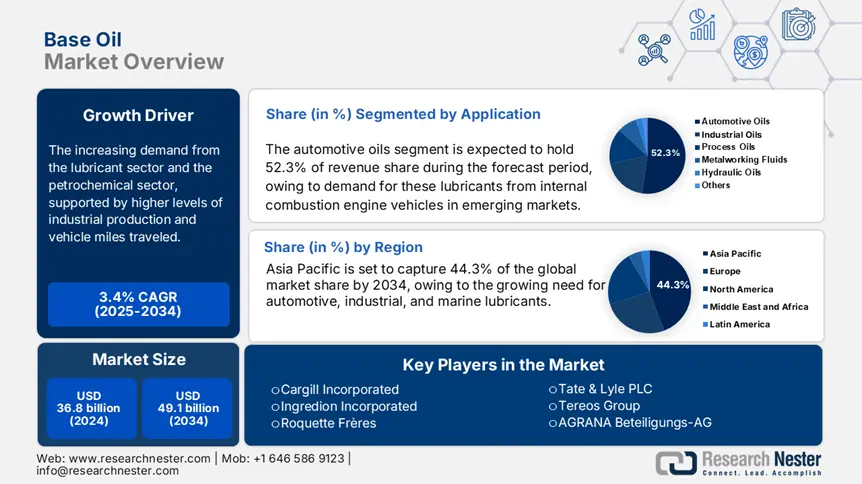

Base Oil Market Outlook:

Base Oil Market size was estimated at USD 36.8 billion in 2024 and is projected to USD 49.1 billion by the end of 2034, rising at a CAGR of 3.4% during the forecast period, from 2025 to 2034. In 2025, the industry size of base oil is estimated at USD 37.8 billion.

The primary driver of growth in the market remains increasing demand from the lubricant sector and the petrochemical sector, supported by higher levels of industrial production and vehicle miles traveled. In the U.S., the Producer Price Index for intermediate goods is reporting a 0.5% month-on-month increase in non-energy processed materials, a category that includes feedstock for base stock, and a 12-month increase of 2.1% as of May 2023. All Consumer Price Indices (CPI) for energy commodities declined 11.61% year-on-year, reflecting a disproportionate downstream pressure to deliver a higher amount of demand to refined lubricants. Government capital provided under current legislation (e.g., CHIPs & Science and bipartisan infrastructure) continues to influence development and deployment investments related to base oil R&D; these investments are aggregated under broader manufacturing grants within the tracking of federal budget programs.

The supply chain for raw materials for base oil (crude oil and non-ferrous additives) has noticeable shifts. Between 2016 and 2021, U.S. crude imports decreased from 9.069 million barrels per day (b/d) down to 7.81 million b/d (-14.1%), contributing to more favorable cost structures for feedstock. Net exports of U.S. petroleum reached +1.20 million b/d in 2022, furthering domestic refinery utilization. The index of U.S. nonfuel imports is reporting an increase of 1.6% year-on-year through March 2023. The increase was led by industrial materials in the export of lubricant products, being assisted by an increase of ~2.6% in export pricing goods to derive competitive returns from most major markets, including non-agricultural goods.