Automotive Tinting Film Market Outlook:

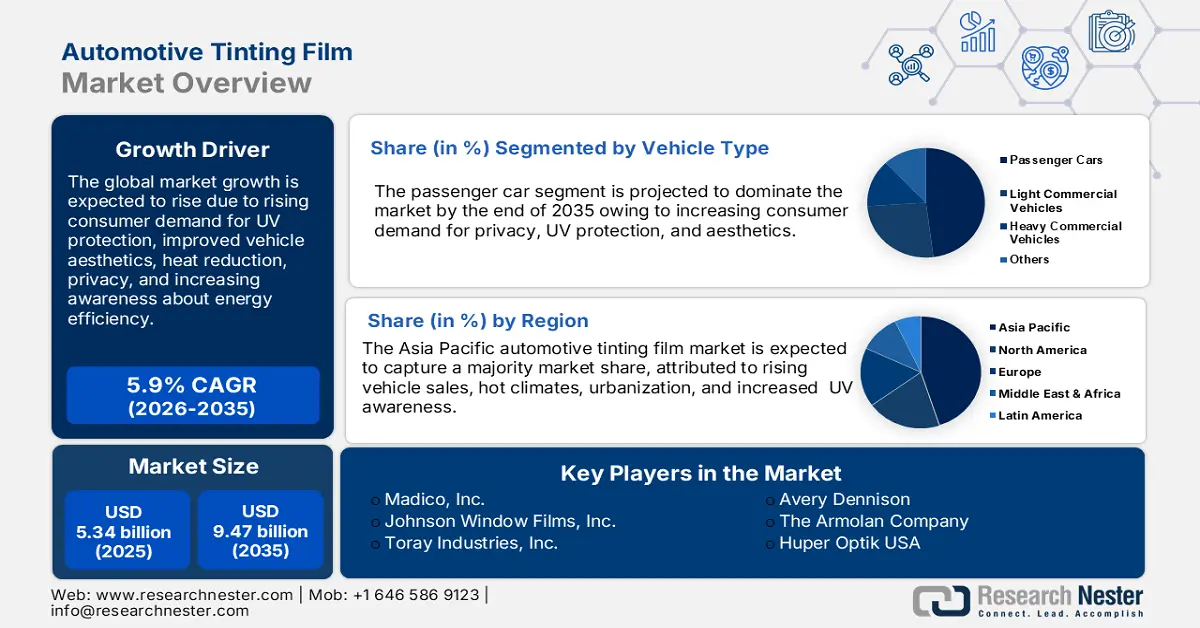

Automotive Tinting Film Market size was over USD 5.34 Billion in 2025 and is projected to reach USD 9.47 Billion by 2035, witnessing around 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive tinting film is evaluated at USD 5.62 Billion.

The primary factor that is attributed to the market growth in the assessment period is the rapid expansion of the automotive industry. As per the estimations, the revenue generation by the global automotive industry is anticipated to stand at almost USD 9 trillion by 2030.

Heat and glare reduction functions are expected to drive the demand for automotive tinting film owing to their advantages, which include a desired level of comfort by stopping the maximum percentage of sun rays by reflecting them back at the sky or dispersing them around. Furthermore, these films not only protect against the sun's and UV rays, but also any physical object that comes through the window in the event of a car crash or accident. This trend is expected to raise the adoption rate considerably in the automotive industry. A recent report stated that in 2018, the Indian automotive industry employed approximately 2 million people.

Key Automotive Tinting Film Market Insights Summary:

Regional Highlights:

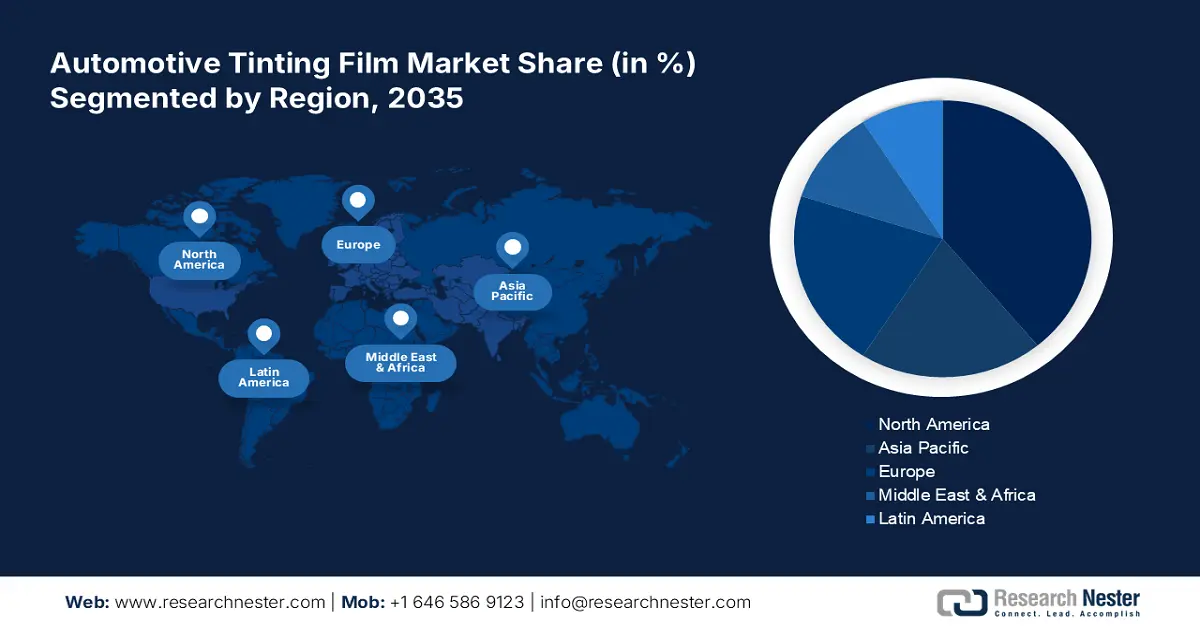

- The Asia Pacific automotive tinting film market commands the largest share by 2035, driven by the rising population, increased income levels, and growing demand for vehicles, leading to increased opportunities for automotive tinting film.

Segment Insights:

- The passenger cars vehicle type segment in the automotive tinting film market is anticipated to secure the highest market share by 2035, driven by the high demand for passenger vehicles from the growing global population.

Key Growth Trends:

- Growth in Population Across the World

- High Number of Vehicles on the Roads

Major Challenges:

- Extra Expenses Incurred in Production Cycles

- Low Adoption Rate in Developing Countries

Key Players: Eastman Chemical Company, Madico, Inc., Johnson Window Films, Inc., Toray Industries, Inc., Saint-Gobain Performance Plastics Corporation, Avery Dennison, The Armolan Company, Huper Optik USA, 3M, TintFit Window Films Ltd.

Global Automotive Tinting Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.34 Billion

- 2026 Market Size: USD 5.62 Billion

- Projected Market Size: USD 9.47 Billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Automotive Tinting Film Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in Population Across the World - Nowadays, people are more inclined towards safety from harmful sun rays and protection of car interiors. Further, the high demand for vehicles by the burgeoning population is also expected to upsurge the adoption rate of automotive tinting film in the forecast period. World Bank estimated that the world population stood at 7.84 billion in 2021, an increase from 7.09 billion in 2021. This number is anticipated to rise to 9.8 billion in 2050 and 11.2 billion in 2100, as per United Nations, Department of Economic and Social Affairs.

-

High Number of Vehicles on the Roads – As a result of recent urbanization, the number of vehicles on the road has increased. As a result, the utilization of automotive tinting film is expected to also surge considerably. As per the calculations, it was forecasted that were approximately 2 billion vehicles on roads across the globe by the end of the first quarter of 2022.

-

Rapid Production Rate of Vehicles - International Organization of Motor Vehicle Manufacturers (OICA), released the global sales of vehicles statistics which revealed that it rose to 56 million in 2021 from 53 million in 2020. Whereas, the global production of vehicles is calculated to be 57 million in 2021.

-

Increasing Need of Luxury Cars - According to a recent report, the global sales of luxury cars are anticipated to stand at 200K vehicles in 2026, a rise from 190K vehicles in 2022.

Challenges

-

Extra Expenses Incurred in Production Cycles

-

Low Adoption Rate in Developing Countries

- Rising Governmental Policies Regarding Pollutants Emission by Vehicles

Automotive Tinting Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 5.34 Billion |

|

Forecast Year Market Size (2035) |

USD 9.47 Billion |

|

Regional Scope |

|

Automotive Tinting Film Market Segmentation:

Vehicle Type Segment Analysis

The automotive tinting film market is segmented and analyzed for demand and supply by vehicle type into passenger cars, light commercial vehicle, heavy commercial vehicle, and others. Out of these, the passenger cars segment is attributed to garner the highest market share by 2035, owing to the high demand of passenger vehicles by the burgeoning population. International Organization of Motor Vehicle Manufacturers (OICA) stated that the global sales of passenger vehicles sales rose from 53 million in 2020 to 56 million in 2021, whereas, the production rose from 55 million in 2020 to 57 million in 2021.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Vehicle Type |

|

Major Macro-Economic Indicators Impacting the Market Growth

The chemical industry is a major component of the economy. According to the U.S. Bureau of Economic Analysis, in 2020, for the U.S., the value added by chemical products as a percentage of GDP was around 1.9%. Additionally, according to the World Bank, Chemical industry in the U.S. accounted for 16.43% to manufacturing value-added in 2018. With the growing demand from end-users, the market for chemical products is expected to grow in future. According to UNEP (United Nations Environment Program), the sales of chemicals are projected to almost double from 2017 to 2030. In the current scenario, Asia Pacific is the largest chemical producing and consuming region. China has the world’s largest chemical industry, that accounted for annual sales of approximately more than USD 1.5 trillion, or about more than one-third of global sales, in recent years. Additionally, a vast consumer base and favorable government policies have boosted investment in China’s chemical industry. Easy availability of low-cost raw material & labor as well as government subsidies and relaxed environmental norms have served as a production base for key vendors globally. On the other hand, according to the FICCI (Federation of Indian Chambers of Commerce & Industry), the chemical industry in India was valued at 163 billion in 2019 and it contributed 3.4% to the global chemical industry. It ranks 6th in global chemical production. This statistic shows the lucrative opportunity for the investment in businesses in Asia Pacific countries in the upcoming years.

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Tinting Film Market Regional Analysis:

Regionally, the global automotive tinting film market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in Asia Pacific is projected to hold the largest market share by the end of 2035. The rising the population along with their income levels have increased the demand of vehicles which, in turn, is expected to bring lucrative growth opportunities for automotive tinting film market. The total production of vehicles in the region was 46 million in 2021, whereas, the total sales in the region was 42 million in 2021 as per statistics released by International Organization of Motor Vehicles (OICA). Also, the presence of leading key players and exporters in the region is an another factor that is expected to affect the market positively. China, a country of Asia Pacific is estimated to have exported around 400,000 commercial vehicles and around 2 million passenger vehicles in the year 2021.

Automotive Tinting Film Market Players:

- Eastman Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Madico, Inc.

- Johnson Window Films, Inc.

- Toray Industries, Inc.

- Saint-Gobain Performance Plastics Corporation

- Avery Dennison

- The Armolan Company

- Huper Optik USA

- 3M

- TintFit Window Films Ltd.

Recent Developments

-

Eastman Chemical Company has launched the LLumar IRX Series of automotive window tint in their LLumar automotive tint portfolio.

-

Madico, Inc., a leader in the manufacturing of quality window films, is all set acquire of its two Canadian distributors, Courage Distributing, Inc. and Window Film Systems.

- Report ID: 4510

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Tinting Film Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.