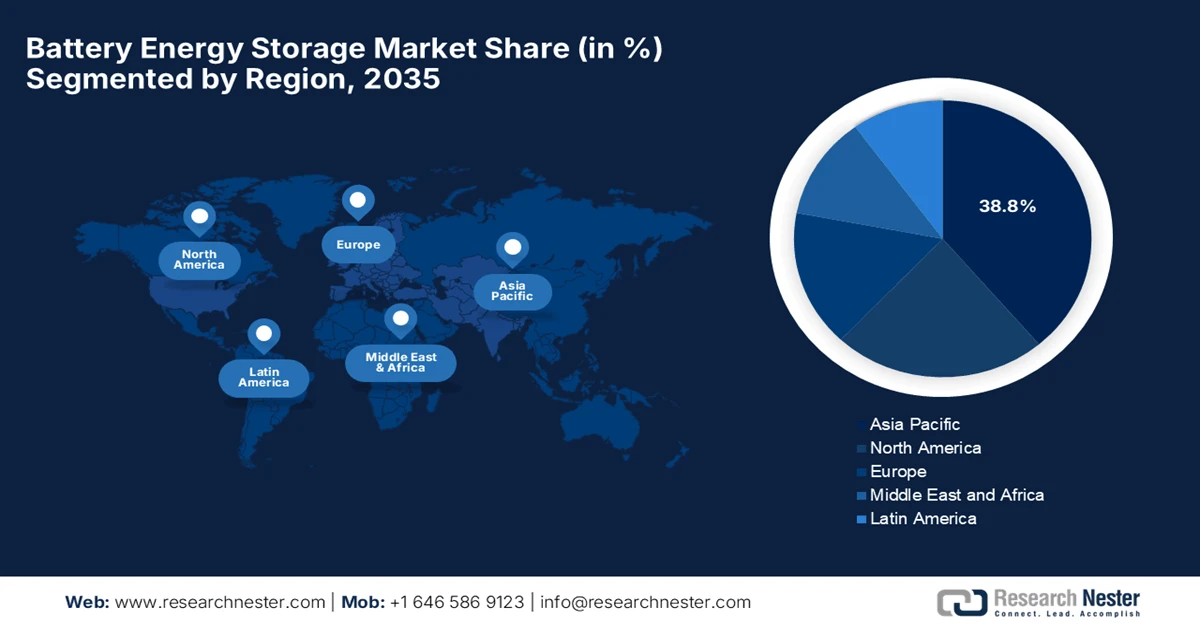

Battery Energy Storage Market - Regional Analysis

APAC Market Insights

The Asia Pacific battery energy storage market is expected to garner the largest revenue share of 38.8% by the end of 2035. The region’s dominance in this field is mainly propelled by increasing deployments and rapid renewables integration. In this context, Japan Petroleum Exploration Co., Ltd. (JAPEX) in October 2025 announced that it had commenced construction of the JAPEX Tomakomai battery energy storage system, which is a grid-scale battery facility located at its Hokkaido District Office in Tomakomai City. The firm also notes that this project aims to stabilize the power grid by compensating for output fluctuations from renewable energy sources such as solar and wind, with commercial operations planned for autumn 2027. Furthermore, it is selected under Japan’s FY2024 Renewable Energy Expansion and Grid-Scale Energy Storage System Support Program, wherein the Tomakomai BESS represents JAPEX’s first extra-high voltage battery system and supports its strategy to expand revenue opportunities in the energy storage business.

China battery energy storage market is progressing at a notable pace on account of large-scale deployments that are best aligned with national energy transition strategies. Storage is used to support high renewable penetration and enhance grid dispatch capabilities, reflecting the country’s focus on strengthening power system flexibility. In January 2026, HiTHIUM reported that its Chongqing manufacturing base was recognized by the World Economic Forum as the world’s first lighthouse factory for energy storage batteries. The company also notes that this facility is the first mass-production site for kAh long-duration energy storage batteries, that leverages intelligent manufacturing, AI, and AIoT technologies to ensure high-quality, near-zero-defect production and enhance grid-scale renewable energy integration. Further with mass production of the ∞Cell 1175Ah LDES batteries and deployment of ∞Power 6.25MWh 4h BESS systems, the plant positions HiTHIUM to lead large-scale, safe, and efficient energy storage solutions across the globe.

India battery energy storage market is also gaining momentum as the country is readily expanding solar and wind capacity to meet the heightened electricity demand. Simultaneously, the government-backed initiatives are positioning storage as a tool to improve renewable reliability, support a consistent power supply, and address grid balancing challenges in this evolving power system. In September 2025, the Ministry of Electronics & IT reported that the Union Minister inaugurated TDK Corporation’s lithium-ion battery manufacturing plant in Sohna, Haryana. It also stated that the facility is designed to produce 20 crore (200 million) battery packs on a yearly basis, thereby meeting nearly 40% of India’s domestic requirement for batteries used in mobile phones, laptops, wearables, and hearables. Also, this milestone is a significant step toward Atmanirbhar Bharat, creating around 5,000 direct jobs, strengthening the country’s electronics manufacturing ecosystem, and positioning India as a growing hub for advanced electronics production.

North America Market Insights

The North America battery energy storage market is expected to grow at a considerable rate, mainly driven by the grid modernization and renewable integration infrastructure, with strong growth supported by supportive policies. In January 2026, PowerBank Corporation announced a 5 MW hybrid solar and battery energy storage project in New York, which is called the NY-Holland Glnwd project. Besides, the system will store surplus renewable energy from solar generation to balance supply and demand by also enabling community solar participation, where local residents can benefit from reduced electricity costs without installing equipment. In addition, this project supports New York’s Climate Leadership and Community Protection Act goals and builds on PowerBank’s extensive regional renewable energy development experience, contributing to the state’s growing clean energy infrastructure.

The U.S. battery energy storage market is growing on account of increased adoption, which is driven by policy support, utility procurement programs, and the expansion of solar and wind generation. Storage systems are being integrated into wholesale power markets in the country to provide services such as frequency regulation and capacity support, thereby strengthening overall grid flexibility. In this regard, the U.S. Department of Energy announced in December 2024 a USD 28.7 million investment under the Grid Resilience and Innovation Partnerships (GRIP) Program to deploy a utility-scale battery energy storage system in Florida. The system will provide backup power to critical community facilities, including nursing homes and community centers, improve grid resilience against extreme weather, and save an estimated USD 160,000 on a yearly basis in fuel costs for municipal utility customers. Furthermore, this project advances the Biden-Harris Administration’s agenda to modernize the grid, enhance reliability, and ensure equitable energy access through clean energy and resilient infrastructure investments.

Canada battery energy storage market is positively influenced by its clean energy transition and emphasis on decarbonizing provincial power systems. There has been a strong presence of lithium-ion technology in Ontario & Alberta, coupled with increasing large-scale projects, which are highlighting opportunities in data centers and industrial sectors. The Canada Energy Regulator in July 2025 reported that the country’s grid-connected energy storage capacity of over 1 MW could more than double by the end of 2030, growing from 552 MW in 2024 to 1,149 MW based on projects under construction, and potentially reaching 2,768 MW if all approved projects are completed. It also stated that battery energy storage systems are the fastest-growing and most widely deployed technology, thereby complementing variable renewable energy sources such as wind and solar while enhancing grid reliability and power quality. Additionally, the government funding, such as the Smart Renewables and electrification pathways program, is supporting utilities and system operators in modernizing grids and integrating renewables.

Canada Energy Storage Overview: Technology, Capacity & Deployment Status (2025-2030)

|

Storage Type |

Status in Canada |

Typical Capacity / Duration |

Key Features |

|

Battery Energy Storage (BESS) |

Under construction & proposed |

1-411 MW, 0.5-6 hours |

Fastest-growing, scalable, mainly lithium-ion, supports renewables integration. |

|

Pumped Storage Hydropower (PSH) |

Active (Sir Adam Beck) |

174 MW |

Uses water stored at height to generate electricity; the longest-standing and largest storage type. |

|

Compressed Air Energy Storage (CAES) |

Active (Goderich) |

1.75 MW |

Stores air in underground structures; adiabatic type captures heat for efficient energy release |

Source: Canada Energy Regulator

Europe Market Insights

Europe battery energy storage market has acquired a prominent position, especially driven by decarbonization goals, cross-border power integration, and the need for system flexibility. Storage solutions are supporting the transition away from fossil fuels by enabling higher renewable penetration and improving the responsiveness of interconnected electricity industries. In this context, Canadian Solar in November 2025 announced that its subsidiary e-STORAGE secured a 20.7 MW / 56 MWh battery energy storage project in Lower Saxony, Germany, under a 20-year long-term service agreement. Besides, this project was developed by Kyon Energy and will deploy e-STORAGE’s proprietary SolBank platform, wherein the shipments are starting in March 2026, and commissioning will follow later the same year. Simultaneously, this initiative supports Germany’s grid flexibility and renewable integration by leveraging e-STORAGE’s automated facilities and 10 GWh annual BESS capacity.

Germany battery energy storage market reflects its advanced energy transition, with storage supporting decentralized energy systems and high renewable generation. The country’s market also benefits from batteries that are integrated with solar installations and smart energy management systems to enhance grid stability and self-consumption. In November 2025, LEAG Clean Power and Fluence announced the GigaBattery Jänschwalde 1000 project, which is Europe’s largest battery energy storage system, with a capacity of 1 GW / 4 GWh in Germany. It was powered by Fluence’s Smartstack platform, whereas the project will provide essential grid services, enhance renewable integration, and support the country’s energy transition. Furthermore, this flagship collaboration demonstrates the prominent role of gigascale storage facilities in stabilizing the grid and advancing regional clean energy infrastructure, hence making it suitable for overall market growth.

The UK battery energy storage market is shaped mainly by the government targets and increasing investments in this sector. Developers in the country are capitalizing on capacity additions and large projects, where revenue streams are evolving beyond simple frequency response. In December 2025, RWE announced its largest UK battery energy storage project, which is the Pembroke Battery Storage in South Wales, with a capacity of 350 MW and 700 MWh. It is scheduled for construction in early 2026 and commissioning in 2028, wherein the facility will support the Pembroke Net Zero Centre, enhance grid stability, and integrate renewable energy. Moreover, the project also includes biodiversity measures and reflects RWE’s commitment to expanding battery storage as a key driver of the country’s clean energy transition. Hence, this development strengthens the country’s market by increasing grid flexibility and helping stabilize electricity supply during peak demand periods.