Battery Chargers Market Outlook:

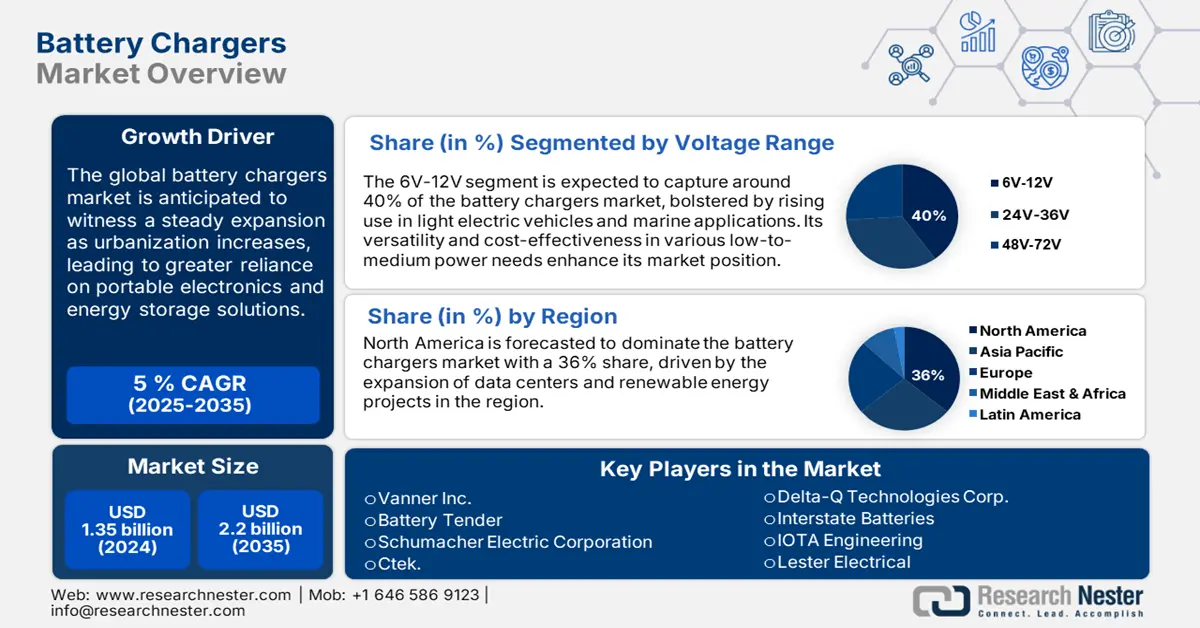

Battery Chargers Market size was over USD 1.35 billion in 2025 and is anticipated to cross USD 2.2 billion by 2035, growing at more than 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of battery chargers is estimated at USD 1.41 billion.

The market for battery chargers is rising rapidly due to the increasing demand for electric vehicles, boats/marine applications, golf carts, scissor lifts, pallet jacks, low-speed vehicles (LSVs)/work vehicles, and the growing thoughtfulness pertaining to renewable solutions. The growth of automotive industries toward electrification fuels the demand for efficient, high-capacity chargers and creates lucrative opportunities for manufacturers. In November 2022, BorgWarner won a major contract to supply an 800-volt bi-directional onboard charger to an OEM in North America. The move will improve the fast charging capability of the next generation of battery chargers. This development underlines the industry's commitment toward higher-scale charging solutions, meeting the efficiency and compatibility needs in the battery charging infrastructure.

Governments around the world also push the battery chargers market growth through the promotion of expanding electric infrastructure and offering incentives for sustainable energy solutions. Significantly, government initiatives in both the U.S. and Europe have provided tax benefits and grants toward establishing EV charging networks, further propelling this industry's growth. Consequently, many government reports indicate that such programs have resulted in increased participation in public-private collaboration in infrastructure projects. Such strategic support by governments is likely to accelerate further developments and innovations in the battery chargers market.

Key Battery Chargers Market Insights Summary:

Regional Highlights:

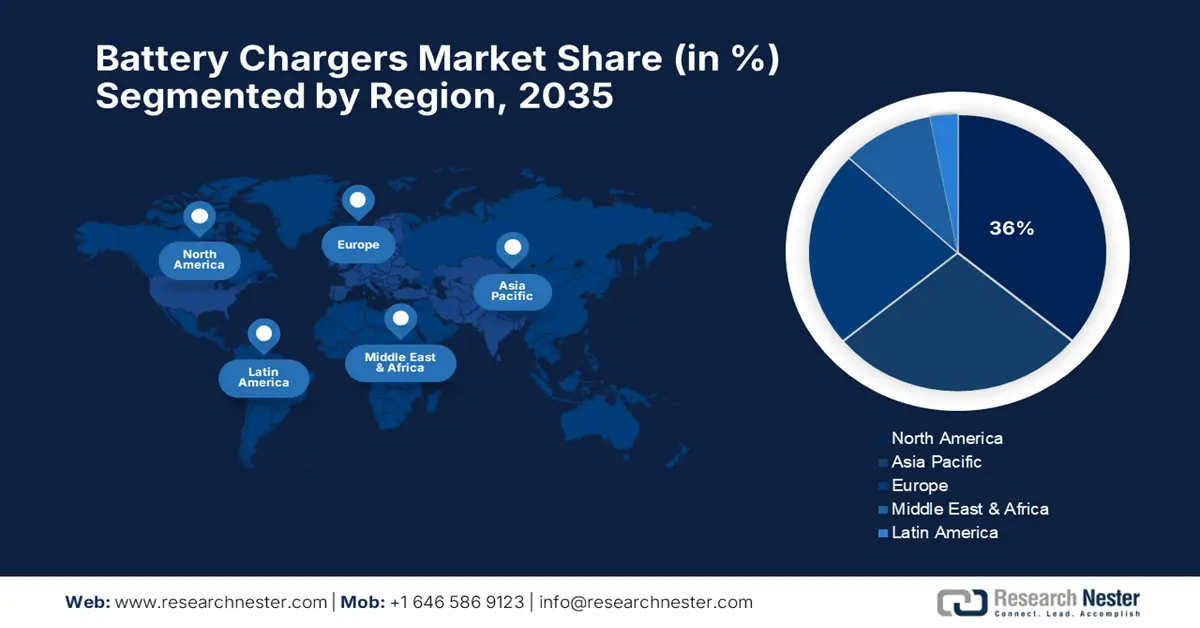

- North America leads the battery chargers market with a 36% share, fueled by strong government support for electric vehicle adoption through 2026–2035.

- The Asia Pacific Battery Chargers Market is set for significant growth through 2026–2035, driven by urbanization, increasing EV adoption, and demand for energy-efficient solutions.

Segment Insights:

- The 5A–15A segment is anticipated to secure a 33% share by 2035, driven by its suitability for moderately fast charging in residential and commercial applications.

- The 6V–12V segment is anticipated to capture more than a 40% share by 2035, fueled by high demand from consumer electronics and electric three-wheeler applications.

Key Growth Trends:

- Electrification of various industries

- Advances in charging technology

Major Challenges:

- Infrastructure limitations

- Regulatory compliance and safety standards

- Key Players: Battery Tender, IOTA Engineering, Lester Electrical, Minn Kota, NOCO, Ctek, Delta-Q Technologies Corp., and Interstate Batteries.

Global Battery Chargers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.35 billion

- 2026 Market Size: USD 1.41 billion

- Projected Market Size: USD 2.2 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Battery Chargers Market Growth Drivers and Challenges:

Growth Drivers

- Electrification of various industries: The rapid growth in the electrification of vehicles and equipment significantly raises the demand for efficient and adaptable battery chargers. The need for advanced charging solutions is significant, especially considering the diversity in battery types and capacities, as more and more industries are turning to electrification. For instance, the adoption of electric vehicles and equipment requires reliable charging solutions. In April 2022, Faraday Future collaborated with Meta System to develop a 15.2 kW AC charging feature for the FF 91 EV. This inherently indicates that high-performance charging remains essential amidst the evolution of electric equipment and vehicles. Such collaborations depict how electrification directly contributes to growth in the battery chargers market.

- Advances in charging technology: With the development of fast-charging technology, the market for battery chargers is poised for rapid expansion. Fast-charging solutions not only cater to consumer demand for reduced wait times but also support the adoption of electric vehicles and equipment by making charging more convenient. In October 2022, Kempower introduced a Megawatt Charging System designed specifically for heavy-duty electric vehicles and machinery, addressing the need for faster, high-capacity charging solutions. These technological improvements reflect a market-shifting movement toward chargers capable of handling demands for both consumer and commercial electric applications.

- Rising demand for renewable energy integration: Another crucial driver influencing the battery chargers market is the greater demand for renewable energy integration into electric grids and charging networks. Renewable power systems require compatible battery chargers able to store energy and efficiently manage the energy gained from sources like solar and wind, hence keeping the power supply stable and reliable. The trend is driving the demand at a rapid pace due to the efforts of many countries toward carbon reduction and green energy initiatives.

Challenges

- Infrastructure limitations: One of the major challenges in the battery chargers market is that several regions suffer from poor charging infrastructure, which is holding back the complete penetration of electric vehicles and equipment. This issue is being dealt with incrementally by governments and private companies, but this slow pace of infrastructure expansion may lead to restricting the growth in the market. Although efforts are being made, this is still an area where accessibility and availability are less, and as a result, the industry faces such challenges.

- Regulatory compliance and safety standards: As the battery chargers market grows, companies will have to follow regulatory standards that are very specific regarding the safety and environmental concerns of such chargers. This requires an ongoing process of investment and adaptation toward upholding such regulations which includes introducing an operational challenge that may impact production schedules along with cost structures. All these factors increase burdens on companies, which makes it necessary to keep up the innovation while meeting high standards for safety and sustainability.

Battery Chargers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 1.35 billion |

|

Forecast Year Market Size (2035) |

USD 2.2 billion |

|

Regional Scope |

|

Battery Chargers Market Segmentation:

Voltage Range (6V-12V, 24V-36V, 48V-72V)

6V-12V segment is set to hold battery chargers market share of more than 40% by 2035, because of demand from consumer electronics, small vehicles, and compact devices. Applications include personal electronics to low-capacity vehicles due to the versatility of 6V-12V chargers. In February 2023, Tube Investments of India announced plans to enter the EV market, highlighting the need for 6V-12V chargers to power its forthcoming electric three-wheelers. Such developments are likely to drive the segment to cater effectively to diverse charging requirements across consumer and industrial applications.

Current Rating (5A-15A, 16A-30A, 31A-50A, 51A-75A)

In battery chargers market, 5A to 15A current rating segment is likely to account for revenue share of around 33% by 2035, due to its applicability to most devices requiring moderately fast charging. Furthermore, its suitability for residential and commercial applications, serving low- to mid-capacity batteries, also fuels the segment’s growth. EnerSys introduced its ODYSSEY battery chargers in September 2022 that provided competent charging in the range of 5A-15A for a variety of battery chemistries. Furthermore, the rising demand for robust and adaptable charging solutions is anticipated to boost the current rating segment’s growth through 2035.

Our in-depth analysis of the global market includes the following segments:

|

Voltage Range |

|

|

Application |

|

|

End user |

|

|

Current Rating |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Chargers Market Regional Analysis:

North America Market Analysis

North America industry is set to account for largest revenue share of 36% by 2035. Strong government support for the adoption of electric vehicles and equipment, coupled with investment plans in charging infrastructure, propels growth in the region. Incentives at the federal level, coupled with programs at the state level, have favored the environment for battery charger manufacturers. Companies are leveraging these policies to expand their product lines and enhance charging capabilities, positioning North America as a leading market for battery chargers.

The U.S. battery chargers market benefits from robust federal incentives that promote the adoption of electric vehicles and equipment and charging infrastructure expansion. In January 2022, HULKMAN launched the Sigma 5 Amp Automatic Car Battery Charger, catering to the growing consumer demand for reliable battery maintenance solutions. This development highlights how the U.S. battery chargers market is evolving with products that support both traditional and electric vehicles and equipment, meeting consumer demand for efficient and accessible charging.

Government initiatives targeted at the development of electric vehicle-related infrastructure and green energy projects are potent drivers of growth in Canada battery chargers sector. As the country's priority for greener transportation and equipment is growing, vast opportunities open for battery charger manufacturers whose solutions blend well with renewable sources of energy. Moreover, new subsidies and grants are being offered at the federal and provincial levels to fast-track electric adoption and expand charging networks across both urban and rural areas. Canada is also committed to clean energy and sustainable transport, hence driving demand for advanced chargers and making Canada an attractive market for manufacturers looking to facilitate the nation's green energy goals.

Asia Pacific Market Analysis

Asia Pacific battery chargers market is set to showcase a strong growth rate between 2025 and 2035. The growth is driven by urbanization, growing adoption of electric vehicles and equipment, and increasing demand for energy-efficient solutions in the region. Many countries in Asia Pacific are investing heavily in electric infrastructure and supporting advanced development in battery charging solutions for consumer and commercial applications. Different policies taken by various governments are promoting and driving electric vehicle adoption that may reduce emissions, hence creating a lucrative landscape for manufacturers of battery chargers.

India battery chargers market is also among the fastest-growing industries as the government has taken initiatives to encourage people towards the use of electric vehicles and renewable energy sources. Policies like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme motivate the development of infrastructure, including battery charging stations. Additionally, these policies are expected to drive private investments into the sector, making India a hub for advanced battery technology.

The battery chargers demand in China is driven by strong government support for clean energy and sustainable transportation. As one of the significant electric vehicle markets, China has implemented policies that push both the manufacturing of electric vehicles and equipment and the building of related infrastructures, such as battery charging stations. In August 2023, Iontra closed a USD 67 million funding round to accelerate its next-generation battery charger MCU, aiming to enter the battery chargers market in Asia Pacific, particularly China. This funding demonstrates the country’s pledge to advance charging technologies so that quicker, efficient solutions can fill the demand gap in the electric vehicle sector.

Key Battery Chargers Market Players:

- Vanner Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Battery Tender

- Schumacher Electric Corporation

- Ctek

- Delta-Q Technologies Corp.

- Interstate Batteries

- IOTA Engineering

- Lester Electrical

- Minn Kota

- NOCO

- ProMariner

- Quick USA

- Samlex America

- Schauer Battery Charger

The competitive outlook of the battery chargers market includes key players like Battery Tender, IOTA Engineering, Lester Electrical, Minn Kota, NOCO, Ctek, Delta-Q Technologies Corp., and Interstate Batteries. These companies have increasingly begun to invest aggressively in product innovation, partnerships, and strategic expansions, ensuring strategic positions and exuberant demand from consumers. Emphasizing sustainability and embedding the use of more advanced technologies into arrays of products aids the players in leading the market, especially in highly attractive regions driven by the adoption of electric vehicles and equipment.

The competitive landscape is further characterized by continuous technological advancement, with several companies striving for differentiation through distinctive offerings and additional value in charging solutions. In February 2024, Nexteer Automotive acquired advanced battery charger technologies from GreenTech Innovations, marking a strategic move to expand its electric vehicle component offerings. This acquisition reflects how competitive the market is since companies are building their technological capabilities for emerging opportunities in electric vehicles and equipment battery charging. Due to the growing electric mobility sector, market competition is likely to intensify during the forecast period.

Here are some leading players in the battery chargers market:

Recent Developments

- In September 2024, Enersys launched a new range of 12V Odyssey battery chargers suitable for AGM, flooded lead-acid, and lithium batteries. This product line is designed to cater to various vehicle applications, including automotive, marine, and recreational vehicles, aiming to meet diverse customer needs in the battery charging market.

- In April 2023, EST-Floattech launched the Octopus Series, a modular maritime battery charger designed to meet the diverse needs of various marine applications. Building on over a decade of experience with their previous Green Orca battery charger, this new series offers enhanced flexibility and scalability for maritime energy solutions.

- Report ID: 6675

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Battery Chargers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.