Baby Care Packaging Market Outlook:

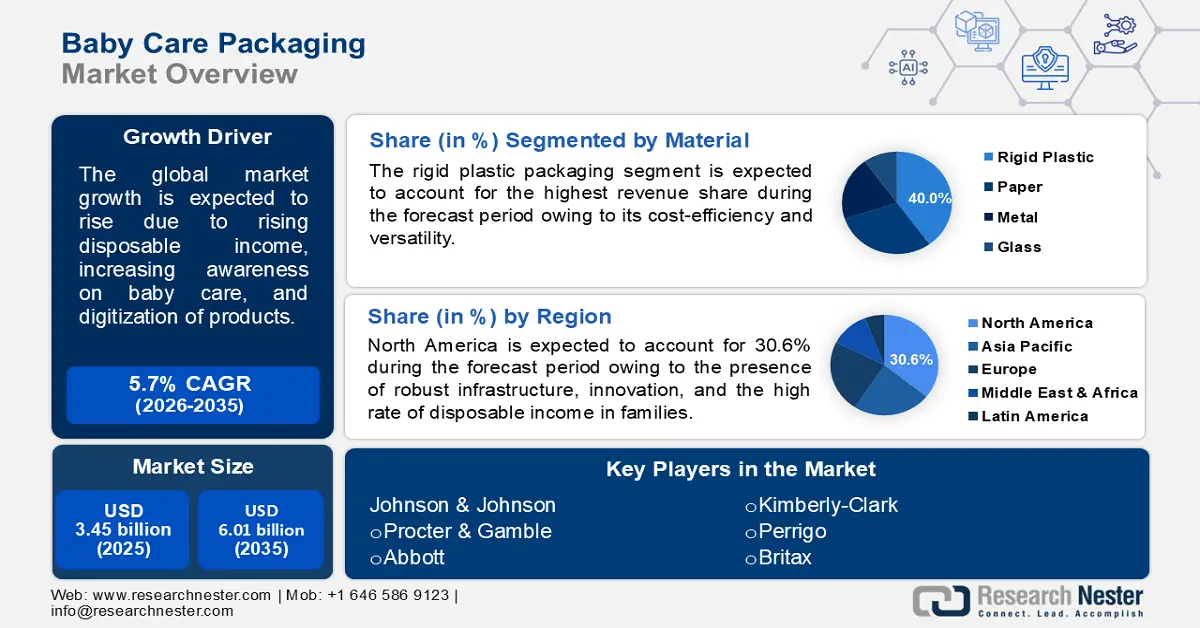

Baby Care Packaging Market size was valued at USD 3.45 billion in 2025 and is set to exceed USD 6.01 billion by 2035, expanding at over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of baby care packaging is estimated at USD 3.63 billion.

The present trend in the baby care packaging sector is the demand for sustainable and user-friendly packaging. Brands are innovating products that are cost-effective and eco-friendly. For instance, Healthy Baby is incorporating natural fibers to replace plastic in their products. In September 2023, Johnson’s Baby announced that its baby skincare products will have 100% transparency so buyers can refer to all the ingredients in their products. Vegan and cruelty-free baby care products are growing in popularity among the new generation of parents as the demand for sustainable packaging solutions soars.

Population growth, demand for sustainable packaging, and increasing disposable income levels are other factors boosting global baby care packaging market growth. Several multinational and regional players such as Johnson & Johnson, Kimberly-Clark, Unilever, and others are dominating the global market.

Key Baby Care Packaging Market Insights Summary:

Regional Highlights:

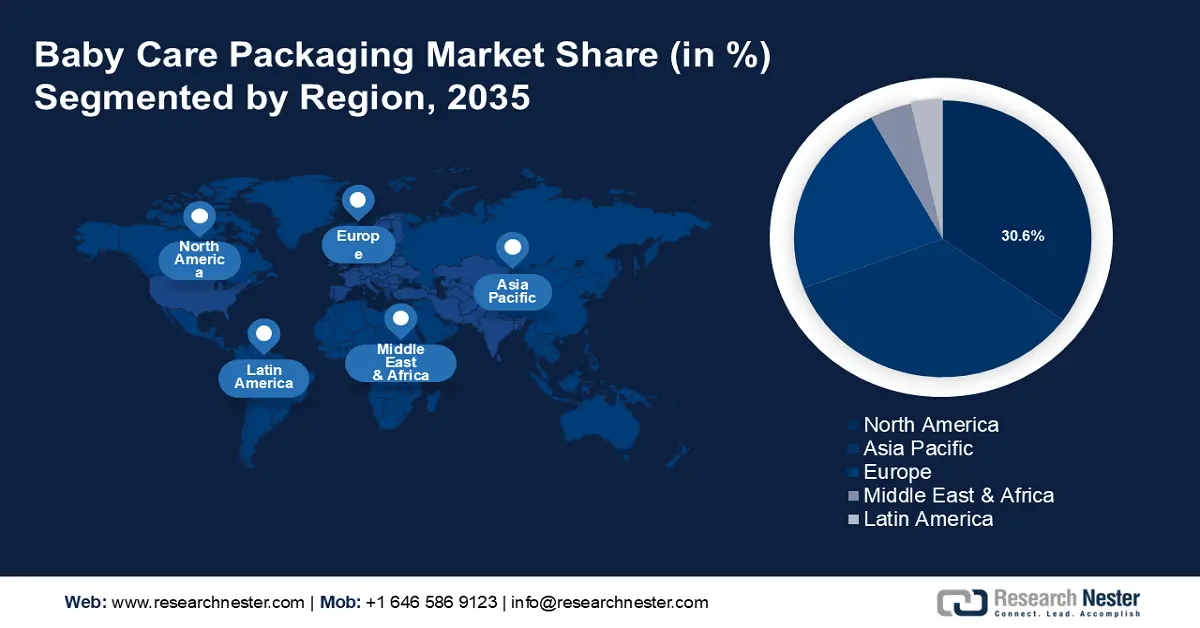

- The North America baby care packaging market is anticipated to capture 31% share by 2035, driven by product innovations, high income rates, and stringent regulations.

Segment Insights:

- The plastic bottles segment in the baby care packaging market is projected to hold the highest market share by 2035, attributed to demand for baby shampoos and oils packaging driven by ease of use.

Key Growth Trends:

- High focus on sustainable packaging post-COVID-19 pandemic

- Increased digitization in sales

Major Challenges:

- Strict regulatory hurdles

Key Players: Amcor plc, Berry Global Group, Inc., Mondi Group, Sonoco Products Company, Sealed Air Corporation, AptarGroup, Inc., Huhtamäki Oyj, Silgan Holdings Inc., Winpak Ltd., Constantia Flexibles Group GmbH.

Global Baby Care Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.45 billion

- 2026 Market Size: USD 3.63 billion

- Projected Market Size: USD 6.01 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Baby Care Packaging Market Growth Drivers and Challenges:

Growth Drivers

- High focus on sustainable packaging post-COVID-19 pandemic: The demand for baby care products made from sustainable materials has drastically increased post-COVID-19 outbreak due to rising concerns for baby health and safety. Manufacturers are focusing on packaging made of eco-friendly materials. Brands have tried to incorporate plant-based products in their packaging. 80% of brands are using flexible packaging as per Research Nester on brand trends on packaging. The baby care packaging market trends show that the transparency in baby food products is a popular trend and using thin materials with microwaveable characteristics is expected to be a driving factor in packaging demands.

- Increased digitization in sales: The emergence of e-commerce platforms and easy accessibility to a wide range of baby care products is a significant factor boosting global baby care packaging market growth. The online purchase of baby care products increased exponentially during the COVID-19 pandemic and has continued to remain steady in 2024. Kimberly-Clark reported a global sale of 7.1 billion in 2023 of its baby care products ascribed to its digital campaigns. Companies have better brand penetration due to online platforms and it has contributed significantly to the growth of the baby care industry.

- Change in purchasing behavior of parents: Parents are investing more in baby care products due to better accessibility to information and education. The purchasing behavior of parents has evolved as there is a greater focus on sustainable and premium products. The new generation of parents demand baby care products that are gentle for their infants, resulting in the growing demand for vegan baby care products by cruelty-free certified companies such as OrganicaLibra, Abby & Finn, and Acure.

Challenges

- Uncertainty of raw materials: The availability of raw materials such as sustainable bio-degradable plastics, plant-based fibers, and paperboard can fluctuate and affect the baby care packaging industry. Plastic remains the dominant material in packaging but many governments are adopting tough stances on single-use plastic, thereby forcing brands to integrate green alternatives. This transition positions operational challenges in production due to the lack of availability of raw materials to produce cost-effective sustainable packaging.

- Strict regulatory hurdles: The regulations are stringent and it may increase the time and cost of product development. For example, CDSCO regulates the manufacture of baby diapers and does not allow the use of chemicals such as sodium polyacrylate, dioxins, etc. Most countries are also strict about the labelling in the baby care products. Emerging markets in Asia-Pacific are rife with opportunities but also can be unstable due to fluctuating currency values and inflation. The fluctuations may disrupt the manufacturer in maintaining stable prices for the products and can hinder baby care packaging market growth.

Baby Care Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 3.45 billion |

|

Forecast Year Market Size (2035) |

USD 6.01 billion |

|

Regional Scope |

|

Baby Care Packaging Market Segmentation:

Material Segment Analysis

Rigid plastic packaging is the dominant sector owing to its versatility and cost-efficiency. It is expected that packaging designs will continue to minimize material use to be cost-effective and the emphasis on returnable and reusable packaging will grow. In April 2022, Goodnest announced the launch of reusable silicone bottles and refill tablets to eliminate single-use plastics.

Product Segment Analysis

The bottles segment in the baby care packaging market is expected to register the highest revenue share during the forecast period. Bottle packaging is used for baby shampoos and oils and is in demand due to its ease of use. The pouches segment is also gaining traction for wipes and baby food, offering eco-friendly, flexible, and lightweight packaging solutions. With the growing demand for eco-friendly products, brands are investing in innovative product packaging.

Our in-depth analysis of baby care packaging market includes the following segments:

|

Material |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Baby Care Packaging Market Regional Analysis:

North America Market Insights

North America dominates the baby care packaging market due to product innovations and high income rates in the U.S. and Canada. North America industry is poised to account for largest revenue share of 31% by 2035. Other factors such as stringent regulations on baby care packaging and efforts to introduce sustainable packaging solutions are expected to boost market growth going ahead.

The U.S. is expected to continue to have the most presence in the baby care packaging market due to robust infrastructure, innovations, and demands by consumers for premium baby care packaging. Canada is another major contributor to the North America market due to high rates of disposable income and focus on quality baby care. In June 2022, the Government of Canada donated USD 1 million to Magemi Mining Inc. to develop a prototype of a reduced graphene oxide reinforced recycled paper seen as a sustainable alternative to plastic packaging. This reinforces the government’s commitment to sustainable packaging practices that foster the growth of the market.

Asia Pacific Market Insights

Asia Pacific is the fastest-growing baby care packaging market owing to emerging economies such as China, India, and Thailand. In 2023, India recorded 23.3 million childbirths and China recorded 9.02 million childbirths. The high rate of population in China and India is conducive to the growth of the baby care packaging market. In Japan, the government has funded childcare programs aimed at financial assistance to childbearing couples to encourage an increase in childbirths.

The rapid growth of economies in the Asia Pacific and the increase in disposable income has changed buyer behavior. For example, around 26.8% of Indian households are expected to have an annual disposable income of USD 10,000 by the end of 2024. Buyers are increasingly demanding high-quality baby care products, resealable pouches, and premium infant formula. Buyers are also increasingly demanding sustainable products that are eco-friendly.

Baby Care Packaging Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Procter & Gamble

- Kimberly-Clark

- Nestle

- Kraft Heinz

- Himalaya Global Holdings Ltd

- Abbott

- Danone SA

- Perrigo

- Dorrel Industries

- Britax

The market leaders in the baby care packaging market are continuously trying to innovate and create user-friendly products. The focus is now on creating sustainable, reusable products that are cost-effective and also satisfy the user intent. Here is a list of key players in the market:

Recent Developments

- In May 2024, Rascal + Friends, a premium baby care brand, announced a brand refresh. The brand’s products will now have bold, modern packaging in the signature teal color.

- In February 2024, Amcor announced its collaboration with Stonfield Organic and Cheer Pack North America to launch the first all-PE spouted pouch.

- In September 2023, Johnson’s Baby announced 100% transparency across its baby skincare products by showing buyers 100% of the ingredients in the products.

- In February 2022, Goodnest released the first ever silicone reusable baby wash bottles. The bottles had on-the-go magic wash sheets to eliminate water waste.

- Report ID: 6371

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Baby Care Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.