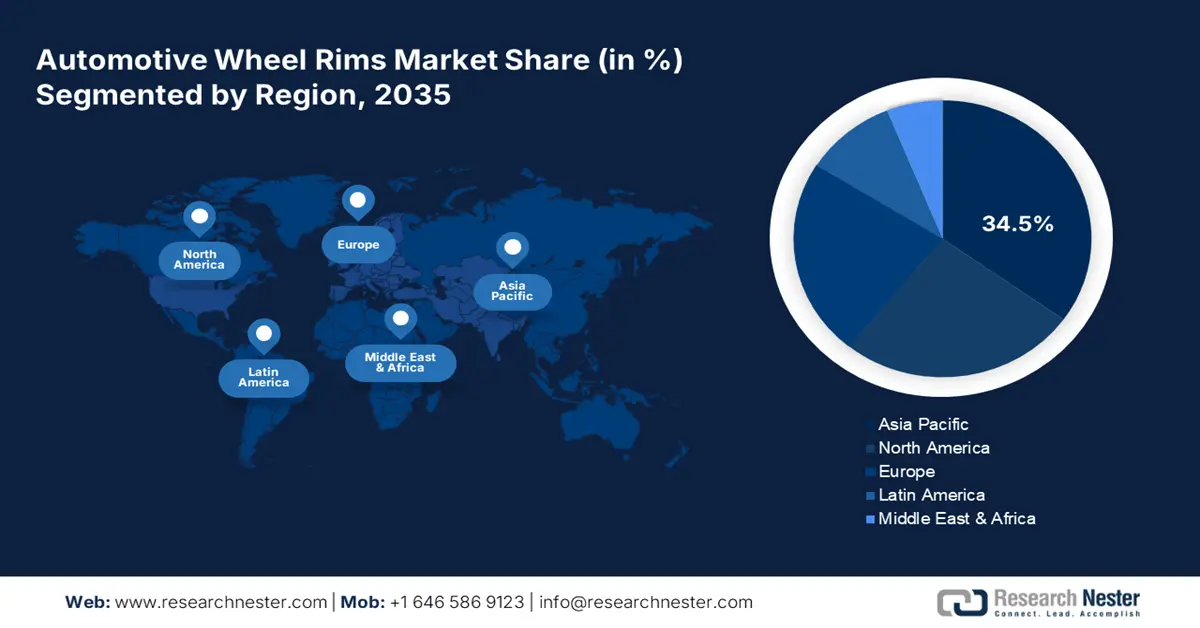

Automotive Wheel Rims Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to hold 34.5% of the global revenue share through 2035. The swift rise in automotive production and the EV trend is likely to accelerate the sales of wheel rims in the coming years. The boom in ICT-backed smart manufacturing trends is set to propel the sales of wheel rims in Japan, China, India, Malaysia, and South Korea. In addition, the increasing deployment of AI-integrated quality control systems and IoT-based production lines is expected to boost the dominance of Asian countries in the global automotive wheel rims landscape.

China is leading the sales of automotive wheel rims owing to the expansive auto production base and smart factory policies. The hefty public-private investments are also driving the trade of automotive wheel rims. This is increasing the use of digital technologies in automotive wheel rim manufacturing. The tax incentives are also poised to increase the automotive wheel rim export activities in the coming years. Along with this, public-private investments in advanced manufacturing infrastructure and technology have played a prominent role in supporting the automotive sector. With the large expenditures on research and development (R&D) and production capacity, China is increasingly not only moving forward with the manufacturing of traditional wheel rims, but is also leading the manufacturing of specialized, lightweight alloy rims and wheel rims for electric vehicles (EVs).

There are many reasons India is stepping up as a notable challenger in the automotive wheel rims market. The nation has quickly turned into the largest hub of automotive manufacturing across the globe, with a vibrant domestic automotive industry and increasing exports, especially for small and mid-segment vehicles. High production volumes of vehicles lead to a higher demand for automotive wheel rims, which are components for OEM (Original Equipment Manufacturer) vehicle manufacture. Moreover, affordable labor and low-cost automotive manufacturing capabilities continue to draw a vast array of global automotive manufacturers to create production facilities in India.

North America Market Insights

North America automotive wheel rims market is projected to increase at a CAGR of 5.9% from 2026 to 2035. The rise in EV registrations and increasing demand for luxury and supercars are fueling the sales of advanced wheel rims. The government-backed smart manufacturing policies are expected to drive innovations in the automotive wheel rims. There exists a compelling urgency surrounding environmental sustainability across North America in the automotive sector. There are tight regulations around emissions and sustainability, so manufacturers anticipate a higher demand for recycled aluminum solutions and sustainability solutions for wheels. As part of this continuum, automakers use more recyclable materials within the wheel rim, contributing to overall growth in the marketplace.

The U.S. automotive wheel rims market is driven by the federal infrastructure and ICT integration support for innovation. According to the National Telecommunications and Information Administration (NTIA), more than USD 2.8 billion was allocated to digital infrastructure via the BEAD and Digital Equity Act in 2023 to support automation across the automotive supply chain. In addition, government support in the form of policies and funding is encouraging local manufacturers to expand their operations. Federal incentives under the Infrastructure Investment and Jobs Act rope in electrification trends, which drive OEMs to adopt lightweight alloy rims optimized for EVs.

Canada's automotive sector is mature, and it has a long history of foreign automakers and OEMs. Canada's automotive manufacturing is predominantly aimed at light- and heavy-duty vehicles, which have a wide array of requirements for durable and high-performing wheel rims. Canada continues to make automobiles, and the drive toward investment in EVs will continue the trend toward increased innovative wheel rim design, especially lighter-weight aluminum alloy wheel rims. Canada’s sustainability focus and reducing carbon footprint are also evident in the automotive sector.

Europe Market Insights

The Europe automotive wheel rims market is foreseen to account for 22.9% of the global revenue share by 2035. The rapid digitalization in manufacturing and stringent CO₂ emission standards are prime factors fueling the trade of automotive wheel rims. The demand for lightweight, recyclable materials is gaining traction in the EU-based wheel rim production facilities. The rise in Industry 5.0 initiatives and EU-led sustainability regulations is poised to promote the sales of automotive wheel rims. Furthermore, the European Green Deal is pushing automakers to incorporate advanced alloy and forged rims into electric and hybrid vehicles. Overall, the EU is an investment-worthy market for automotive wheel rim producers.

In Germany, a robust automotive manufacturing base and strategic digital policy execution are set to significantly drive the sales of wheel rims. The smart manufacturing trend, coupled with government support, is likely to accelerate the demand for advanced wheel rims in the coming years. Also, the push toward CO₂-neutral manufacturing is promoting alloy and forged rim demand, particularly for EV platforms. Overall, the digital shift is anticipated to have a strong influence on the automotive wheel rims market.

France is one of the largest manufacturers of automobiles, including car makers such as Renault, Peugeot, and Citroën. The strong automobile manufacturing industry in France creates a rising demand for high-quality wheel rims in the country, particularly alloy wheel rims. As French automobile manufacturers continue to produce significant volumes of passenger vehicles, commercial vehicles, and electric vehicles (EVs) over the coming years, the increasingly high demand for durable, lightweight wheel rims with high-performance characteristics will help to fuel the growth of the market. France is also one of the top exporters of automobile components in Europe, including wheel rims.