Autonomous Farm Equipment Market Outlook:

Autonomous Farm Equipment Market size was valued at USD 21.95 billion in 2025 and is likely to cross USD 69.4 billion by 2035, expanding at more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of autonomous farm equipment is assessed at USD 24.36 billion.

The reason behind the growth is the rapid advancement in robotics. As of April 2024, American manufacturing organizations have made significant investments in automation by 2023, there will be 44,303 industrial robots installed, a 12% increase from the previous year.

Key Autonomous Farm Equipment Market Insights Summary:

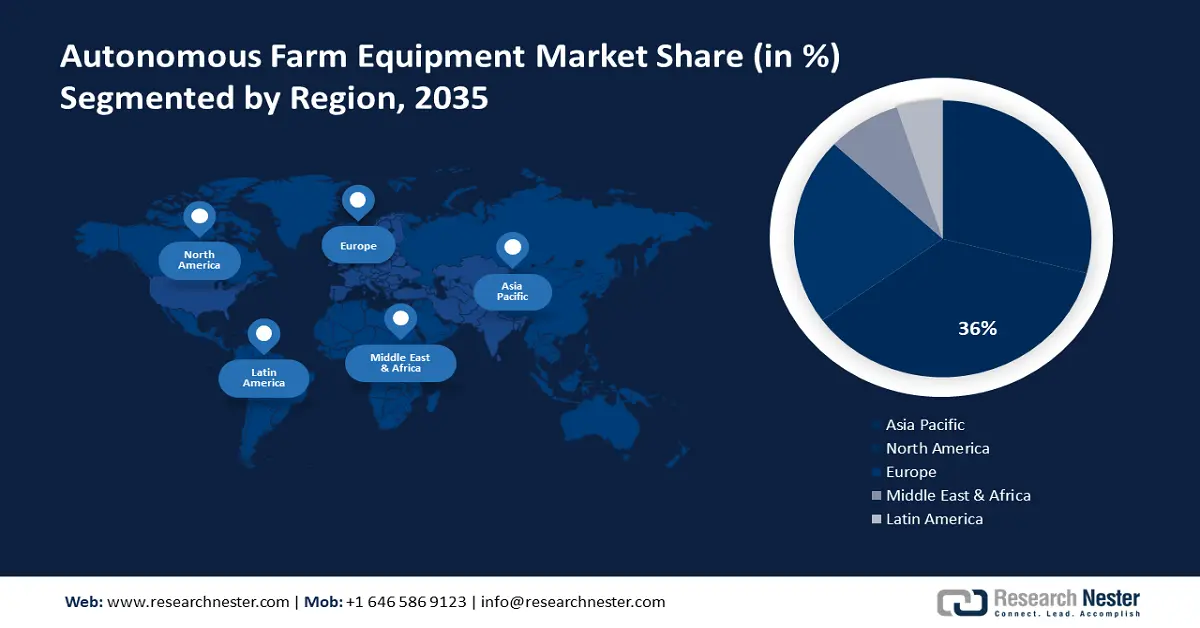

Regional Highlights:

- North America autonomous farm equipment market will account for 36% share by 2035, driven by the adoption of accurate automation in agriculture in this region.

Segment Insights:

- The fully autonomous segment in the autonomous farm equipment market is projected to hold a 70% share by 2035, fueled by increased adoption of precision farming without manual assistance.

- The hardware segment in the autonomous farm equipment market is forecasted to achieve a 66% share by 2035, driven by the development of advanced technologies enhancing farm equipment efficiency.

Key Growth Trends:

- Rising awareness of environmental sustainability

- Consolidation of smartphones with agricultural hardware and software applications for autonomous tractors

Major Challenges:

- Incapacity of farmers to understand the latest technologies in agriculture

- Costliness and complication of completely automated tractors

Key Players: Bobcat Company, Autonomous Solutions, Inc., Clearpath Robotics, Inc., Agrobot, New Holland, CNH Industrial America LLC, Deere & Company, AGCO Corporation, YANMAR HOLDINGS Co., Ltd., CLAAS KGaA mbH, Kubota Corporation, Montag Mfg, SanBio Co, Ltd., Sagri Co., Ltd, Agri Info Design, LTD.

Global Autonomous Farm Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.95 billion

- 2026 Market Size: USD 24.36 billion

- Projected Market Size: USD 69.4 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Netherlands

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Autonomous Farm Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Rising awareness of environmental sustainability - Consumer behavior has changed dramatically in recent years as more people prioritize sustainability and environmental conscience when making purchases. A new wave of responsibility has entered every sector due to the increase in eco-consciousness. Because of this, businesses are now rethinking customer experience (CX) in order to be more sustainable.

As stated in the World Bank released in June 2021, the United Nations Carbon Change Conference (COP26) in November 2021, and the European Union's green agreement, which pledges the EU to achieve carbon neutrality by 2050 is done to achieve environmental sustainability. - The growing IoT and navigational technologies globally - Technological advancements in sensors and connection enable more affordable digitalization, equipment downsizing, increased bandwidth availability, and seamless connectivity with private or public 5G networks. Once people incorporate the Internet of Things (IoT) and AI in their business they start understanding the ever-expanding capabilities that start from learning the data and using AI.

As per a Research Nester expert poll, there will be 83 billion IoT connections globally by 2024, up from 35 billion in 2020. - Consolidation of smartphones with agricultural hardware and software applications for autonomous tractors - The way farmers cultivate, supply, harvest, and transport food is being greatly improved by software engineers, increasing yields and lowering expenses. In this whole process, mobile apps are helping immensely. Smartphone apps are affordable and can easily be incorporated into agricultural hardware and software. Their high-resolution cameras and GPS help in taking samples, aerial imaging, and record keeping.

Recently, cell phones have evolved into a wide range of practical portable gadgets, such as tablets and smartphones. People are so deep-seated with these devices that experts of Research Nester estimated that there will be more cellphone devices around 7.25 billion in 2024 than people almost 7.2 billion globally.

Challenges

-

Incapacity of farmers to understand the latest technologies in agriculture - One major obstacle is farmers' ignorance of contemporary farming methods. Farmers in rural regions frequently lack knowledge about the most recent advancements in agricultural operations, which makes it more difficult for them to implement creative strategies that might increase productivity and lessen their influence on the environment.

-

Costliness and complication of completely automated tractors - Because autonomous tractors integrate cutting-edge technology such as GPS, sensors, and AI, they come with significant upfront expenses. Widespread adoption may be hampered by farmers' reluctance to incur these fees, particularly small-scale farms with tight budgets.

Autonomous Farm Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 21.95 billion |

|

Forecast Year Market Size (2035) |

USD 69.4 billion |

|

Regional Scope |

|

Autonomous Farm Equipment Market Segmentation:

Operation Segment Analysis

Fully autonomous segment is set to account for around 70% autonomous farm equipment market share by 2035. The rising use of precise farming systems without the assistance of manual effort globally will help this segment to have a massive revenue share by the end of 2035.

Corresponding to the United States Government Accountability Office printed on January 2024, for the fiscal years 2017–2021, the National Science Foundation (NSF) and the USDA will jointly support about USD 200 million in precision agricultural research and development.

Product Segment Analysis

By the end of 2035, tractors segment is expected to capture around 55% autonomous farm equipment market share. The expanding use of tractors and rising versatility will highly drive the market expansion of this segment.

As per our experts' research done in 2024, TAFE tractors are leading the way in the trend of sustainable farming. With the help of these state-of-the-art features, farmers can plant, fertilize, and harvest with pinpoint accuracy, increasing production and minimizing environmental impact.

Technology Segment Analysis

In autonomous farm equipment market, hardware segment is expected to dominate over 66% revenue share by 2035. The growth of this segment will be noticed because of the rising development of technologies in farming equipment to increase the efficiency and power of agricultural equipment.

In 2020, data analytics breakthroughs allowed scientists to take enormous steps toward creating a more resilient and productive global food system. The possibilities in crop protection, plant breeding, and other fields are being opened up by the computerized tools; the uses for these technologies are virtually limitless.

Our in-depth analysis of the autonomous farm equipment market includes the following segments:

|

Operation |

|

|

Product |

|

|

Technology |

|

|

Service Provider |

|

|

Application |

|

|

Output Power |

|

|

Crop Type |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous Farm Equipment Market Regional Analysis:

North American Market Insights

North America in autonomous farm equipment market is set to account for more than 36% revenue share by the end of 2035. By 2035 the industry of autonomous farm equipment in North America will reach around USD 62.1 billion.

This rapid expansion will be noticed mainly due to the adoption of accurate automation in agriculture in this region. As shared in the journal of the U.S. Department of Agriculture (USDA) in February 2023, yield maps, soil maps, VRT, and guidance systems are used by at least half of moderately large row crop farms (those at or above the third quintile of acreage, that is, with at least 60% of fields on farms with lower acreage) in North America.

The autonomous farm equipment market has amplified in the U.S. as a result of a rising application of GPS application in farms in the U.S. Moreover, taking the estimates of USDA into account that were released in February 2023, for on-farm productivity, GPS apps were utilized on 40% of total U.S. farm and ranchland acreage in 2019.

The Canadian autonomous farm equipment sector will notice enormous growth mainly due to the country’s commitment to agricultural progress. As per the Organization for Economic Cooperation and Development (OECD) Library evaluation done in 2023, in recent years, around 40% of GSSE was made up of expenditures on agricultural innovation and expertise, as well as inspection and control systems. Between 2020 and 2022, the Total Support Estimate (TSE) accounted for 0.4% of GDP.

APAC Market Insights

The Asia Pacific region will encounter massive growth in the sector of the autonomous farm equipment sector market during the anticipated period.

The increased demand for good grain quality due to the rising population will drive the market expansion of autonomous farm equipment. In line with the Food and Agricultural Organization’s journal published in 2023, by 2025, Asia's rice consumption will have increased by more than 51% from 1995, the base year. It is anticipated that the 524 million tonnes of demand currently in place will rise to above 700 million tonnes.

Autonomous farm equipment is especially going to increase massively in China, driven by the rising adoption of autonomous technologies by farmers in this country. According to the World Bank Group published in 2019, farmers in Guangdong applied 770 kg of fertilizer per acre, which was twice as much as in Japan, five times as much as in Thailand, and six times more than in the US.

In Japan, autonomous farm equipment market will encounter massive growth because of the government initiatives for sustainable farming and the use of sustainable crop protection chemicals in this region. As stated in the Multidisciplinary Digital Publishing Institute in 2024, the Japanese government hopes to see 63,000 hectares of organic farming under cultivation by 2030, and by 2050, that amount of land should make up 25% of all agricultural land.

The autonomous farm equipment sector will also be huge in India due to the huge expansion of the farmland in this country and the huge opportunity to perform sustainable farming. Based on a thorough study of yearly land use and land cover issued in April 2024 by the National Remote Sensing Centre (NRSC), ISRO, Hyderabad, built-up land showed a modest increase with an overall gain of almost 31% between 2005-06 and 2022-23.

Autonomous Farm Equipment Market Players:

- Bobcat Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Autonomous Solutions, Inc.

- Clearpath Robotics, Inc.,

- Agrobot

- New Holland

- CNH Industrial America LLC

- Deere & Company

- AGCO Corporation

- YANMAR HOLDINGS Co., Ltd.

Details by competitor are provided by the competitive environment for autonomous farm equipment. Many companies are merging, and introducing new innovative technologies across the world. Some major participants in the industry are:

Recent Developments

- Bobcat Company, a global brand known for its equipment, innovation, and job site solutions, is building in Mexico a USD 300 million manufacturing complex. The groundbreaking ceremony was held on June 13, 2024.

- Bobcat Company, the worldwide equipment, innovation, and workplace solutions brand introduced three new utility tractors to its range on June 10, 2024: the Bobcat UT6066, UT6566, and UT6573. Built for heavy-duty labor, Bobcat utility tractors enable users of all skill levels to get more done on their property.

- Report ID: 6229

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous Farm Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.