Autonomous Forklift Market Outlook:

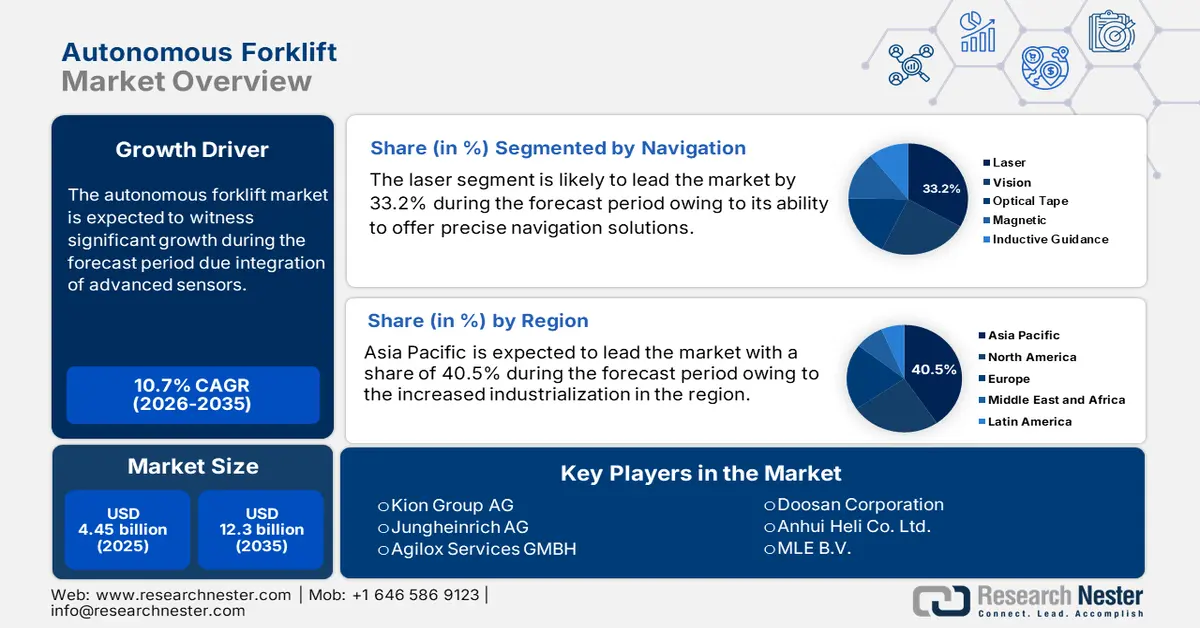

Autonomous Forklift Market size was valued at USD 4.45 billion in 2025 and is likely to cross USD 12.3 billion by 2035, registering more than 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of autonomous forklift is assessed at USD 4.88 billion.

The autonomous forklift market is expected to witness significant growth in the coming years. Business organizations prefer safer alternatives, owing to an excessive number of work-related injuries from manual forklift operations. Autonomous forklifts with sensors and navigation systems cut down on hazardous work tasks. This reduces worker injuries and leads to safer working conditions. Autonomous machines demonstrate the ability to recognize obstacles and stop collisions as they perform tasks with steady accuracy that helps prevent forklift accidents triggered by human errors and visual limitations.

The deployment of autonomous forklifts allows organizations to strengthen their safety guidelines thereby decreasing industrial incidents at their facilities. Recent developments in the industry highlight this shift towards automation for safety enhancement. KION North America joined forces with Fox Robotics in May 2024, to produce and assemble FoxBot autonomous trailer loading and unloading equipment in its South Carolina manufacturing site. The joint initiative between these companies is expected to expand the production network for autonomous forklifts to offer safer material-handling platforms for multiple industries. The industry demonstrates rising concern about reducing workplace hazards through automation operations that confirm autonomous forklifts provide essential operational safety measures.

Key Autonomous Forklift Market Insights Summary:

Regional Highlights:

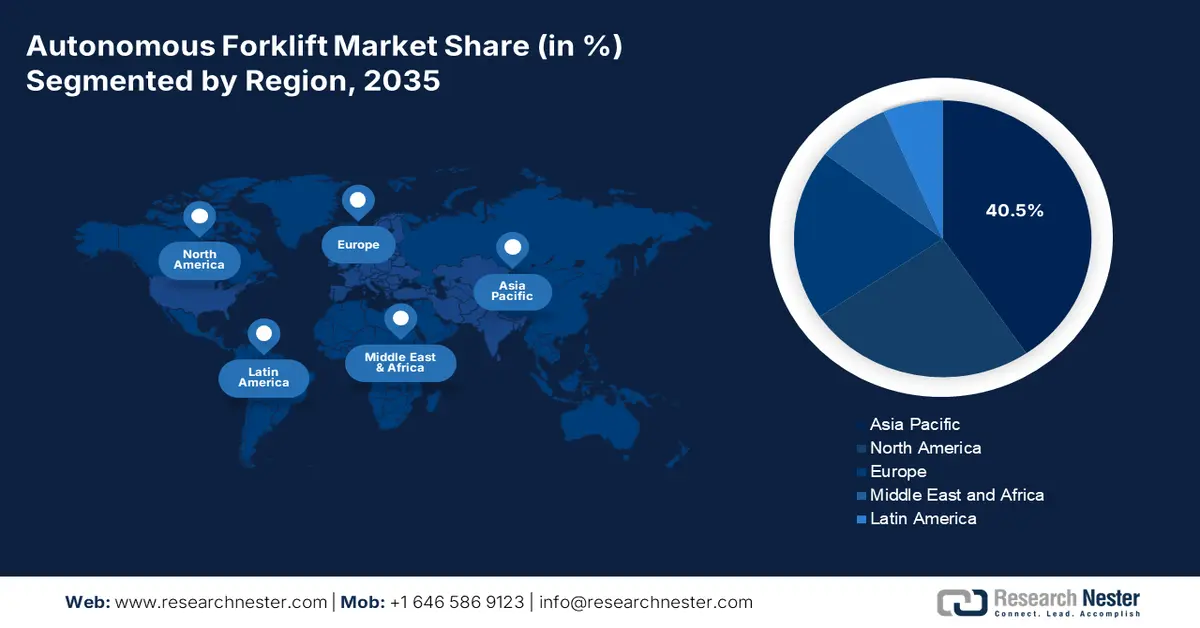

- Asia Pacific leads the Autonomous Forklift Market with a 40.5% share, driven by increased industrialization and rising e-commerce activities demanding automation, ensuring robust growth through 2026–2035.

- The Autonomous Forklift Market in North America is experiencing rapid growth by 2035, driven by the urgent need for improved workplace safety and the shift to autonomous material handling.

Segment Insights:

- The Laser segment is forecasted to achieve more than 33.2% market share by 2035, propelled by its ability to offer precise navigation in complex warehouse environments.

- The Above 10 Tons segment is set for significant revenue growth by 2035, driven by demand from heavy industries for autonomous handling of substantial material loads.

Key Growth Trends:

- Integration of advanced sensors and perception systems

- Safety and risk mitigation

Major Challenges:

- Connectivity and cybersecurity risks

- Limited workforce expertise

- Key Players: Kion Group AG, Jungheinrich AG, Hyster-Yale Materials Handling, and Agilox Services GMBH.

Global Autonomous Forklift Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.45 billion

- 2026 Market Size: USD 4.88 billion

- Projected Market Size: USD 12.3 billion by 2035

- Growth Forecasts: 10.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Autonomous Forklift Market Growth Drivers and Challenges:

Growth Drivers

-

Integration of advanced sensors and perception systems: Companies are implementing autonomous forklifts due to their advanced sensor technologies such as 3D cameras, LiDAR, radar, and ultrasonic sensors. Through these perception systems, forklifts create real-time maps of environments, detect obstacles instantly, and execute precise operations in elaborate warehouse layouts. Hybrid sensor systems managed by AI technology let forklifts improve their awareness of space, helping them design better routes and detect hazards while adjusting to shifting conditions. The system uses technology to minimize operational mistakes while maximizing throughput values and providing continuous workflow operations. With the use of machine learning algorithms, the forklifts enhance their capacity to process past navigation data, which helps them optimize their route selection and boost efficiency levels. The autonomous forklift market demands these systems as organizations prefer to enhance their logistics operations, minimize material damage, along with enhancing safety measures.

-

Safety and risk mitigation: The safety needs of the workplace serve as the primary motivator for adopting autonomous forklifts, as traditional forklifts cause thousands of daily injuries. Traditional forklift operations produce substantial financial consequences together with operational risks as humans make mistakes that can cause collisions while handling loads unsafely. Autonomous forklifts use artificial intelligence navigation while detecting live emergencies and predicting operation needs. Safe workplace solutions are provided by automated braking together with obstacle avoidance and geofencing functions, that prevent accidents and maintain work area regulations.

Workers using autonomous forklift systems face fewer interruptions at the workplace, while costs associated with employee injuries decrease and their operations become more efficient. Business operations are making automation their top priority, as the regulations have intensified and employees need enhanced safety measures. Intelligent material handling solutions receive heavy investments from manufacturing together with logistics and e-commerce industrial sectors for risk reduction. Companies are also introducing advanced autonomous solutions, including the use of AI, in their cutting-edge solutions.For instance, in March 2022, OTTO Motors unveiled its OTTO Lifter model, which utilizes AI to detect obstacles and make decisions in real-time for better workplace safety through its safety sensors.

Challenges

-

Connectivity and cybersecurity risks: Autonomous forklift technology functions with real-time data exchange and navigation through wireless networks and cloud platforms together with IoT communication. Wireless communication proves unsafe for autonomous systems due to security risks including unauthorized data access and hacking while delivering data breaches. The attack on autonomous systems using cyber tactics results in interrupted warehouse activities combined with breached sensitive logistics data, leading to potential safety risks.

-

Limited workforce expertise: The deployment of autonomous forklifts necessitates trained personnel at various levels including operators, technicians, and IT professionals, capable of handling, fixing, and keeping up AI-powered systems. The workforce struggles to implement robotics and machine learning technology, as employees do not have sufficient experience with these systems. This workforce lack generates delays in implementation. Businesses in areas with limited technological expertise need assistance from external training programs and technical support, as they are unable to find suitable personnel for their positions. Insufficient workforce preparation leads companies to experience operational stagnation and delays in automation implementation, together with increased expenditures required for employee skill enhancement.

Autonomous Forklift Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 4.45 billion |

|

Forecast Year Market Size (2035) |

USD 12.3 billion |

|

Regional Scope |

|

Autonomous Forklift Market Segmentation:

Navigation Technology (Laser, Vision, Optical Tape, Magnetic, Inductive Tape)

Laser segment is anticipated to account for more than 33.2% autonomous forklift market share by the end of 2035, attributed to its ability to offer precise navigation solutions in intricate warehouse areas. The laser simultaneous localization and mapping technology permits devices to generate live maps and navigate autonomously using laser-based systems, that do not require physical guidance like QR codes or magnetic strips. These platforms demonstrate quick deployment capabilities, resulting in operational adaptability, therefore delivering efficient material handling solutions for modern requirements.

Laser-based technologies find acceptance in autonomous forklifts, as warehouses require effective navigation solutions that adapt efficiently to their needs. In October 2024, Reeman introduced its Stackman 1200 autonomous forklift that uses advanced Laser SLAM navigation technology and enables exact real-time mapping and autonomous route navigation. The system removes the requirement for common navigation aids through its ability to deploy quickly while the setup of navigation maps takes 30 minutes. Advanced navigation solutions have emerged to drive the industry toward better efficiency as well as flexibility in autonomous material handling.

Tonnes (Below 5 Tons, 5 to 10 Tons, Above 10 Tons)

The above 10 tons segment in autonomous forklift market is expected to account for a significant revenue during the forecast period, attributed to the requirement of efficient heavy materials handling solutions from industries such as construction, automotive, and heavy machinery manufacturing. The substantial material movements that these sectors need can be better managed through autonomous forklifts, as they perform with superior precision and safety than manual operations. These vehicles bring increased productivity alongside lower operating costs and are becoming favorable choices for big-scale operations due to their continuous operation ability without wear.

The forklift market has expanded with the development of next-generation autonomous forklifts that operate with heavy loads. The autonomous forklift market demands push companies toward autonomous forklift development that increases load capacity for heavy-duty applications. In May 2023, Combilift worked with Siemens Gamesa to create the Combi-LC, which functions as an autonomous truck for managing extensive wind turbine elements. The Combi-LC holds the capacity to move 70-tonne cargo including 115-meter turbine blades as its maximum load dimension. The product provides an effective solution to handle renewable energy sector oversized components with safety and efficiency in mind.

Our in-depth analysis of the global autonomous forklift market includes the following segments:

|

Tonnes |

|

|

Navigation Technology |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous Forklift Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific autonomous forklift market is poised to capture revenue share of around 40.5% by the end of 2035, owing to increased industrialization. Advanced technology implementations between China and Japan are expected to improve operation functionality and reduce labor expenses. The rise of e-commerce activities demands automated material handling solutions that help businesses deal with high order volumes while providing prompt delivery services. The modern market drives businesses toward autonomous forklift purchases in order to make their warehouses more efficient and competitive.

The focus on sustainability and energy efficiency in warehouse operations is expected to boost autonomous forklift market growth during the forecast period. The demand for autonomous forklift solutions has increased as companies throughout the region select lithium-ion battery-powered systems, due to their ability to provide longer usable time combined with quicker recharge abilities than lead-acid batteries. The demand for sustainable and environmentally friendly solutions, coupled with economic power needs is encouraging manufacturers to develop innovative energy-efficient technologies. This is expected to make autonomous forklifts a preferred option for companies, to cut their carbon emissions and achieve operational excellence.

The China autonomous forklift market is expected to propel, due to the fast industrial growth and rising automation use throughout production and logistics sectors. The Made in China 2025 initiative by the government supports the development of smart manufacturing through autonomous forklifts, that companies use to improve their operation performance and output.

National policy initiatives in China have surged investments in autonomous material handling technologies, promoting the development of specialized solutions for its various industrial facilities. Companies are joining forces to accelerate innovations in the autonomous forklift industry. The partnership between BYD and Cyngn represents a major movement in the China autonomous forklift market, announced in June 2023. Through their joint venture, BYD and Cyngn plan to merge autonomous forklift technology from Cyngn, with material handling products from BYD to create AI-enabled autonomous forklifts.

The autonomous forklift industry in India is growing rapidly, due to the expanding e-commerce activities combined with essential requirements for optimal warehousing systems. The growth of e-commerce has triggered elevated demands for simplified logistics processing and companies are using autonomous forklifts to improve business operations and minimize personnel expenses. The initiative for digitalization and smart infrastructure development in India is establishing conditions that favor supply chain automation across operations. For instance, in August 2024, Godrej & Boyce launched a lithium-ion powered forklift truck, featuring an indigenously developed battery management system. The solution is expected to address a critical need in the Indian material handling sector by providing a self-reliant and secure lithium-ion battery system.

North America Market

The North America autonomous forklift market is expected to witness a rapid expansion between 2026 and 2035. The growth is attributed to the urgent requirement to boost workplace safety functions as a key driver for the regional facilities to migrate toward autonomous forklift implementations. Yearly operations with traditional forklifts lead to multiple workplace injuries and death cases. The increasing number of workplace risks has convinced manufacturers to incorporate automated material handling solutions as risk reduction measures. The shift towards autonomous vehicles and automated systems is being implemented by companies, thereby removing employee-driven forklift operations to create safer operation zones.

The U.S. autonomous forklift market is increasing, owing to the major investments by technology companies that are aimed at improving material handling system efficiency. In January 2025, Cyngn secured USD 33 million through funding to extend the production and deployment of autonomous forklifts and tuggers. The investment demonstrates how manufacturers are bringing advanced AI and autonomous systems into industrial vehicles for better warehouse operations management. The autonomous forklift market expansion is driven by the rising implementation of shared autonomy systems that enable humans to work together with autonomous forklifts. Companies across industries choose hybrid forklift oversight as the method balances operational efficiency with human supervision while replacing only parts of the human role.

The autonomous forklift market in Canada is embracing sustainability along with energy efficiency in its business operations, driving the adoption of lithium-ion-powered autonomous forklifts. These progressive forklift models provide operators with advantages that comprise minimized upkeep requirements alongside extended functional periods as well as reduced ecological consequences compared to standard lead-acid battery-operated versions. The companies are driven toward eco-friendly autonomous material handling equipment, due to their compliance requirements with environmental regulations and their focus on green logistics systems which leads to the autonomous forklift market's continuous expansion.

Key Autonomous Forklift Market Players:

- Kion Group AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Agilox Services GMBH

- Doosan Corporation

- Anhui Yufeng Equipment Co. Ltd.

- Anhui Heli Co. Ltd.

- Crown Equipment Corporation

- MLE B.V.

- Hangcha Group Co. Ltd.

The competitive landscape of the autonomous forklift market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their autonomous forklift market position. Here are some key players operating in the global market:

Recent Developments

- In January 2025, Kion Group collaborated with NVIDIA and Accenture to integrate Physical AI, into warehouse operations. This initiative involves creating digital twins of warehouses using NVIDIA Omniverse, allowing advanced simulations and real-time optimizations to enhance automation and efficiency.

- In October 2024, Third Wave Automation closed a USD 27 million Series C round, led by Woven Capital, Toyota’s growth fund. The funding is expected to enable Third Wave to scale its pioneering Shared Autonomy Platform.

- Report ID: 7196

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous Forklift Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.