Banking as a service Market Outlook:

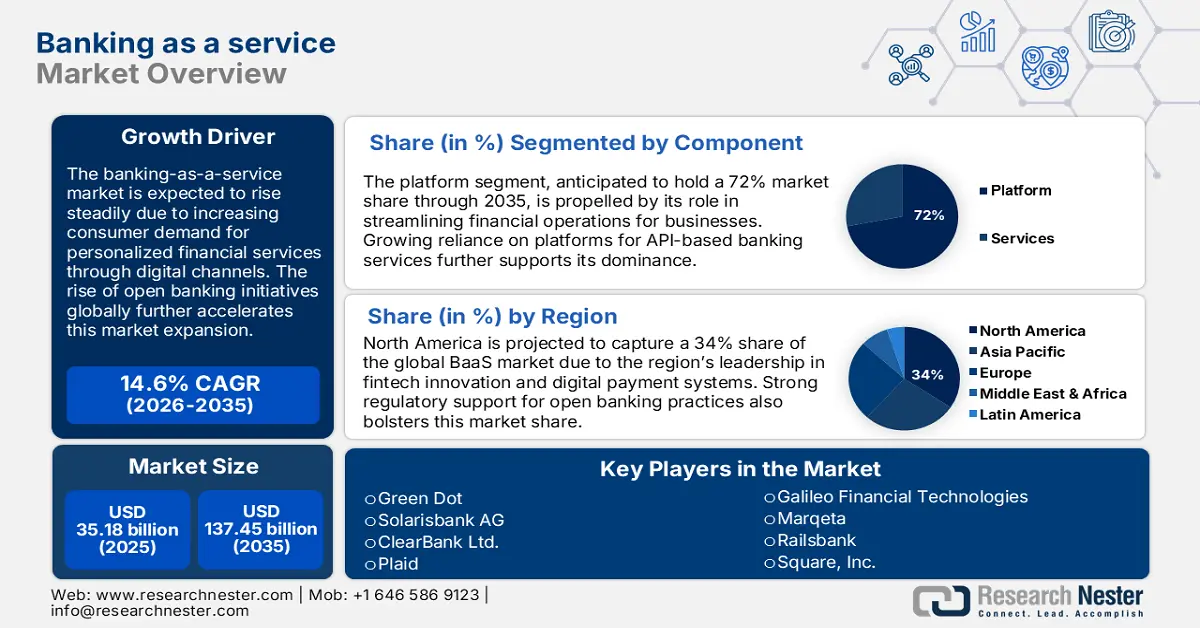

Banking as a service Market size was valued at USD 35.18 billion in 2025 and is set to exceed USD 137.45 billion by 2035, expanding at over 14.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of banking as a service is evaluated at USD 39.8 billion.

The banking as a service market is likely to experience steady expansion driven by the increasing digitization of financial services and the growing demand for seamless integration between banking platforms and third-party applications. BaaS enables non-bank businesses to offer financial services by embedding banking capabilities through APIs and cloud-based solutions. For example, in November 2023, Zile Money partnered with Sunrise Bank to deliver real-time monitoring and streamlined onboarding, enhancing the BaaS ecosystem. The governments in many countries promote digital banking transformation, hence boosting market opportunities for financial inclusion.

Furthermore, governments and financial regulators are also contributing to the increase in the pace of adoption by providing support policies for digital banking ecosystems. For example, the recent launch of the Saudi Central Bank's Naqd in July 2024 underlines governmental efforts toward integrating secure digital platforms for financial transactions with full transparency and efficiency. This modernizes the financial infrastructure and promotes innovation in BaaS offerings, driving banking as a service market growth.