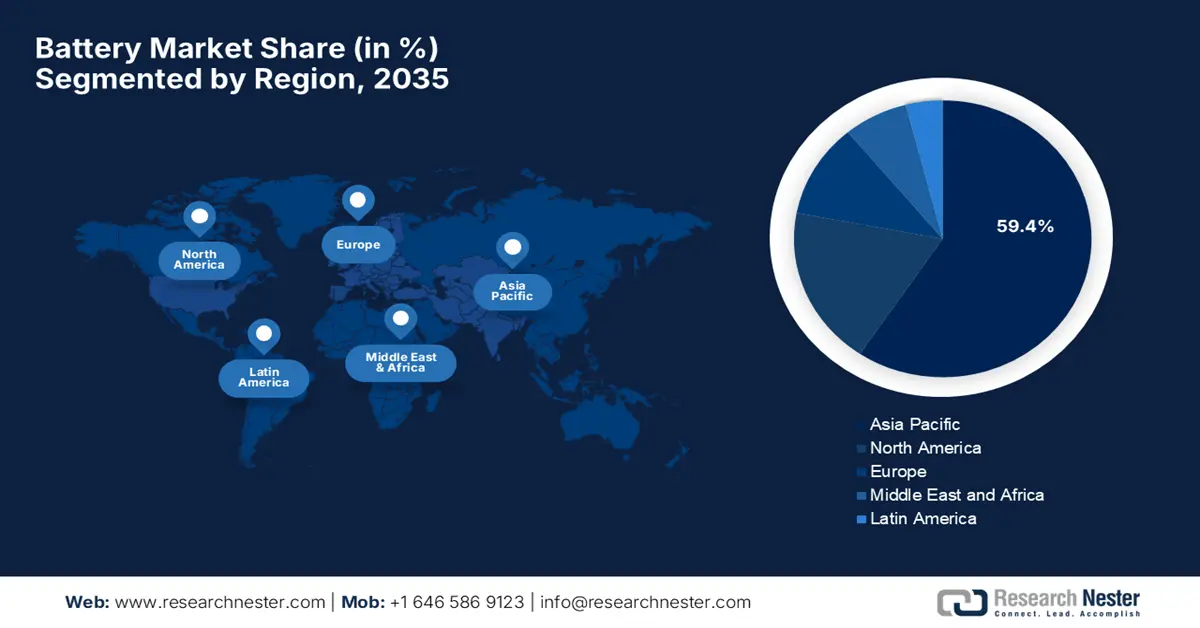

Battery Market - Regional Analysis

APAC Market Insights

The battery market in the Asia Pacific is likely to emerge as the dominant force by the end of 2035, with the largest share of 59.4%. This dominance is efficiently propelled by rising electrification programs, accelerating renewable energy deployments, and the continuous growth of renewable energy. In October 2025, Saft announced that it had expanded its footprint in the Asia Pacific with a new contract to supply a 356 MWh lithium-ion battery energy storage system for Foxwell Power Co in Taichung, supporting Taiwan’s 2050 net-zero roadmap. The company also stated that the project will enhance grid stability by enabling frequency regulation and peak-shifting as renewable penetration increases across the island. Furthermore, it leverages advanced, AI-enabled control architecture and high-level cybersecurity capabilities, marking their fifth and largest collaboration, hence continuing to shape the region’s growth trajectory.

China is the global hub in the entire battery market, which is the most dominant, large as well and influential. The country is supported by mature manufacturing capabilities, which have extensive mineral processing capacity and strong policy incentives. The article published by the U.S. Energy Information Administration in May 2025 the country plays a dominant role in the global battery supply chain, controlling all of the major stages from mineral production to battery cell manufacturing. It also mentioned that the country produces lithium, graphite, and cobalt, and leads in processing and exporting battery materials, components, and packs. Furthermore, China’s global influence ensures it remains central to the trade of battery minerals and materials, shaping supply chains for electric vehicles as well as energy storage worldwide.

China’s Dominance in Global Battery Minerals and Materials Trade

|

Battery Supply Stage |

China’s Share |

Notes |

|

Lithium production |

18% of the global mined lithium |

Controls 25% of global mining capacity, with investments in Argentina |

|

Graphite production |

79% of the global natural graphite |

Major domestic production; the U.S. produces none |

|

Cobalt production |

80% in Congo-Kinshasa |

China controls a significant global cobalt supply |

|

Raw battery mineral imports |

46% of world trade |

Mainly lithium from Australia |

|

Processed battery mineral exports |

58% of world trade |

Includes synthetic graphite |

|

Battery material exports |

53% of world trade |

Key materials for electrodes, cathodes, and electrolytes |

|

Battery component & pack exports |

74% of world trade |

Includes anodes, cathodes, electrolytes, and separators |

|

Battery cell production capacity (monetary) |

85% of world capacity |

Largest global share by monetary value |

Source: EIA

India is readily exploring opportunities in the battery market, efficiently backed by the push for energy independence, renewable energy integration, and rapid electrification in multiple sectors. The country’s market also benefits from government support for domestic manufacturing and large-scale commitments in cell production and battery recycling. For instance, in June 2025, Cummins India Limited announced the launch of its battery energy storage systems, which support the country’s clean energy transition and enhance grid reliability, aligning with net-zero and renewable energy goals. It also stated that the modular and scalable BESS solutions integrate solar and wind power with existing infrastructure, enabling peak shaving, energy shifting, as well as renewable energy utilization across industries.

North America Market Insights

North America is predicted to hold a strong position in the global battery market throughout the discussed tenure. The leadership of the region in this field is primarily fueled by significant investments in domestic manufacturing, critical mineral processing, and next-generation technologies. In December 2024, the U.S. DOE announced a major investment of USD 25 million across 11 projects to advance domestic manufacturing of next-generation batteries, focusing on scalable, flexible, and cost-effective production processes. It also stated that these projects target platform technologies, which include sodium-ion battery manufacturing, flow battery system scale-up, and nanolayered film production, as well as smart manufacturing platforms applicable across battery types. Furthermore, the initiative aims to build on more than USD 140 billion in private investments in battery and critical mineral supply chains.

The U.S. is undergoing significant transformations in the regional battery market, wherein the large-scale gigafactory projects, recycling facilities, and mineral extraction facilities are gaining momentum. The country’s market also benefits from federal incentives as well as partnerships across automotive, energy, and technology sectors, which are accelerating the adoption of advanced battery chemistries. As per an article by the U.S. DOE in December 2024, its four-year review, the country’s battery industry is catalyzed by federal policies like the Bipartisan Infrastructure Law and the Inflation Reduction Act. The report also mentioned that these policies have spurred over USD 150 billion in private investment and built a pipeline of over 1,100 GWh of annual domestic battery cell manufacturing capacity, hence denoting a positive market outlook.

Canada has gained immense exposure in the regional battery market since it’s the hub of battery materials, cell manufacturing, and clean storage deployment. The country leverages abundant natural resources, a supportive policy landscape, and growing collaboration with automotive OEMs. In this regard, the country’s government reported that it is investing over USD 22 million through its Energy Innovation Program to accelerate domestic battery innovation and production capacity. This funding supports eight projects across the country focused on developing next-generation technologies, including more efficient and environmentally friendly production of cathode materials, advanced anode materials such as silicon and tin, and the creation of ultra-high-power and high-energy-density battery cells. Furthermore, these initiatives aim to enhance the safety, performance, and competitiveness of Canada's battery value chain.

Energy Innovation Program: Battery Industry Acceleration Projects

|

Recipient |

Project Focus |

Funding Amount |

|

NOVONIX Battery Technology Solutions Inc. |

Dry, zero-waste cathode production |

USD 5,000,000 |

|

Calumix Technologies Inc. |

Coated current collectors |

USD 4,545,000 |

|

Flex-Ion Battery Innovation Center |

Ultrahigh-capacity cylindrical cells |

USD 3,319,640 |

|

HPQ Silicon Inc. |

Silicon oxide anode material |

USD 3,000,000 |

|

NanoXplore Inc. |

Ultra high-power cylindrical cells |

USD 2,750,000 |

|

E-One Moli Energy (Canada) Ltd |

Power capability enhancement |

USD 1,620,314 |

|

Nanode Battery Technologies |

Tin-based anode materials |

USD 1,500,000 |

|

E-One Moli Energy (Canada) Ltd |

Low-temperature performance |

USD 1,067,499 |

|

Total Investment |

|

USD 22,802,453 |

Source: Government of Canada

Europe Market Insights

Europe is readily blistering growth in the international battery market owing to the decarbonization targets, automotive electrification commitments, and the drive to localize battery production. The collaborative industry initiatives, stringent environmental standards, and strong demand across various sectors are solidifying the long-term growth. The European Commission in November 2025 announced that five innovative EV battery cell projects have secured €643 million (USD 707 million) under the innovation fund 2024 battery call, aiming to reduce 88 million tonnes of CO₂ over their first decade and enter operation between 2027 and 2029. It is located across four EU countries, and the projects will advance the battery value chain through material production, cell manufacturing, recycling, and second-life applications, thereby reducing dependence on external suppliers. It also underscored that this project is aligned with the EU climate, industrial, and circular economy support net-zero objectives and contributes to a sustainable battery industry.

Germany has a strong position in the regional battery market, supported by the automotive sector’s transition towards electrified platforms, a strong manufacturing and industrial base. The presence of key market players and their strategic steps is also driving business in the market. For instance, in November 2025, Canadian Solar announced that its subsidiary e-STORAGE had secured a 20.7 MW / 56 MWh battery energy storage project in Lower Saxony, Germany, including a 20-year long-term service agreement, supporting grid flexibility and renewable integration. The project, developed by Kyon Energy, will use e-STORAGE’s proprietary SolBank technology, and this expansion strengthens the firm’s presence in Europe. Furthermore, the move leveraging its expertise in utility-scale solar and battery storage solutions will advance the energy transition.

France is exponentially growing in the regional battery market on account of strategic investments in battery gigafactories, domestic mineral processing, and clean mobility initiatives. The collaborations between government and industry are strengthening domestic innovation, whereas increasing EV adoption and energy storage requirements are reshaping the growth dynamics in this field. In September 2025, Connected Energy announced that it is expanding into France with a 100 MWh second-life battery energy storage project in Région Centre-Val de Loire, marking one of Europe’s largest such deployments. The company has inaugurated a Bordeaux office and aims to deploy around 1 GWh of second-life BESS across multiple sites by the end of 2030, leveraging the country’s renewable growth and grid stability needs. Furthermore, the firm plans to optimize site selection, secure land, and accelerate the adoption of second-life battery systems in the country’s market.