Automotive Wheel Market Outlook:

Automotive Wheel Market size was over USD 42.44 billion in 2025 and is anticipated to cross USD 76.72 billion by 2035, growing at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive wheel is assessed at USD 44.77 billion.

Over the years, the automotive wheel market has grown due to the demand for alloy wheels, the rising manufacturing of electric vehicles, and the popularity of vehicle fuel economy concerns. The ongoing transformation in the global automotive industry bodes well for the future of more innovations and advancements in the materials used. Strong and lightweight polymer nanocomposites are being increasingly used for fuel efficiency. Carbon fiber, including Epoxy Carbon UD 395 GPa Prepreg and Epoxy Carbon UD 230 GPa Prepreg is also an excellent material choice for designing automotive wheel rims. They deliver better outcomes in comparison to aluminum alloy counterparts.

Key Automotive Wheel Market Insights Summary:

Regional Highlights:

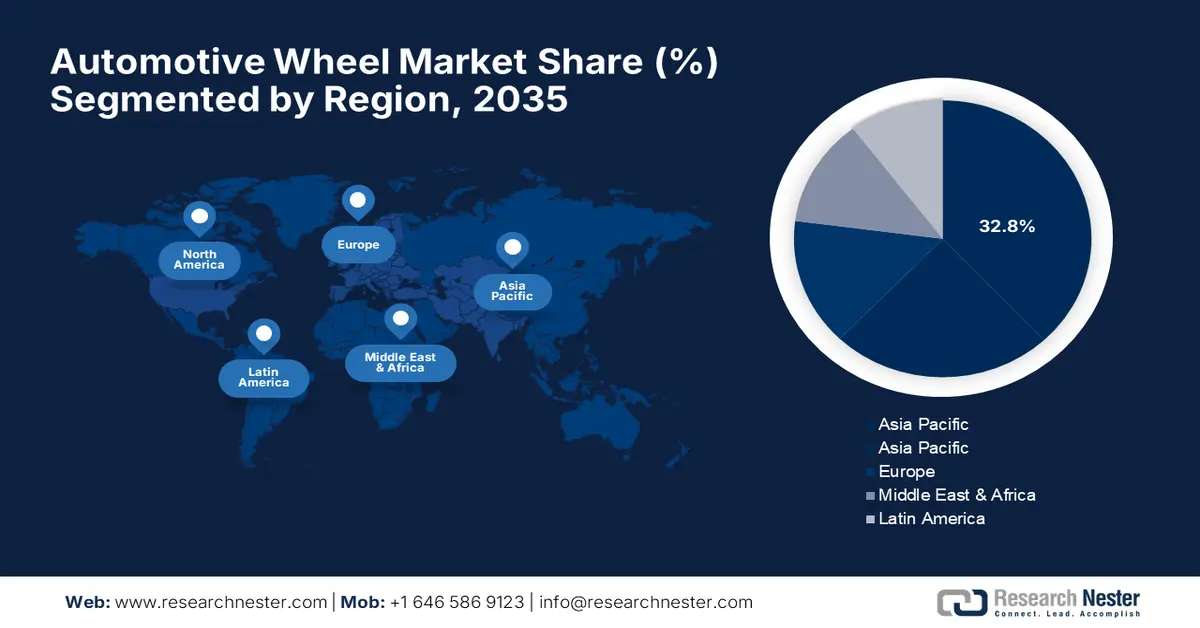

- Asia Pacific automotive wheel market is anticipated to capture 32.80% share by 2035, driven by key automotive hubs, government promotion policies, and rising demand for lightweight vehicles.

- North America market will exhibit the fastest growth during the forecast timeline, driven by strong automotive industries, government initiatives, and demand for advanced wheel technologies.

Segment Insights:

- The aluminum segment in the automotive wheel market is projected to hold a 56.50% share by 2035, driven by the increasing use of aluminum alloys for their strength and lightweight properties.

- The passenger vehicles segment in the automotive wheel market is anticipated to grow rapidly by 2035, attributed to rising demand for fuel-efficient and high-performance passenger vehicles.

Key Growth Trends:

- Governments to shape technological uptake in the overall automotive industry

- Advancement in material and manufacturing expansion

Major Challenges:

- Intense market competition

Key Players: Aluminum Wheel Co. Ltd, Superior Industries International Inc., Foshan Nanhai Zhongnan, Ronal Group, BBS GmbH.

Global Automotive Wheel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.44 billion

- 2026 Market Size: USD 44.77 billion

- Projected Market Size: USD 76.72 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Automotive Wheel Market Growth Drivers and Challenges:

Growth Drivers

- Governments to shape technological uptake in the overall automotive industry: Technological advances in autonomous driving vehicles, automotive parts, EVs, vehicle connectivity, and in-vehicle infotainment are profoundly influenced by the extent to which governments regulate the value chain including subsidies or other incentives. In the self-driving cars segment, OEMs have also profoundly ramped up the development of safety technologies such as in-wheel motors, emergency call systems, and collision avoidance. One of the key wildcards amongst these opportunities comprises the regulatory environment.

In the U.S., for instance, the Department of Transportation (DOT) in collaboration with the National Highway Traffic Safety Administration (NHTSA) has been working to standardize vehicle-to-vehicle collision-avoidance equipment in new automobiles. Similar to GM’s OnStar technology, an eCall emergency call system is likely to become mandatory in the U.S. and the EU. At the federal level, automakers and auto parts are regulated by two key agencies: the U.S. Environmental Protection Agency (EPA) and NHTSA. The latter oversees vehicle safety compliance and the former regulates emissions. Local and state jurisdictions are permitted to institute their safety regulations providing that they do not conflict with federal standards.

The California Air Resources Board (CARB) authorizes the vehicle emissions standards, which other U.S. states may then adopt. NHTSA enforces Federal Motor Vehicle Safety Standards (FMVSS) to set up safety performance requirements for new automotive parts and components. They cover items such as wheels, wheel rims, tires, brake hoses, lighting, and glazing. Notably, in 2021, over 1.5 million vehicles could not be manufactured owing to a direct effect of global semiconductor chip shortage. OEMs, undoubtedly, need to maximize chip production to meet the demand for new-vehicle production levels, while abiding by government regulations. To mitigate this crisis, in August 2022, the U.S. government rolled out the CHIPS and Science Act which aided chip manufacturers with USD 52.7 billion, thus, helping to boost domestic automobile production.

The value proposition is high for EVs with lower operating costs-electricity tends to be cheaper than gasoline. The exponential growth in EV sales is, in turn, influencing demand for lightweight wheels, advanced wheel technologies, and wheel designs that enhance the aerodynamics of wheels offered in the market today. Wheel manufacturers, therefore, invest in research and development to innovate new products and technologies that can serve the emerging market needs for forged aluminum and carbon fiber wheels.

For example, BMW reinvented its wheel with the aerodynamic rims of the BMW iX3. An innovative design that ensures that it is lighter than the standard aerodynamic rim and is fuel-efficient. - Advancement in material and manufacturing expansion: The development in the material and manufacturing process has transformed the landscape of automotive wheels, wherein high-performance wheels can be manufactured to be lightweight yet durable. New premium material developments such as forged aluminum, carbon fiber, and titanium, among others, have involved new wheel makers in manufacturing wheels with better strength-to-weight ratio, corrosion resistance, and durability.

In January 2024, Carbon Revolution study shared that its carbon fiber wheel production tripled in Q4 CY2023 and has ramped up its throughput and mega-line capacity to cater to its growing OEM customers including Ford, JLR, General Motors, Ferrari, and Renault. Production for Q1 and Q2 of the fiscal year ending in June 2024 was equivalent to the collective total production of 2023, with a backlog doubling to USD 730 million since October 2022. The company plans to expand its regional presence in North America, Mexico, and Australia to cater to its global consumer base.

Furthermore, advanced manufacturing processes such as 3D printing, casting, and forging have allowed the production of complex wheel designs with unparalleled accuracy. Advanced materials combined with manufacturing technologies enabled innovative designs for wheels-such as aerodynamic wheels, turbine wheels, and ventilated wheels-to be developed. For instance, manufacturers have turned to lighter materials such as aluminum, carbon fiber, and composite materials to reduce the overall weight of the vehicle and improve fuel efficiency and performance. - Increasing adoption of advanced features: Prevailing awareness among consumers about advanced safety features is driving the growth of the automotive wheel market. People are shifting more towards high-value vehicles inclusive of advanced features such as anti-lock braking systems, electronic stability control, and lane departure warning systems. These features require high-performance wheels, hence pushing the demand for wheels that are durable, responsive, and full of stability. Additionally, autonomous emergency braking and adaptive cruise control will also drive demand for more precise and consistent wheels, therefore driving demand for forged aluminum and carbon fiber wheel technologies. Also, with increasingly advanced safety features, there is a higher demand for better aerodynamic wheels that enhance the stability and responsiveness of a vehicle.

Challenges

- Raw material price volatility: The volatility in raw materials poses significant challenges in the industry, price hikes in vital components in manufacturing wheels such as steel, aluminum, titanium, and iron can affect the profitability of producers. The price fluctuations are driven by several factors such as disruptions in timely supply and demand, trade regulations, and inflation which add up to high production costs and unstable economic conditions. Thus, it hinders automotive wheel market growth and compels manufacturers to face the challenges of high competition and increased production costs.

- Intense market competition: Competition in the automotive wheel market is growing intense, with many established players and new entrants, making it very complex for manufacturers to attain a stable market position. A highly competitive environment has emerged with multiple suppliers and low-cost manufacturers, forcing companies to constantly innovate and differentiate their products to sustain in the competition. Key players like Enkei, Accuride, and BORBET have managed to create brand equity and customer loyalty, which might prove to be a challenge for new entrants.

Automotive Wheel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 42.44 billion |

|

Forecast Year Market Size (2035) |

USD 76.72 billion |

|

Regional Scope |

|

Automotive Wheel Market Segmentation:

Material Segment Analysis

The aluminum segment will account for 56.5% automotive wheel market share by 2035. The escalated demand for aluminum wheels is attributed to the ever-growing utilization of aluminum alloys in the automotive industry owing to its advantages. Moreover, aluminum wheels provide an outstanding combination of strength, resistance, and lightweight, which makes them preferable for manufacturers committed to enhancing fuel efficiency, handling, and overall performance. Major prominent players, which include companies like such as Accuride, and BORBET, have products in the market with manifold designs addressing the needs of customers.

However, demand for aluminum wheels is likely to remain strong, aided by an increase in fuel efficiency due to lighter vehicles, improved performance of vehicles made possible by strong and light materials, and corrosion resistance. For instance, In September 2023, Uno Minda launched a new range of alloy wheels in India with Kosei Aluminium to enhance efficacy in the driving experience.

Vehicle type Segment Analysis

The passenger vehicles segment in the automotive wheel market is expected to register rapid revenue CAGR during the forecast period owing to the growing demand for fuel-efficient and high-performance vehicles in the automotive wheels industry. The key functions of wheels in passenger vehicles are to strike a balance for comfort, handling, and durability among various types of passenger vehicles; thus, driving interest in advanced wheel technologies. It would most likely continue its growth path on account of rising demand for premium and luxury vehicles, along with increasing traction in electric and hybrid vehicles.

Key players address diverse passenger vehicle manufacturer needs by providing a host of wheel products able to meet strict safety, performance, and aesthetic expectations. The focus areas remain on innovation and quality hence, the passenger vehicle segment would continue to be the prime driving factor for the automotive wheels industry followed by commercial vehicles due to demand for distinct features in heavy vehicles.

End user Segment Analysis

The original equipment manufacturer OEMs segment in the automotive wheel market is poised to register significant growth as they are the primary end-users of automotive wheels, purchasing directly from suppliers for new vehicle installations. OEMs maintain quality control to ensure that wheels meet the standards for safety, performance, and aesthetics. They manufacture in bulk and procure directly, and these factors add to their huge market share, thus commanding the industry of automotive wheels.

Our in-depth analysis of the automotive wheel market includes the following segments:

|

Material |

|

|

Vehicle type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Wheel Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is likely to hold largest revenue share of 32.8% by 2035, impelled by key automotive hubs, favorable promotion policies by the government, and growing consumer demand for lightweight vehicles advanced with distinct features and high performance. Large-scale manufacturing, low labor costs, and strategic trade agreements within the region make it more attractive for wheel manufacturers to invest and expand their business. In addition, the demand for electric and hybrid vehicles is gaining momentum in the region, therefore, opening new avenues for wheel suppliers. Thus, the Asia-Pacific is anticipated to dominate the automotive wheel market over the years.

India finds its significant position in the automotive wheel market due to the presence of a fast-growing automotive industry, strategic government policy that facilitates foreign direct investment boosting the growth of the automotive sector, and growing demand from consumers. Manufacturers of wheels strive to expand their clientele within domestic areas as well as in the export markets. Therefore, it expects to witness a surge in the wheel manufacturing industry in the coming years.

North America Market Insights

North America witnesses to be the fastest-growing region owing to strong automotive industries and strong implementation of initiatives by the local government, and growing consumer demand for advanced technologies in wheels. Additionally, the surge in demand for electric and hybrid vehicles in North America has created new opportunities for wheel suppliers, fostering innovation and growth in the region.

Regional growth can also be attributed to key automotive hubs in Detroit, U.S. that drive noteworthy investment by wheel manufacturers. Strong manufacturing capabilities, and strategic trade pacts, coupled with surging consumer demand across the continent would contribute in North America’s significant growth in the global automotive wheel market during the forecast period.

Automotive Wheel Market Players:

- Euromax Wheel

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Prime Wheel Corporation

- Carbon Revolution

- Aluminum Wheel Co. Ltd

- Superior Industries International Inc.

- Foshan Nanhai Zhongnan

- Ronal Group

- BBS GmbH

- Center Motor Wheel of America Inc.

Automotive wheel market expansion is predicted to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous demand for lightweight and efficient vehicles with competitive features. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for the automotive wheel market around the world.

Recent Developments

- In September 2024, JSW MG revealed the alloy in the upcoming Windsor EV will have 18-inch alloy wheels with a diamond-cut design.

- In January 2024, Accuride Corporation, announced Accuride’s steel wheel part numbers 51408, 51487, and 51637 have been tested and approved for a new increased tire inflation rate of 125 psi which will expand the range of tire choices available to trucking fleets allowing them to balance cost, availability, and efficiency as needed.

- Report ID: 6439

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Wheel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.