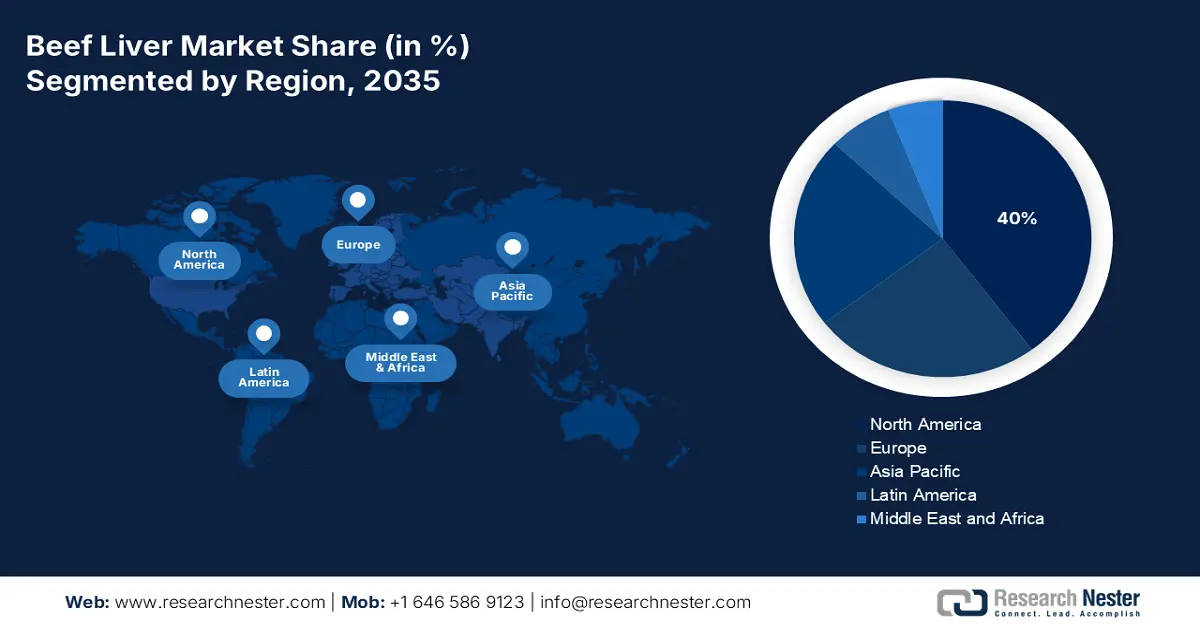

Beef Liver Market - Regional Analysis

North America Market Insights

North America is dominating the beef liver market and is projected to hold 40% of the market share by 2035. The market is driven by increasing consumer awareness of their nutritional density, mainly in high iron and vitamin A content. One of the major trends includes the product's growing positioning as a functional food and supplement, often in powdered or encapsulated forms for the health and wellness sector. Demand is also spurred by the paleo and carnivore diets. The industry enjoys a highly developed meat processing sector, which provides an assured by-product supply base. Nevertheless, growth is moderated by issues such as consumer dislike of taste and worry about dietary cholesterol, together with rigorous food safety regulation from the likes of the USDA and CFIA.

The U.S. market is significantly expanding and is led by its use in specialised dietary systems. The U.S. has a rising demand for beef liver and other organ meats among health-conscious demographics. According to the OEC report of 2023, the U.S. exports most frozen beef liver worth USD 92.3 million. A major trend is the conversion of the product into value-added forms; firms are manufacturing freeze-dried liver powders and capsules as a means of breaking taste barriers and targeting the supplement market.

The beef liver market in Canada is driven by the strong domestic production and health-focused consumption. The food inspection agency in Canada strictly inspects the meat safety and labelling to ensure the integrity of the product. According to the April 2025 report of the USDA, Canadian beef production was at 1,326 (1,000 metric tons), which reflects the increased demand of the organs in different industries. Furthermore, the increasing consumer perception of the health benefits of beef liver, like its high iron and vitamin A levels, is slowly increasing its demand in retail and foodservice markets.

Trade Data on Frozen Liver Beef in 2023

|

Country |

Import (USD) |

Export (USD) |

|

U.S. |

360 K |

92.3 million |

|

Canada |

3.4 million |

5.87 million |

Source: OEC 2023

APAC Market Insights

The Asia-Pacific is the fastest-growing region in the beef liver market and is fueled by varying culinary habits, increasing disposable incomes, and heightened nutritional deficiency awareness. India and China consider liver as an affordable source of essential nutrients and overcome the health concerns like anaemia, which affects a significant portion of the population. Key trends include the modernisation of supply chains to improve food safety and the emergence of liver-based dietary supplements. Growth is not even, but rather hampered by religious food restrictions in some markets and competition from other sources of protein.

China is leading the market in the APAC region, as it is the second-largest country in beef production. The market is fueled by the large population and culinary use. Various research programs and studies in China have highlighted the importance of iron-rich foods such as liver to address the nutritional iron deficiency, a condition prevalent in certain demographics. The United States Department of Agriculture Foreign Agricultural Service data in April 2025 depicts that China's beef import market has traditionally concentrated with the top five markets, such as Brazil, Argentina, Uruguay, Australia, New Zealand and the U.S., accounting for nearly 90% of total beef imports in 2024.

The beef liver market in India is very niche and geographically fragmented because of religious restrictions in the cultural diet. Demand still exists in areas with high non-beef-prohibiting populations, where liver is highly regarded as a cheap, dense nutrient food item. According to the USDA report of February 2025, the beef production in India was 4.57 metric million tons in 2024. Its demand is primarily found in states such as Kerala, West Bengal, and the northeast, where the consumption of beef is a part of local culture and added to local diets. Market growth is further driven by the contribution it makes to address the nutritional deficiencies, like anaemia, as reflected in public health information.

Europe Market Insights

Europe market is defined by the demand based on traditional recipes, offset by a long-term trend of declining per capita consumption. The main drivers of the market are the affordability of the product and its high density of nutrients, attractive to price-sensitive consumers and the growing demand for natural sources of iron and vitamins. One key trend is increasing demand for liver from alternative production systems, including organic and grass-fed beef cattle, owing to consumer interest in animal welfare and product origin. The beef liver is also considered an alternative protein source, which changes the eating patterns among the younger population, but it remains a strong sector in the overall meat by-products industry.

UK beef liver demand is supported by the product's status as a low-cost, traditional source of protein, with demand being concentrated in older age groups and lower-income families. The Food Standards Agency (FSA) prescribes strict guidelines on offal production and handling to ensure food safety. The UK is a net importer of bovine offal in general, and figures provided by the Department for Environment, Food & Rural Affairs (DEFRA) point to steady levels of importation to meet domestic demand, particularly from EU member states like Ireland.

Germany is expected to hold the largest revenue share in Europe's beef liver market by 2035. This dominance is due to the country being the largest producer of beef and veal, as Eurostat consistently reports, ensuring a consistent and adequate domestic supply of liver as a by-product of the slaughterhouse. In addition, Germany, being among the major importers of meat and edible meat offal amounting to USD 113 million including products salted, brined, dried, or smoked as well as meat flours or meals, according to the OEC report in 2023 is an important market for beef liver, which indicates robust demand for quality offal products in foodservice as well as industrial uses.