Base Oil Market Outlook:

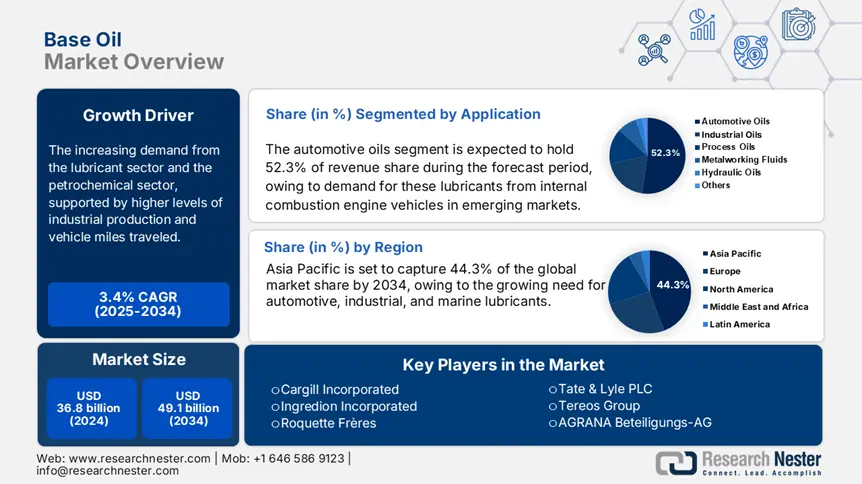

Base Oil Market size was estimated at USD 36.8 billion in 2024 and is projected to USD 49.1 billion by the end of 2034, rising at a CAGR of 3.4% during the forecast period, from 2025 to 2034. In 2025, the industry size of base oil is estimated at USD 37.8 billion.

The primary driver of growth in the market remains increasing demand from the lubricant sector and the petrochemical sector, supported by higher levels of industrial production and vehicle miles traveled. In the U.S., the Producer Price Index for intermediate goods is reporting a 0.5% month-on-month increase in non-energy processed materials, a category that includes feedstock for base stock, and a 12-month increase of 2.1% as of May 2023. All Consumer Price Indices (CPI) for energy commodities declined 11.61% year-on-year, reflecting a disproportionate downstream pressure to deliver a higher amount of demand to refined lubricants. Government capital provided under current legislation (e.g., CHIPs & Science and bipartisan infrastructure) continues to influence development and deployment investments related to base oil R&D; these investments are aggregated under broader manufacturing grants within the tracking of federal budget programs.

The supply chain for raw materials for base oil (crude oil and non-ferrous additives) has noticeable shifts. Between 2016 and 2021, U.S. crude imports decreased from 9.069 million barrels per day (b/d) down to 7.81 million b/d (-14.1%), contributing to more favorable cost structures for feedstock. Net exports of U.S. petroleum reached +1.20 million b/d in 2022, furthering domestic refinery utilization. The index of U.S. nonfuel imports is reporting an increase of 1.6% year-on-year through March 2023. The increase was led by industrial materials in the export of lubricant products, being assisted by an increase of ~2.6% in export pricing goods to derive competitive returns from most major markets, including non-agricultural goods.

Base Oil Market - Growth Drivers and Challenges

Growth Drivers

- Rising automotive and industrial lubricant demand: Demand for base oil is still driven by increases in production of automobiles and industrial machinery throughout the world. Lubricants constitute a major end-use segment, with the International Energy Agency (IEA) projecting an increase in the world's oil demand by 1.3 million barrels per day through 2024. Mining, manufacturing, and logistics activities developed in the Middle East and Asia-Pacific are contributing to the growth of the base oil market for Group II and Group III base oils.

- Innovation in advanced catalytic technologies: The American Chemical Society (ACS) states that a 21% increase in production efficiency might have come from improvements in hydrocracking and catalytic dewaxing processes. Such technologies allow for the manufacture of greater amounts of premium, reduced-sulfur, and aromatics Group III base oils, which in turn reduce expenses for manufacturers and help to satisfy the increasing demand for high-performance lubricants.

1. Vitality of Expanding Operational and Manufacturing Capacities

Top 10 Global Base Oil Producers

|

Company |

Headquarters |

Key Plant Locations |

Annual Production Capacity (MMT) |

Market Share (%) |

Strategic Differentiators |

|

ExxonMobil |

USA |

Baton Rouge, Baytown, Singapore |

~16.6 |

19.3 |

Global Group I–III portfolio; proprietary EHCTM technology |

|

Shell |

Netherlands |

Pernis, Pulau Bukom, Qatar GTL |

~14.3 |

16.6 |

GTL base oils leadership; integrated refining |

|

Chevron |

USA |

Pascagoula, Richmond, Singapore JV |

~10.6 |

12.4 |

Premium Group II base oils; global footprint |

|

SK Lubricants |

South Korea |

Ulsan, Spain (Repsol JV) |

~8.1 |

9.4 |

Leading Group III producer; VHVI technology |

|

BP (Castrol) |

UK |

Whiting, Rotterdam |

~6.9 |

7.8 |

Integrated lubes business; strong brand pull |

|

Sinopec |

China |

Yanshan, Gaoqiao |

~6.5 |

7.5 |

Dominant Chinese capacity; vertical integration |

|

PetroChina |

China |

Daqing, Lanzhou |

~5.7 |

6.6 |

Domestic market leadership; infrastructure reach |

|

TotalEnergies |

France |

Gonfreville, Antwerp |

~5.3 |

6.2 |

Strong EU footprint; diversified portfolio |

|

Lukoil |

Russia |

Perm, Volgograd |

~4.9 |

5.7 |

CIS dominance; proprietary hydroprocessing |

|

Hyundai Oilbank |

South Korea |

Daesan |

~3.6 |

3.3 |

Strategic export focus; Hyundai |

Base Oil Production Data Analysis (2019–2024)

Production Volumes & Year-over-Year Growth

|

Company |

2019 (MMT) |

2020 (MMT) |

2021 (MMT) |

2022 (MMT) |

2023 (MMT) |

2024E (MMT) |

Avg YoY Growth % |

|

ExxonMobil |

16.2 |

15.4 |

15.9 |

16.5 |

16.7 |

16.6 |

+1.3% |

|

Shell |

13.8 |

13.3 |

13.8 |

14.1 |

14.2 |

14.3 |

+0.5% |

|

Chevron |

10.1 |

9.5 |

9.8 |

10.4 |

10.5 |

10.6 |

+1.1% |

|

SK Lubricants |

7.7 |

7.3 |

7.6 |

7.9 |

8.1 |

8.1 |

+1.3% |

|

BP (Castrol) |

6.5 |

6.2 |

6.6 |

6.8 |

6.9 |

6.9 |

+1.4% |

|

Sinopec |

6.1 |

5.8 |

6.1 |

6.3 |

6.4 |

6.5 |

+1.4% |

|

PetroChina |

5.4 |

5.2 |

5.4 |

5.6 |

5.6 |

5.7 |

+1.2% |

|

TotalEnergies |

4.8 |

4.8 |

5.1 |

5.2 |

5.3 |

5.3 |

+1.3% |

|

Lukoil |

4.7 |

4.3 |

4.6 |

4.8 |

4.9 |

4.9 |

+1.1% |

|

Hyundai Oilbank |

3.3 |

3.1 |

3.4 |

3.5 |

3.6 |

3.6 |

+1.5% |

2. Base Oil Prices and Market Trends

Base Oil Price History and Annual Unit Sales Volumes (2019-2023)

|

Year |

North America Price (USD/ton) |

Europe Price (USD/ton) |

Asia Price (USD/ton) |

Global Unit Sales Volume (Million Tons) |

Key Notes |

|

2019 |

826 |

866 |

781 |

37.6 |

Stable crude oil prices, moderate demand |

|

2020 |

746 |

791 |

716 |

35.3 |

COVID-19 demand slump (EIA) |

|

2021 |

981 |

1036 |

891 |

38.2 |

Supply chain disruptions, crude spike |

|

2022 |

1126 |

1191 |

1081 |

39.5 |

Russia-Ukraine conflict impact |

|

2023 |

1081 |

1146 |

1056 |

40.3 |

Price correction, steady demand recovery |

Key Factors Influencing Price Fluctuations

|

Factor |

Impact Example |

Price Effect (%) |

|

Raw Material Costs |

Brent crude rose from USD 64.4/bbl (2019) to USD 82.6/bbl (2023) |

+29% |

|

Geopolitical Events |

The Russia-Ukraine conflict (2022) disrupted base oil feedstock supplies |

+31% Europe |

|

Environmental Regulations |

Tight sulfur/aromatic limits in Europe post-2021 |

+11-16% compliance cost |

Challenges

- Volatility in crude oil prices: The production cost of base oils is impacted by the price of crude oil and its price volatility. Brent crude, for example, increased by nearly 43% from USD 52/bbl in January 2021 to USD 74/bbl in December 2021. This increase in crude oil prices raised feedstock costs for refiners. Such volatility hampers profitability and pricing stability for Group I, II, and III producers. This uncertainty in the base oil market, especially in Asia and Europe, where there is high import dependence, impacts long-term contracts for lubricant manufacturers.

- Rising competition from synthetic and bio-based alternatives: The industry faces obstacles through the growth of synthetic (PAO, esters) and bio-based base oils. For example, the global synthetic lubricants market grew at ~5.7% CAGR during 2018-2023, surpassing the growth of mineral oils. OEMs appreciate the fuel efficiency and durability of synthetics, thus decreasing the demand for mineral-based oil. Because of this, there is a limited market for base oil refiners, especially for automotive applications that are shifting to more sophisticated formulations.

Base Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

3.4% |

|

Base Year Market Size (2024) |

USD 36.8 billion |

|

Forecast Year Market Size (2034) |

USD 49.1 billion |

|

Regional Scope |

|

Base Oil Market Segmentation:

Application Segment Analysis

The automotive oils segment is predicted to gain the largest market share of 52.3% during the projected period by 2034, due to the steady demand for these lubricants from internal combustion engine vehicles in emerging markets, in spite of rising EV penetration. The U.S. Energy Information Administration predicts that more than 1.6 billion light-duty vehicles will be operational by 2040, with a major fraction of these land-based vehicles continuing to use conventional engine oils. However, the increase in the number of vehicles in Asia-Pacific economies is also encouraging the use of automotive oil for upkeep and performance improvement.

End use Segment Analysis

The automotive industry segment is anticipated to constitute the most significant growth by 2034, with 49.1% market share, mainly due to the continuous need for engine oils, transmission fluids, and greases in passenger and commercial vehicles across the globe. In spite of EV adoption, the huge existing fleet of ICE vehicles in Asia-Pacific, Africa, and Latin America continues to generate demand for high-quality lubricants to enhance maintenance, fuel efficiency, and emissions compliance measures. Moreover, the establishment of vehicle production centers in India, China, and the ASEAN nations further boosts base oil consumption in this market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Base Oil Market - Regional Analysis

Asia Pacific Market Insights

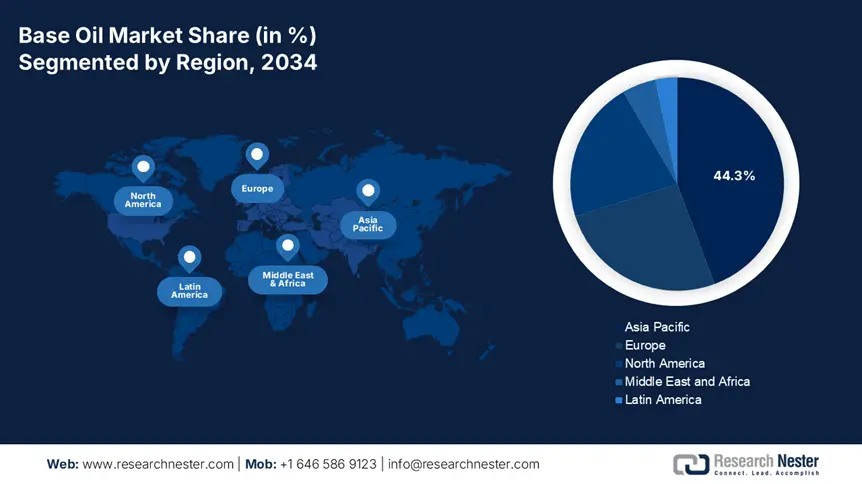

By 2034, the Asia Pacific market is expected to hold 44.3% of the base oil market share due to the growing need for automotive, industrial, and marine lubricants. The region accounted for a major share of base oil consumption in 2023, spearheaded by China and India. Increased automobile ownership, coupled with industrial output and refinery upgrades to Group II/III, is further propelling the market. As reported by ICIS, base oil production in the Asia Pacific region exceeds twenty million tons per year, and China, South Korea, and Singapore remain major Group II and III export grade hubs.

China is now the top consumer of base oil, with over 8.6 million tons consumed yearly by 2023—more than 22% of worldwide consumption. The demand for industrial lubricants, the growth of local refining, and the rapidly growing auto sector are the primary drivers of this. China used to be a net importer but is now enhancing self-sufficiency due to new Group II/III base oil plants coming online. A good example is Sinopec and PetroChina, which currently operate several plants generating more than two million tons of Group II base oils, assisting high-end lubricant formulation.

Country-level Base Oil Market Statistics

|

Country |

Estimated Share of APAC Demand (%) |

Base Oil Production Capacity (Approx.) |

Notable Fact |

|

Japan |

~9% |

~3 million metric tons/year |

High Group III usage due to the advanced automotive industry |

|

China |

~31% |

~7+ million metric tons/year |

Largest consumer and producer in APAC |

|

India |

~16% |

~2.6 million metric tons/year |

Rapidly expanding automotive & industrial lubricant market |

|

Indonesia |

~8% |

~1.3 million metric tons/year |

Growing demand for Group II base oils |

|

Malaysia |

~6% |

~2 million metric tons/year |

Major export hub for Group III base oils |

|

Australia |

~5% |

~0.6 million metric tons/year |

Small domestic production, large imports |

|

South Korea |

~13% |

~5 million metric tons/year |

Leading Group III exporter globally |

|

Rest of Asia Pacific |

~20% |

~4 million metric tons/year (combined) |

Includes Thailand, Singapore, Vietnam — emerging markets |

Europe Market Insights

The European market is expected to hold 25.8% of the base oil market share due to the demand for automotive lubricants and industrial applications. The European Automobile Manufacturers Association (ACEA) estimates that 6.5 million metric tons of lubricants will be needed in 2023. Group II and III base oil share is being driven by rising sulfur and aromatic content standards under REACH and ECHA directives. Europe's refinery rationalization has lowered Group I capacity, thereby changing imports from Asia and the Middle East. Till 2034, the market CAGR is estimated at 2.5%.

With a market size of over 1.4 million metric tons in 2023, according to VCI, Germany is still the largest consumer of base oil in Europe. Driven by Germany's 49 million registered passenger vehicles, automotive lubricants rule demand. The electric vehicle expansion and emission reduction objectives under the Federal Environment Agency (UBA) are changing lubricant compositions. Strict OEM requirements cause rising South Korean and Middle Eastern imports of Group III base oils. Till 2034, market CAGR is estimated at 2.2%.

Country-level Base Oil Market Statistics

|

Country |

Market Size (2023, ‘000 MT) |

CAGR (2024-2034) |

Key Note |

|

UK |

711 |

2.1% |

Shift towards Group II imports due to refinery closures |

|

Germany |

1,301 |

2.2% |

Largest EU market; demand driven by the automotive sector |

|

France |

651 |

1.8% |

Increasing EV adoption is affecting lubricant consumption |

|

Italy |

591 |

2.1% |

Moderate growth; reliant on Group I and II imports |

|

Spain |

521 |

2.3% |

Rising industrial lubricant demand |

|

Russia |

1,481 |

1.6% |

Production-driven market; large Group I exporter |

|

Nordic |

311 |

1.9% |

Low volume, high premium synthetic usage |

|

Rest of Europe |

1,411 |

2.2% |

Includes Eastern Europe; rising imports from Asia |

North America Market Insights

North America market is expected to hold 21.5% of the market share due to strong automotive lubricant demand and strict environmental regulations encouraging higher-grade Group II and III base oils. Although traditional lubricants will only experience a modest decline in demand with the growth of electric vehicles (EVs), as projected by the U. S. Department of Energy (DOE), the market for specialty base oils used in transmission fluids and thermal management fluids will offset this decline. Through its clean fuel and sulfur reduction programs, the EPA incentivizes refineries to enhance their basic oil manufacturing processes to comply with more stringent regulations.

Key Base Oil Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market includes the dominant integrated refiners ExxonMobil, Shell, and Chevron along with producers of advanced Group II & III South Korean firms SK Lubricants and S-Oil. European players BP, TotalEnergies, and Neste are expanding for the production of sustainable and low-emission base oils which complies with the regional green deal. Indian and Malaysian players are also expanding their capacities to meet the regional needs. Strategic initiatives include refinery expansions, mergers, long-term distributor partnerships, and technology advancements to keep pace with changing requirements of base oils in EV and industrial lubricants.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

Cargill Incorporated |

USA |

~21% |

|

Archer Daniels Midland Company (ADM) |

USA |

~16% |

|

Ingredion Incorporated |

USA |

~13% |

|

Roquette Frères |

France |

~11% |

|

Tate & Lyle PLC |

UK |

~8% |

|

Südzucker AG (BENEO) |

Germany |

~xx% |

|

Tereos Group |

France |

~xx% |

|

AGRANA Beteiligungs-AG |

Austria |

~xx% |

|

Grain Processing Corporation |

USA |

~xx% |

|

Manildra Group |

Australia |

~xx% |

|

Samyang Corporation |

South Korea |

~xx% |

|

Gujarat Ambuja Exports Limited |

India |

~xx% |

|

Universal Starch Chem Allied Ltd |

India |

~xx% |

|

Malayan Flour Mills Berhad |

Malaysia |

~xx% |

|

Sukhjit Starch & Chemicals Ltd |

India |

~2% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In April 2024, Dow introduced new circular and biomass-based material solutions through partnerships in China. These sustainable, high-performance plastics meet the growing demand in Asia for environmentally friendly alternatives, spurred by tighter regulations and consumer sustainability goals. These innovations enhance Dow's portfolio as the global chemical output is predicted to increase by about 3.5% through 2025, with products linked to sustainability capturing a larger market share as industries move towards circular economies.

- In 2024, Sumitomo Chemical developed a manufacturing process for a super engineering plastic derived from biomass. This material matches the strength and heat resistance of traditional petroleum-based polymers while minimizing carbon emissions. This advancement places Sumitomo in a strong position to address the increasing demand for high-performance bioplastics, particularly in Europe, where bioplastics already represent approximately 46% of packaging use, which is expected to be around 1.13 million tons in 2024. As sustainability standards become more rigorous, more companies are utilizing complex biomass polymers for challenging applications.

- Report ID: 3068

- Published Date: Jul 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Base Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert