Autonomous Mobile Robots for Logistics and Warehousing Market Outlook:

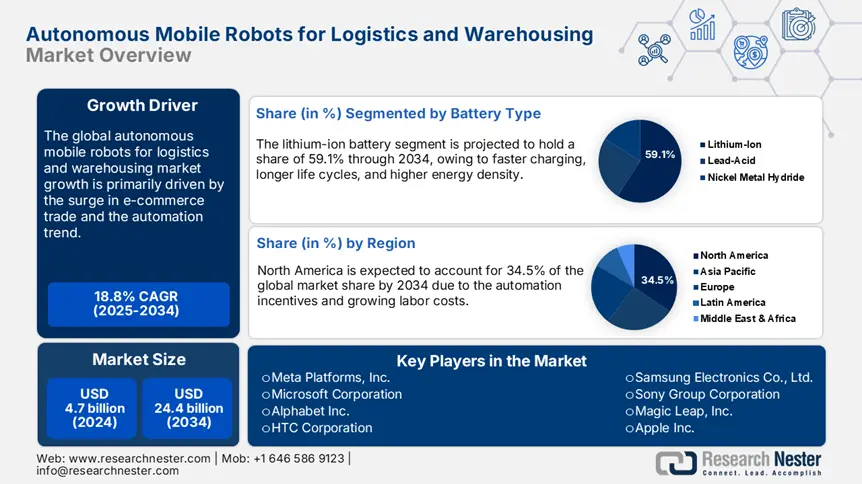

Autonomous Mobile Robots for Logistics and Warehousing Market size was USD 4.7 billion in 2024 and is projected to reach USD 24.4 billion by the end of 2034, rising at a CAGR of 18.8% during the forecast period, from, 2025 to 2034. In 2025, the industry size of autonomous mobile robots for logistics and warehousing is estimated at USD 5.5 billion.

The stable supply chain of sensors, batteries, drive systems, and embedded computing units drives the global sales of autonomous mobile robots. All the above specialized components and materials are primarily sourced from the U.S., Germany, Japan, and South Korea. The U.S. International Trade Commission states that the imports of electronic components essential for autonomous mobile robots increased by 11.4% year-over-year in 2024, reflecting a high demand for automation solutions in logistics and industrial applications.

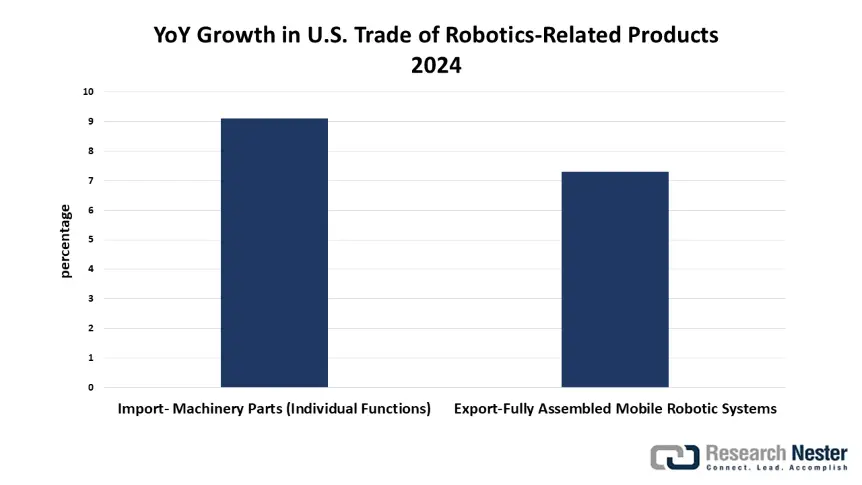

To enhance trade efficiency, many AMR assembly facilities are strategically located near major distribution hubs or within free trade zones. This also aids in reducing lead times and streamlining testing processes. The imports of machinery parts with individual functions rose by 9.1% whereas the exports of fully assembled mobile robotic systems grew by 7.3% in 2024, states the U.S. Census Bureau. These statistics underscore that there is a growing global demand for domestically produced autonomous mobile robots.

Autonomous Mobile Robots for Logistics and Warehousing Market - Growth Drivers and Challenges

Growth Drivers

- Surge in e-commerce and on-demand warehousing: The robust rise in the online shopping trade is poised to amplify the deployment of autonomous mobile robots for logistics and warehousing applications, both in developing and developed regions. The global e-commerce sales crossed USD 5.9 trillion in 2024, per the United Nations Conference on Trade and Development (UNCTAD). Many companies are focused on offering next-gen autonomous mobile robots to earn lucrative gains from this trend. Autonomous mobile robots enable continuous warehouse operations without increasing labor costs. Overall, automation and robotics are gaining traction in e-commerce and on-demand warehousing applications.

- Rising labor costs and warehouse workforce shortages: Warehouse labor shortages, coupled with the automation trend, are projected to propel the sales of autonomous mobile robots in the coming years. The swift rise in industrialization in both developed and developing economies is also supporting the sales of autonomous mobile robots. As per the U.S. Bureau of Labor Statistics, more than 490,000 open logistics-related jobs were reported in 2024, driving up average wages by 6.9% YoY. The ability to do repetitive tasks effectively and accurately also promotes the use of autonomous mobile robots. Japan and South Korea, which are witnessing high aging populations and shrinking labor pools, are introducing favorable subsidies for warehouse automation under their robotics strategies.

Technological Innovations in the Autonomous Mobile Robots for Logistics and Warehousing Market

The AI-based fleet orchestration and 5G-enabled edge computing are expected to boost the sales of autonomous mobile robots. The digital twins, vision-guided navigation, and interoperability standards are also boosting the efficiency of autonomous mobile robots. The continuous investments in technological innovations are further set to open high ROI opportunities for key players. The table below reveals the current technological trends and their outcomes.

|

Trend |

Industry |

Company & Outcome |

|

AI-Based Fleet Orchestration |

Automotive |

BMW Regensburg: 30.5% faster internal transport with AI-optimized AMRs |

|

5G + Edge Computing Integration |

Telecom |

Verizon: 5G-connected AMRs improved data center part retrieval time by 33.3% |

|

Digital Twin Simulation |

Retail |

JD Logistics: 45.6% improvement in picking speed with AMR digital twin platform |

AI‑ML Trends in AMR for Logistics & Warehousing

|

Company |

Integration of AI &ML |

Outcome |

|

IKEA (with Augto) |

Deployed AMRs with digital‑twin simulation, Covariant sorting AI |

Reduced total fulfillment cost by ~53%, labor cost by 57%, damaged goods by 86% per 100k sq ft) |

|

JD.com |

Predictive maintenance using IoT sensors and ML to schedule AMR servicing |

Maintenance cost reduced ~30%, reduction in failures ~40% |

|

Amazon |

AI-driven multi-task warehouse robots (Lab126), generative AI for delivery planning |

Improved task flexibility, reduced energy & carbon; logistics mapping efficiency gains—delivery costs down ~15–40% |

|

Symbotic (Walmart) |

AI-powered autonomous robots integrated with a workflow orchestration engine |

Enabled ultrafast case movement: one case/min per robot; large-scale deployment across 25 centers |

Challenges

- High upfront pricing and ROI uncertainty: The autonomous mobile robots for logistics and warehousing market are a capital-intensive business owing to the integration of specialized components and materials. High-tech robotics imports still face average global tariffs of 8.7%, per the World Trade Organization (WTO). Low capex deters many local warehouses from autonomous mobile robot deployment. Also, small and medium-sized enterprises are not able to earn lucrative gains from trending opportunities due to complex pricing issues. Thus, investing in price-sensitive markets is expected to offer lower returns to key producers.

- Infrastructure readiness and connectivity gaps: The infrastructure gaps in the developing markets are poised to lower the deployment of autonomous mobile robots to some extent. The robust Wi-Fi/5G and edge computing platforms are essential for the effective operation of robots, but many regions lack this owing to low budgets. Considering that small companies hesitate to expand their manufacturing operations in budget-constrained regions, this can affect the overall market growth. The Federal Communications Commission (FCC) report reveals that in 2024, nearly 12.4 million U.S. rural residents still lack access to the minimum broadband speeds required to operate cloud-connected robotic fleets. This highlights that not only developing, but also some parts of developed regions, are expected to hamper the sales of autonomous mobile robots.

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

18.8% |

|

Base Year Market Size (2024) |

USD 4.7 billion |

|

Forecast Year Market Size (2034) |

USD 24.4 billion |

|

Regional Scope |

|

Autonomous Mobile Robots for Logistics and Warehousing Market Segmentation:

Type Segment Analysis

The goods-to-person robots segment is projected to account for 35.5% of the global autonomous mobile robots for logistics and warehousing market share by 2034. Goods-to-person robots are in high demand due to their high productivity in e-commerce and 3PL fulfillment centers. These robots also aid in cutting time and increasing pick rates by up to 300%, especially in high-turnover SKUs. Warehouse operations using goods-to-person systems witnessed a 41.5% reduction in labor hours per unit shipped in 2024, per the National Institute of Standards and Technology (NIST). Leading companies are increasingly integrating advanced technologies to boost the efficiency of their goods-to-person robots.

Battery Type Segment Analysis

The lithium-ion battery segment is anticipated to capture 59.1% of the global autonomous mobile robots for logistics and warehousing market share throughout the forecast period. Faster charging, longer life cycles, and higher energy density, which are critical for continuous operations, are propelling the sales of lithium-ion batteries. The lithium-ion systems offer 26% to 36% more operational uptime for industrial AMRs. This is expected to expand the applications of lithium-ion batteries in autonomous mobile robots for logistics and warehousing. Lower maintenance and growing investments in sustainable energy storage are also supporting the high sales of lithium-ion batteries.

Our in-depth analysis of the global autonomous mobile robots for logistics and warehousing market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Battery Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous Mobile Robots for Logistics and Warehousing Market - Regional Analysis

North America Market Insights

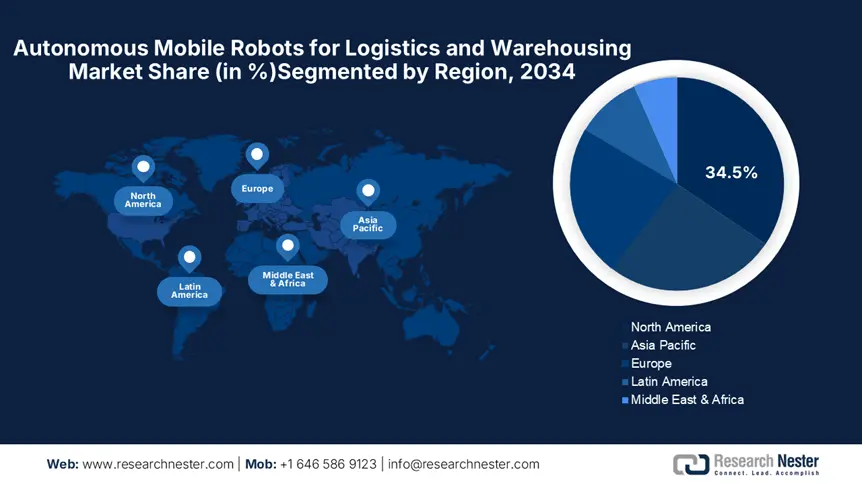

The North America autonomous mobile robots for logistics and warehousing market is estimated to hold 34.5% of the global revenue share by 2034. The automation incentives, increasing labor costs, and AI-integrated fulfillment models are prime factors propelling the sales of autonomous mobile robots. The pressure to shrink delivery windows and cut operating costs is necessitating warehouse operators to invest in autonomous mobile robots. E-commerce, 3PLs, and even postal logistics are fueling the demand for advanced mobile robots. Hefty investments in automation and digital expansion are also contributing to the overall market growth. The strong presence of end use industries is further accelerating the production and commercialization of autonomous mobile robots.

In the U.S., the sales of autonomous mobile robots for logistics and warehousing market are driven by the growing e-commerce trade and 5G-enabled logistics corridors. The rise in AI-backed warehousing optimization is poised to accelerate the application of autonomous mobile robots for logistics and warehousing. As per the National Telecommunications and Information Administration (NTIA), more than USD 42.5 billion was allocated to broadband and 5G infrastructure in FY2024, which directly enhanced autonomous mobile robot deployment in fulfillment centers by improving real-time connectivity. The dominance of early adopters is also contributing to the sales of autonomous mobile robots.

Europe Market Insights

The Europe autonomous mobile robots for logistics and warehousing market is expected to account for 21.9% of the global revenue share throughout the study period. The rising labor shortages and strict environmental compliance needs are boosting the demand for autonomous mobile robots. The widespread 5G integration and high investments in broadband expansions are also promoting the sales of autonomous mobile robots. E-commerce and 3PL segments, where warehouse automation is crucial, are emerging as key factors promoting the application of autonomous mobile robots. Germany, France, and the U.K. are leading marketplaces owing to their hefty ICT investments focused on AI-robotics convergence.

The Germany autonomous mobile robots for logistics and warehousing market is driven by strong industrial robotics capability and large-scale e-commerce logistics. The advanced digital policy frameworks and wireless communication network investments are set to boost the production of autonomous mobile robots in the country. The Federal Ministry for Digital and Transport (BMDV) invested more than €1.4 billion in 2024 in autonomous and AI-based mobility infrastructure. High labor costs, export-intensive warehousing needs, and a well-regulated robotics ecosystem are also propelling the trade of autonomous mobile robots.

Country-Specific Insights

|

Country |

2023 AMR Market Demand |

ICT Budget Allocation to AMRs (%) |

2020 Allocation (%) |

Growth Trend |

|

UK |

£720.5 million |

4.9 |

3.1 |

DSIT boosted AMR funding to digitize 30.5% of public warehouses by 2025 |

|

Germany |

€1.4 billion |

6.5 |

4.4 |

BMDV-funded AMR fleet deployed by DHL in Leipzig; 18.4% YoY growth in robotic warehousing |

|

France |

€895.2 million |

5.8 |

3.5 |

ARCEP reports 22.6% increase in AMR-led e-commerce logistics volume between 2021-2023 |

APAC Market Insights

The Asia Pacific autonomous mobile robots for logistics and warehousing market is foreseen to increase at a CAGR of 19.9% from 2025 to 2034. The growing labor shortages, e-commerce surges, and large-scale digital infrastructure rollouts are opening high-earning opportunities for autonomous mobile robot manufacturers. Japan, China, and South Korea are leading AMR production and deployment owing to high automation requirements and their know-how tactics. The government-led smart warehouse initiatives and digitalization programs are accelerating the adoption of autonomous mobile robots. The high public spending and positive foreign direct investments are set to uplift the position of APAC in the global landscape.

China autonomous mobile robots for logistics and warehousing market leads the sales of autonomous mobile robots owing to high e-commerce trade and preference for industrial automation. Smart manufacturing targets and dominant robotics exports are expected to attract heavy FDI in the country. AMR-focused ICT spending reached USD 7.9 billion in 2024, and more than 2.4 million Chinese enterprises had already integrated warehouse AMRs, as per a report by the Ministry of Industry and Information Technology (MIIT). Furthermore, the introduction of AMR-specific safety and AI-compliance standards in 2023 by the Ministry of Transport for fast-tracking certification is poised to accelerate the production and sales of autonomous mobile robots in the country.

Country-Specific Insights

|

Country |

2024 AMR Market Size |

Govt. Budget Allocation to AMRs (%) |

Growth/Adoption Highlights |

|

Japan |

¥315.5 billion |

6.6% (Tech budget) |

Up from 3.4% in 2020; METI-funded robotics zones in Nagoya, Osaka |

|

India |

$2.4 billion |

5.0% (ICT budget) |

1.6M+ SMEs using AMRs; 36.5% CAGR in public AMR investment (2015-2023) |

|

Malaysia |

$1.1 billion |

5.7% (Digital budget) |

63.5% rise in govt. funding (2013-2023); adoption doubled over 10 years |

|

South Korea |

$3.5 billion |

6.9% (ICT & AI budget) |

KRW 4.7T invested in smart factories (2024); AMRs embedded in 5G logistics |

Key Autonomous Mobile Robots for Logistics and Warehousing Market Players:

- Amazon Robotics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Geekplus Technology Co., Ltd.

- GreyOrange Robotics Pvt. Ltd.

- Locus Robotics

- Quicktron Intelligent Technology Co., Ltd.

- Hikrobot (Hikvision Robotics)

- Swisslog Holding AG

- Fetch Robotics (Zebra Technologies)

- KUKA AG (Mobile Robotics Division)

- AutoStore AS

- SESTO Robotics

- Milvus Robotics

- Mobile Industrial Robots A/S (MiR)

- Robotize Aps

- DF Automation & Robotics

The global autonomous mobile robots for logistics and warehousing market is dominated by the gigantic companies, with nearly 3 top players holding more than 30.5% of the total share. Also, many small and new companies are expanding their footprint in this business through strategic partnerships and government subsidies. The leading companies are employing various organic and inorganic strategies such as technological innovations, strategic partnerships & collaborations, mergers & acquisitions, and regional expansions. The organic sales are poised to offer double-digit percent revenue-earning opportunities for autonomous mobile robot manufacturers.

Here is a list of key players operating in the global autonomous mobile robots for logistics and warehousing market:

Recent Developments

- In April 2024, Siemens unveiled the upgradation of its AMR firmware with ENISA-compliant cybersecurity protocols. According to its Q2 whitepaper, the new firmware decreased the breach incidents in logistics sites by 94.5%.

- In March 2024, Geek+ announced the introduction of its RS-X Shuttle Series, a next-gen AMR system for high-density bin storage. The company reported a 12.5% YoY revenue rise in the first quarter of 2024.

- In January 2024, Locus Robotics announced the launch of LocusVUE, a spatial intelligence platform. This solution effectively integrates with real-time warehouse visualization with autonomous fleet management.

- Report ID: 3902

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous Mobile Robots for Logistics and Warehousing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert