Automotive Transmission Market Outlook:

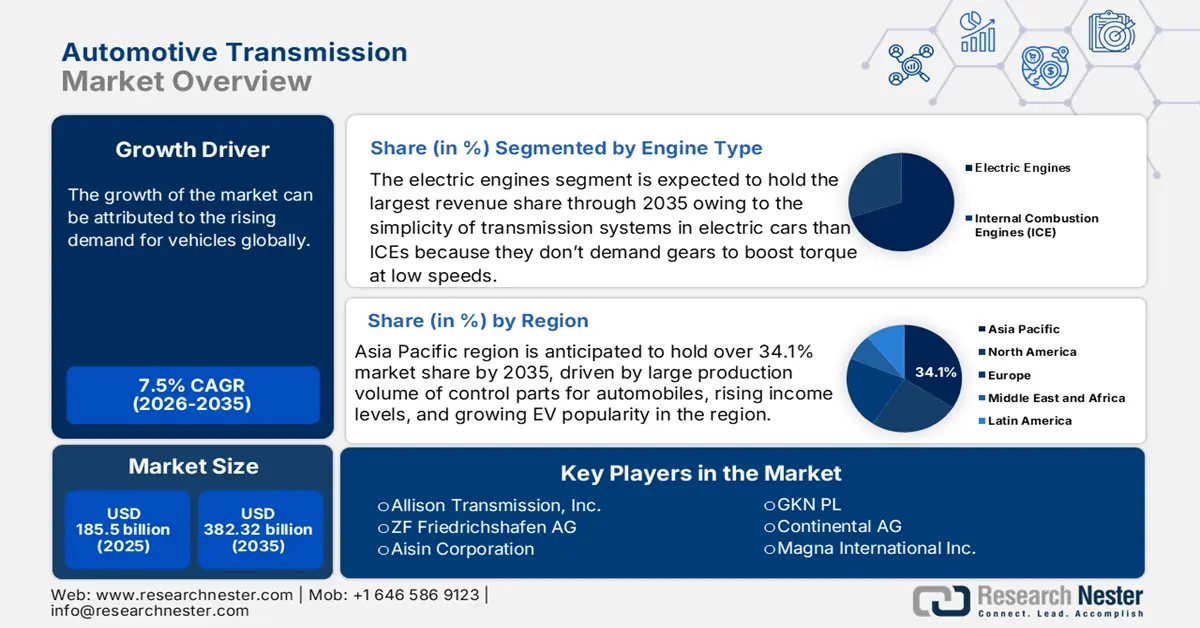

Automotive Transmission Market size was over USD 185.5 billion in 2025 and is anticipated to cross USD 382.32 billion by 2035, witnessing more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive transmission is assessed at USD 198.02 billion.

The growth of the market can primarily be attributed to the growing demand for vehicles worldwide. Furthermore, the global demand for cars is rising as a result of factors including population expansion, urbanization, and economic expansion. As populations and economies continue to grow, more people can afford and desire personal vehicles. Urbanization also drives demand for automobiles as people living in cities often rely on cars for transportation owing to limited public transportation options. In addition, factors such as increasing disposable income and a growing middle class in many countries are also contributing to the growing demand for automobiles. Particularly in emerging nations, these demographics are more inclined to own vehicles. The growing demand for automobiles also creates opportunities for the manufacturing and sales of cars, as well as the development of related industries such as parts suppliers, and maintenance and repair services. For instance, more than 82.5 million vehicles were sold worldwide in 2021.

Automotive transmission is what moves the power from the engine to the wheels. Transmissions are necessary for any motor vehicle to prevent the engine from destroying itself. Most car engines would shake themselves to pieces or overheat without a gearbox system. Furthermore, any car without a transmission would be unable to harness the engine’s speed, capping its maximum velocity. With rising sales of vehicles as well as cars, the demand for automotive transmission is on the rise amongst car users, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive transmission market during the forecast period. For instance, nearly 2 million total cars sold were in China in 2020.

Key Automotive Transmission Market Insights Summary:

Regional Highlights:

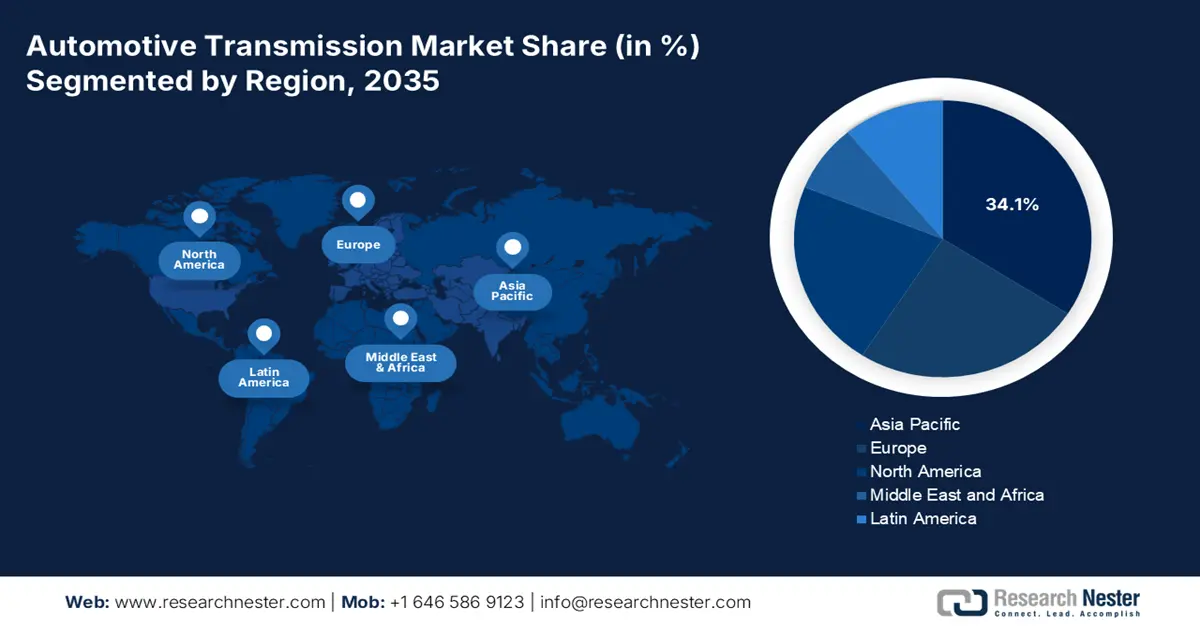

- Asia Pacific automotive transmission market will secure around 34.1% share by 2035, driven by large production volume of control parts for automobiles, rising income levels, and growing EV popularity in the region.

Segment Insights:

- The light motor vehicle (vehicle type) segment in the automotive transmission market is expected to capture the largest share by 2035, driven by rising disposable incomes and consumer preference for safe, efficient personal transport.

- The electric engines segment in the automotive transmission market is projected to hold the largest share by 2035, fueled by the growing fleet of electric vehicles and increased EV sales worldwide.

Key Growth Trends:

- Increasing Number of Wheels

- Upsurge in the Production of Light Vehicles

Major Challenges:

- Requires Huge Investment

- High Cost of Various Components Required in a Transmission System

Key Players: Allison Transmission, Inc., ZF Friedrichshafen AG, Aisin Corporation, GKN PL, Continental AG, Magna International Inc., Borgwarner Inc., Jatco Ltd., Schaeffler Group, Eaton Corporation plc, Vitesco Technologies Group AG.

Global Automotive Transmission Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 185.5 billion

- 2026 Market Size: USD 198.02 billion

- Projected Market Size: USD 382.32 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Automotive Transmission Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Demand for Gearboxes -A transmission allows you to harness your vehicle’s engine energy when necessary. Through applying proper gear as per the need of speed, the transmission allows you to benefit from more of your car's power, rotating the wheels more slowly or quickly. The rising sales of gearboxes are expected to boost the automotive transmission market in the projected period. It was found that the sales volume of gearboxes and their parts for motor cars, tractors, and other motor vehicles, in 2018, amounted to more than 7 million sold items in the United Kingdom.

-

Increasing Number of Wheels – The use of transmissions is spreading as more wheels are seen on the roads across the world. For instance, there are an estimated 37 billion wheels worldwide as of October 2022.

-

Upsurge in the Production of Light Vehicles – Most consumer cars fall under the light motor vehicle (LMV) category, as their unladen weight does not exceed more than 5-7 tons. It is also projected that 99 million light vehicles will be produced worldwide by 2025.

-

Growing Volume of Autonomous Vehicles – AI-powered vehicles such as autonomous cars are gaining traction at a faster rate across the globe. These cars may be self-driving, and perform various other operations such as navigation. For instance, the ratio of autonomous vehicles is expected to account for around 12% of global car registrations by 2030.

-

Rising Production of Truck Trailers – With strengthening supply chains, trucks are getting more powerful and fuel-efficient as they pull bigger trailers. The production of trailers was found to reach over 1 million units around the world in 2021.

Challenges

-

Requires Huge Investment

-

High Cost of Various Components Required in a Transmission System

-

Volatility in Material Cost – A transmission assembly is made of various electric and mechanical components. Price surges in raw materials such as steel, silicone, and other metals hamper the production of these products, which may stagnate demand and drive losses

Automotive Transmission Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 185.5 billion |

|

Forecast Year Market Size (2035) |

USD 382.32 billion |

|

Regional Scope |

|

Automotive Transmission Market Segmentation:

Engine Type Segment Analysis

The global automotive transmission market is segmented and analyzed for demand and supply by engine type segment into internal combustion engines (ICE) and electric engines. Amongst these segments, the electric engines segment is anticipated to garner the largest revenue by the end of 2035. Transmission systems in electric cars (EVs) are frequently significantly simpler than those in conventional internal combustion engine vehicles. There is no need for gears to boost torque at low speeds since, unlike internal combustion engines, electric motors can create their full torque from a complete stop. Owing to this, the majority of EVs only have a single-speed gearbox. An electric vehicle employs a gear reduction system, sometimes known as a gearbox, in place of a conventional transmission to convert the high-speed rotation of the electric motor to the slower revolution of the driving wheels. This gear reduction system can either be a direct drive system—integrated directly into the electric motor—or a separate component. Therefore, backed by the growing fleet of electric vehicles along with the surge in the sales of electric cars worldwide, the segment will boom. For instance, the electric car fleet is expected to become more than 300 million in 2030 with electric cars accounting for 60% of new car sales globally.

Vehicle Type Segment Analysis

The global automotive transmission market is also segmented and analyzed for demand and supply by vehicle type into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Out of these segments, the light motor vehicle segment is projected to produce the most revenue by 2035 and garner the largest market share. Vehicles that are generally lighter and smaller in size and weight and are intended for personal transportation are referred to as light motor vehicles. Typically, this market sector consists of passenger automobiles and light trucks such as pickups, SUV, and vans. Light motor vehicles are preferred for urban use and personal transportation since they are typically thought to be more efficient and simpler to operate than bigger vehicles. Many people worldwide are buying cars with rising disposable incomes and choosing the safety and security that a car provides. Hence, it is projected that there will be over 255 million light motor vehicles in the U.S. alone by 2030.

Our in-depth analysis of the automotive transmission market includes the following segments:

|

By Type |

|

|

By Engine Type |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Transmission Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 34.1% market share by 2035, driven by large production volume of control parts for automobiles, rising income levels, and growing EV popularity in the region. For instance, in 2020, the overall production value of the automatic transmission system with many of its parts in Japan amounted to over USD 19 billion. Apart from that, rising income levels and the societal status of the Indian people are also expected to drive the market in the region. The popularity of EVs in the subcontinent is also booming, as it is projected that EVs will account for a third of the total vehicles on the road in India by 2030.

Automotive Transmission Market Players:

- Allison Transmission, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ZF Friedrichshafen AG

- Aisin Corporation

- GKN PL

- Continental AG

- Magna International Inc.

- Borgwarner Inc.

- Jatco Ltd.

- Schaeffler Group

- Eaton Corporation plc

- Vitesco Technologies Group AG

Recent Developments

-

Allison Transmission Inc. - announced that Isuzu has introduced its new medium-duty FVR 18.5T truck featuring the Allison 3000 Series 6-speed fully automatic transmission in Taiwan.

-

ZF Friedrichshafen AG - unveiled EcoLife CoachLine, the second generation of its proven six-speed automatic transmission suitable for coach applications, whether operating in a city, inter-city, or even a challenging, steep mountain track.

- Report ID: 4640

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Transmission Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.