Barge Transportation Market Outlook:

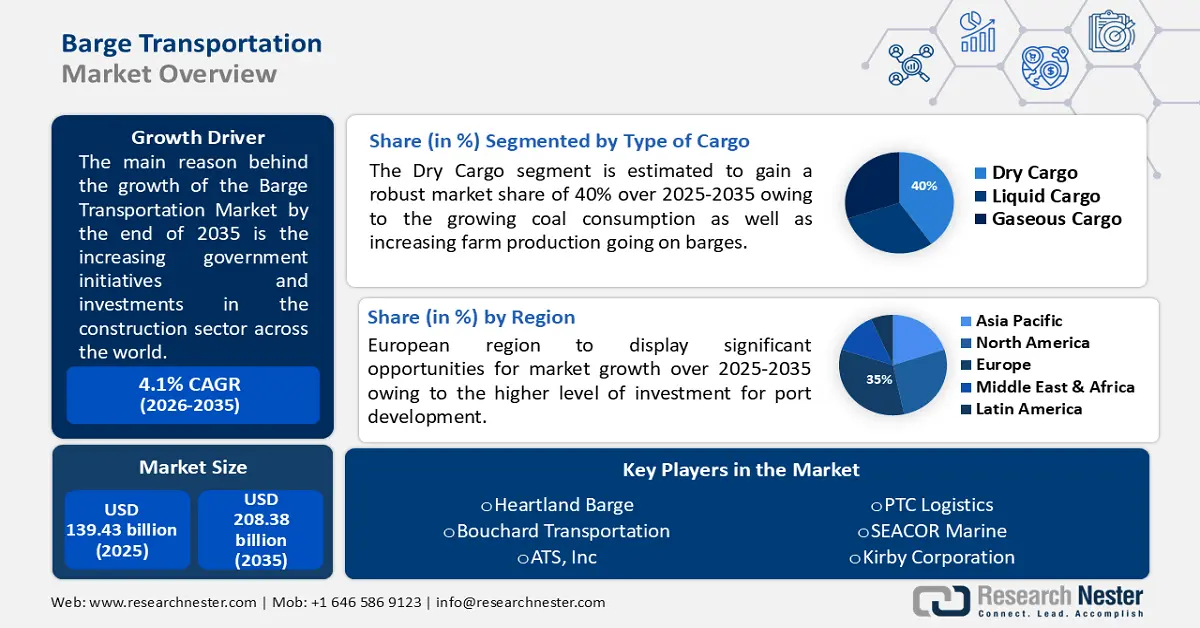

Barge Transportation Market size was valued at USD 139.43 billion in 2025 and is expected to reach USD 208.38 billion by 2035, expanding at around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of barge transportation is evaluated at USD 144.57 billion.

Barges have a substantial carrying capacity, thus, they can be regarded as the perfect kind of transportation for moving large quantities of goods. A river barge, for example, has a carrying capacity of about 1,500 tons, which is fifteen times the carrying capacity of a 100-ton jumbo hopper train car and sixty times the carrying capacity of a trailer truck with a 25-ton carrying capacity.

The market has enormous growth potential in the upcoming years due to a number of factors, including the rise in government investments and initiatives for the construction of efficient inland water infrastructure and the research and development efforts of major industry players to create new and improve existing barge designs. For example, hybrid LNG barges are an environmentally beneficial and fuel-efficient substitute for traditional diesel-fired barges.

Key Barge Transportation Market Insights Summary:

Regional Highlights:

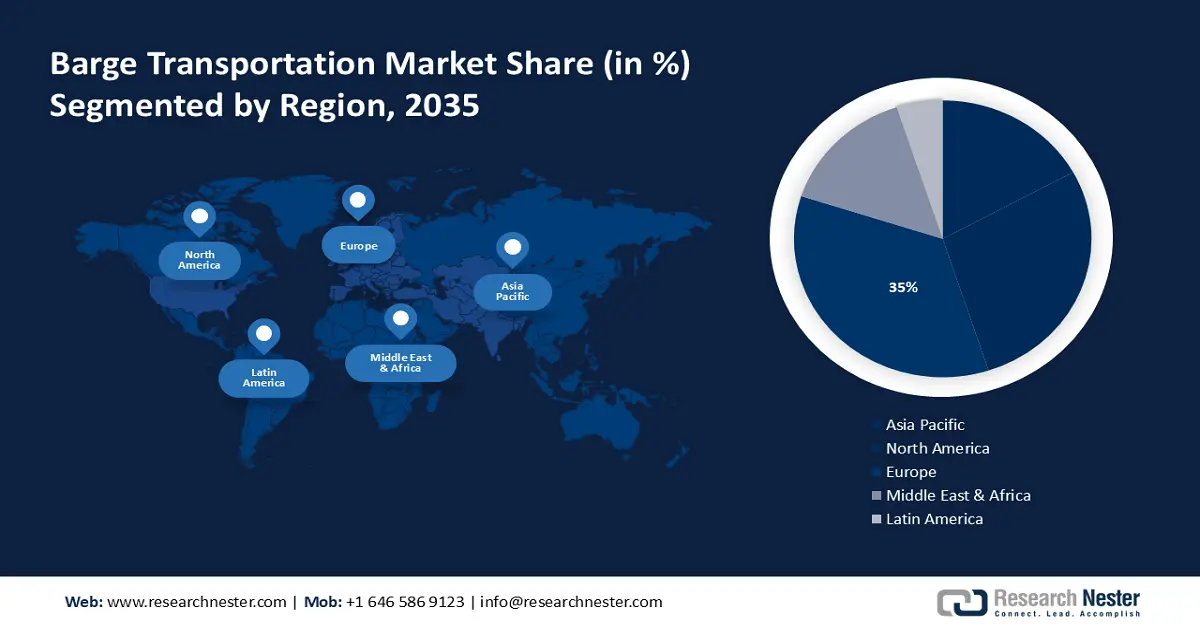

- Europe barge transportation market will hold more than 35% share by 2035, driven by increased investment in port development and bulk trade.

- North America market will attain a 28% share by 2035, fueled by a well-established inland waterway infrastructure and shale oil production.

Segment Insights:

- The dry cargo segment in the barge transportation market is anticipated to experience robust growth through 2035, driven by the growing need for cost-effective transport of dry bulk like iron ore and timber.

- The crude & petroleum products segment in the barge transportation market is poised for substantial growth through 2035, driven by increasing demand for crude oil and ethanol production.

Key Growth Trends:

- Escalating export and import trade

- Boom in the trade for metal ores

Major Challenges:

- Weather reliability

- High transportation rates and infrastructure limitation is also anticipated to hinder market growth.

Key Players: Kirby Corporation, SEACOR Marine, PTC Logistics, ATS, Inc., Bouchard Transportation, Heartland Barge.

Global Barge Transportation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 139.43 billion

- 2026 Market Size: USD 144.57 billion

- Projected Market Size: USD 208.38 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Netherlands, France

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Barge Transportation Market Growth Drivers and Challenges:

Growth Drivers

- Escalating export and import trade - In particular, better economic circumstances in the majority of the world's economies together with increasing export and import commerce are significantly contributing to the barge transportation market revenue. An effective form of transportation is becoming more and more necessary as domestic trade grows.

- Boom in the trade for metal ores - Given the increased global trade in metals and minerals, metal ore is estimated to capture a large part of the industry's share during this period. Brazil is the world's largest supplier of iron ore and has a significant role to play in exports. Export and import volumes in each developing country are rising very significantly. Moreover, demand for metal ores is boosted by increased sales of vehicles and a growth in construction activity.

- Infrastructure development leads to better connectivity - For the growth of the barge transport market, the expansion and modernization of inland waterway infrastructure is a fundamental pillar. The efficiency and reliability of barge transport are greatly enhanced by investments in waterway infrastructure, such as the development of locks, dams, or navigational aids. With enhanced infrastructure, it is a more attractive option for shippers, reducing transit times and increasing the safety and reliability of waterborne transport.

Challenges

- Weather reliability - Barge transportation is widely impacted by weather conditions. Low water levels owing to drought or ice cover in winter can significantly hinder navigation and limit cargo capacity. This can lead to delays and disruption in deliveries.

- High transportation rates and infrastructure limitation is also anticipated to hinder market growth.

Barge Transportation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 139.43 billion |

|

Forecast Year Market Size (2035) |

USD 208.38 billion |

|

Regional Scope |

|

Barge Transportation Market Segmentation:

Application Segment Analysis

In terms of application, the crude & petroleum products segment is anticipated to account for the largest barge transportation market share of 15% during the time period. This can be attributed to escalating demand for coal. In addition, the growth of this segment is supported by rising demand for crude oil and an increase in ethanol production.

As per research, the global demand for crude oil comprising biofuels was 99.57 million barrels per day in the year 2022 and is poised to grow to 101.89 million barrels per day by the end of 2023. As a result of strict regulations being drawn up by various governments to reduce air pollution and prevent environmental damage caused by burning, coal consumption has declined in recent times. In parallel, there has been a growing trend towards the use of clean and lower-cost fuels like gas.

Type of Cargo Segment Analysis

The dry cargo segment is set to hold 40% barge transportation market share by the end of 2035, impelled by the increased volumes of farm produce going on barges. The growth of the market is expected to be further supported by a growing need for cost-effective transport of products such as iron ore, steel, timber, and gravel around the world. However, dry cargo segment growth is likely to be slowed down in the coming years due to a diminishing demand for coal.

Our in-depth analysis of the global market includes the following segments:

|

Type of Cargo |

|

|

Barge Fleet |

|

|

Activities |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Barge Transportation Market Regional Analysis:

European Market Insights

The Europe industry is poised to account for largest revenue share of 35% by 2035. Over the years, the European barge transport industry has been positively influenced by increasing investment in port development. For example, QTerminals announced a USD 120 million investment in the development of its port terminal in Ukraine in February 2020. The development of ports has led to increased oil and bulk trade, containers, and work for tugs in the country. A network of 2,000 kilometers of inland waterways in the United Kingdom offers ample opportunities for service providers to compete in the market.

The demand for barges in the region is being driven by factors such as improving economic conditions and a well-established network of inland waterways. The Netherlands has developed waterways to a high standard. In addition, various initiatives have been implemented by the Netherlands Government to develop a barge transportation management system in that country.

North American Market Insights

The barge transportation market share in the North America region is estimated to reach 28% by the end of 2035. The market in this region is driven by a well-established inland waterway infrastructure in the United States.

The United States is a resource-rich country in need of an efficient transportation network. With that in mind, a significant infrastructure of locks and dams, water storage reservoirs, hydropower stations, levees, and other facilities are located there which bodes well for the sector. There is also a huge potential for barge transport due to an increase in shale oil production in the U.S.

Barge Transportation Market Players:

- Campbell Transportation Company, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alter Logistics

- American Commercial Lines LLC

- Heartland Barge

- Kirby Corporation

- SEACOR Marine

- PTC Logistics

- ATS, Inc.

- Bouchard Transportation

- Heartland Barge

Recent Developments

- Campbell Transport Company, Inc. acquired the marine assets of E Squared Marine Service, LLC., a tank barge company located in Houston, Texas, in April 2022. In order to expand Campbell's tank barge operation in Houston, this is an important acquisition.

- CTC Campbell Transportation Company, Inc. has signed an agreement to buy the majority of NGL Maritime, LLC's assets by the end of March. Campbell's strategic objective to expand its maritime business will be further strengthened by this acquisition.

- Report ID: 6011

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Barge Transportation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.