Automotive VVT System Market Outlook:

Automotive VVT System Market size was over USD 60.53 billion in 2025 and is anticipated to cross USD 98.6 billion by 2035, witnessing more than 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive VVT system is assessed at USD 63.25 billion.

The automotive industry is focusing on downsizing engines to maintain the vehicle’s performance for better fuel economy and decreased pollution output. The power delivery from smaller engines matches that of bigger engines through variable valve timing, to control the intake and exhaust flow effectively. Advanced system technologies are being implemented in multi-cylinder engines throughout SUVs, sports cars, and pickup trucks to achieve performance quality while enhancing efficiency. The system's adaptive valve timing adjustments according to engine load produce better combustion efficiency, leading to faster throttle response and minimized emissions together with improved fuel economy.

The growing international emission regulations are driving manufacturers to integrate electrically assisted VVT technology with turbocharging systems to enhance the engines while minimizing displacement. Automotive companies are introducing advanced technologies to enhance multi-cylinder engine management. For instance, Honda demonstrated its world-leading V3 motorcycle engine equipped with an electric compressor in November 2024. The slim compact V3 75-degree engine design of the water-cooled power unit maintains exceptional torque response properties throughout the entire rpm spectrum. This technology uses independent air compression control from engine speed to improve engine performance and efficiency therefore highlighting the ability of advanced air pressure management solutions to drive multi-cylinder engine development.

Key Automotive VVT System Market Insights Summary:

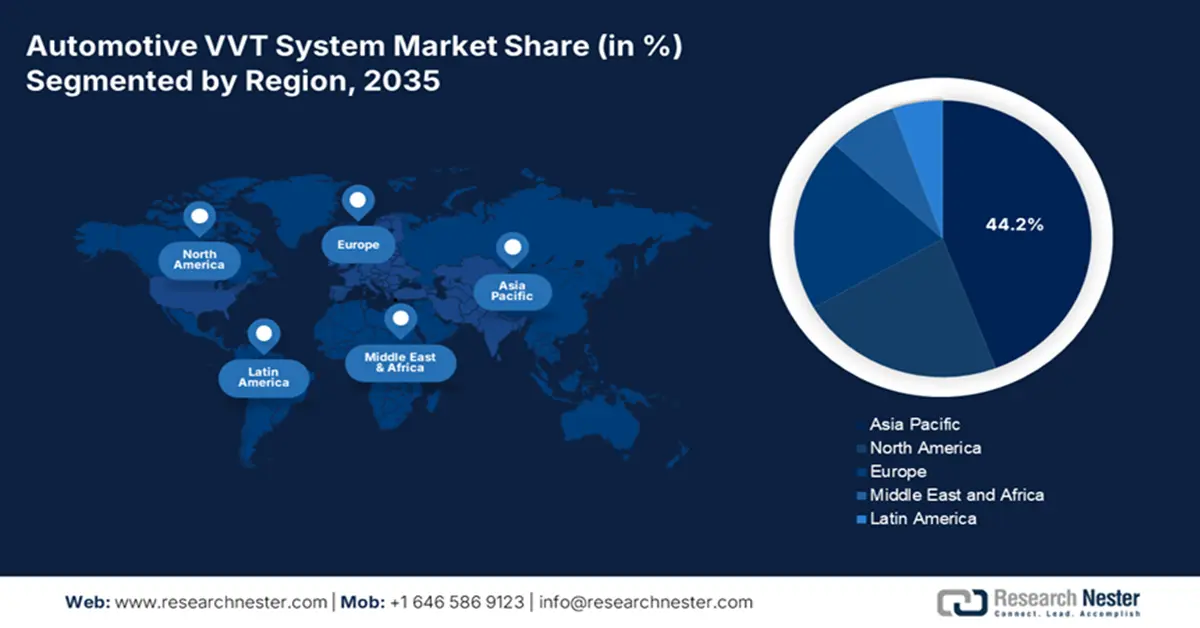

Regional Highlights:

- Asia Pacific dominates the Automotive VVT System Market with a 44.2% share, driven by industrial expansion and rising vehicle manufacturing, fueling growth through 2035.

Segment Insights:

- The passenger vehicles segment of the Automotive VVT System Market is projected to hold a 66% share by 2035, driven by increasing demand for fuel-efficient vehicles and stringent emission regulations.

Key Growth Trends:

- Rising demand for fuel efficiency

- Increasing popularity of turbocharged engines

Major Challenges:

- Rising popularity of hybrid powertrains

- Durability and wear issues

- Key Players: Mikuni American Corporation, Johnson Controls Inc., Federal-Mogul LLC, and Camcraft Inc.

Global Automotive VVT System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.53 billion

- 2026 Market Size: USD 63.25 billion

- Projected Market Size: USD 98.6 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Automotive VVT System Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for fuel efficiency: The automotive industry has been increasingly adopting variable valve timing technology due to the rising demand for improved fuel efficiency and reduced emissions. There have been rising advancements in the system technology, highlighting essential contributions to environmental compliance. The automotive industry benefits from advanced electronic and hydraulic systems to achieve better valve timing results that increase fuel efficiency and reduce emissions. For instance, the implementation of Dual VVT and VVT-i enables better control over engine valves during intake and exhaust to optimize combustion efficiency. Modern turbocharged engines implement VVT as a technology to improve low-end torque delivery as well as power output at less cost to fuel efficiency. Modern vehicle engineering reinforces system capabilities, combines to fulfill minimum regulatory standards, and produces superior vehicle performance.

-

Increasing popularity of turbocharged engines: Automakers have been adopting the systems as the increasing turbocharged engine sales demand better power delivery and fuel efficiency results. When turbocharging forces additional air through the chamber, the power output rises and incorrect valve timing produces turbo lag and less efficient fuel burning. Through its core functionality, the system technology regulates air-fuel mixtures to deliver smooth power output that brings better throttle reactions during low-speed operations. The automakers are gaining enhanced torque performance and reduced engine wear with improved acceleration when there is a connection between the system technology and turbochargers.

Challenges

-

Rising popularity of hybrid powertrains: Hybrid powertrain adoption as a trend is leading to decreased use of these systems in traditional automotive applications. The Atkinson cycle engine design in hybrid automobiles improves fuel efficiency, by controlling emissions by itself without detailed control systems. Automakers invest their resources into hybrid-developed technologies that include advanced power management and electric valve control for superior performance optimization. Hybrid manufacturers are replacing conventional systems with electronic alternatives due to decreasing demand for the hybrid market.

-

Durability and wear issues: High-performance along with heavy-duty vehicles operate the systems under intense heat and rapid engine rotations as well as harsh mechanical conditions, reducing longevity and causing system breakdowns. Engine reliability suffers from continuous operations in such conditions that may result in oil contamination while causing actuator failures and timing system malfunctions. Manufacturers prefer alternative valvetrain technologies that combine better longevity with precise operation in demanding applications instead of conventional systems.

Automotive VVT System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 60.53 billion |

|

Forecast Year Market Size (2035) |

USD 98.6 billion |

|

Regional Scope |

|

Automotive VVT System Market Segmentation:

By Vehicle Type (Passenger Vehicles, Electrical Vehicles, Commercial Vehicles)

Passenger vehicles segment is predicted to capture automotive VVT system market share of over 66% by 2035, due to the increasing demand for fuel-efficient vehicles. The implementation of VVT integration is anticipated to improve engine functionality while following international efforts to create environmentally friendly automobile technologies. in addition, the existing emission regulations along with consumer preference for fuel-efficient vehicles is expected to fuel segment growth. A global increase in emission standards for pollution control is expected to make vehicle producers develop new system technology, that helps engines run more efficiently and reduce environmental emissions.

Valve Train (Over Head Valve, Double Overhead Cam, Single Overhead Cam)

The double overhead cam (DOHC) segment in automotive VVT system market is expected to register significant revenue during the forecast period as the DOHC systems represent optimal selection for automotive producers for their ability to provide superior efficiency and power characteristics. A DOHC configuration allows individual valve control of intake and exhaust valves, enabling optimal airflow management at precise valve timing settings. Better combustion efficiency combined with increased horsepower and improved torque throughout a wide RPM range exists, due to this system design. DOHC engine valve train mass reduction creates lower friction loss, improving fuel efficiency alongside emission standards compliance.

DOHC systems are also expected to expand the automotive VVT system market relevance, as they effectively support different engine designs ranging from naturally aspirated to turbocharged and hybrid powertrains. The precise control of valves through fine-tuning allows vehicles to respond more rapidly, leading to optimal power transmission across diverse operational conditions. DOHC-based systems are gaining increased traction from automakers, due to their ability to work better with advanced fuel injection technologies, including direct and port fuel injection, which is further anticipated to boost efficiency.

Our in-depth analysis of the global automotive VVT system market includes the following segments:

|

Fuel Type |

|

|

Methods |

|

|

System |

|

|

Number of Valves |

|

|

Valve Train |

|

|

Technology |

|

|

Vehicle Type |

|

|

Actuation Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive VVT System Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in automotive VVT system market is likely to hold more than 44.2% revenue share by 2035. This growth is attributed to the industrial expansion of these systems and rising vehicle manufacturing in the region. Three major automotive manufacturing hubs China, India, and Japan support the technology adoption through their automakers, attributed to its capability to meet present and future performance and efficiency standards. Growing consumer needs for more efficient fuel vehicles are driving manufacturers to implement the systems, as these systems improve combustion quality while minimizing fuel usage. In addition, the region is experiencing automotive VVT system market potential due to the presence of key automotive firms along with component manufacturer companies such as Honda Motors, Hyundai, and Tata Motors, among others. The implementation of government regulations focused on emission reduction and fuel efficiency enhancement is also encouraging the manufacturers to adopt these systems on a large scale.

The China automotive VVT system market is expected to propel at a robust CAGR, attributed to the focus on high-performance engines. The demand for better engine efficiency and power is expected to prompt automotive companies to adopt advanced VVT platforms that enhance engine effectiveness. The country’s automotive industry specifically develops turbocharged engines that integrate the systems, as this method improves torque control while raising combustion performance. The manufacturers are using these systems in range-extender hybrid engines to reach maximum fuel economy rates, maintaining their power capabilities for electric vehicle hybrids. Moreover, the automotive sector in the country is gaining momentum from localized manufacturing goals to actively develop new technology solutions. Local automotive component manufacturers are receiving government support, leading to substantial growth in investments for the technology development for future applications. In addition, automobile technology companies from across the globe are establishing joint ventures with local manufacturers to improve their system capabilities.

The automotive VVT system sector advancement in India is expected to accelerate due to its move towards power-dense engines and reduced displacement sizes. The local automobile industry uses the technology in small-capacity engines as they seek high fuel economy and strong power output without expanding their engine dimensions. The compact and subcompact car segments lead the country’s market. Manufacturers are integrating the technology to fulfill automotive VVT system market needs for efficient powerful vehicles through these systems during times of fuel price changes.

The increasing market demand for flexible fuel resources such as flex-fuel and CNG-powered cars drives manufacturers to implement the system technology. These systems have become essential for alternative fuel engines, as they need exact valve timing control to achieve optimal combustion outcomes and improve efficiency and emissions control. Modern Indian automobile manufacturers are creating multi-fuel capable power plants that integrate the new technology for better engine adaptability. The technological advancement supports government initiatives that promote alternative fuel use along with lowering engine dependence on petroleum fuel through petrol and diesel engines.

North America Market

The North America automotive VVT system market is expected to witness a rapid expansion between 2025 and 2035 as customers increasingly buy vehicles with high-performance capability. The regional consumer market demands vehicles with better acceleration and power output, therefore automobile manufacturers implement advanced systems to enhance engine performance. The trend dominates the sports and luxury vehicle markets as precise valve timing adjustments play a critical role in achieving peak engine efficiency alongside top-notch responsiveness.

The increasing demand for light trucks and SUVs in the region is driving manufacturers to use these systems in their products. The demanding nature of different road conditions and heavy loads requires these vehicles to utilize powerful engine systems. The technology deployment enables manufacturing companies to enhance torque capabilities and fuel mileage performance, fulfilling the automotive VVT system market demand between power output and efficiency needs. Automakers are focusing on system advancements and superior engine technology, as changing consumer behavior pushes them to stay competitive within the market competition.

The U.S. automotive VVT system market is increasing due to the surging adoption of vehicular start-stop systems. The automatic start-stop technology concurrently disables the engine while the vehicle stands still and then reactivates. The automotive VVT system market also benefits from recent developments in electronic technologies, such as electronic variant systems that supersede traditional hydraulic systems, with the electronic systems enabling higher accuracies in valve timing control for better engine responsiveness and fuel efficiency improvements.

The automotive VVT system market in Canada is expected to experience significant growth, due to the increasing popularity of hybrid and plug-in hybrid vehicles in the country. Government support for electric and hybrid automobiles through initiatives and infrastructure improvements is expected to accelerate the growing trend for these vehicles. The automotive suppliers in the country together with manufacturers are also investing in advanced systems to achieve flexible adaptive engines, that are expected to enhance the efficiency of hybrid vehicles.

Key Automotive VVT System Market Players:

- Mikuni American Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson Controls, Inc.

- Federal-Mogul LLC

- Camcraft, Inc.

- BorgWarner Inc.

- Robert Bosch GmbH

- Schaeffler AG

- Eaton Corporation

The competitive landscape of the automotive VVT system market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global automotive VVT system market:

Recent Developments

- In June 2023, Standard Motor Products announced that the company continues to add to its VVT program, which already includes more than 550-part numbers for import and domestic vehicles.

- In February 2023, Eaton Corporation announced that its Vehicle Group cylinder deactivation and late intake valve closing have been proven to simultaneously reduce nitrogen oxides and carbon dioxide.

- Report ID: 7256

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive VVT System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.