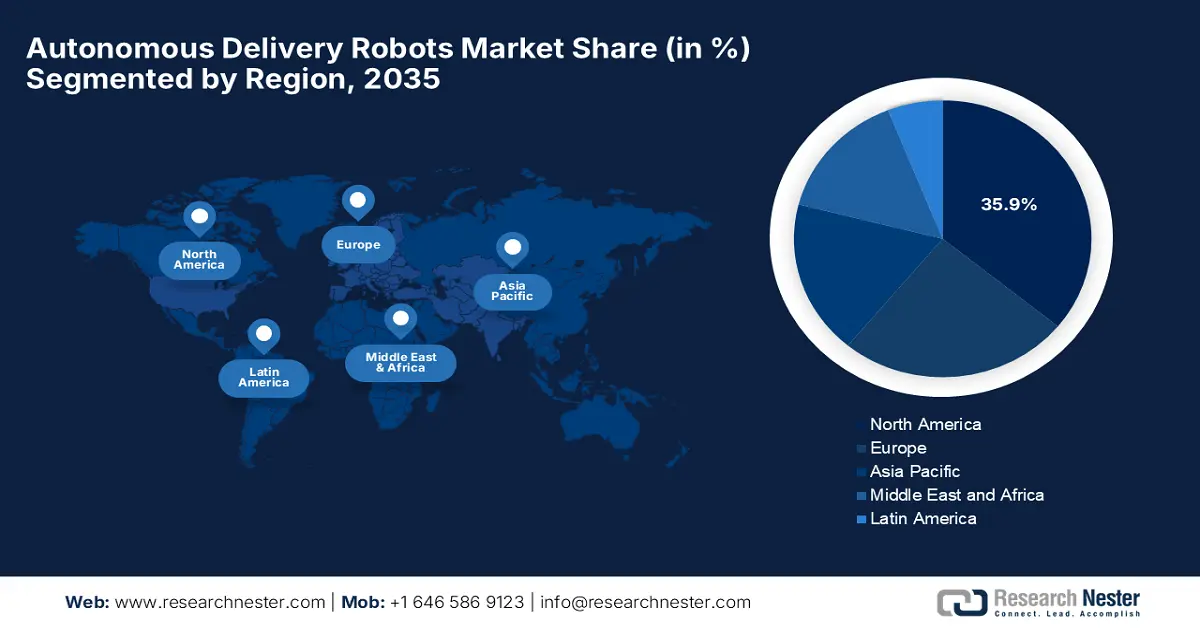

Autonomous Delivery Robots Market - Regional Analysis

North America Market Insights

North America market is projected to register the largest revenue share, i.e., 35.9% revenue share, between 2026-2035. The market growth can be ascribed to the presence of state-of-the-art ICT infrastructure and expanding e-commerce platforms. Testifying, the International Trade Administration stated that gross merchandise value for B2B eCommerce in North America for 2025, accounting for approximately 15.0% of the worldwide B2B eCommerce market, underscoring the region's critical role in the digital transformation of business-to-business trade.

U.S. market is productively influenced by the rising adoption of digitalization in logistics and favorable regulatory policies. The country has also benefited from the presence of rising investment in start-up initiatives and high consumer tech adoption. In August 2022, the NCSES working paper highlights how digitalization and cloud computing are reshaping innovation in U.S. businesses, especially by lowering the cost of experimentation, hence paving the way for broader autonomous robotic vehicle adoption.

Canada is gaining momentum in the market, efficiently backed by last-mile delivery and middle-mile logistics, driven by both private firms and retailers. The businesses in the country are increasingly preferring reduced delivery costs and increasing efficiency. In October 2022, Gatik and Loblaw announced that they had launched the country's ever fully driverless commercial delivery operation, wherein it uses autonomous, multi-temperature box trucks to move online grocery orders for Loblaw’s PC Express service in the Greater Toronto Area, hence suitable for standard market growth.

APAC Market Insights

Asia Pacific is likely to showcase the fastest growth rate in the autonomous delivery robots market during the analyzed timeframe. The region’s progress in this field is effectively catered to rapid e-commerce expansion, especially in urban centers, which has been a major driver for ADR adoption. Moreover, major pioneers in this region are increasingly integrating both outdoor delivery vehicles and indoor robots to streamline last-mile logistics, particularly in dense cities where labor is costly and congestion is severe.

China is augmenting its leadership in the regional market owing to the growing use of autonomous delivery vehicles by express delivery services to handle large parcel volumes and cover repetitive routes. China Post in November 2022 reported that it had launched its integrated indoor and outdoor Robot Plus AI delivery solution in June 2023, which is a combination of unmanned vehicles for outdoor delivery and robots for indoor navigation. The company also stated that the system enhances last-mile delivery efficiency by over 50% when compared to traditional methods, utilizing advanced sensors and AI for autonomous operation.

India represents one of the most influential landscapes for the autonomous delivery robots market, wherein aerial drones are seen as the fastest-growing segment. As per an article published by IBEF in May 2025, the country is witnessing booming e-commerce and hyperlocal delivery sectors, which are expected to lay a fertile ground for the adoption of autonomous delivery robots. As quick commerce, same-day, and ultra-fast models proliferate in metro and Tier‑II/III cities, demands for efficient, scalable last-mile solutions intensify.

Europe Market Insights

The market in Europe is anticipated to garner a considerable share, with prominent contributions from the U.K., Germany, Italy, and Nordic countries. For instance, in August 2025, Just Eat Takeaway.com declared that it us partnering with RIVR in Zurich to use innovative robots powered by Physical AI. The company further stated that these robots combine wheels for speed and legs for navigating stairs and curbs, operating safely around obstacles and pedestrians at about 15 km/h in various weather conditions, hence positively influencing market upliftment.

Germany is investing heavily in making last-mile automation feasible in its country, showcasing tremendous efforts made by the government. The market is also flourishing in the country, fueled by a significant surge in policies in logistics digitalization. In May 2025, Amazon unveiled seven new robots at its Last Mile Innovation Center in Dortmund, the country, which includes Tipper, which automates package unloading from carts to conveyor belts, reducing manual labor and physical strain.

The U.K. in the autonomous delivery robots market is rapidly advancing, driven by increasing demand for contactless and efficient last-mile delivery solutions. Besides, key players, including technology startups and established logistics firms, are proactively piloting and deploying robots in urban environments to enhance delivery speed and reduce costs. This is also supported by technological improvements in terms of AI, navigation, and safety features, thereby enabling robots to operate reliably in complex city landscapes.