Autonomous IoT Payments Market Outlook:

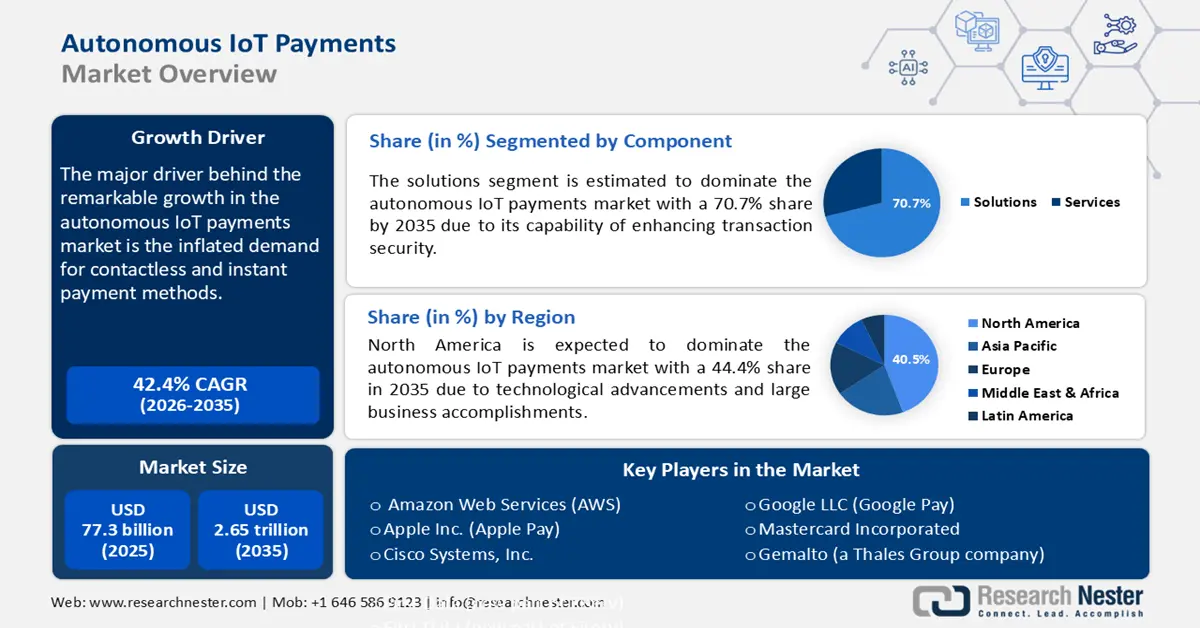

Autonomous IoT Payments Market size was valued at USD 77.3 billion in 2025 and is set to exceed USD 2.65 trillion by 2035, expanding at over 42.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of autonomous IoT payments is estimated at USD 106.8 billion.

The market growth is influenced by inflated demand for digitalized and instant payment methods. Consumers expect more convenience while making payments, regardless of the amount. Market leaders allegedly incorporate advanced features for seamless transactions in autonomous IoT payment methods.

From NEFT to QR Code transactions, autonomous IoT payments have brought unmatched favorable features into action. Key players are introducing advanced technologies for enhanced security in the payment process. In addition, the traditional banking system is transforming with digitalization, offering a cashless experience for consumers. According to a report published by the Bank for International Settlements, in January 2023, the total value of cashless payments grew by a record hike. The growth escalated by 14% in AEs (Advanced Economies), and 15% in EMDEs (Emerging Market and Developing Economies) in 2021. As technology advances, and reaches rural areas worldwide, the autonomous IoT payments market is projected to witness significant expansion over the years.

Key Autonomous IoT Payments Market Insights Summary:

Regional Insights:

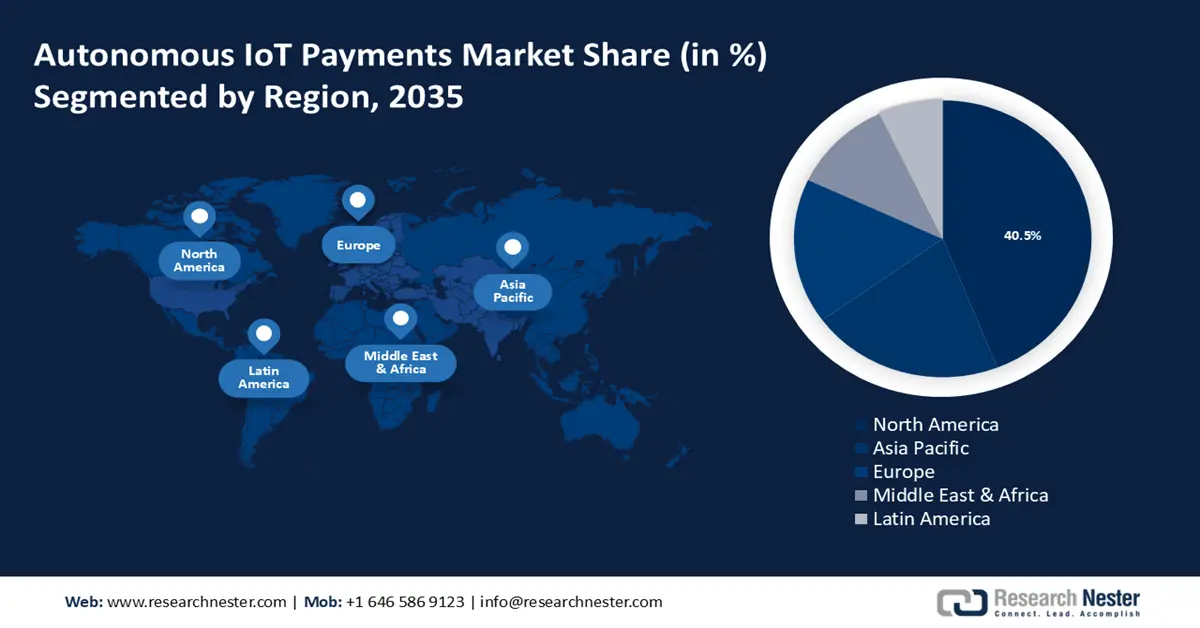

- North America is anticipated to secure 44.4% share by 2035 in the autonomous IoT payments market, due to technological advancements and large business accomplishments.

- Asia Pacific is projected to expand its presence by 2035, attributed to widespread mobile payment usage and rapid digitalization.

Segment Insights:

- The Solution segment in the autonomous IoT payments market is projected to hold over 70.7% share by 2035, owing to its capability of enhancing transaction security.

- By 2035, the B2B segment is expected to capture more than a 33.6% share, impelled by the increment in demand for robust data management.

Key Growth Trends:

- Demand for contactless payment methods

- Government support in digitalization

Major Challenges:

- Security of data and increasing scams

- Lack of regulatory consent

Key Players: Amazon Web Services (AWS), Apple Inc. (Apple Pay), Cisco Systems, Inc., First Data (now part of Fiserv), Gemalto (a Thales, Group company), Google LLC (Google Pay), Honeywell International Inc., IBM Corporation, Intel Corporation, Mastercard Incorporated, Visa Inc.

Global Autonomous IoT Payments Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 77.3 billion

- 2026 Market Size: USD 106.8 billion

- Projected Market Size: USD 2.65 trillion by 2035

- Growth Forecasts: 42.4%

Key Regional Dynamics:

- Largest Region: North America (44.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, UAE

Last updated on : 1 December, 2025

Autonomous IoT Payments Market - Growth Drivers and Challenges

Growth Drivers

- Demand for contactless payment methods: The secured-streamline system offers speed and convenience, which enhances the consumer experience. The adoption of IoT payment has broadened remarkably in past years due to the integration of smart devices. This method allowed everyone to pay through a single device for everything, promoting the cashless campaign. The rise in e-commerce shopping and subscriptions has also impacted autonomous IoT payments. The 2023 BIS report states that the annual average number of digital payments per person increased from 179 in 2012 to 332 in 2021 in the Red Book statistics countries. Contactless transaction systems have also become a market trend after the pandemic struck. In that era, the fear of infection fostered digitalization in every sector, further introducing IoT methods in cashless payment.

- Government support in digitalization: Commendatory governing bodies on digital payments are encouraging the autonomous IoT payments sector to boost. Additionally, authorities are investing to increase the efficiency and sustainability of IoT devices to supervise safe transactions. Governments are establishing clear standards for companies to ensure data privacy, and build consumer trust. Many are contributing to the autonomous IoT payments market growth through financial subsidies to strengthen research and innovation in IoT payment technologies. The intention of building smart cities encourages governments to facilitate autonomous IoT solutions for infrastructure maintenance. In August 2023, the Government of India approved the extension of the DI program with a total outlay of USD 1.8 billion, covering the period from 2021-22 to 2025-26. This investment was made to expand digital payments across the country.

Challenges

- Security of data and increasing scams: Considering the volume of sensitive financial information, the risk of data corruption can restrict market growth. The evolving technology of IoT consists of a complex ecosystem, making it difficult to deliver consistent security over all devices and platforms. A single inadequate transaction can lead to unauthorized access, further redirecting to phishing attacks. The increased number of cybercrimes is threatening consumers to trust new technologies. Such scams have become the reason behind the lack of adoption for newcomers.

- Lack of regulatory consent: Complicated regulations of individual regions can be challenging to follow during innovation. This uncertainty may slow the process of new technology development, hindering new market entry. The unclear regulatory framework can lead to discrepancies in data handling practices, further deteriorating consumer confidence. Furthermore, individual regions develop indifferent market standards, which can restrict the global operations of companies.

Autonomous IoT Payments Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

42.4% |

|

Base Year Market Size (2025) |

USD 77.3 billion |

|

Forecast Year Market Size (2035) |

USD 2.65 trillion |

|

Regional Scope |

|

Autonomous IoT Payments Market Segmentation:

Component Segment Analysis

Solution segment is likely to hold over 70.7% autonomous IoT payments market share by the end of 2035, due to its capability of enhancing transaction security. The segment offers consumers end-to-end comprehensive solutions such as payment gateway, cloud services, and analytic tools. These solutions allow real-time transaction processing to manage the data of connected devices, enhancing user experience. With the increased adoption of IoT devices, it has become crucial to enable scalable and adaptable payment solutions, attracting more consumer engagement. Features such as seamless transactions and personalized services are also one of the growth factors, solidifying the leading position in the market.

Payment Segment Analysis

By 2035, B2B segment is predicted to capture over 33.6% autonomous IoT payments market share. The segment growth is driven by the increment in demand for robust data management. Business transactions consist of larger sums, which require an efficient and secure automated system to be processed. The autonomous IoT payment systems align perfectly with consumer needs and offer fast and cost-effective solutions. Moreover, businesses opt for real-time data analytic systems to upgrade their economic strategies, subsequently enlarging the market. Business-specific IoT technologies are carefully designed to comply with regulatory standards to protect consumer data. Many market leaders are now targeting large-scale businesses to secure a stable client base. They are also inventing advanced solutions, which can handle complex billing and invoicing without human intervention.

Our in-depth analysis of the global market includes the following segments:

|

Components |

|

|

Payment |

|

|

Deployment |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous IoT Payments Market - Regional Analysis

North America Market Insights

North America dominates the autonomous IoT payments market with a 40.5% share in 2024, due to technological advancements and large business accomplishments. The region is expected to capture 44.4% of the total sector by the end of the forecast period. Heavy investments in 5G networks have boosted the complete cashless payments throughout the region. Advanced technological infrastructure is helping market leaders to invest in IoT innovations. Situating some of the world’s biggest businesses has increased the demand for large-scale transaction management systems. The key players are investing overseas to expand their IoT product portfolio worldwide. In April 2024, Microsoft announced an investment of USD 2.9 billion to reconstruct the AI and cloud infrastructure in Japan. They are also planning to provide AI skills to more than 3 million people to expand their digital skilling programs.

The U.S market for autonomous IoT payments is witnessing record-high growth. Innovation in AI, machine learning, and blockchain has secured the market-leading position of this country. The rapid increment in the adoption of smart devices also inflates the demand for enhanced payment automation systems. Investment in fintech startups is also fostering its potential for development. The key players are now collaborating with banks to outstretch their services to a larger number of consumers. According to a report published by Mastercard, in December 2023, they built a powerful set of Open Banking assets acquired through Finicity and Aiia. In addition, with its connectivity to over 95% of deposit accounts in the US and 3,000 banks across Europe, they are expanding its portfolio to outer regions.

Canada is also predicted to witness a remarkable development in the autonomous IoT payments market. The increasing deployment of advanced IoT devices is connecting consumers with a sustainable payment integration facility. A huge number of connected devices have been implemented across sectors such as retail and transportation, stimulating the market to grow bigger. Faster data transmission due to the 5G rollout boosted the e-commerce shopping sector, which cordially piqued the demand for efficient automated payment systems.

APAC Market Insights

The widespread mobile payment usage and rapid digitalization have stimulated the Asia Pacific autonomous IoT payments market to grow bigger in the upcoming years. The government and private sectors are conjugately contributing to developing the digital infrastructure of this region. Further encouraging companies to invest in bringing instant digital transaction solutions. The region’s varied payment landscape also captivates the focus for future innovations. The region’s growing international trade and travel are also contributing to the autonomous IoT payments industry.

India is one of the fastest-growing countries in this sector. Government campaigns such as Atmanirbhar Bharat Abhiyan, and Digital India are attracting bigger investments in the development of digital payment. According to a report published by RTI, in August 2024, the volume of digital payment transactions increased from USD 0.3 billion in FY 2017-18 to USD 2.2 billion in FY 2023-24 at a CAGR of 44%. This massive growth concludes in the enlargement of the overall autonomous IoT payments market.

With one of the largest populations and recent developments, China is also augmenting to achieve noticeable growth in the IoT payment industry. With a wider network of 5th-generation operating systems, China is expected to shape the IoT at home and abroad. According to a report published by Merics, in 2021, China accounted for three-quarters of cellular IoT connections worldwide at the end of 2020. Electronic companies such as Xiaomi are generating larger market revenue from IoT platform connections. Further increasing the demand for autonomous IoT payment systems.

Autonomous IoT Payments Market Players:

- Amazon Web Services (AWS)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc. (Apple Pay)

- Cisco Systems, Inc.

- First Data (now part of Fiserv)

- Gemalto (a Thales Group company)

- Google LLC (Google Pay)

- Honeywell International Inc.

- IBM Corporation

- Intel Corporation

- Mastercard Incorporated

- Visa Inc.

Big market players are now expanding their market reach by partnering with regional governments or private sectors. They are acquiring other companies to collaborate on new technologies, which widens the scope for future investments. In August 2024, Mastercard announced the global launch and first massive test of its new Payment Passkey service in India. Such bold moves made by market leaders are creating a new path for newcomers to extend their footprint in external regions.

Recent Developments

- In September 2024, Mastercard acquired global threat intelligence company Recorded Future from Insight Partners for USD 2.65 billion to expand its cybersecurity services.

- In September 2024, SEALSQ integrated the Internet of Payment (IoP) in next-generation IoT-enabled semiconductors, to conduct autonomous, secure transactions for commerce networks.

- Report ID: 6532

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous IoT Payments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.