Bearing Market Outlook:

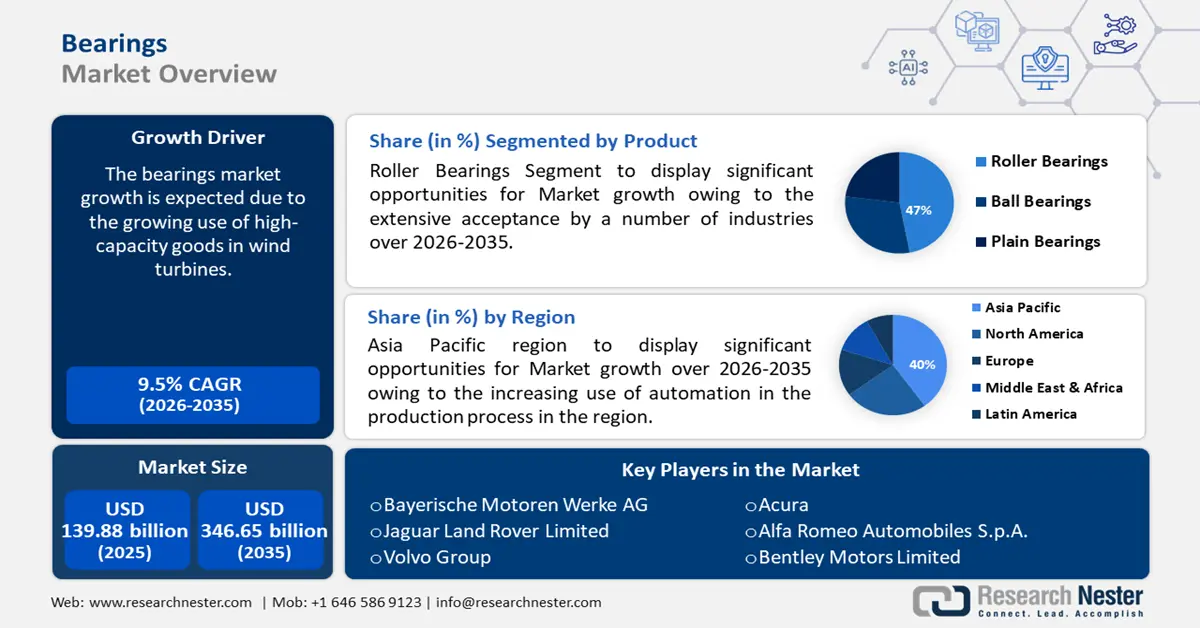

Bearing Market size was over USD 139.88 billion in 2025 and is poised to exceed USD 346.65 billion by 2035, witnessing over 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bearing is estimated at USD 151.84 billion.

The bearing market growth is expected due to the growing use of high-capacity goods in wind turbines. These products are used by wind turbines to improve their efficiency and dependability, produce more energy, and use less lubricant. The total installed wind capacity reached 906 GW1 in 2022 when 77.6 GW of new wind generating capacity was added to electricity networks worldwide. This is a 9% increase from 2021.

Key Bearing Market Insights Summary:

Regional Highlights:

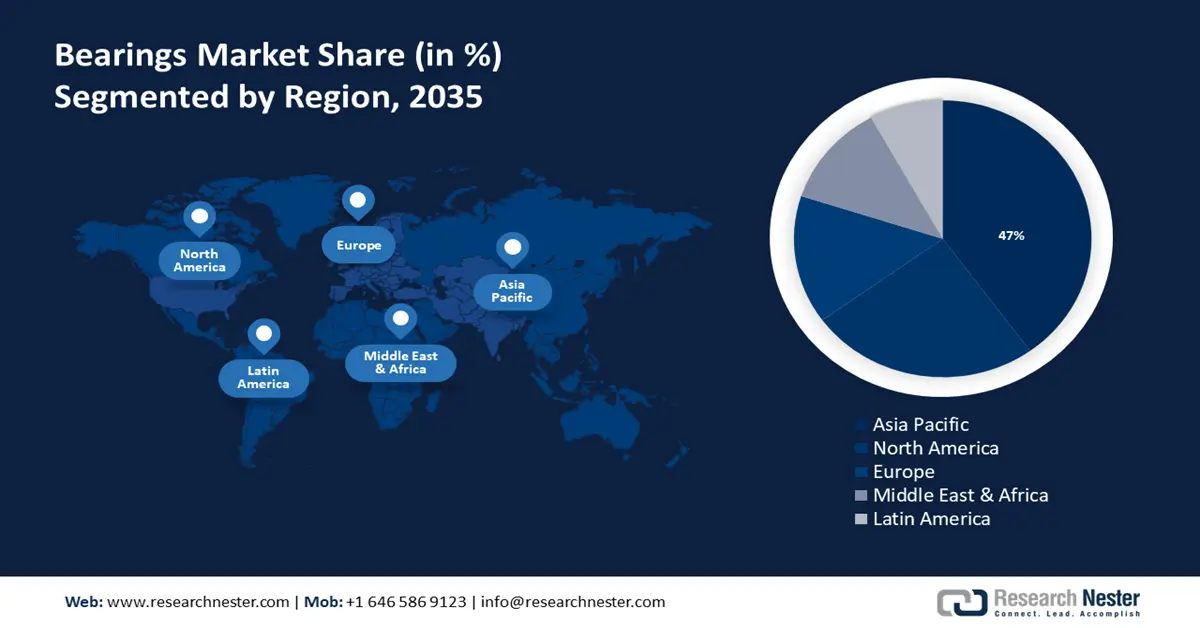

- Asia Pacific bearing market will dominate around 40% share by 2035, driven by rising automation in production processes and the adoption of industrial IoT.

- North America market will achieve huge CAGR during 2026-2035, attributed to increasing sales of SUVs and hatchbacks, which require more bearings per vehicle.

Segment Insights:

- The automotive segment in the bearing market is projected to capture a 68% share by 2035, driven by rising demand for technologically advanced automobiles and increased vehicle production.

- The roller bearing segment in the bearing market is expected to hold a 47% share by 2035, fueled by excellent performance features and adoption across multiple industries like capital equipment and automotive.

Key Growth Trends:

- Growing need for precision bearing

- Demand for small single-aisle aircraft from emerging economies has increased significantly

Major Challenges:

- Growing need for precision bearing

- Demand for small single-aisle aircraft from emerging economies has increased significantly

Key Players: Regal Rexnord Corporation, RHP Bearing, Schaeffler AG, SKF, The Timken Company, Danaher Corporation, Bearing Manufacturing Company, THB BEARING CO., LTD., Luoyang Huigong Bearing Technology Co., Ltd.

Global Bearing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 139.88 billion

- 2026 Market Size: USD 151.84 billion

- Projected Market Size: USD 346.65 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Bearing Market Growth Drivers and Challenges:

Growth Drivers

-

Growing need for precision bearing - The expansion of the bearing market as a whole is estimated to be considerably impacted by the rising demand for precision bearing. The tremendous benefits of smooth and accurate rotation are a major reason driving the demand for precision bearing in the automotive and heavy engineering sectors. To fulfill the needs of contemporary applications, these improvements necessitate ever-more precise and efficient components.

Precision bearing save energy consumption, improve overall performance, and guarantee precise and smooth rotation. In April 2022 to March 2023, the industry produced 2,59,31,867 vehicles, including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, compared to 2,30,40,066 units in April 2021 to March 2022. This growing need for precision bearing is estimated to support the growth of bearing market demand in the upcoming years. - Demand for small single-aisle aircraft from emerging economies has increased significantly - The noteworthy increase in demand for tiny single-aisle airplanes and helicopters from emerging nations is credited with driving the bearing market's growth rate. The swift economic expansion of emerging economies is driving up demand for all forms of transportation, including aviation.

Additionally, the necessity for effective logistics solutions and the expansion of online retail have led to a need for smaller planes and helicopters to facilitate last-mile delivery and the transfer of goods in distant places. Retail e-commerce sales are predicted to surpass 6.3 trillion USD globally in 2024, and these numbers are awaited to rise even further in the years to come. - Increasing use of bearing in rolling mills, electric cars, and railroads - The railway industry is placing greater emphasis on cost reduction and rail life extension. Railway gearboxes employ bearing to reduce vibrations and shocks induced by the force of the traction motor and wheels on the tracks. As a result, harsh operating circumstances lengthen engine maintenance intervals.

The railway industry's need for bearing has been driven by recent advancements in bearing technology. For instance, pinion shafts that need to be adjusted frequently are supported by tapered roller bearing, and skilled maintenance has been created to lower maintenance costs and improve cage strength. There are more than 1.3 million route kilometers in the global railway network.

Challenges

-

High product starting costs can impede market expansion- This industry's gain and profitability are hampered by the high cost of maintenance and the volatility of raw material prices. Cost fluctuations for raw materials can have a big effect on the bearing market.

Usually composed of polymers, steel, or ceramics, bearing are volatile in price. It is difficult for manufacturers to keep steady pricing and profit margins since fluctuations in the cost of raw materials have a direct impact on the manufacturing costs of bearing. Disruptions to the

supply chain may result from manufacturers' inability to consistently find high-quality raw materials at reasonable rates. - Insufficient bearing clearance - Most used bearing outlast the equipment they installed, with failure occurring in a very tiny number of cases. As a precautionary measure, multiple bearing are replaced before it falls to guarantee safety. 0.05% of the bearing must be changed in total because they are broken or faulty.

As a result, each year, 50,000,000 bearing are replaced due to deterioration and failure. For example, in the pulp and paper industry, excessive lubrication and contamination are more common reasons for bearing failure than fatigue. Every one of these events leaves a unique scar.

Bearing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 139.88 billion |

|

Forecast Year Market Size (2035) |

USD 346.65 billion |

|

Regional Scope |

|

Bearing Market Segmentation:

Product

Roller bearing segment is estimated to capture over 47% bearing market share by 2035. This is impelled by the excellent performance of roller bearing, which provide low rotational friction, axial and radial load support, and effective management of heavy and restricted axial loads. The need for roller bearing is anticipated to increase further as a result of its extensive acceptance by a number of industries, including capital equipment, automotive, and home appliances. In 2020, 668 million appliances were sold worldwide. Both large and small appliances fall under this category.

Roller bearing are finding more and more uses in the railroad, aircraft, and mining industries. These bearing are recommended led by their great mechanical efficiency, ease of installation and maintenance, and interchangeability. They can support heavy loads. They have a long service life and support high precision. In general, the bearing market's growth is expected to be favorably impacted by the roller bearing sector.

Application

Automotive segment share in the bearing market is poised to exceed 68% by the end of 2035. The segment growth can be poised to the need for increasingly complex bearing products has increased as a result of the growing demand for technologically superior automobiles and the corresponding rise in vehicle manufacturing. The automobile industry's need for bearing has propelled by the growing demand for luxury cars with cutting-edge features.

The relocation of production lines from developed to developing economies by multinational automakers is projected to boost the automotive bearing industry in India. The International Energy Agency (IEA) estimates that 11.3 million battery electric vehicles (BEVs) were in operation last year worldwide.

The global fleet of battery-electric vehicles now numbers over four million. The automobile industry's increasing need for robust and lightweight bearing is pushing well-known bearing manufacturers like SKF India, Schaeffler India, and NRB Bearing to concentrate on using novel raw materials rather than conventional high-grade steel.

Our in-depth analysis of the bearing market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

|

Machine Type |

|

|

Size |

|

|

Group |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bearing Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 40% by 2035. Asia Pacific's market is boosted by the increasing use of automation in the production process and the industrial internet of things (IoT). With around 35% of the global industry, Asia-Pacific is the largest region for process automation and controls.

The quickening pace of infrastructure development, industrialization, and urbanization in China is responsible for the revenue share. China's urbanization rate was 66.2% by the end of 2023 and is predicted to rise to 75–80% by 2035.

In Japan region, the rise of the automotive and electronics industries, along with technological innovation and automation in production processes, are responsible for the revenue share. In the manufacturing sector, Japan used 631 robots for every 10,000 human workers in 2021.

The need for heavy-duty, lightweight bearing in the aerospace sector in Korea is growing along with the industry's expanding R&D. This is a result of growing air traveler and freight usage. Korean Air handled around 1.35 million tons of international air cargo travel in 2022.

North America Market Insights

The North America region will also encounter huge growth for the bearing market during the forecast period. It is anticipated that as sales of SUVs and hatchbacks increase, so will the requirement for bearing across the country. A hatchback typically has 60 installed bearing; sedans and SUVs typically have more bearing installed.

In the United States, by reducing the financial burden of additional inspection fees on small meat, poultry, and egg processing businesses, the program would enable farmers to process more animals and provide them with more reasonably priced local options. According to the U.S. Department of Agriculture, the agricultural industry in the United States experienced a rise in export volumes in 2021. The United States' agriculture and food exports were USD 177 billion in 2020, an 18% rise. This all collectively leads to bearing market’s expansion in North America region.

Bearing Market Players:

- Myopic GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Regal Rexnord Corporation

- RHP Bearing

- Schaeffler AG

- SKF

- The Timken Company

- Danaher Corporation

- Bearing Manufacturing Company

- THB BEARING CO., LTD.

- Luoyang Huigong Bearing Technology Co., Ltd.

The top businesses in the bearing market are listed below. Together, these businesses control the lion's share of the market and set the direction of industry trends. To map the supply network, these bearing companies' financials, strategy plans, and goods are examined.

Recent Developments

- The Timken Company has effectively completed the purchase of Engineered Solutions Group, which is commonly known as iMECH, or Innovative Mechanical Solutions. With a staff of about 70 experts, iMECH is a leading manufacturer of thrust bearing, radial bearing, specialized coatings, and other parts mostly designed for the energy sector. For the calendar year 2023, the company anticipates making about USD 30 million in sales. The company's reputation as a supplier of all-inclusive solutions for industrial motion and designed bearing is further enhanced by this calculated acquisition.

- Schaeffler AG deliberately expanded the range of products it offers by launching new products in the areas of torque motors, linear motors, and rotary table bearing. Expanded bearing sizes for rotary table and rotary axis bearing are being added, and bearing-integrated angular measuring systems are also being included. The ability of the company to provide a wide range of superior solutions is further strengthened by the standardization of torque motors within the RKIB series, which are now available up to size 690.

- Report ID: 6082

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bearing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.