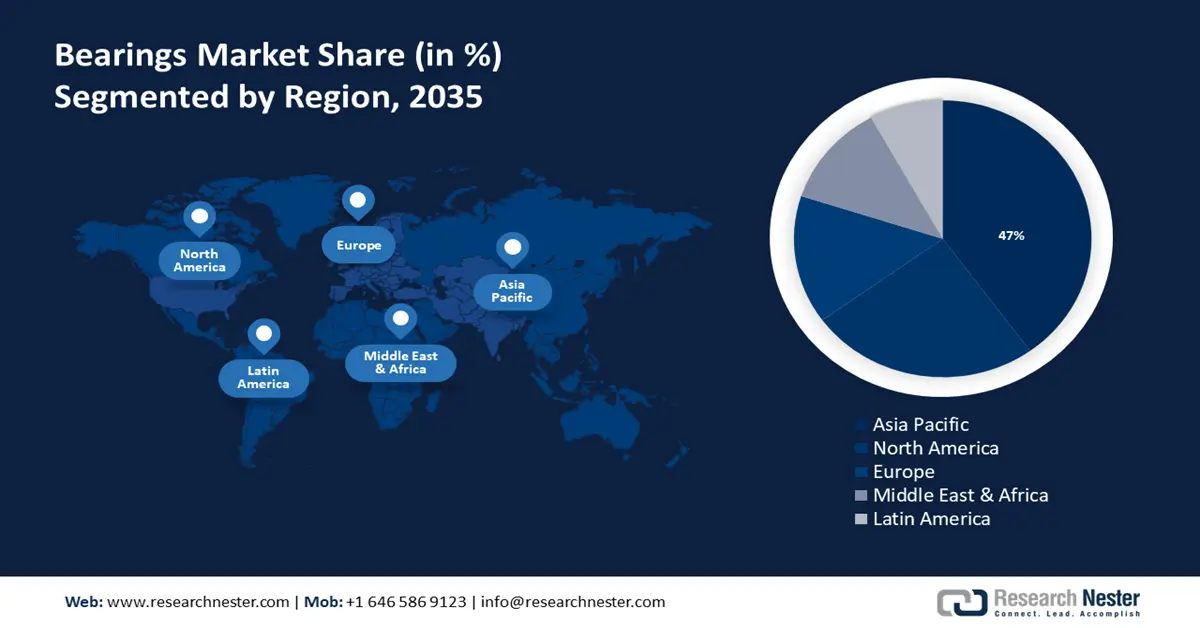

Bearing Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 40% by 2035. Asia Pacific's market is boosted by the increasing use of automation in the production process and the industrial internet of things (IoT). With around 35% of the global industry, Asia-Pacific is the largest region for process automation and controls.

The quickening pace of infrastructure development, industrialization, and urbanization in China is responsible for the revenue share. China's urbanization rate was 66.2% by the end of 2023 and is predicted to rise to 75–80% by 2035.

In Japan region, the rise of the automotive and electronics industries, along with technological innovation and automation in production processes, are responsible for the revenue share. In the manufacturing sector, Japan used 631 robots for every 10,000 human workers in 2021.

The need for heavy-duty, lightweight bearing in the aerospace sector in Korea is growing along with the industry's expanding R&D. This is a result of growing air traveler and freight usage. Korean Air handled around 1.35 million tons of international air cargo travel in 2022.

North America Market Insights

The North America region will also encounter huge growth for the bearing market during the forecast period. It is anticipated that as sales of SUVs and hatchbacks increase, so will the requirement for bearing across the country. A hatchback typically has 60 installed bearing; sedans and SUVs typically have more bearing installed.

In the United States, by reducing the financial burden of additional inspection fees on small meat, poultry, and egg processing businesses, the program would enable farmers to process more animals and provide them with more reasonably priced local options. According to the U.S. Department of Agriculture, the agricultural industry in the United States experienced a rise in export volumes in 2021. The United States' agriculture and food exports were USD 177 billion in 2020, an 18% rise. This all collectively leads to bearing market’s expansion in North America region.