Aviation IoT Market Outlook:

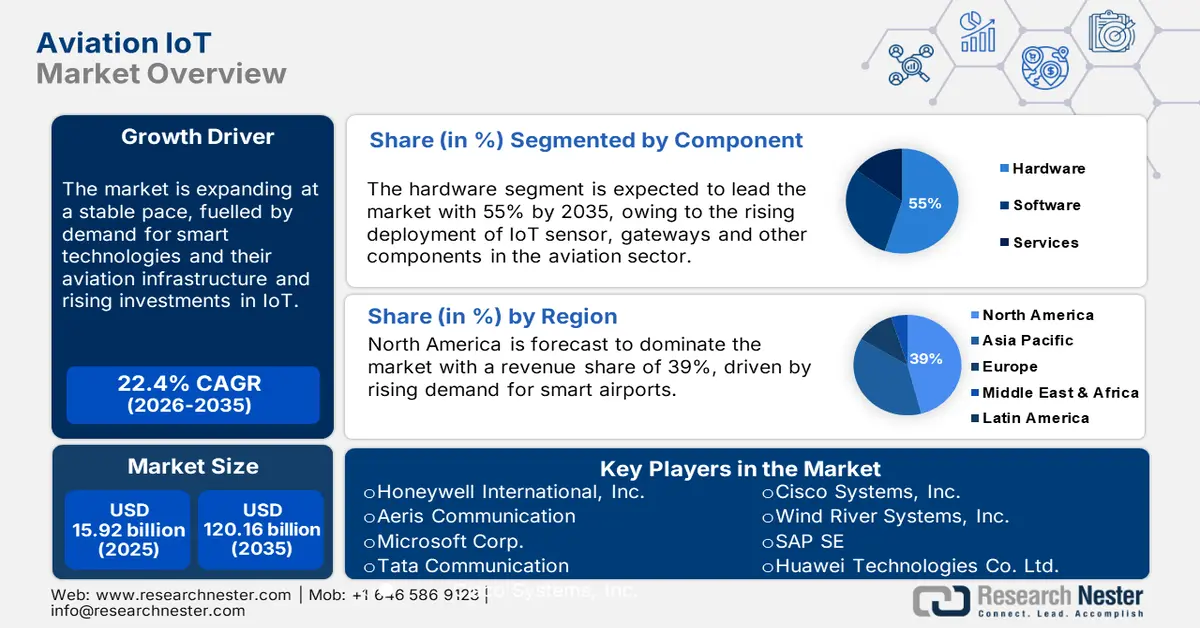

Aviation IoT Market size was over USD 15.92 billion in 2025 and is anticipated to cross USD 120.16 billion by 2035, witnessing more than 22.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aviation IoT is assessed at USD 19.13 billion.

The market is rising at a rapid pace as most airlines and airports are seeking IoT technologies to help improve overall operational efficiency, safety, and passenger service. The incorporation of advanced sensors, analytics, as well as automation in the processes of aviation, drives growth in this sector. Governments are also contributing their share to the growth of the aviation IoT market through smart airport initiatives and regulatory frameworks, ensuring incentives for adopting these IoT technologies. For example, in May 2023, the European Union launched a €1.2 billion program to modernize airport infrastructure across member states with a strong focus on IoT and AI integration to enhance safety and operational efficiency.

Companies in the aviation IoT market are getting more innovative to claim a larger share of the growing business. Some forward strides include the strategic coalition of GE Aviation with Verizon, announced in April 2021, for a new IoT platform providing real-time data transmission across airports using 5G connectivity. The platform looks forward to bettering ground operations through high-speed, low-latency communication among the plethora of IoT devices, thereby enhancing efficiency and safety within airport environments. The collaboration represents the push toward deploying the latest technology to satisfy the complex needs of contemporary aviation.

Key Aviation IoT Market Market Insights Summary:

Regional Highlights:

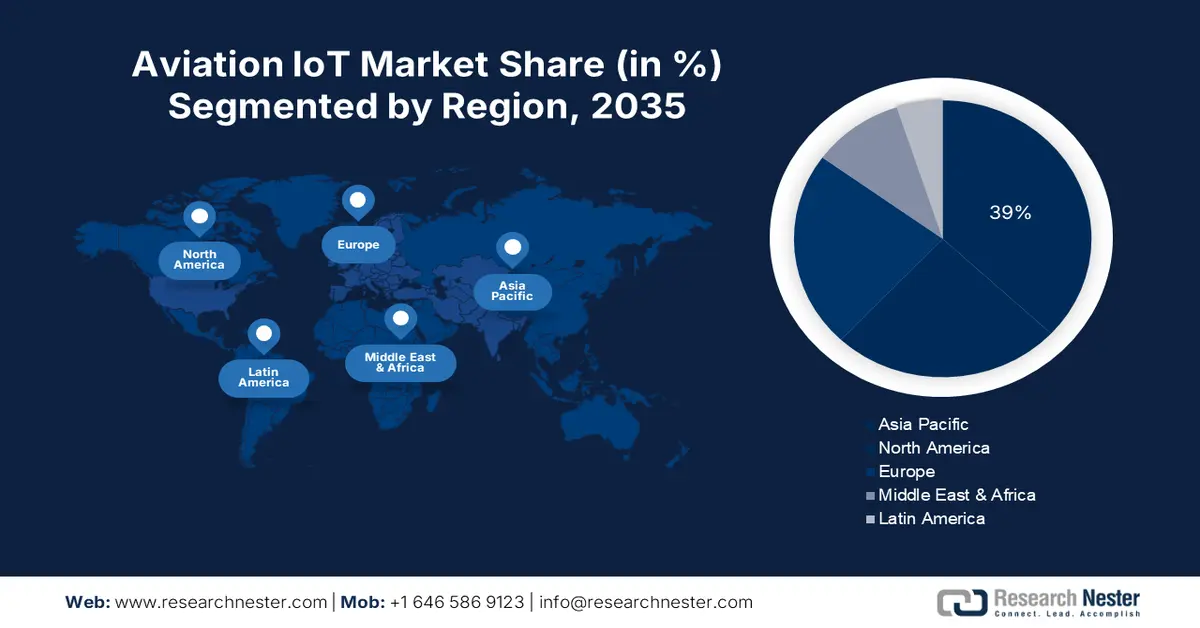

- The North America aviation IoT market is anticipated to capture 39% share by 2035, driven by technological advancements and rising demand for smart airports.

- The Asia Pacific market grows rapidly with a strong CAGR during 2026-2035, driven by increasing air travel demand and airport infrastructure modernization.

Segment Insights:

- The hardware segment in the aviation iot market is projected to see substantial growth till 2035, driven by deployment of IoT sensors and devices in aviation.

- The asset management segment in the aviation IoT market is forecasted to witness substantial growth till 2035, driven by the rising need for real-time tracking and operational efficiency.

Key Growth Trends:

- Improved operational efficiency

- Growing demand for predictive maintenance and autonomous solutions

Major Challenges:

- Regulatory compliance

Key Players: Honeywell International, Inc., Tata Communication, Cisco Systems, Inc., Aeris Communication Huawei Technologies Co. Ltd., IBM Corp., Wind River Systems, Inc., SAP SE, Microsoft Corp., and Tech Mahindra Ltd.

Global Aviation IoT Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.92 billion

- 2026 Market Size: USD 19.13 billion

- Projected Market Size: USD 120.16 billion by 2035

- Growth Forecasts: 22.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 18 September, 2025

Aviation IoT Market Growth Drivers and Challenges:

Growth Drivers:

- Improved operational efficiency: The delivery of better operational efficiency is the primary driving factor behind growth in the aviation IoT market. IoT allows airlines and airports to trace and control their assets in real-time, which minimizes downtime and enables effective resource distribution. For example, in June 2023, Airbus launched an IoT-enabled predictive maintenance system, which has reduced aircraft time by about 20%, indicating how IoT drives efficiency.

- Growing demand for predictive maintenance and autonomous solutions: The aviation industry is following increased efforts to decrease the number of unplanned downtimes and increase component life through predictive maintenance solutions driven by the IoT. The government and airlines are also collaborating to develop autonomous aviation projects. For example, in December 2023, Boeing built the X-37B autonomous spaceplane for its seventh mission aboard a SpaceX Falcon Heavy launch vehicle. The X-37B and Boeing government teams have been preparing a much more responsive, resilient and variable experimentation platform.

- Enhanced passenger experience: The aviation IoT market has seen an increased focus on enhancing passenger experience. Airlines are using solutions of the IoT for personalized service, in order to reduce lead service times and increase customer convenience/overall service for those passengers, making the general travel experience much more satisfying. In December 2021, Eindhoven Airport announced the competition of new technology for bag identification through the use of AI in conjunction with business partners Vanderlande and BagsID. This new luggage check-in system was introduced, eliminating bag tag usage and label printing usage equipment, giving impetus to greatly enhanced total travel experience.

Challenges:

- Cybersecurity threats: With growing connectedness in the industry, the susceptibility to a cyber-attack has increased. Since IoT is a part of critical infrastructure and hackable, it, too, will disrupt operations and make passengers vulnerable to springboards. In March 2023, the U.S. Department of Homeland Security witnessed a 30% increase in imposed avouches for aviation IoT systems, thus disrupting its normal course. Such challenges pose a serious threat to the adoption of aviation IoT through 2035.

- Regulatory compliance: A major challenge in the aviation IoT market is to navigate the complex regulatory landscape. The Governments bring about constant revisions in the regulations to ensure the safety and security aspect of the IoT deployments for aviation. In April of 2023, the European Union Aviation Safety Agency (EASA) made new regulations that required very strict cybersecurity protocols for IoT systems in their airports. This increased the burden of compliance on companies.

Aviation IoT Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.4% |

|

Base Year Market Size (2025) |

USD 15.92 billion |

|

Forecast Year Market Size (2035) |

USD 120.16 billion |

|

Regional Scope |

|

Aviation IoT Market Segmentation:

Application Segment Analysis

By application, the asset management segment in the aviation IoT market is estimated to hold a share of 35% by 2035, due to the growing demand for tracking and proper management of aviation assets. IoT-enabled asset management systems facilitate real-time information on the location of the asset and its status, hence diminishing losses and increasing the utilization of such assets. In May 2023, Honeywell found a solution based on the IoT for asset management—one that lets airports manage airport assets, such as baggage carts and fuel trucks, all to make sure they can live up to the operational efficiency necessary at a lower cost to the customer.

Component Segment Analysis

By component, the hardware segment is expected to secure a 55% aviation IoT market share by 2035. This segment demand has been growing owing to the rising deployment of IoT sensors, gateways, and other hardware components in aviation operations; such devices are crucial for data collection and their transmissions across IoT networks. For example, Siemens AG integrated further with the healthy growth potential of the hardware wing of the aviation IoT market in June 2023 by launching new lines of IoT sensors targeted at harsh aviation environments.

End use Segment Analysis

The airport segment is estimated to account for a significant revenue share in the aviation IoT market over the forecast period. The increasing trend to adopt IoT technologies is making airports massively invest in them to smooth operations, enhance security, and improve passenger experience.

In June 2023, Pristina International Airport introduced Amadeus' Airport Management Suite (AMS) in a major initiative to optimize flight scheduling planning up to a year in advance. New operational systems will distribute and regularly update key flight data at strategic points throughout the airport while introducing advanced optimization algorithms to better manage commonly used facilities such as parking, departure gates, and check-in counters for the benefit of airlines flying from Pristina. Developments like these further boost the adoption of aviation IoT in airports.

Our in-depth analysis of the aviation IoT market includes the following segments:

|

Application |

|

|

End use |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aviation IoT Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 39% by 2035. The aviation IoT market in North America is rapidly growing since the region is technologically advanced, with rising demand related to smart airports throughout.

The U.S. aviation IoT industry is rising steadily owing to the rising demand for smart technologies and as a factor emanating from the country's interest in enhancing some of the efforts that have been benchmarked in safety improvements and operational efficiency in aviation. The companies in the U.S. industry have increased the implementation of IoT in airport operations, enhanced the passenger experience, and increased flight safety. In April 2024, Honeywell introduced its IoT-based “Connected Airport” platform, designed to enhance airport efficiency by integrating various systems for real-time data analysis and decision-making.

The market in Canada is growing at a rapid rate with the increased focus that countries are laying on modernizing their aviation infrastructure and enhancing their passenger services. Some growth drivers for the Canada market include the rise in smart airports, supportive government initiatives, and efficient air traffic management.

Asia Pacific Market Insights

The aviation IoT market in Asia Pacific is likely to grow at a rapid pace through 2035, with the increase in the demand for air travel and the growing modernization of airport infrastructure. India's market is expected to gather pace quite rapidly because massive uptake of digital technology has been taken forward and government emphasis on infrastructure modernization. For example, in July 2024, SITA announced its plan to deploy its biometric system across 10 more Indian airports as part of the Digi Yatra initiative. This will contribute to the general trend of utilizing IoT in facilitating airport operations and easing travel formalities.

China’s aviation IoT market is driven due to increasing domestic and international air traveling. In November 2023, Huawei was a forerunner top leader in the technology space to launch its all-encompassing IoT and AI "Smart Airport Solution" for aviation and boosted airport operations and passenger services. This growth is emphasized in the new development plan of the Chinese government includes a comprehensive package that will develop inventive infrastructure, including airports, with huge investments earmarked for such kind of project. The plan outlines substantial financial commitments that would ensure the modernization of the nation's aviation hubs.

Aviation IoT Market Players:

- Honeywell International, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aeris Communication

- Microsoft Corp.

- Tata Communication

- Cisco Systems, Inc.

- Wind River Systems, Inc.

- SAP SE

- Huawei Technologies Co. Ltd.

- IBM Corp.

- Tech Mahindra Ltd.

The leading players in the aviation IoT market are involved in the high competition, setting new standards for deploying innovation and technology. Key players in the industry include NEC Corporation, Fujitsu Limited, Hitachi Ltd., Mitsubishi Electric Corporation, and Japan Airport Terminal Co., Ltd. These firms are taking the lead in developing applications related to integrated airport IoT as well as AI technology to optimize airport operations, security, and passenger experience.

In March 2024, Fujitsu Limited announced the debut of an advanced IoT-derived baggage tracking system at Tokyo Haneda Airport. The new system uses real-time data and AI to substantially reduce errors in baggage handling and improve the effectiveness of luggage processing. The launch underlines the role of Fujitsu as a leader in smart airport technologies and the evolution of IoT usage across the aviation sector to streamline operational challenges.

Here are some leading players in the aviation IoT market:

Recent Developments

- In June 2024, SmartWings Group transitioned to Conduce’s eTechLog8 electronic logbook solution. This shift from paper-based technical logbooks to an electronic format is designed to improve efficiency and has already received approval from the Civil Aviation Authority of the Czech Republic. The group plans to extend this approval to other air operator certificates across Poland, Hungary, and Slovakia

- In June 2024, Lufthansa Technik opened a new warehouse at Narita International Airport in Tokyo. This facility initially serves customers in Japan, with plans to expand services across the Asia-Pacific region. This move is part of Lufthansa Technik’s strategy to enhance its IoT-enabled logistics and supply chain operations.

- In March 2023, Honeywell partnered with Lufthansa Technik to develop a digital platform named AVIATAR, focused on enhancing customer experience through aviation analytics. This collaboration is part of Honeywell's broader strategy to expand its IoT offerings in the aviation sector.

- Report ID: 6350

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aviation IoT Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.