Barite Minerals Market Outlook:

Barite Minerals Market size was valued at USD 1.8 billion in 2025 and is projected to reach USD 2.7 billion by the end of 2035, rising at a CAGR of 4.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of barite minerals is evaluated at USD 1.9 billion.

The primary growth driver of the global barite minerals market is the steady and rising demand from the oil and gas industry, for which barite has widespread use as a weighting agent in drilling fluids, offering wellbore stability and preventing blowouts during drilling. Rising global production and drilling, driven by shale plays, offshore Deepwater drilling, and improved recovery programs, are propelling high-grade barite demand. Upstream oil and gas infrastructure investments, growth, and rising energy demand in emerging countries are expected to drive the market during the forecast period. For instance, according to researchers, 90% of the natural gas and 75% of the crude oil produced in the U.S. are currently produced domestically. In 2021, its daily production was approximately 100 billion cubic feet of gas and 11 million barrels of crude oil. Similarly, the Asia-Pacific and Middle East are witnessing vibrant exploration and development activity driven by increasing domestic consumption and export-led production.

The supply of barite mineral heavily depends on high-quality barite from major mining regions such as China, India, Morocco, and the USA. Barite production for drilling must be carefully controlled to meet the specific gravity and purity standards required by the oil and gas industry. Due to the lack of publicly available government data on detailed factors such as raw material price indexes or barite R&D expenses, international trade information provides more clues about market trends. For example, OEC statistics highlight China's role as the leading exporter of barite, with over USD 144 million in 2024. This is driven by its strong downstream industrial base and focus on exports.

Key Barite Minerals Market Insights Summary:

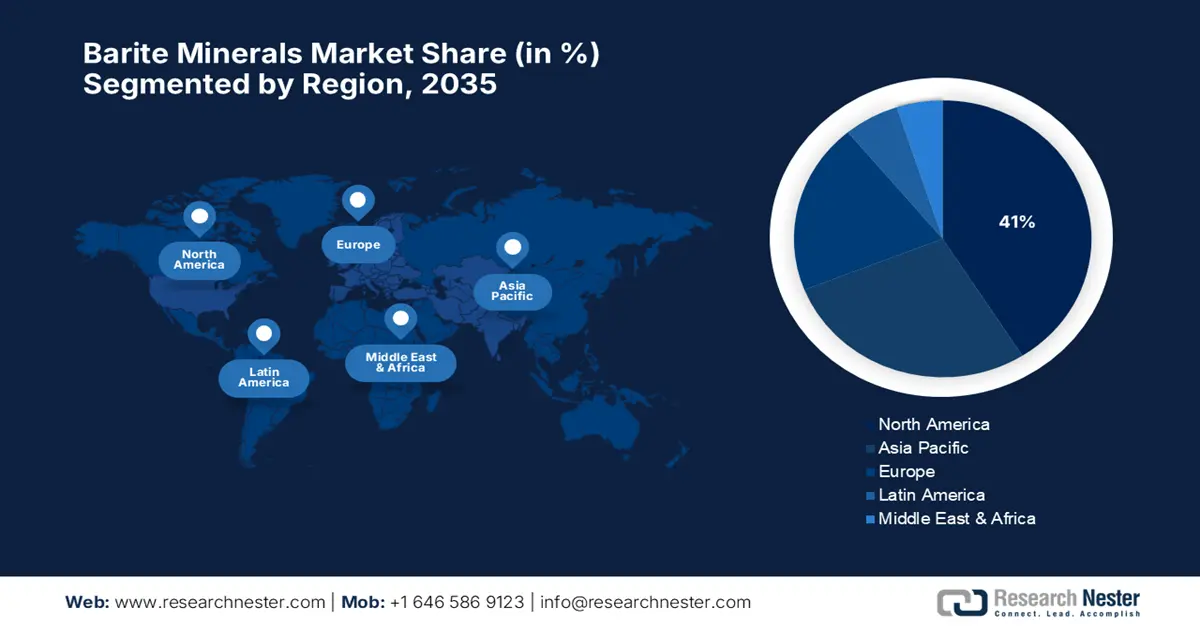

Regional Insights:

- North America is projected to hold about 41% share of the Barite Minerals Market by 2035, underpinned by expanding shale oil production and advanced drilling infrastructure across major U.S. basins.

- Asia Pacific is estimated to capture around 29% share by 2035, stimulated by intensified exploration and production initiatives in China, India, and Australia.

Segment Insights:

- The Natural Barite segment is projected to account for 81% share by 2035 in the Barite Minerals Market, propelled by extensive oil and gas exploration and the abundant availability of high-purity natural reserves.

- The Oil-Grade Barite segment is anticipated to secure a dominant 73% share by 2035, owing to its critical role in drilling mud formulations for oil well stabilization and blowout prevention.

Key Growth Trends:

- Surge in oil & gas exploration activities

- Regulatory changes impacting production costs

Major Challenges:

- Regulatory compliance and environmental restrictions

- Fluctuating raw material prices and supply chain disruptions

Global Barite Minerals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 2.7 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Saudi Arabia

- Emerging Countries: Brazil, Australia, United Arab Emirates, Mexico, Indonesia

Last updated on : 25 September, 2025

Barite Minerals Market - Growth Drivers and Challenges

Growth Drivers

- Surge in oil & gas exploration activities: The global energy demand increased by 2.2% in 2024, which was much higher than the 1.3% yearly average observed from 2013 to 2023, creating more oil and gas drilling operations. As barite is a primary weighting additive in the drilling fluids, it is critical in ensuring wellbore stability and protection against blowouts. The continued growth of technology surrounding hydraulic fracturing and horizontal drilling has further caused greater demand for quality barite. For example, by 2040, shale gas output is expected to more than double from 37 billion cubic feet per day in 2015 to 79 Bcf/d, or 70% of total U.S. natural gas production in the AEO2016 Reference case, an indicator of the significance of barite as a part of unconventional drilling.

- Regulatory changes impacting production costs: Recent regulations, such as the strict regulations by the U.S. Environmental Protection Agency on the composition of the drilling fluid, have promoted the use of environmentally friendly barite substitutes. The regulation has prompted research and development investments as companies favor green processing methods. By 2040, shale gas output is expected to be 50% greater in the High Oil and Gas Resources and Technology case, reaching 112 Bcf/d, and 50% lower than under the Reference case, reaching 41 Bcf/d, under the Low Oil and Gas Resources and Technology case.

- Technological innovations enhancing production efficiency: Barite mining is getting modernized through the implementation of artificial intelligence and machine learning in the extraction industries. Probing further behind the curtains, AI-driven technologies optimize resource extraction, minimize operation costs, and improve product quality. The companies that have tested AI and implemented it into their mining operations experienced cost reduction in production and in resource recovery rates. All these advances are bringing cost savings and sustainable growth for the barite market.

Emerging Trade Dynamics in the Barite Minerals Market

Export and Import Data of Natural barium sulphate (barytes) in 2024

|

Exporting Country |

Value (USD Million) |

Importing Country |

Value (USD Million) |

|

United States |

34.5 |

Laos |

2.68 |

|

Netherlands |

27.3 |

Myanmar |

0.458 |

|

Saudi Arabia |

18.3 |

Germany |

0.287 |

|

South Korea |

9.71 |

Spain |

0.276 |

|

Italy |

6.77 |

Japan |

0.141 |

Source: OEC

Challenges

- Regulatory compliance and environmental restrictions: Reducing environmental regulations in leading producing regions is increasingly hindering compliance expenses on barite processing and mining plants. Such regulations entail high-cost waste handling, emissions, and environmentally friendly mining upgrades. This exposes producers to higher operating expenses and project completion durations. Such regulations increase entry barriers and limit growth prospects, thus inhibiting aggregate market expansion as well as supply chain dependability for downstream oil and gas drilling end-users

- Fluctuating raw material prices and supply chain disruptions: The barite minerals market is still highly vulnerable to raw material price fluctuations and periodic supply chain interruptions due to geopolitical tensions and transportation. Raw material price volatility increases procurement costs for industrial buyers, while erratic supply affects project and production schedules timing to be carried out. These issues reduce market foresight ability, discourage long-term contract agreements, and cause end-users to turn to alternative materials, thereby suppressing uniform demand growth and limiting market scalability in headline markets like oil and gas drilling.

Barite Minerals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 2.7 billion |

|

Regional Scope |

|

Barite Minerals Market Segmentation:

Source Segment Analysis

Natural barite is expected to dominate the source segment with 81% market share by 2035. Natural barite is highly available and contains high-purity content, and therefore, it is the material of choice to use in oilfields, especially drilling fluids. Natural barite demand comes from continuing oil and gas exploration across the world, where artificial alternatives are still more costly and not as readily available. Geographic regions with significant natural reserves, such as the U.S., China, and India, also provide a rationale for the widespread market presence of natural barite.

Grade Segment Analysis

Oil-grade barite is expected to hold a leading 73% market share in the grade segment by 2035. Its purity and high density qualify it as a vital ingredient of drilling mud used in oil wells for formation stabilization and prevention of blowouts. About 80% of the barytes produced globally are used in oil and gas drilling as a weighing agent in the drill mud, mainly to stop the gas and oil from exploding when drilling. The United States Geological Survey points out that oil-grade barite prevails in global consumption of barite, specifically in oil-producing nations such as North America and the Middle East, where drilling complexity and depth continue to increase.

End-Use Segment Analysis

Oil & Gas is expected to hold a 71% market share in the end-use industry segment by 2035. The segment is led by continued world energy demand and exploration technology investment targeting offshore and shale reservoirs. With increasing well depth and drilling complexity, the use of barite in exploration drilling fluids is expected to likewise increase. Drilling requires barytes powder with a specific gravity of 4.15 and a minimum of 90% barium sulphate. The specific gravity for offshore drilling should be 4.2. 95% of ground barytes should flow through a 53-micron IS sieve and at least 97% via a 75-micron IS sieve. The U.S. Energy Information Administration foresees continued growth in exploration spending, maintaining barite's essential role in attaining borehole stability and drilling safety.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Source |

|

|

Grade |

|

|

End user |

|

|

Application |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Barite Minerals Market - Regional Analysis

North America Market Insights

North America is expected to hold about 41% of the world's barite minerals market size by 2035. Demand is driven by robust oil and gas exploration in major U.S. shale assets such as the Permian, Eagle Ford, and Bakken. Experienced drilling technologies and infrastructural development in the region are driving demand for quality barite as a top-weight agent in drilling fluids. With an average of 12.4 million barrels per day (b/d) in 2023 and 12.8 million b/d in 2024, U.S. crude oil output in January 2023 surpassed the previous record of 12.3 million b/d set in 2019. The United States produced an average of 11.9 million barrels of crude oil per day in 2022. Growing production in the Permian and, to a lesser degree, the Federal Offshore Gulf of Mexico (GOM) is what propels our production growth prediction.

The U.S. is a market leader and is expected to hold approximately 31.2% of the global barite minerals market share by 2035. Investment by the government in infrastructure development and policy incentives for safer drilling technology also fuel barite demand. Drilling rig counts, both domestically and internationally, have historically been a reliable indicator of barite consumption, and they grew throughout 2021. This pattern was evident in domestic ground barite sales, which grew by 6% in 2021, mostly due to higher sales in Texas. An 8% increase in global mine production was estimated. Additionally, government efforts in promoting efficient and safer drilling also raise demand for high-quality oil-grade barite.

Canada is expected to command a global share of the market for barite at approximately 11% in 2035 due to the oil sands and offshore oil exploration in the Atlantic basin. The forecast of oil production development is accomplished by the Canadian Energy Regulator with the help of developing technologies in extraction systems. By 2040, it is anticipated that shale gas output in Canada will have increased to about 30% of the country's total natural gas production. Pipeline infrastructure investment and colorization laws boost the demand for high-quality barite, an essential in controlling drilling fluid density and wellbore stability.

Asia Pacific Market Insights

Asia Pacific is set to account for around 29% of the global barite minerals market share by 2035, following increasing oil and gas exploration and production in leading economies in the region, including China, India, and Australia. Energy demand and oil and gas exploration and production in the region drive high-value onshore and offshore drilling activities. For example, Chinese officials continue to invest whopping amounts in oil pipelines and non-traditional oil fields, with energy spending growing during the forecast period.

China is projected to hold the highest market share in the region and is expected to capture nearly 16.2% of the global barite minerals market in 2035. China's growing offshore oil exploration and unconventional drilling operations, which have been motivated by the 14th Five-Year Plan, are reshaping the consumption pattern. According to Chinese customs data, China, the world's largest importer of crude oil, imported 11.3 million barrels per day (b/d) in 2023, a 10% increase over 2022. In 2023, China purchased 1.1 million barrels of crude oil per day, 54% higher than in 2022, from Malaysia. China raised its imports of crude oil from the United States by 81%, from 158,000 barrels per day to 286,000 barrels per day, and from Brazil by 52%, from 498,000 barrels per day to 755,000 barrels per day, in 2023. This supports the ongoing use of barite due to rising drilling activity.

India is expected to hold around 8.7% of the global barite market share in 2035 and become a high-growth center. Government initiatives such as the National Infrastructure Pipeline and the PLI scheme for the energy sectors are driving exploration and production activity. The Bombay High Oilfields account for 65% of all crude oil output and are the main oil-producing fields along India's western coast. About 35 million tons of crude oil and 40,000 billion cubic meters of natural gas were the field's reserves. Presently, 82% of India's oil needs are imported. However, by 2025, it is expected to reduce this by 67% through the use of domestic ethanol fuel, renewable energy, and the exploration of other local resources. The Western Offshore (37%) and Assam (27%) have the largest oil and gas deposits in India. By 2040, India's oil consumption is predicted to rise by over 3.3 billion barrels a year.

Oil Fields Percentage in India

|

State/Sector |

Percentage |

|

Offshore |

48% |

|

Rajasthan |

24% |

|

Gujarat |

13% |

|

Assam |

12% |

|

Others |

3% |

Source: oercommons.org

State-wise Production of Barytes

|

State |

2019-20 |

2020-21 |

|

Andhra Pradesh |

2735439 |

1212038 |

|

Rajasthan |

3000 |

3287 |

|

Telangana |

150 |

- |

|

Karnataka |

345 |

1596 |

Source: ibm.gov

Europe Market Insights

Europe is also expected to gain a share of about 20% of the world barite minerals market by 2035, driven by growth on the back of increased offshore North Sea drilling and clean energy transition expenditure. With oil production from mature fields declining, new exploration, development, and enhanced recovery methods continue to propel barite consumption. Europe's focus on green energy and environmental legislation is said to be encouraging the demand for high-purity barite in ecologically friendly drilling fluids. The European Commission indeed forecasts offshore investment for oil and gas infrastructure in Europe to rise during the forecast period, ensuring steady consumption of barite on the continent.

Germany is expected to dominate Europe with an estimated 4.4% market share in the overall world market for barite minerals by 2035. Investments and explorations in offshore, particularly in the North Sea, and energy transition and EOR or enhanced oil recovery investments are stimulating the interest of the German nation in offshore oil and gas investments, which is expected to grow at a CAGR of 4.3% over the entire forecast period. Germany's primary energy usage in 2024 was 10,478 Petajoules, of which over 77% came from fossil fuels and 20% from renewable sources. With a share of 36.1%, oil continued to be the most significant energy source, followed by natural gas at 25.9%. Lignite made up 7.6% and hard coal 7.3%. Demand for drilling products such as barite is therefore maintained at a constant growth throughout the entire period.

Key Barite Minerals Market Players:

- Excalibar Minerals LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ashapura Minechem Limited

- Milwhite Inc.

- CIMBAR Performance Minerals

- APMDC (Andhra Pradesh Mineral Development Corp.)

- Sachtleben Minerals GmbH & Co. KG

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Incorporated

- Anglo Pacific Minerals

- International Earth Products LLC

- New Riverside Ochre Company, Inc.

- Deutsche Baryt Industrie

- Sojitz Corporation

- Buckman (Japan Division)

The global market is moderately fragmented: top-tier producers such as Excalibar Minerals (USA), Ashapura Minechem (India), Milwhite Inc. (USA), and Sachtleben Minerals (Germany) account for nearly 45% of the market share. Key strategies include vertical integration, capacity expansion, and specialty processing to serve oil and gas drilling grade and high-purity industrial uses. Companies like Schlumberger, Halliburton, and Baker Hughes leverage their global service networks and invest in eco-friendly barite processing, AI integration, and strategic third-party partnerships to secure supply and differentiate offerings. Sojitz (Japan) operates via global mining investments and trading platforms.

Top Global Barite Minerals Manufacturers

Recent Developments

- In December 2022, CIMBAR Resources, Inc. officially completed its acquisition of the Excalibar Minerals LLC barium sulfate assets from Newpark Resources. This transaction bolstered CIMBAR’s production capacity and extended its supply footprint in the U.S., Mexico, China, and Pakistan, strengthening barite product availability and continuity across drilling-grade portfolios.

- In March 2021, CIMBAR Performance Minerals (a division of United Minerals & Properties) announced the acquisition of TOR Minerals North American barite and alumina trihydrate manufacturing assets in Corpus Christi, Texas, enhancing its operational base for high-grade barite production for the drilling fluids market.

- Report ID: 8123

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Barite Minerals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.