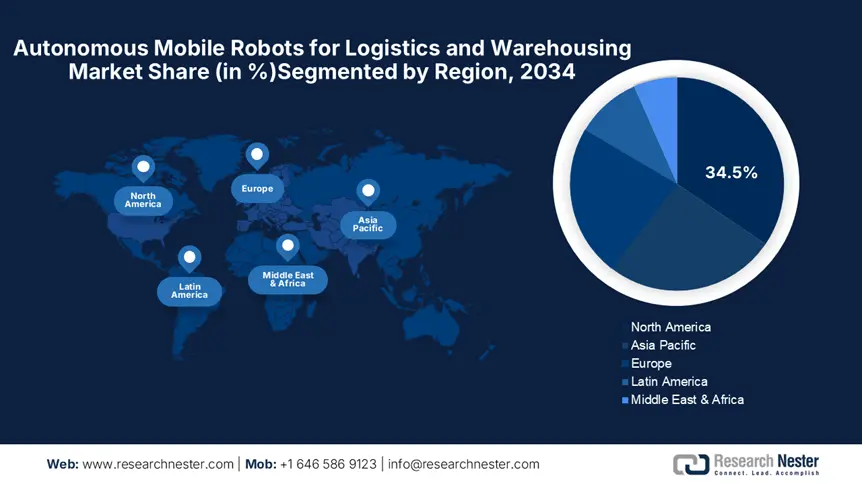

Autonomous Mobile Robots for Logistics and Warehousing Market - Regional Analysis

North America Market Insights

The North America autonomous mobile robots for logistics and warehousing market is estimated to hold 34.5% of the global revenue share by 2034. The automation incentives, increasing labor costs, and AI-integrated fulfillment models are prime factors propelling the sales of autonomous mobile robots. The pressure to shrink delivery windows and cut operating costs is necessitating warehouse operators to invest in autonomous mobile robots. E-commerce, 3PLs, and even postal logistics are fueling the demand for advanced mobile robots. Hefty investments in automation and digital expansion are also contributing to the overall market growth. The strong presence of end use industries is further accelerating the production and commercialization of autonomous mobile robots.

In the U.S., the sales of autonomous mobile robots for logistics and warehousing market are driven by the growing e-commerce trade and 5G-enabled logistics corridors. The rise in AI-backed warehousing optimization is poised to accelerate the application of autonomous mobile robots for logistics and warehousing. As per the National Telecommunications and Information Administration (NTIA), more than USD 42.5 billion was allocated to broadband and 5G infrastructure in FY2024, which directly enhanced autonomous mobile robot deployment in fulfillment centers by improving real-time connectivity. The dominance of early adopters is also contributing to the sales of autonomous mobile robots.

Europe Market Insights

The Europe autonomous mobile robots for logistics and warehousing market is expected to account for 21.9% of the global revenue share throughout the study period. The rising labor shortages and strict environmental compliance needs are boosting the demand for autonomous mobile robots. The widespread 5G integration and high investments in broadband expansions are also promoting the sales of autonomous mobile robots. E-commerce and 3PL segments, where warehouse automation is crucial, are emerging as key factors promoting the application of autonomous mobile robots. Germany, France, and the U.K. are leading marketplaces owing to their hefty ICT investments focused on AI-robotics convergence.

The Germany autonomous mobile robots for logistics and warehousing market is driven by strong industrial robotics capability and large-scale e-commerce logistics. The advanced digital policy frameworks and wireless communication network investments are set to boost the production of autonomous mobile robots in the country. The Federal Ministry for Digital and Transport (BMDV) invested more than €1.4 billion in 2024 in autonomous and AI-based mobility infrastructure. High labor costs, export-intensive warehousing needs, and a well-regulated robotics ecosystem are also propelling the trade of autonomous mobile robots.

Country-Specific Insights

|

Country |

2023 AMR Market Demand |

ICT Budget Allocation to AMRs (%) |

2020 Allocation (%) |

Growth Trend |

|

UK |

£720.5 million |

4.9 |

3.1 |

DSIT boosted AMR funding to digitize 30.5% of public warehouses by 2025 |

|

Germany |

€1.4 billion |

6.5 |

4.4 |

BMDV-funded AMR fleet deployed by DHL in Leipzig; 18.4% YoY growth in robotic warehousing |

|

France |

€895.2 million |

5.8 |

3.5 |

ARCEP reports 22.6% increase in AMR-led e-commerce logistics volume between 2021-2023 |

APAC Market Insights

The Asia Pacific autonomous mobile robots for logistics and warehousing market is foreseen to increase at a CAGR of 19.9% from 2025 to 2034. The growing labor shortages, e-commerce surges, and large-scale digital infrastructure rollouts are opening high-earning opportunities for autonomous mobile robot manufacturers. Japan, China, and South Korea are leading AMR production and deployment owing to high automation requirements and their know-how tactics. The government-led smart warehouse initiatives and digitalization programs are accelerating the adoption of autonomous mobile robots. The high public spending and positive foreign direct investments are set to uplift the position of APAC in the global landscape.

China autonomous mobile robots for logistics and warehousing market leads the sales of autonomous mobile robots owing to high e-commerce trade and preference for industrial automation. Smart manufacturing targets and dominant robotics exports are expected to attract heavy FDI in the country. AMR-focused ICT spending reached USD 7.9 billion in 2024, and more than 2.4 million Chinese enterprises had already integrated warehouse AMRs, as per a report by the Ministry of Industry and Information Technology (MIIT). Furthermore, the introduction of AMR-specific safety and AI-compliance standards in 2023 by the Ministry of Transport for fast-tracking certification is poised to accelerate the production and sales of autonomous mobile robots in the country.

Country-Specific Insights

|

Country |

2024 AMR Market Size |

Govt. Budget Allocation to AMRs (%) |

Growth/Adoption Highlights |

|

Japan |

¥315.5 billion |

6.6% (Tech budget) |

Up from 3.4% in 2020; METI-funded robotics zones in Nagoya, Osaka |

|

India |

$2.4 billion |

5.0% (ICT budget) |

1.6M+ SMEs using AMRs; 36.5% CAGR in public AMR investment (2015-2023) |

|

Malaysia |

$1.1 billion |

5.7% (Digital budget) |

63.5% rise in govt. funding (2013-2023); adoption doubled over 10 years |

|

South Korea |

$3.5 billion |

6.9% (ICT & AI budget) |

KRW 4.7T invested in smart factories (2024); AMRs embedded in 5G logistics |