Bamboos Market Outlook:

Bamboos Market size was valued at USD 74.59 billion in 2025 and is expected to reach USD 115.84 billion by 2035, registering around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bamboos is evaluated at USD 77.61 billion.

Bamboo is commonly used in construction for many purposes; for instance, in the construction of extra equipment, flooring, and any other part of construction. Therefore, the increase in the trend of construction activities is creating a positive impact on the growth of the bamboos market. Referring to the properties of mechanical characteristics, the tensile strength of the bamboo is in the range of from 70 MPa to 210 MPa while the compressive strength range between 20 MPa to 65 MPa, the elastic modulus is from 2500 to 17500 MPa, and modulus of rupture from 50 to 200 MPa. Thus, bamboo can be used in construction in different forms given its versatility when being used for construction purposes.

Key Bamboos Market Insights Summary:

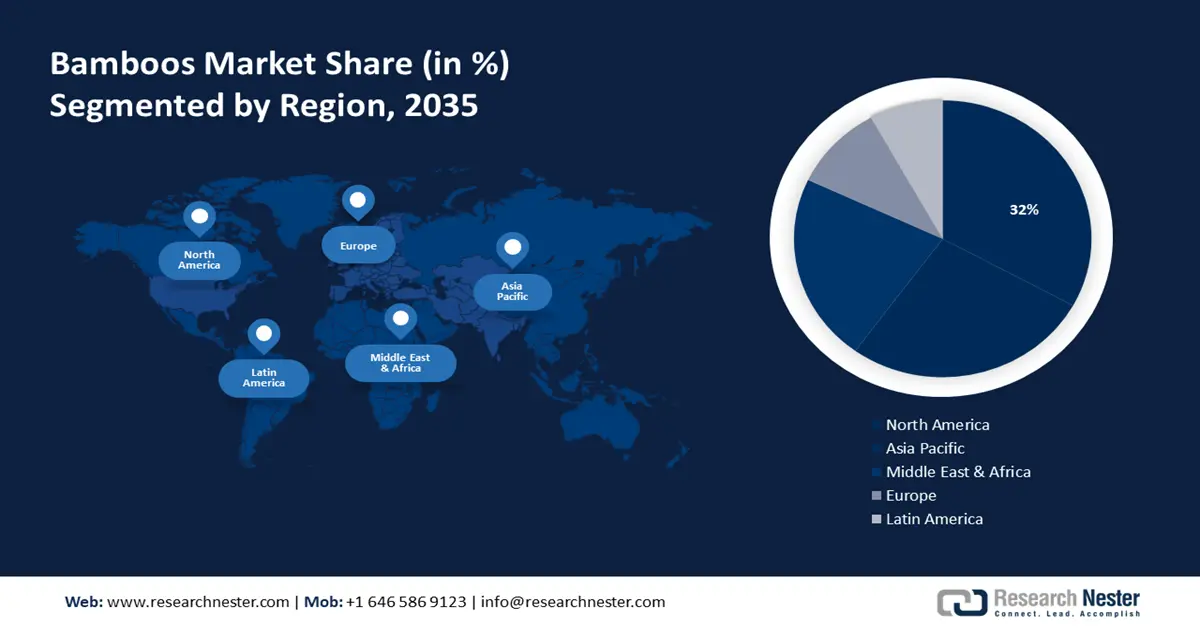

Regional Highlights:

- North America bamboos market will account for 32% share by 2035, driven by increasing adoption of bamboo in home building, gardening, and sustainable product sectors.

- Asia Pacific market will achieve huge CAGR during 2026-2035, driven by the wide use of bamboo in construction and paper industries.

Segment Insights:

- The scaffolding segment in the bamboos market is anticipated to achieve a 48% share by 2035, driven by extensive use of bamboo scaffolding in construction, especially in Asia, due to its strength and renewability.

- The furniture segment in the bamboos market is forecasted to witness notable growth till 2035, attributed to rising consumer preference for eco-friendly bamboo furniture that saves traditional wood.

Key Growth Trends:

- Awareness among consumers

- Increased concerns about health

Major Challenges:

- Awareness among consumers

- Increased concerns about health

Key Players: LetsBeco, BWG Strategy, Choho, HunanTaoHuaJiang Bamboo Science & Technology Co. LtD, Anji QiChen Bamboo Industry Co Ltd, bambu LLC.

Global Bamboos Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.59 billion

- 2026 Market Size: USD 77.61 billion

- Projected Market Size: USD 115.84 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, India, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Bamboos Market Growth Drivers and Challenges:

Growth Drivers

- Awareness among consumers- The boom in the market is because there is a new perception towards the methods that are used to implement sustainable and environmentally friendly practices. Consumers are starting to be more conscious about the products they use, focusing on environmentally friendly, recyclable as well as durable, all of which come with bamboo products.

Bamboo is light in weight yet it is stronger than steel and it can be used in different ways. It is 35 times stronger than steel; tensile strength is at 28,000 PSI and for steel it is at 23,000 only. This new trend of consumers is placing pressure on manufacturers to make a switch to more natural products with the help of bamboos. - Increased concerns about health - Bamboo is one of those plants that are members of the grass family, and there are 1,640 known species of bamboo worldwide; however, not all of them yield edible shoots. Among 800 species of biota identified in China, 153 are known to be edible while only 56 of those species can be considered to be of ‘high’ quality.

The targeted consumers have taken an increased concern towards health and well-being and hence are willing to pay for products that will benefit their health and wellbeing as will be demonstrated by the bamboo. Bamboo contains necessary vitamins and minerals such as Niacin, vitamin A, vitamin B6, vitamin C, vitamin E, and the list goes including potassium, manganese, magnesium, etc.

Another constituent found in the bamboo extract is natural antioxidant phenols that decline inflammation and oxidation processes in the body. Furthermore, flexible and smooth skin and healthy hair are also associated with the use of bamboo due to its ability to increase the level of collagen. This is a positive development and its familiarity can be attributed to research and sensationalized media coverage, which is making consumers across different industries embrace bamboo-based products for use in foods, cosmetics, and even products associated with health care and pharmaceuticals. - Initiatives taken by the government - Steps taken by the government have helped in popularizing bamboo products, building up a sustainable economy for the rural people, and providing a favorable climate for the development of the sector. These measures entail offering bonuses and other privileges, which promote the production of bamboo by farmers thus increasing its availability in the market.

Controlling bamboo after they have been cut ensures the material is used properly in making quality bamboo products to avoid wastage. Governments viz. Burma, India, and China with 19,800,000 ha of bamboo reserves in all have started paying attention to the economic facets of bamboo productivity.

Challenges

- Supply chain issues – Supply chain problem results in poor quality of raw bamboo and is a major challenge to entrepreneurs and industries, as the bamboo supply is irregular and scarce. Bamboo production ending is done in the rural areas while demand for such products occurs in the urban areas and this leads to supply glitches.

- Branding and marketing complications - Some of the challenges associated with bamboo include low market share, as this is because most bamboo products do not have a proper market and brand market. In addition, a lack of knowledge about bamboo products’ advantages and possibilities can be the major problematic area for consumers.

Bamboos Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 74.59 billion |

|

Forecast Year Market Size (2035) |

USD 115.84 billion |

|

Regional Scope |

|

Bamboos Market Segmentation:

Application

Furniture segment is expected to dominate bamboos market share of around 32% by the end of 2035. Currently, the market has many demanding consumers who are embracing environment-friendly furniture and bamboo fulfills this requirement. Most types of bamboo are incredibly renewable, so using them in the production of furniture helps save fellow woods and other unsustainable ones. Bamboo is a popular material for making furniture because it is decent and can sustain great stress. Such furniture can include chairs, tables, bed frames, cupboards, and any piece of furniture you might think of.

Furniture made from bamboo has an indigenous outlook, which is natural and has an ergonomic feel. For 2022, Indonesia exported bamboo furniture to France worth around USD 307 thousand. Australia was the second largest destination country of Indonesia’s bamboo furniture export market with export value up to USD 217 thousand. This appeal is quite evident in the furniture segment in which people are interested in items that will give some elegance to their homes. Today, more and more people prefer bamboo furniture, using it for commercial, for example, hotels, offices, and more.

Construction

In bamboos market, scaffolding segment is projected to dominate revenue share of around 48% by the end of 2035. Because of the enormous use of bamboo in construction industries, the segment of scaffolding has occupied the largest market share. Bamboo scaffolding is widely used in such a region as Asia since they use it when constructing roads, bridges, buildings, and everything else. Bamboo scaffolding is most popular since it is strong and durable and since it is obtained naturally is renewable. In the same way, by-products in the manufacturing and construction of the bamboo industry and rising green solutions needed bamboo scaffolding.

Other varieties of bamboo are commonly used to construct scaffolds, including Kao Jue and Mao Jue. While further studying the specifications of Kao Jue and Mao Jue, it is stated that the length of both is 6 meters. The dimension of Kao Jue should have an external diameter of not less than 40mm while Mao Jue’s dimension should not be less than 75mm. Mao Jue should also have a use limit of thickness being at least 10mm for it to be used in the construction of the scaffold.

Our in-depth analysis of the bamboos market includes the following segments:

|

Application |

|

|

Construction |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bamboos Market Regional Analysis:

North American Market Insights

North America industry is expected to hold largest revenue share of 32% by 2035. This market share is because of the increased awareness of the possibilities of using bamboo not as a simple vegetable but as its growing shoots and other features of using the older canes in gardening, home building, etc. This region for instance has risen to a significant center for furniture production and processing and thus the need to harvest bamboo products. While seeing higher yields of bamboo production by farmers in the region, is set to drive investment opportunities for bamboo to enhance the industry in the future years.

The United States plays a crucial role in the global bamboos market, driven by the growing demand for sustainable products and the increasing adoption of bamboo in various industries. Chinese exports of bamboo in the United States economy are foreseen to be USD 10.6 million annually.

APAC Market Insights

The Asia-Pacific region will also encounter huge growth for the bamboos market during the forecast period and will hold the second position. This regional growth can be attributed to the wide use of bamboo in the paper and pulp industry and construction area. The fact that bamboo is grown in most countries that are key consumers such as China, India, and Japan, is what propels the region's dominance.

Moreover, the load of bamboo in the Asia-Pacific region would increase, as society becomes more conscious of green products and bamboo finds its use in a multiplicity of objects such as indoor and outdoor furniture and landscaping. It was discovered that the Asia-Pacific region is responsible for consuming a greater part of the bamboo consumed in the global market with areas of application ranging from construction to paper and pulp industries.

Holding over half of the global bamboos market, China undoubtedly has an influential role in improving Asia Pacific’s situation. Many bamboo are produced and used in China, with the tally exceeding 40 million tons of output. Thus, the Chinese industry of bamboo is among the largest employing over 35 million people.

Bamboos Market Players:

- Mutha Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LetsBeco

- BWG Strategy

- Choho

- HunanTaoHuaJiang Bamboo Science & Technology Co. Ltd

- Anji QiChen Bamboo Industry Co Ltd

- bambu LLC

- JiangXI Longtai New Material Co.,Ltd.

- Madake Bamboo Solutions

- The Bamboo Bae

The fueling aspect of this market also includes the indulgence of industries that provide the best quality bamboo products to their consumers. The indulgence of a skilled workforce, apt use of technology, and nature's goodness bring out the desired results. The following are the major players in the bamboo industry:

Recent Developments

- Bambu, the company has been providing and manufacturing unique, user-friendly products that use raw materials like plants globally. That achievement marks two decades from the company’s establishment coincides with the World Bamboo Day which is every year on the 18th of September in the year 2023.

- CHOHO Industrial has organized the customer year start-up meeting on the 16th of February 2024 at the training room of the Pingdu Factory area.

- Report ID: 6231

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bamboos Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.