to achieve over 66.6% market share by 2035, driven by the increasing need for food-grade benzaldehyde and advancements in oxidation techniques.

- Benzyl Alcohol segment is expected to grow at a substantial rate from 2026-2035, fueled by increasing demand in personal care and pharmaceutical applications in developing economies.

Key Growth Trends:

- Increasing applications in pharmaceutical and agriculture industries

- Growing shift towards bio-economy

Major Challenges:

- Fluctuating raw material prices

- Strict laws and safety concerns

- Key Players: LANXESS AG, Valtris Specialty Chemicals, Hubei Kelin Bolun New Materials Co., Ltd., Lihai Chemical Industry Co., Ltd., Gujarat Alkalies & Chemicals Ltd., KLJ Group, Kadillac Chemicals Pvt., Ltd., Wuhan Dico Chemical Co., Ltd., Axxence Aromatic GmbH, Elan Chemical Co., Inc..

Global Benzaldehyde Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 310.32 million

- 2026 Market Size: USD 322.33 million

- Projected Market Size: USD 472.77 million by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Benzaldehyde Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing applications in pharmaceutical and agriculture industries: Benzaldehyde serves as a versatile building block in the synthesis of various medicinal compounds, making it an essential component of pharmaceutical production. This compound is utilized in the manufacture of several classes of medications, including analgesics, antibiotics, and antipsychotics. Due to its unique chemical properties, benzaldehyde is a critical precursor for generating pharmaceutical intermediates, which are pivotal in the development of novel therapeutic agents. The increasing demand for benzaldehyde within the pharmaceutical sector is primarily driven by the expansion of the industry and ongoing initiatives in research and development for drug discovery.

Furthermore, benzaldehyde is also a key ingredient in the formulation of pesticides and herbicides, supporting crop protection efforts. As agricultural production demands escalate, the consequent rise in the need for agrochemicals further fuels the demand for benzaldehyde, thereby generating substantial revenue for producers within the agrochemical industry. Also, leading agrochemical companies are expanding their product portfolios with innovative formulations and bio-based agrochemicals, where benzaldehyde plays a crucial role. As a result, the benzaldehyde market is experiencing notable growth, responding to the population's heightened requirements for increased agricultural output and the protection of crops.

The top five companies alone generated 54% of the USD 396 billion in total agrochemical revenue in 2024, out of the top eight corporations in terms of market capitalization. By 2025, Syngenta invested USD 2 billion in ground-breaking sustainable and regenerative technologies.Company

Agrochemical Revenue (in USD Billion)

SABIC

63

Syngenta

52

BASF SE

43

Corteva Inc.

37

Bayer AG

28

Nutrien

25

Mosaic

9

Yara International

7

- Growing shift towards bio-economy: The catalytic transformation of bio-oil, a renewable product derived from lignocellulosic biomass, into benzaldehyde and benzoic acid presents a sustainable alternative to fossil-based chemicals. This process utilizes lignin-derived phenolic compounds, which are oxidized using advanced catalysts such as Ru, Pd, or Cu on oxide supports under mild conditions with green oxidants such as O2 or H202. Benzaldehyde can be further oxidized to produce benzoic acid, offering high selectivity and yield. Despite challenges like bio-oil complexity and catalyst design, green solvents, and continuous flow processes are addressing these issues. These high-value aromatic chemicals support the shift towards a circular bio-economy and reduce dependence on fossil fuels.

Challenges

-

Fluctuating raw material prices: The cost and availability of raw materials, especially toluene, which is frequently utilized as a feedstock for the production of benzaldehyde, have an impact on the worldwide benzaldehyde market. Since it influences the cost of production, changes in raw material prices can highly affect benzaldehyde businesses' profitability. To reduce the financial risks associated with price swings, the volatility of raw material prices calls for effective supply chain management, hedging techniques, and strategic sourcing methods.

- Strict laws and safety concerns: Due to its harmful qualities, benzaldehyde is governed by several laws and safety requirements. Its flammability, susceptibility to irritate skin and eyes, and potential for negative consequences if consumed or inhaled in excess raise safety issues. Manufacturers of benzaldehyde face difficulties in complying with regulations, which force them to invest in environmental standards, safety precautions, appropriate handling techniques, and staff training. The overall profitability and competitiveness of the benzaldehyde market will be impacted by the costs related to fulfilling these regulatory requirements.

Benzaldehyde Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 310.32 million |

|

Forecast Year Market Size (2035) |

USD 472.77 million |

|

Regional Scope |

|

Benzaldehyde Market Segmentation:

Process (Toluene Oxidation Process, Toluene Chlorination Process)

The toluene oxidation process segment is set to capture over 66.6% benzaldehyde market share by 2035. The segment’s growth is driven by the increasing need for food-grade benzaldehyde, which is produced during the toluene oxidation process in the food and beverage industry. Furthermore, growing advancements in the toluene oxidation process are also escalating the growth of the segment. For instance, a 2023 research on the oxidation of toluene to benzaldehyde using air as an oxidant and catalyzed by polyoxometalate (POM) loaded on activated carbon demonstrates an efficient and eco-friendly approach. The catalyst consisting of POM immobilized on activated carbon, facilitates selective oxidation under mild conditions, minimizing by-products. Activated carbon enhances the dispersion of POM, improving catalytic activity and stability. Air, as a green oxidant, eliminates the need for harmful chemicals, making the process sustainable. This method offers a scalable and cost-effective alternative for industrial applications.

Derivatives (Benzoic Acid, Sodium Benzoate, Benzyl Alcohol, Cinnamic Acid)

The benzyl alcohol segment in benzaldehyde market will grow at a substantial rate during the assessed period. The growing demand for benzyl alcohol as an anti-parasite medication and a frequent preservative in injectable medications is driving the segment’s expansion in developing economies. Moreover, the growing usage of benzyl alcohol in personal care products. Cosmetics and beauty items like body lotions, shampoos, sunscreens, soaps, and hair care products are preserved by benzoyl alcohol. The desire for natural products has also increased as attention to skin and hair has grown. Organic sources are becoming necessary in face creams, eye shadows, wrinkle-free creams, and other night creams due to growing awareness of the negative effects of parabens and silicones.

Our in-depth analysis of the global benzaldehyde market includes the following segments:

|

Derivatives |

|

|

Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Benzaldehyde Market Regional Analysis:

North America Market Statistics

North America benzaldehyde market will garner a share of 33.3% by 2035. The market is growing due to the region’s well-established agricultural sector and expanding pharmaceutical industry. Additionally, the region’s flourishing flavors and fragrances industry, supported by the rising demand for processed foods, cosmetics, and luxury products, is boosting benzaldehyde usage. Also, innovations in bio-based benzaldehyde production and the region’s focus on sustainable and regulatory-compliant solutions further contribute to the benzaldehyde market growth. Moreover, major key players are increasing their benzaldehyde derivatives production capacity to meet the consumer demand in the region accelerating the market expansion. In May 2023, to support the expansion of its existing clientele in North America, the special chemicals business LANXESS increased the amount of benzyl alcohol it can produce at its facility in Kalama/Washington, USA. Several technological advancements have led to the capacity increase.

Due to the growing use of benzaldehyde in the industrialized food business in the U.S., the country has a sizable benzaldehyde market. It is becoming one of the most sought-after ingredients in various food products across the nation due to its almond-like flavor and aroma. For the launch of novel foods and beverages, the country boasts state-of-the-art research and development facilities. Benzaldehyde is used by companies to create distinctive flavor profiles that give them a distinctive and enticing taste. Additionally, in Canada, the government’s emphasis on sustainability and green chemistry is encouraging the adoption of bio-based benzaldehyde, fostering market expansion. The combination of industrial development and regulatory compliance supports the steady growth of the benzaldehyde market.

APAC Market Analysis

Asia Pacific benzaldehyde market is expected to grow at a significant rate during the projected period. The market’s expansion can be attributed to the region's high demand for cosmetics and personal care items. As of 2023, the Asia Pacific region accounted for 32% of the personal care and cosmetics industry. The four leading markets within this area—South Korea, Japan, India, and China—each follow unique developmental trajectories. Also, the region's increasing urbanization and disposable income will propel the benzaldehyde market growth. The benzaldehyde market will increase profitably as a result of the large-scale rural-to-urban migration.

Also, China has easy access to the raw materials needed to produce benzaldehyde, and it also has a sophisticated industrial infrastructure to support this capability. As a result, the domestic market now has a consistent and affordable supply of benzaldehyde to meet the rising demand from several industries. It is anticipated that benzaldehyde will be widely utilized in synthesis as an intermediary to create the API needed for many pharmaceuticals. Its distinct chemical characteristics make it an essential component in the creation of a large number of medications.

The benzaldehyde market has seen a significant increase in sales due to the country's rapidly expanding pharmaceutical sector. With a growth of USD 332 billion by 2022, with a compound annual growth rate (CAGR) of 7% from 2022 to 2025, the pharmaceutical industry in China continues to be strategically significant. The primary drivers of this growth are still the aging population and the prevalence of chronic diseases, the expansion of insurance coverage, and the affluent middle class with their higher healthcare demands.

Product demand is expected to benefit from India's status as a rapidly expanding economy, which is facilitated by the nation's growing disposable income. These factors are expected to contribute to India's appeal as a location for benzaldehyde manufacturers and investors. Also, the increasing sales of processed foods and beverages in the nation will drive the market growth. The regional food industry had a strong demand for and offtake of benzaldehyde. In the second quarter of 2024, PepsiCo's India business experienced robust improvements in beverage and snack sales volumes along with high single-digit organic revenue growth. Convenient food unit volume climbed by 1% in the AMESA region, primarily due to double-digit growth in India, while beverage unit volume increased by 2%, primarily due to India.

Key Benzaldehyde Market Players:

- LANXESS AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Valtris Specialty Chemicals

- Hubei Kelin Bolun New Materials Co., Ltd.

- Lihai Chemical Industry Co., Ltd.

- Gujarat Alkalies & Chemicals Ltd.

- KLJ Group

- Kadillac Chemicals Pvt., Ltd.

- Wuhan Dico Chemical Co., Ltd.

- Axxence Aromatic GmbH

- Elan Chemical Co., Inc.

The benzaldehyde market will continue to rise owing to the major players in the industry making significant R&D investments to broaden their product ranges. Key market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Market participants are also engaging in various strategic initiatives to broaden their reach. The benzaldehyde industry needs to provide affordable products in order to grow and thrive in a more competitive and expanding benzaldehyde market environment.

Recent Developments

- In November 2021, Valtris Specialty Chemicals significantly boosted production capacity at its Advanced Organics facility in Tessenderlo, Belgium. Following the 2020 expansion at the Tessenderlo plant for both Benzyl Chloride and Orthochlorobenzyl Chloride, the company successfully carried out the following stage of its growth plans. Nine months ago, the company attempted to meet its customers' expectations by increasing its Benzaldehyde capacity by 20%.

- In August 2021, LANXESS, a specialty chemicals firm, completed the acquisition of Emerald Kalama Chemical. The corporation is situated in the U.S. and is a global leader in specialty chemical manufacturing.

- Report ID: 7042

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Benzaldehyde Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.