Global Autonomous Driving Services Market

- An outline of the Global Autonomous Driving Services Market

- Market Definition

- Market Segmentation

- Solution Overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Technological Advancements

- Growth Outlook

- SWOT

- Regional Demand

- Supply Chain

- Merger and Acquisitions (M&A)

- Recent News

- Decoding the Autonomous Driving Revolution: Insights into Service Types and Market Trends

- Growth Potential for Service Type of Autonomous Driving Services Market

- The Role of High-Performance Windows

- Revolutionizing Autonomous Driving: Key Technologies Shaping the Future

- Consumer Decision-Making: Key Factors Impacting Autonomous Vehicle Acceptance

- The Backbone of Autonomous Vehicle Industry

- Key Players

- Market for Autonomous Vehicle Market

- Projected Vehicle Distribution By Service Type and Automation Level: 2024 vs 2037

- Root Cause Analysis (RCA) for Discovering problems of the Autonomous Driving Services Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Competitive Landscape

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share

- Business Profile of Key Enterprise

- Cruise LLC

- EasyMile

- Kodiak Robotics, Inc.

- Lyft, Inc.

- Motional, Inc.

- Navya

- Nuro, Inc.

- Pony.ai

- Vay

- Waymo LLC

- Competitive Landscape: Key Players

- Competitive Model

- Market Share of Major Companies Profiled, 2023

- Business Profile of Key Enterprise

- AB Volvo

- Alexander Dennis Limited

- Ashok Leyland Limited.

- Blue Bird Corporation.

- BYD Motors

- Collins Bus Corporation

- Daimler Truck Holding AG

- Deccan Auto Limited

- Eicher Motors Limited

- Ford Motor Company

- Hyundai Motor Company

- ISUZU MOTORS

- Iveco Group NV.

- JBM Motor Limited

- Mahindra and Mahindra.

- PACCAR Inc.

- Tata Motors Limited.

- TEMSA

- The Lion Electric Company

- TRATON SE

- VDL Van Hool.

- Yutong Group

- Global Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Global Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

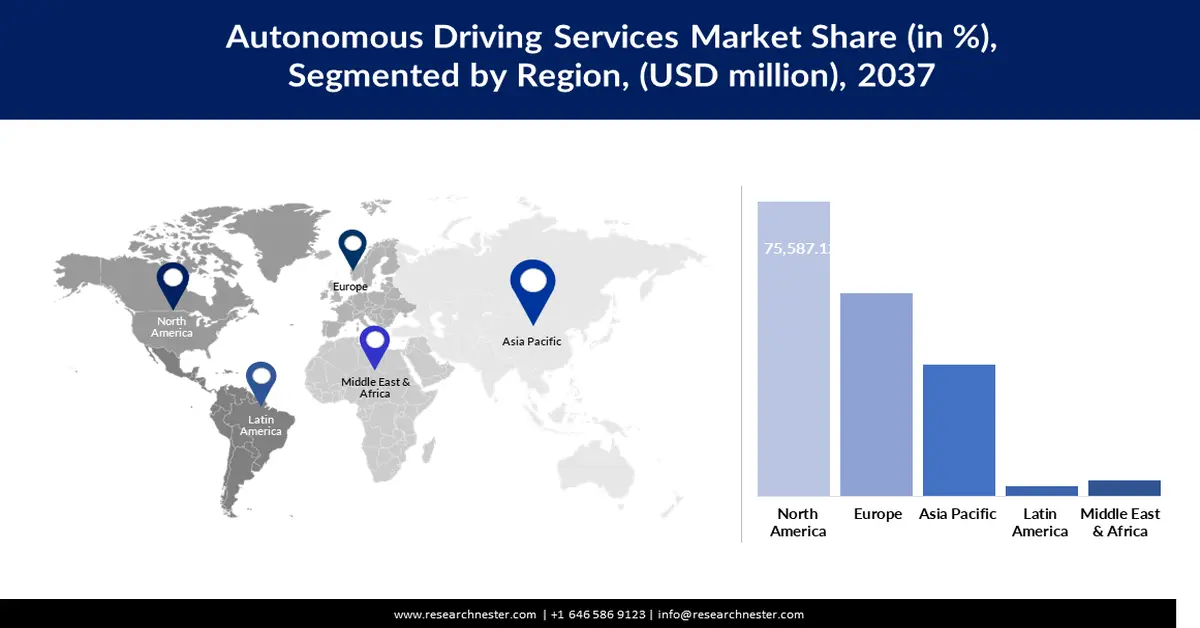

- By Region

- North America, Market Value (USD Million) and CAGR, 2014-2037F

- Europe, Market Value (USD Million) and CAGR, 2014-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million) and CAGR, 2014-2037F

- Japan, Market Value (USD Million) and CAGR, 2014-2037F

- Latin America, Market Value (USD Million) and CAGR, 2014-2037F

- Middle East and Africa, Market Value (USD Million) and CAGR, 2014-2037F

- By Service Type

- Cross Analysis of Vehicle Type W.R.T. Level of Automation (USD Million), 2024-2037

- North America Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- North America Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- U.S., Market Value (USD Billion), Volume(Thousand Units) and CAGR, 2014-2037F

- Canada Market Value (USD Billion), Volume(Thousand Units) and CAGR, 2014-2037F

- By Service Type

- Cross Analysis of Vehicle Type W.R.T. Level of Automation (USD Million), 2024-2037

- Europe Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Europe Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- UK, Market Value (USD Million) and CAGR, 2014-2037F

- Germany, Market Value (USD Million) and CAGR, 2014-2037F

- France, Market Value (USD Million) and CAGR, 2014-2037F

- Italy, Market Value (USD Million) and CAGR, 2014-2037F

- Spain, Market Value (USD Million) and CAGR, 2014-2037F

- BENELUX, Market Value (USD Million) and CAGR, 2014-2037F

- Poland, Market Value (USD Million) and CAGR, 2014-2037F

- Russia, Market Value (USD Million) and CAGR, 2014-2037F

- Rest of Europe, Market Value (USD Million) and CAGR, 2014-2037F

- By Service Type

- Cross Analysis of Vehicle Type W.R.T. Level of Automation (USD Million), 2024-2037

- Asia Pacific Excluding Japan Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- China, Market Value (USD Million) and CAGR, 2014-2037F

- India, Market Value (USD Million) and CAGR, 2014-2037F

- South Korea, Market Value (USD Million) and CAGR, 2014-2037F

- Australia, Market Value (USD Million) and CAGR, 2014-2037F

- Indonesia, Market Value (USD Million) and CAGR, 2014-2037F

- Malaysia, Market Value (USD Million) and CAGR, 2014-2037F

- Vietnam, Market Value (USD Million) and CAGR, 2014-2037F

- Singapore, Market Value (USD Million) and CAGR, 2014-2037F

- Thailand, Market Value (USD Million) and CAGR, 2014-2037F

- New Zealand, Market Value (USD Million) and CAGR, 2014-2037F

- Rest of Asia Pacific excluding Japan, Market Value (USD Million) and CAGR, 2014-2037F

- By Service Type

- Cross Analysis of Vehicle Type W.R.T. Level of Automation (USD Million), 2024-2037

- Japan Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Japan Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

- By Service Type

- Cross Analysis of Vehicle Type W.R.T. Level of Automation (USD Million), 2024-2037

- Latin America Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Latin America Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- Brazil, Market Value (USD Million) and CAGR, 2014-2037F

- Argentina, Market Value (USD Million) and CAGR, 2014-2037F

- Mexico, Market Value (USD Million) and CAGR, 2014-2037F

- Rest of Latin America, Market Value (USD Million) and CAGR, 2014-2037F

- By Service Type

- Middle East & Africa Autonomous Driving Services Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Autonomous Driving Services Market Segmentation Analysis (2014-2037)

- By Service Type

- Ride-Hailing, Market Value (USD Million) and CAGR, 2014-2037F

- Public Transportation, Market Value (USD Million) and CAGR, 2014-2037F

- Freight and Delivery, Market Value (USD Million) and CAGR, 2014-2037F

- By Level of Automation

- Partial Automation(L1 & L2), Market Value (USD Million), and CAGR, 2014-2037F

- High Automation(L3), Market Value (USD Million), and CAGR, 2014-2037F

- Full Automation(L4 & L5), Market Value (USD Million), and CAGR, 2014-2037F

- By Vehicle Type

- Passenger Cars, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial Vehicles, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- GCC, Market Value (USD Million) and CAGR, 2014-2037F

- Israel, Market Value (USD Million) and CAGR, 2014-2037F

- South Africa, Market Value (USD Million) and CAGR, 2014-2037F

- Rest of Middle East & Africa, Market Value (USD Million) and CAGR, 2014-2037F

- By Service Type

- Cross Analysis of Vehicle Type W.R.T. Level of Automation (USD Million), 2024-2037

- World Economic Outlook

- About Research Nester

Autonomous Driving Services Market - Historic Data (2019-2024), Global Trends 2025, Growth Forecasts 2037

Autonomous Driving Services Market in 2025 is evaluated at USD 5.81 billion. The global market size was around USD 4.6 billion in 2024 and is likely to expand at a CAGR of more than 33%, surpassing USD 187.43 billion revenue by 2037. North America is poised to reach USD 76.47 billion by 2037, fueled by significant investments in AI and smart infrastructure.

The autonomous driving services market is anticipated to rise significantly due to advances in AI, sensor technologies, and connectivity solutions, which further drive innovation in this sector. Furthermore, the integration of Level 4 and Level 5 automation in ride-hailing and public transportation services is transforming urban mobility. In July 2024, Alphabet announced that it was planning to invest around USD 5 billion into Waymo, promoting the commercialization of its autonomous driving technologies. This investment underlines huge growth potential for this sector and draws special attention from improving road safety to easing congestion and increasing consumer convenience-propelled by driverless mobility solutions.

Governments are also supportive of the development and deployment of autonomous technologies through funding and strategic initiatives. For instance, the SMART program by USDOT, announced in August 2024, provides up to USD 15 million in grants to implement smart community technologies, including autonomous transportation solutions. These, together with private sector investments, are overcoming infrastructure challenges and ensuring seamless integration of autonomous services within modern transportation ecosystems.

Key Autonomous Driving Services Market Insights Summary:

Regional Insights:

- North America is projected to command over 40.8% revenue share by 2037 in the autonomous driving services market, underpinned by the rapid rollout of new mobility services and heavy investments in AI-driven infrastructure strengthening autonomous fleet deployment

- Asia Pacific is expected to witness over 33.6% growth through 2037, supported by accelerating adoption of connected vehicle technologies and expanding AI and IoT ecosystems enhancing autonomous mobility solutions

Segment Insights:

- In the autonomous driving services market, the ride-hailing segment is forecast to secure over 54% share by 2037, reinforced by accelerating urbanization and rising consumer inclination toward on-demand, driverless transportation experiences

- Partial automation (L1 & L2) is anticipated to capture around 73.9% revenue share by 2037, attributed to widespread integration of advanced driver-assistance systems enhancing vehicle safety and functional automation

Key Growth Trends:

- Technological advancements

- Government support and incentives

Major Challenges:

- Regulatory hurdles and public acceptance

- Integration with complex infrastructure

Key Players: AB Volvo, Alexander Dennis Limited, Ashok Leyland Limited., Blue Bird Corporation., BYD Motors, Collins Bus Corporation, Daimler Truck Holding AG, Deccan Auto Limited, Eicher Motors Limited, Ford Motor Company, Hyundai Motor Company, ISUZU MOTORS, Iveco Group NV., JBM Motor Limited, Mahindra and Mahindra., PACCAR Inc., Tata Motors Limited., TEMSA, The Lion Electric Company, TRATON SE, VDL Van Hool., Yutong Group.

Global Autonomous Driving Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 4.6 billion

- 2025 Market Size: USD 5.81 billion

- Projected Market Size: USD 187.43 billion by 2037

- Growth Forecasts: 33% CAGR (2024-2037)

Key Regional Dynamics:

-

Largest Region: North America (over 40.8% share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, United Arab Emirates, Singapore

-

Last updated on : 23 April, 2025

Autonomous Driving Services Market: Growth Drivers and Challenges

Growth Drivers

- Technological advancements: The advent of artificial intelligence-driven perception systems supported by high-precision sensors is remolding the landscape of autonomous driving to ensure that systems can be more intelligent and secure. In March 2023, RoboSense launched the automotive-grade LiDAR system RS-Fusion-P6 targeted for Level 4 autonomous driving. This move is likely to improve the level of safety, accuracy of navigation, and reliability since the challenges related to urban mobility in the context of a city ecosystem are complex. Besides this, machine learning algorithm development allows for carrying out updates in real time on adaptive vehicles.

- Government support and incentives: Governments around the world are providing grants, subsidies, and favorable regulatory environments for companies to come up with autonomous vehicles. For example, Japan Government collaborated with Tokyo-based telco NTT West and Macnica Inc. in June 2024 to resolve the driver shortage with investments in autonomous driving services in rural areas. Such initiatives include infrastructure upgrades like smart road systems and 5G networks for safe deployment. Financial incentives further reduce the barriers for manufacturers and operators, thus encouraging faster commercialization.

- Increased demand for sustainable mobility solutions: With the increased carbon emission reduction policies and the development of sustainable transport solutions, there is a rise in the adoption of autonomous electric vehicles. In May 2024, Volvo Trucks announced the development of hydrogen-powered autonomous trucks for which on-road testing is scheduled to start in 2026. These vehicles target net-zero emissions, yet high efficiency and reliability. Additionally, there is increased interest in autonomous electric shuttles within urban areas, which are considered efficient in reducing congestion and air pollution.

Challenges

- Regulatory hurdles and public acceptance: Autonomous driving technologies face very strict regulatory frameworks designed to ensure safety and compliance. Various legislations on self-driving cars around the world, coupled with a lack of standardization, hinder the process of their adoption since manufacturers must go through difficult approval processes. Furthermore, people are skeptical of the whole idea because of doubts over safety issues and ethical decision-making by AI, further impeding widespread acceptance. In October 2023, the U.S. Department of Transportation proposed stricter guidelines for autonomous vehicle testing, reflecting the regulatory barriers that manufacturers must address.

- Integration with complex infrastructure: To integrate autonomous cars into the going structure is one considerable challenge on the technical as well as logistics level. For seamless deployment, there stands the legacy in-road systems without advanced traffic management systems, along with inconsistent global standards for implementation. Most autonomous vehicles need extensive sensor networks, 5G connectivity, and real-time data, hence requiring serious infrastructure upgrades. In August 2024, the Land Transport Authority of Singapore started tests that would, subsequently, enable the integration of self-driving shuttles with smart traffic systems and that even infrastructure will need to be reshaped. These challenges require some collective efforts on the part of the government, technology providers, and urban planners.

Autonomous Driving Services Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

33% |

|

Base Year Market Size (2024) |

USD 4.6 billion |

|

Forecast Year Market Size (2037) |

USD 187.43 billion |

|

Regional Scope |

|

Autonomous Driving Services Segmentation

Service Type (Ride-Hailing, Public Transportation, Freight and Delivery)

Ride-hailing segment is projected to hold autonomous driving services market share of over 54% by the end of 2037. The factors contributing to the growth are basically urbanization and an increase in consumer preference for on-demand, driverless transportation. Furthermore, their growing adoption through increased use of ride-hailing applications, added to the increasing integration with other digital services, is a contributing factor. In September 2024, an autonomous micro-transit service launched in California accentuated convenience and ease of access due to autonomous driving technologies enabled for ride-hailing services as part of Contra Costa Transportation Authority. The move consolidates autonomous technology's gaining momentum in public road transport to catalyze urban mobility challenges.

Level of Automation (Partial Automation (L1 & L2), High Automation (L3), Full Automation (L4 & L5))

In autonomous driving services market, partial automation (L1 & L2) segment is expected to capture revenue share of around 73.9% by the end of 2037, due to extensive usage of ADAS systems. These systems provide far better features than their predecessors by adding lane-keeping or adaptive cruise control and bridging the step to higher classes of automation. In August 2024, Stellantis Ventures invested in the on-chip LiDAR technology of SteerLight-a pivotal technology to extend the capability of ADAS. This investment is another proof of the increasing interest in LiDAR technology as one of the critical enablers for advanced driver-assistance systems and autonomous driving.

Our in-depth analysis of the global autonomous driving services market includes the following segments:

|

Service Type |

|

|

Level of Automation |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous Driving Services Industry - Regional Synopsis

North America Market Analysis

North America in autonomous driving services market is anticipated to hold more than 40.8% revenue share by 2037. The development of new transportation services for mobility markets across the continent highlights its growing global leadership role in self-driving technology and sustainable mobility. Furthermore, significant investments in artificial intelligence and related infrastructure in the U.S. are expected to boost autonomous fleet applications.

The U.S. continues to dominate the autonomous driving services market in North America, fueled by innovation from tech giants and automakers. In October 2024, Elon Musk introduced the Tesla Robotaxi, a fully autonomous vehicle that anyone could call upon demand for transport. With strong government incentives for sustainable mobility and advances in 5G networking, the U.S. is moving rapidly toward the widespread deployment of self-driving fleets. In addition, private-public partnerships at the state-government level are accelerating the development of smart transportation infrastructure. These factors ensure that the U.S. remains a global leader in autonomous driving services.

Canada is growing as one of the important contributors in the autonomous driving services market in North America, enabled by a high level of innovation and public-private partnerships. The government of Canada announced some new funding in August 2024 to develop AI-enabled autonomous vehicle technologies. Projects like the Autonomous Vehicle Innovation Network are fostering R&D and pilot programs to enhance the integration of autonomous systems. Furthermore, partnerships with worldwide automakers also help Canada create infrastructure for linked and independent cars, which would provide a significant lead in this growing industry.

Asia Pacific Market Statistics

Asia Pacific autonomous driving services market is expected to register over 33.6% growth till 2037. In December 2023, Hyundai Motor India identified the growth of connected car technologies, owing to the fact that connected vehicle sales rose from 5% in 2019 to 30% in 2023, reflecting the greater preference for advanced connectivity among the consumers of the region. Large investments in AI and IoT infrastructure further drive the demand for autonomous mobility solutions during the projection period.

With the rapid drive of urbanization and smart technology adoption, India is emerging as one of the key players in the autonomous driving services market. Hyundai Motor India also announced that there was a significant increase in the adoption of connected cars, with over 500,000 units being sold till December 2023 since its inception four years ago. Initiatives under the government's smart city program are creating an ecosystem that is conducive to the integration of autonomous mobility solutions.

China leads the Asia Pacific autonomous driving services market underpinned by significant investments in smart infrastructure and advanced technologies. In July 2022, China's SOEs announced that they invested over USD 1.49 trillion in more than 1,300 projects, focusing on AI, IoT, and 5G, further enhancing the deployment of autonomous vehicles and connected ecosystems. Furthermore, domestic companies like Baidu and Huawei are leading in developing autonomous driving platforms, which secures the continuous leading position of China in the autonomous driving services market.

Companies Dominating the Autonomous Driving Services Landscape

- AB Volvo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alexander Dennis Limited

- Ashok Leyland Limited.

- Blue Bird Corporation.

- BYD Motors

- Collins Bus Corporation

- Daimler Truck Holding AG

- Deccan Auto Limited

- Eicher Motors Limited

- Ford Motor Company

- Hyundai Motor Company

- ISUZU MOTORS

- Iveco Group NV.

- JBM Motor Limited

- Mahindra and Mahindra.

- PACCAR Inc.

- Tata Motors Limited.

- TEMSA

- The Lion Electric Company

- TRATON SE

- VDL Van Hool.

- Yutong Group

The autonomous driving services market is highly dynamic in nature, with key players such as AB Volvo, Daimler Truck Holding AG, BYD Motors, Tata Motors Limited, and Hyundai Motor Company leading the charge. Major companies are putting more effort into competitive, advanced technologies while taking strategic partnerships and investing huge amounts in R&D to strengthen their autonomous driving services market position. This includes advanced sensor systems like lidar and radar and sophisticated software used for vehicle control.

In December 2024, Kodiak Robotics partnered with Kognic to improve the reliability and performance of its autonomous trucking AI pipelines. The data labeling platform created by Kognic, which manages time series data from multi sensor systems, is key to bettering Kodiak’s AI models. The goal is to make it easier to put together the AI annotation pipeline and bring Kodiak to build an efficient AI flywheel with a continuous improvement cycle. Such developments indicate that the autonomous driving services market will be driven towards safer and more reliable self driving solutions as the industry pursues the development of autonomous technologies through innovative partnerships.

Here are some leading companies in the autonomous driving services market:

Recent Developments

- In December 2024, Cruise and Numotion launched a six-month wheelchair-accessible vehicle (WAV) pilot program in Houston. The program provides complimentary transportation for Numotion customers, enabling them to visit Numotion facilities for wheelchair repairs. By incorporating robust multi-layered security measures, this initiative enhances accessibility and ensures safe, seamless mobility for individuals with unique transportation needs.

- In September 2024, WeRide, an autonomous driving technology company, collaborated with Uber to integrate autonomous vehicles (AVs) into the Uber platform. The initiative was initially launched in the United Arab Emirates (UAE), marking a significant step in advancing multi-layered security protocols for autonomous ride-sharing services. This partnership aims to prioritize passenger safety while ensuring secure, efficient, and reliable mobility options.

- In August 2024, Uber and Cruise announced a strategic alliance to integrate Cruise's autonomous vehicles into the Uber platform. The partnership, set to roll out next year, will introduce Chevy Bolt-based autonomous vehicles, allowing Uber riders to select Cruise AVs for their trips. Leveraging advanced autonomous technology and multi-layered security frameworks, this collaboration seeks to deliver safer streets, improved urban mobility, and an elevated user experience.

- Report ID: 7029

- Published Date: Apr 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous Driving Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.