Automotive Voice Recognition System Market Outlook:

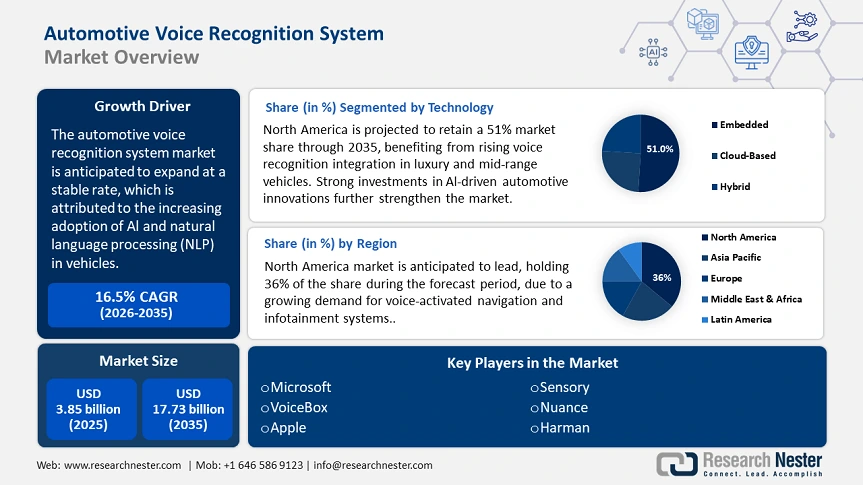

Automotive Voice Recognition System Market size was valued at USD 3.85 billion in 2025 and is set to exceed USD 17.73 billion by 2035, registering over 16.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive voice recognition system is estimated at USD 4.42 billion.

The growth of the market is attributed to the increasing use of artificial intelligence, the need for reduced use of hand controls, and the development of speech recognition. Car manufacturers are increasingly embedding multilingual and natural language processing (NLP) into their vehicles. In October 2024, SoundHound AI collaborated with Perplexity to create new generations of voice assistants for connected automobiles that would use real-time AI and improved conversational engagement. This development marks a great step forward in enhancing the experience of users and their ability to access information.

The automotive voice recognition system market is on the rise due to the digital transformation within the automotive value chain. Investments in R&D are increasing, and the car manufacturing industry is investing 32% of total industrial R&D in Europe, towards making smart connected vehicles. CCAVs are another driver of growth, impacting supply chain, business models, as well as skills needed for particular jobs. The importance of software and digital services in the automotive sector is growing as global market conditions change due to geopolitical tensions and disruptions in supply chains. The table below provides an analysis of trends that have impacted the market based on the shifting automotive value chain.

|

Automotive Voice Recognition System Market: Growth Drivers and Value Chain Impact |

||||

|

Year |

Automotive R&D Investment (EU, % of Total Industrial R&D) |

CCAV Market Expansion (Impact on Value Chain) |

Adoption of Voice Recognition in Vehicles (%) |

Key Supply Chain Factors |

|

2023 |

32% |

Emerging |

35 |

Digitalization, AI development |

|

2025 |

34% |

Expanding |

50 |

Software integration, SME participation |

|

2030 |

38% |

Transformative |

75 |

Supply chain restructuring, geopolitical influences |

|

2035 |

42% |

Standardized |

90 |

Circular economy, regulatory alignment |

Source: OECD

The table illustrates how the market can be embedded into the automotive value chain. As CCAV implementation gains traction, voice recognition is poised to grow from 35% in 2023 to 90% by 2035 with more investments in R&D. Market disruptions in supply chain and digitalization are changing the way manufacturers and suppliers are operating, with SMEs assuming even more importance in supplying software. With the development of new standards and increased integration of the vehicle systems, voice recognition will be one of the key factors determining the further development of the automotive industry in terms of performance, safety, and comfort.

Key Automotive Voice Recognition System Market Insights Summary:

Regional Highlights:

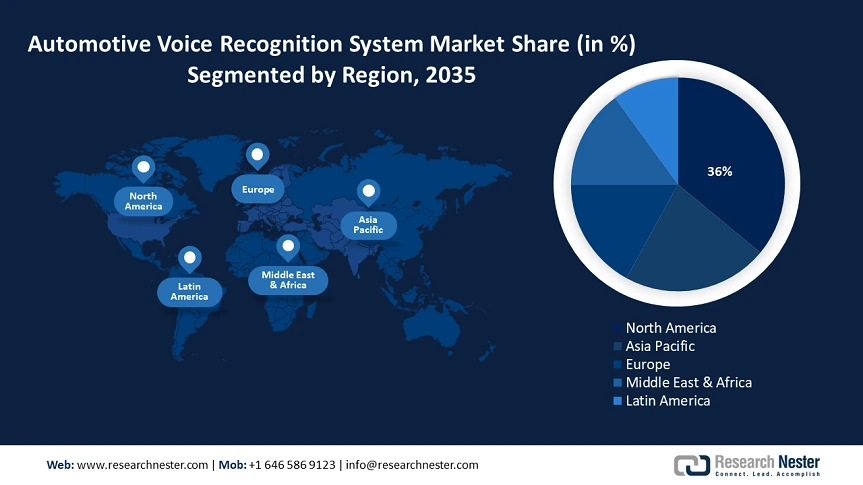

- North America leads the Automotive Voice Recognition System Market with a 36% share, propelled by the rising demand for connected vehicles in the region, along with advancements in AI voice recognition, enhancing its dominance through innovative automotive solutions by 2035.

- The Automotive Voice Recognition System Market in Asia Pacific is forecasted to grow significantly through 2026–2035, driven by the increasing electric vehicle sales and demand for connected cars in Asia Pacific.

Segment Insights:

- Embedded Technology segment is expected to capture over 51% market share by 2035, fueled by its offline capabilities, privacy, and low latency for reliable vehicle controls.

- The AI-based application segment of the Automotive Voice Recognition System Market is forecasted to capture around 78% revenue share by 2035, propelled by advancements in deep learning, NLP, and AI-powered assistants enhancing in-car voice recognition.

Key Growth Trends:

- Advancements in AI-powered voice assistants

- Increased demand for hands-free and safe driving solutions

Major Challenges:

- Data privacy and security concerns

- Regional language and accent recognition issues

- Key Players: Apple, Sensory, Nuance, Microsoft, VoiceBox, Alphabet, Harman.

Global Automotive Voice Recognition System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.85 billion

- 2026 Market Size: USD 4.42 billion

- Projected Market Size: USD 17.73 billion by 2035

- Growth Forecasts: 16.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Automotive Voice Recognition System Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in AI-powered voice assistants: Modern automotive voice recognition systems are shifting to conversational interfaces based on artificial intelligence, which means that drivers will be able to conduct voice interactions in real time and with contextual awareness. In August 2024, DS Automobiles launched voice assistants based on the ChatGPT technology, which enabled drivers to control various aspects of the car, including settings, navigation, and entertainment. The incorporation of large language models improves the engagement of users as well as the interaction of the system.

- Increased demand for hands-free and safe driving solutions: Due to laws against the use of handheld mobile phones while driving, voice recognition systems have become common in today’s automobiles. In July 2024, Tesla decided to incorporate Grok AI assistant into its range of electric vehicles for climate, navigation, and media controls through voice commands. This is a testament to the increasing trend of companies to minimize distractions while also improving the convenience of the drivers.

- Expansion of connected car ecosystems: Due to the advancement of 5G and IoT connectivity, the use of cloud-based automotive voice assistants has become more popular. In June 2024, Mercedes-Benz enhanced the MBUX voice assistant with Azure OpenAI that delivers real-time conversational AI capabilities for navigation, infotainment and vehicle control. This is in line with the current trend of automobile makers to incorporate intelligent and cloud-enabled voice systems in vehicles.

Challenges

-

Data privacy and security concerns: The increasing usage of artificial intelligence-based voice recognition systems has led to a number of issues of data privacy and security. Voice data containing personal information can be intercepted, misused, or sold to third parties. This requires strong measures of data security and high levels of privacy to protect the user data and to ensure that the public places their trust in these systems.

-

Regional language and accent recognition issues: Voice assistants often struggle to interpret various accents, dialects, and languages, which limits their availability and applicability to some groups of people. This can be quite frustrating and isolating for those who speak with regional accents or non-standard dialects. To overcome this challenge, there is a need for further development to enhance the voice recognition software and to increase its effectiveness with the different dialects.

Automotive Voice Recognition System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.5% |

|

Base Year Market Size (2025) |

USD 3.85 billion |

|

Forecast Year Market Size (2035) |

USD 17.73 billion |

|

Regional Scope |

|

Automotive Voice Recognition System Market Segmentation:

Technology (Embedded, Cloud-Based, Hybrid)

The embedded segment is expected to capture automotive voice recognition system market share of over 51% by 2035. This is driven by offline capabilities, privacy, and low latency, which are especially important for dependable controls in cars that do not always have internet connections. Manufacturers are gradually beginning to appreciate these advantages and have started to incorporate these solutions in cars. For instance, in January 2024, Kia Motors introduced the Kia EV3 SUV with an OpenAI voice assistant built into the car, demonstrating how occupants can interact with cars without the need to connect with the cloud. This trend towards embedded voice recognition is expected to persist as more car makers focus on improving the overall experience of drivers and protecting user information.

Application (AI, Non-AI)

In automotive voice recognition system market, AI-based segment is poised to capture revenue share of around 78% by the end of 2035. This substantial market share is largely attributed to deep learning, natural language processing (NLP), and individual user engagement. These technologies have enabled AI-powered assistants to enhance in-car voice experience, making them smarter and more contextual. For instance, in March 2024, Volkswagen incorporated ChatGPT into its infotainment system to enhance real-time command precision and adaptability. In the future, with the advancement of AI technology, future voice recognition experiences in the automotive industry are expected to be far more elaborate and customized.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Voice Recognition System Market Regional Analysis:

North America Market Analysis

North America automotive voice recognition system market is anticipated to dominate revenue share of around 36% by the end of 2035. The rising demand for connected vehicles in the region, the development of AI voice recognition, and the numerous automotive technology start-ups are the major drivers of growth. Car manufacturers are investing in natural voice recognition and smart assistant solutions to improve the driving experience. This promotes a development of real-time connectivity between drivers and their vehicles and is proof of how AI is becoming more integrated into connected cars, driving the market growth.

The U.S. has been one of the most active countries in automotive voice recognition system development due to high consumer demand for smart car systems and AI-based infotainment. Manufacturers are implementing artificial intelligence capabilities to create better customer satisfaction, safety, and instant car information. In April 2024, BMW unveiled the latest version of its AI voice assistant at the CES 2024 event, with gaming and streaming capabilities. This innovation allows users to manage entertainment and other vehicle functions without the use of hands, which is a great advancement in in-car artificial intelligence.

The automotive voice recognition system market in Canada is growing at a steady pace as voice-activated infotainment and connected car solutions gain popularity. Car manufacturers are trying to incorporate AI-driven car assistants to enable people to interact with vehicles safely without having to touch anything. The market in Canada is also experiencing enhanced 5G networks that will improve the real-time voice recognition for AI-controlled car assistants in the cloud. In May 2023, Hyundai Motor Group extended its AI assistant services with Bell Canada to provide real-time voice recognition of the infotainment system and control of the vehicle functions. This is one of the most significant developments in the process of AI adoption in the automotive industry of Canada.

Asia Pacific Market Analysis

Asia Pacific automotive voice recognition system market is poised to see significant growth in the coming years, due to increasing electric vehicle sales, NLP development, and connected car demand. The automakers in the region are increasingly focusing on having multiple languages in voice assistants to suit the linguistic inclination of consumers. The rising demand for in-car AI assistant and the ability to drive a vehicle without any manual task, and multiple regional languages support, makes it more accessible and safer for more consumers.

The automotive voice recognition system market in India is on an upward trajectory as smartphone adoption increases, the demand for connected vehicles grows, and the AI voice recognition technology advances. Automobile manufacturers are also introducing localized AI voice assistants to improve user convenience and vehicle interface. The Indian government’s drive to go digital is also helping in the development of advanced automotive infotainment systems that are based on Artificial Intelligence. In February 2023, Tata Motors introduced a new multilingual voice assistant that is designed for the users of regional languages. This feature ensures that the interactions between vehicles and AI systems are more easily available to the rural and urban motorists alike, and this enhances safety and convenience.

China is currently the largest market for automotive voice recognition systems in Asia Pacific due to the advancement in AI, integration of AI with EVs, and increased consumer demand for smart cars. The automotive manufacturers in the country are shifting towards AI-integrated vehicle companions for voice-based experiences. In March 2023, NIO launched Nomi GPT, an in-car voice assistant that can support natural language processing and the car’s status. This innovation improves the experience and satisfaction of drivers and further establishes China as the go-to destination for smart automotive AI solutions.

Key Automotive Voice Recognition System Market Players:

- Microsoft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- VoiceBox

- Apple

- Alphabet

- Sensory

- Nuance

- Harman

The market for automotive voice recognition systems is highly saturated, and key players are increasingly investing in AI, cloud, and multilingual capabilities. Some of the companies include Apple, Sensory, Nuance, Microsoft, VoiceBox, Alphabet, and Harman, all of which are working towards enhancing the NLU and real-time response accuracy. These firms are using machine learning models in improving user interaction and command processing.

As technology continues to advance, companies are finding new ways to integrate it into their products. In October 2024, iHeartMedia significantly enhanced its iHeartRadio automotive application by integrating an advanced voice assistant. This innovation enables users to manage their playlists, stations, and podcast streaming entirely through voice commands, eliminating the need for manual interaction with the device. Furthermore, the increasing use of voice assistants in infotainment systems underlines the increasing importance of voice technology in the context of in-car entertainment, which is anticipated to drive market growth.

Here are some leading players in the automotive voice recognition system market:

Recent Developments

- In January 2025, SoundHound AI and Lucid Motors introduced an AI-powered voice assistant for electric vehicles. The system integrates generative AI to enhance natural language understanding, allowing drivers to control navigation, climate, and infotainment hands-free. It aims to improve in-car voice interactions for safety and convenience.

- In December 2024, Marelli launched an AI-driven control unit for motorsport vehicles, enhancing real-time vehicle management. The unit leverages AI-based analytics to optimize vehicle performance, predict maintenance needs, and provide precise adjustments during races. It is designed to improve efficiency in high-performance automotive applications.

- Report ID: 7273

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Voice Recognition System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.