Battery Manufacturing Equipment Market Outlook:

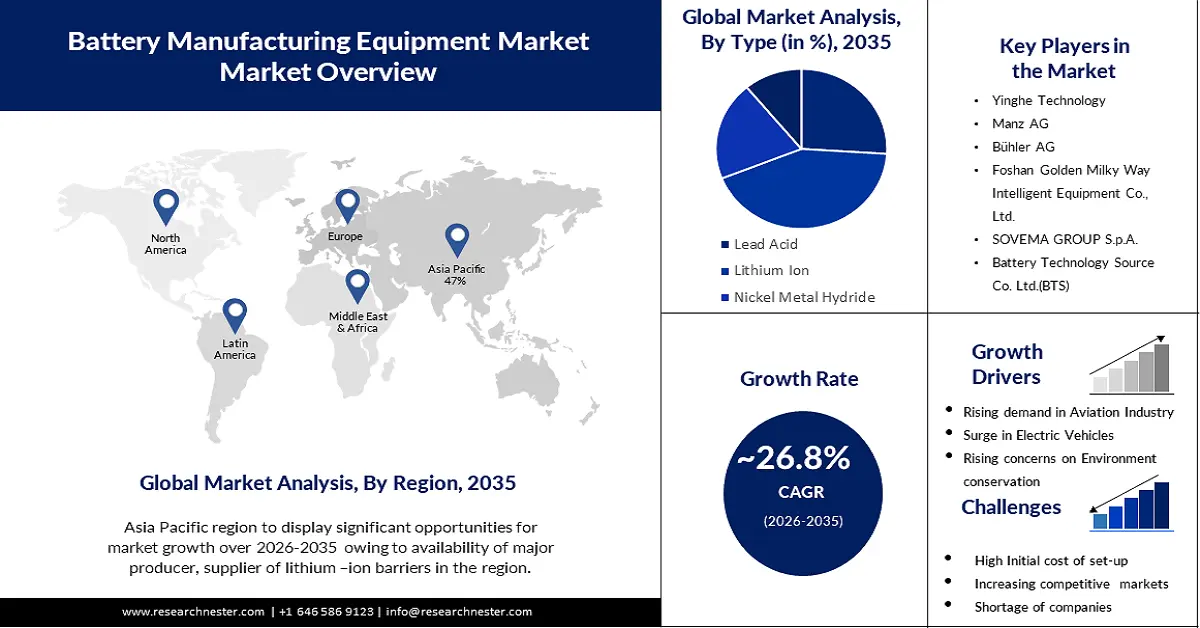

Battery Manufacturing Equipment Market size was over USD 9.59 Billion in 2025 and is anticipated to cross USD 103.04 Billion by 2035, growing at more than 26.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of battery manufacturing equipment is assessed at USD 11.9 Billion.

Numerous factors, including the burgeoning energy storage market and the increased demand for electric vehicles, are driving up the price of lithium-ion batteries globally. Demand for automotive lithium-ion batteries rose by around 65% to 550 GWh in 2022. Businesses in the battery sector concentrate on creating environmentally friendly battery technologies and expanding their manufacturing capabilities to keep up with the increased demand. As a result, battery manufacturing facilities are multiplying quickly worldwide.

Recent years have seen a rise in the need for energy storage batteries as a result of elements like continuous system modernization. When there is a low demand for power, energy storage batteries are utilized to store excess energy for later usage by end users. In many countries around the world, including the US, Canada, Germany, France, China, India, and other major economies, the energy storage battery has been widely installed. The growing movement toward a low-carbon, less reliant on fossil fuels economy, and the continued development of renewable energy.

Key Battery Manufacturing Equipment Market Insights Summary:

Regional Highlights:

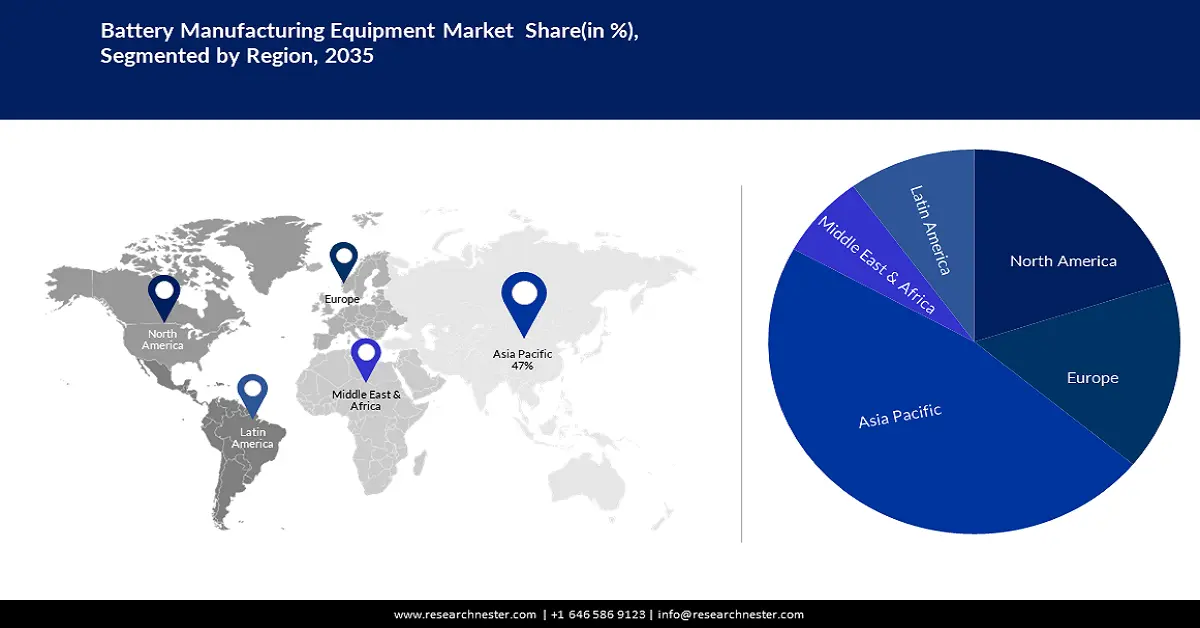

- Asia Pacific battery manufacturing equipment market is anticipated to achieve a 47% share by 2035, driven by China's dominance in lithium-ion battery production and R&D in new battery technologies.

- North America market is forecasted to hold a notable share by 2035, driven by increasing electric vehicle production and demand for battery manufacturing equipment.

Segment Insights:

- The lithium-ion segment in the battery manufacturing equipment market is forecasted to achieve a 43% share by 2035, driven by increasing EV adoption and preference for low-carbon energy storage.

- The automotive batteries segment in the battery manufacturing equipment market is forecasted to maintain a dominant share by 2035, influenced by the expanding electric vehicle sector and sustainability efforts.

Key Growth Trends:

- Increasing Demand in Aerospace Industry

- Expanding Telecommunication Industry

Major Challenges:

- High Investments & Set-up Costs

- Continuous development of a new variety of batteries makes the market highly competitive

Key Players: Yinghe Technology, Manz AG, Bühler AG, Foshan Golden Milky Way Intelligent Equipment Co., Ltd., SOVEMA GROUP S.p.A., Battery Technology Source Co. Ltd. (BTS), Xiamen Tmax Battery Equipments Limited, Readco Kurimoto, LLC, Wirtz Manufacturing, HIRANO TECSEED Co., Ltd.

Global Battery Manufacturing Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.59 Billion

- 2026 Market Size: USD 11.9 Billion

- Projected Market Size: USD 103.04 Billion by 2035

- Growth Forecasts: 26.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Battery Manufacturing Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand in Aerospace Industry- Demand for high-capacity batteries is increasing in the aerospace industry, with aircraft and unmanned aerial vehicles now using electrical propulsion. The industry for aviation batteries is encouraged by the use of electrical technology in aircraft electrical systems. An additional opportunity for innovation and progress in aviation batteries is provided by the aircraft's need for durability and large energy storage capacities. As a result, machine manufacturers of batteries for the aerospace industry are expected to witness significant growth prospects, thereby leading to market growth.

- Expanding Telecommunication Industry- To generate electricity for infrastructure, the telecommunications sector is increasingly switching from conventional sources such as coal and nuclear energy. In 2023, the global telecommunication industry is predicted to spend 1.5 trillion U.S. dollars. The requirement for battery manufacturing equipment that can be used to manufacture batteries for mobile applications will increase as the industry grows.

- Penetration of Battery Recycling Technology- The market for battery manufacturing equipment offers great growth opportunities due to the development of battery recycling technology. There is also a need to recycle batteries due to an increase in battery demand. Recycling can contribute to reduce the greenhouse gas emissions associated with battery production and extend battery life, which could reduce costs in the end. As the technology of recycling batteries is refined, there will be a need for advanced battery-making machines that are capable of producing reprocessed batteries.

- Surge in Electric Vehicles- The key demand factors for battery production machines are increased e-mobility and greater use of electric devices in a variety of sectors. The growing concern about reducing the carbon footprint and the increased use of batteries in vehicles is expected to increase market demand for battery manufacturing equipments, as well as innovations and the growth of electric consumer appliances, which will increase sales of batteries. In light of this, the rising sales of EVs would further result in growth of battery manufacturing equipment market.

Challenges

- High Investments & Set-up Costs- The market for battery manufacturing equipment are in high demand; thus, it becomes necessary to set up new manufacturing plants in different parts of the world. However, the cost of setting up a battery manufacturing machinery plant is relatively high and requires substantial capital investments. Further, the plant in all requires various machinery. Each machine's design, size, technology, and technical specifications vary based on the battery type and technology being manufactured. All these factors are aiding in the high investment costs, which becomes a restraining factor for the battery manufacturing equipment market.

- Continuous development of a new variety of batteries makes the market highly competitive

- The market growth was hindered to a considerable extent by the shortage of companies operating battery production equipment.

Battery Manufacturing Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

26.8% |

|

Base Year Market Size (2025) |

USD 9.59 Billion |

|

Forecast Year Market Size (2035) |

USD 103.04 Billion |

|

Regional Scope |

|

Battery Manufacturing Equipment Market Segmentation:

Type Segment Analysis

The lithium-Ion segment in the battery manufacturing equipment market is anticipated to hold the largest revenue share during the forecast period, accounting for 43%. The growth is being driven by increasing demand from the automotive industry and the rising use of electrical vehicles. In three years, from 4% in 2020 to 14% in 2022, the EV share of overall vehicle sales has nearly tripled. Lithium-ion batteries are the preferred power source for low-carbon technology, such as electric automobiles. They can store a lot of energy in a small amount of area, have charging capabilities, and have a propensity to keep working even after hundreds or even thousands of charge cycles. The present push to phase out gas-powered cars that release carbon dioxide and other types of pollution from carbon is greatly dependent on these batteries. These batteries are excellent choices for the power storage of the electric grid because of their commonalities.

Application Segment Analysis

The automotive batteries segment is expected to hold a dominant market position over the forecast period. As electric vehicles are increasingly used, this segment has an immense demand and supply chain. Different types of vehicles introduced in the market, depending on their power output which has been predicted by the product, are causing demand to arise for a variety of battery types placed on the market. Government officials from several nations are collaborating with automakers to find solutions to the mounting issues of ecological sustainability and energy balance.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Manufacturing Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific is anticipated to hold 47% share of the global battery manufacturing equipment market by 2035. The region is a major producer, supplier, and lithium-ion battery user due to the ease with which raw materials of batteries are available. The region's large battery producers as well as machine manufacturers also have a strong presence in this region. China is currently the leading producer of lithium-ion batteries in the Asia Pacific region and one of the biggest buyers of these batteries. In 2021, China is expected to produce around 79 percent of all lithium-ion batteries entering the global market. Another factor boosting the expansion of the battery manufacturing equipment market in the Asia Pacific is an increase in R&D for creating new battery technologies by various countries in the region. China is a major center for the production of batteries worldwide, home to many reputable battery producers, equipment suppliers, and end customers.

North American Market Insights

North America battery manufacturing equipment market is estimated to gain a notable revenue share by the end of 2035. In response to the region's large number of information technology companies, the market for battery manufacturing equipment is beginning to show signs of expansion. Additional market growth is anticipated due to the growing popularity of electric vehicles. Automobile manufacturers are now creating electric vehicles in a variety of shapes & styles for all car classes to boost sales as the demand for electric vehicles rises. For battery manufacturing to meet the demands of automakers, this personalization in automotive design offers a significant opportunity for growth.

Battery Manufacturing Equipment Market Players:

- Wuxi leads intelligent equipment co

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Yinghe Technology

- Manz AG

- Bühler AG

- Foshan Golden Milky Way Intelligent Equipment Co., Ltd.

- SOVEMA GROUP S.p.A.

- Battery Technology Source Co. Ltd.(BTS)

- Xiamen Tmax Battery Equipments Limited

- Readco Kurimoto, LLC

- Wirtz Manufacturing

Recent Developments

- Volkswagen and Wuxi Lead Intelligent Equipment Co., Ltd. has a deal for the delivery of machinery for the manufacture of 20GWh lithium batteries. The business would increase its market share in Europe and usher in a new phase of its international operations.

- Russia is about to receive a variety of equipment for producing lithium-ion batteries on a lab size. These machines total 48 packages and include a doctor blade coater, heat roller press machine, vacuum mixer, vacuum oven, coin cell crimper, coin cell disc cutter, battery charge and discharge tester, pouch cell sealer, ultrasonic spot welder, cylindrical cell grooving machine, lithium battery spot welder, cylindrical cell winding machine, and more.

- Report ID: 5355

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.